Macroeconomic Interpretation: The U.S. non-farm payroll report, as a key indicator of the U.S. economic condition, has a global impact on financial markets, including stocks, foreign exchange, gold, and cryptocurrency markets. We will conduct an in-depth analysis of the impact of the non-farm payroll report based on recent related reports and explore its potential effects on the crypto market, especially BTC.

U.S. economic data and policy dynamics are under close scrutiny. The U.S. stock market has shown mixed performance under the influence of corporate earnings reports, with the S&P 500 index rising for three consecutive days as investors focus on the upcoming non-farm payroll report. In the global economic landscape, U.S. employment data serves not only as a barometer of domestic economic health but also has profound effects on global capital flows and market sentiment.

The U.S. January non-farm payroll report is set to be released, accompanied by annual revised data, making it a focal point for the market. The market expects an increase of 170,000 jobs, significantly lower than the previous value of 256,000, considering various factors that may hinder employment, such as the Los Angeles wildfires and cold weather. The main highlight of this report is the annual revision of employment data for the 12 months ending March 2024, with economists predicting an actual downward revision of 600,000 to 700,000 jobs. This revision will have a significant impact on labor market data, subsequently affecting market expectations regarding the Federal Reserve's policy path.

Recent statements from Federal Reserve officials regarding interest rate cut expectations have also attracted market attention. Dallas Fed President Lorie Logan stated that unless the job market cools significantly, a slowdown in inflation would not justify further rate cuts. Chicago Fed President Austan Goolsbee believes that while robust economic growth and declining inflation create conditions for rate cuts, tariffs and policy uncertainty will slow the pace of cuts in 2025. Fed Vice Chair Jefferson and San Francisco Fed President Daly have also signaled a slowdown in the pace of rate cuts. These statements have made the market more cautious about the Fed's rate cut expectations.

Historical reactions of the non-farm payroll report on the gold market show that gold prices react more strongly to disappointing employment data. In the 15 minutes, 1 hour, and 4 hours following the release of 35 non-farm data reports, there is a certain negative correlation between gold prices and non-farm surprises. However, this correlation is not entirely significant, as market reactions are also influenced by other factors such as wage inflation, labor force participation rates, and data revisions.

The impact of the non-farm payroll report on the crypto market, especially BTC, is also significant. First, non-farm data influences market expectations regarding the Fed's monetary policy, which in turn affects global capital flows. Bitcoin, as an emerging safe-haven asset and store of value, has its price movements correlated with the macroeconomic environment and monetary policy. When non-farm data is strong, the market expects the Fed to maintain a tightening policy or slow the pace of rate cuts, which may lead to capital flowing out of risk assets, putting downward pressure on Bitcoin prices. Conversely, if non-farm data falls short of expectations, market expectations for Fed rate cuts may increase, potentially driving capital into the crypto market and pushing Bitcoin prices up.

Market volatility triggered by the non-farm payroll report can also affect investor sentiment and risk appetite. Before and after the release of non-farm data, market uncertainty increases, leading to significant fluctuations in investor sentiment. This change in sentiment may transmit to the crypto market, causing substantial volatility in Bitcoin prices. For example, if the data deviates significantly from expectations at the moment of release, panic in the market may lead to a sharp drop or surge in Bitcoin prices.

The correlation between the crypto market and traditional financial markets is gradually strengthening. As more institutional investors enter the crypto market, the impact of fluctuations in traditional financial markets on the crypto market is becoming increasingly significant. The non-farm payroll report, as an important event in traditional financial markets, may trigger a chain reaction that transmits to the crypto market through the trading behavior of institutional investors, thereby affecting Bitcoin prices.

The U.S. non-farm payroll report has a significant impact on the crypto market, and we need to closely monitor changes in non-farm data and its effects on the market. In the current market environment, the crypto market is showing new trends and characteristics, allowing for the capture of emerging trends and reasonable asset allocation to seize potential investment opportunities. At the same time, it is essential to remain vigilant about market risks and implement risk management to cope with market uncertainties.

BTC Data and Market Analysis:

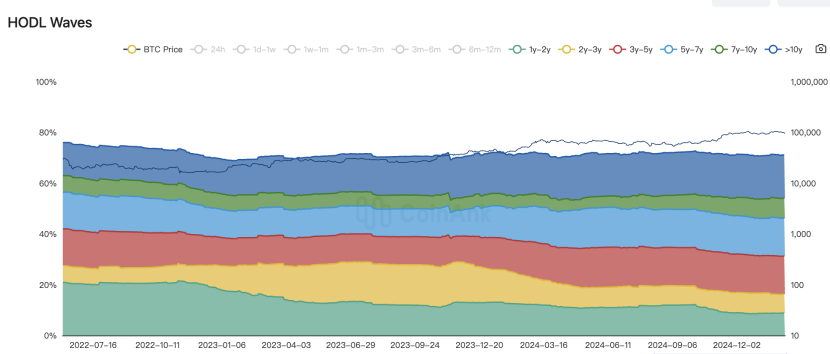

Recently, #BTC long-term holders have been in a trend of reducing holdings, with data showing that #HODL holders of 1-10 years are on a downward trend. Over the past 96 hours, more than 20,000 #Bitcoin have flowed out from long-term holders' wallets. This may also be a reason for the recent weakening of the market. Additionally, the U.S. #non-farm payroll data and #unemployment rate data will be released tonight at 21:30, which may exacerbate market volatility, so be mindful of risks and trading opportunities.

The recent market performance of BTC shows a clear trend of oscillation and decline. From the candlestick chart, the price has retraced after a period of increase and is currently in a consolidation phase, fluctuating around $97,300. Overall, after breaking through the $100,000 mark, the market has seen increased divergence between bulls and bears, with prices experiencing repeated tug-of-war at high levels. The recent trend can be summarized as "repeated oscillation, intensified bull-bear competition," necessitating close attention to changes in key support and resistance levels.

From a technical indicator perspective, the super trend indicator shows that BTC is currently in a short-term bullish trend, but the short-term indicator is positioned at the $94,350 mark, which has become a key support level. If this support can be maintained, a rebound is expected to continue, with short-term resistance levels to reference at around $100,740 and $102,450. If these levels are not broken, oscillation will continue, with mid-term resistance levels to watch at $107,000 and $110,000. If there is a downward oscillation, support levels can be referenced at $91,230 and the previous important support around $89,250. The MACD indicator shows that the DIF line and DEA line are hovering near the zero axis, indicating a weakening of market momentum, and attention should be paid to the volatility brought by tonight's non-farm data.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。