作者:Babywhale,Techub News

一周前,因 DeepSeek 导致投资者对人工智能芯片产业链未来需求可能降低的预期,美股市场包括英伟达、AMD 在内的股票从夜盘就开始了下跌,而近期一直跟随美股走势的比特币也被拖累。今日早间亚盘时间,美股夜盘时间,或许是受到周六美国政府宣布将对墨西哥和加拿大进口商品加征 25% 的关税,对中国进口商品加征 10% 的关税的影响,比特币在周末的小幅下跌后持续跌势,在香港时间 10 时左右跌至接近 9.1 万美元附近。

其实比特币在今日早间的跌幅并不算大,但包括以太坊在内的大多数代币缺出现了断崖式的下跌,以太坊近三日最大跌幅约 40%,今早最低跌至 2100 美元附近,大量山寨币更是创下了 2022 年熊市以来的新低。

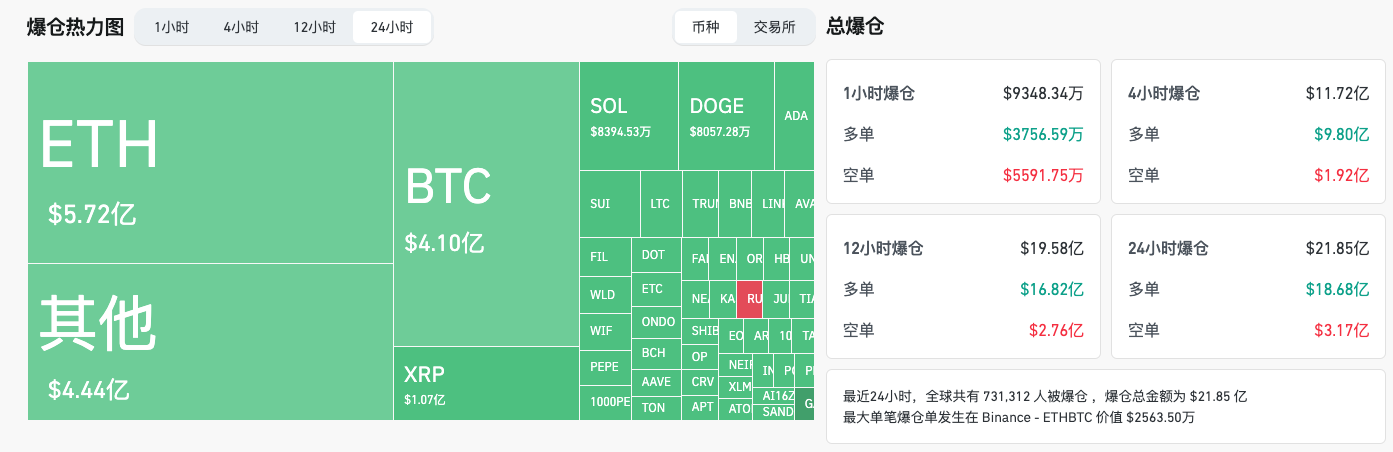

合约市场更是腥风血雨。据 Coinglass 数据,以今日中午的最低点计算,24 小时内加密货币合约市场爆仓额超过了 20 亿美元,超过 70 万人爆仓。该数字甚至高过了去年日本央行意外加息之后市场恐慌导致的爆仓资金,至少创下了近两年以来 24 小时爆仓金额之最。

TradingView 统计的排除市值前十的加密货币外其他加密货币市值总和今晨最低跌至 2200 亿美元附近,已达到了去年 8 月至 10 月的水平。

「最后一跌」or「熊市开端」?

在上周一的分析文章中,笔者指出,在比特币多次尝试突破 10.6 万美元至 10.7 万美元未果之后,我们有理由防范短期的回调风险。比特币在上周一跌至 9.8 万美元附近后迅速反弹,再度触及了 10.6 万美元左右的水平,让很多投资者开始期待连续多年应验的「春节红包行情」。

但就像去年比特币在 7 月底 8 月初反弹至 7 万美元水平后迅速回落一样,如果多次尝试突破某一高点失败则很有可能带来快速的下跌。

上周周中,美联储宣布按兵不动,继续保持利率,并在声明中去除了降通胀取得了持续进展的表述,市场预计美联储可能不会在上半年降息。此消息一出,风险资产市场不降反升。这在某种程度上也为上周一的下跌做了一次很好的解释:

很多投资者对周一因 DeepSeek 出圈引发的暴跌而摸不着头脑,其认为 DeepSeek 的出现反而使得很多公司可以使用更少的算力来训练模型从而有助于 AI 的推广与发展,长期来看对英伟达的芯片设计商有百利而无一害的。但资本市场很多时候并不害怕确定性的坏消息,而更害怕不确定性的消息。这也是在上周比特币能快速收回跌幅的原因之一。短暂的下跌是因为不确定性,而后续的反转则是更像是「即使是坏消息,也是可预测的」。

但这一次笔者想要提醒的是,有关美联储后续的政策路径以及特朗普的激进策略将对全球经济产生的影响已经进入了一个极具不确定性的状态。原本特朗普团队宣布特朗普不会在上任初期就启动提高关税的进程,但现在的事实是这一策略被预计的实施时间提前了不少,而增加关税对美国经济产生的影响犹未可知,这使得美联储接下来的动作变得不可预测。

两件可能可以决定资本市场走向的事件都变得不可预测使得市场变得极端脆弱,后续任何的风吹草动都可能引发超过预期的市场波动。虽然笔者仍然认为当下断言牛熊为时尚早,但短期内风险因素已在快速累积。即使未来一段时间有大量支持 Web3 发展的政策被提出,即使美国多州在短时间内支持政府投资比特币,可能仍然无法抵消宏观不确定性带来的影响。

无论是香港时间今早标普 500 指数期货的跳空低开,美元指数的跳空高开以及近期黄金价格的再创新高,都预示着有大量资金在选择避险。Crypto 可以带来超额收益的另一面是很多人无法承受的巨额亏损,笔者建议在不确定性过高的市场环境下,多看少动方为上策。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。