作者|孙俊律师团队

2025 年 1 月初,先是 1 月 10 日公安部在京召开专题新闻发布会,公安部新闻发言人张明介绍道:诈骗集团利用区块链、虚拟货币、AI 智能等新技术,不断更新升级犯罪工具。针对涉虚拟货币等电诈严峻复杂的犯罪形势,公安机关将纵深推进 “云剑”“断流”“拔钉” 等专项行动,持续保持严打高压态势。紧接着 1 月 13 日,全国检察长会议上最高检强调,检察机关将加大惩治洗钱犯罪力度,依法打击利用虚拟货币非法向境外转移资产犯罪活动。

可见,尽管近年我国对虚拟货币平台交易、投资采取严格监管、打击态度,但相关非法金融活动自线下转移至线上,自境内转移至境外,以更为隐蔽的形式猖狂发展。同时,基于虚拟货币自身匿名化、无国别性等特征,虚拟货币迅速发展为一种新型犯罪工具。在此背景下,涉虚拟货币犯罪已成为当前网络犯罪领域最为典型的问题。

年末已至,在迎接新年之际,本团队特撰写此文,旨在对 2024 年我国涉虚拟货币犯罪总体态势,国家监管、打击虚拟货币违法犯罪活动的最新动态以及实践中对虚拟货币自身法律属性认定的最新动向进行整理、总结。

一、2024 年涉虚拟货币犯罪总体态势

关于 2024 年发生的涉虚拟货币犯罪,由于年份过近,不少案件还在审理阶段等原因,整体数据尚未得以公布。但笔者团队以虚拟货币、刑事、判决书为关键词在威科先行平台进行检索,得到共 401 份刑事判决书,其中包括一审判决 386 份,二审判决 15 份。本文以检索到的这些案例为基础,对 2024 年涉虚拟货币总体态势进行初步分析。对于案件的数据统计、结果分析可能有不准确之处,敬请原谅。

从检索到的案件数据来看,2024 年河南省涉案数量最多,其次为湖南省及陕西省,再为上海市、江西省、河北省。

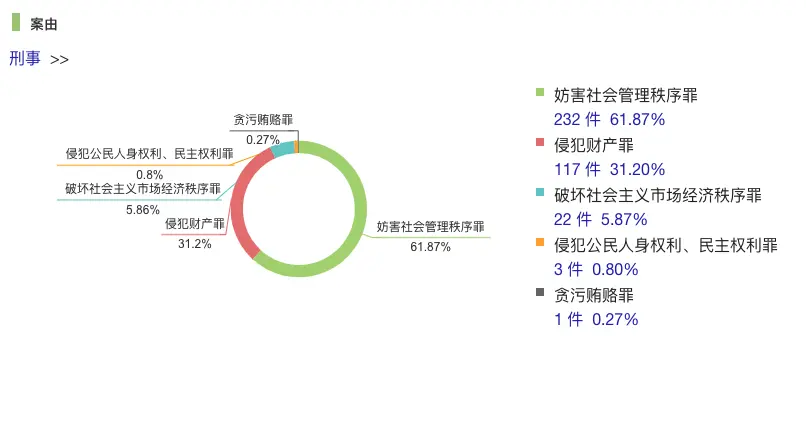

从案由来看,相较于往年因 ICO 活动猖狂,涉虚拟货币犯罪大量集中在破坏社会主义市场经济秩序领域,其中以非法吸收公众存款罪、集资诈骗罪、组织、领导传销活动罪为主要罪名,2024 年,涉虚拟货币犯罪更多集中在涉妨害社会管理秩序罪领域,更为突出的犯罪行为集中在涉妨害社会管理秩序罪,占比高达 61.87%。另外,侵犯财产罪一如既往是涉虚拟货币犯罪的高发地带,占比为 31.2%。

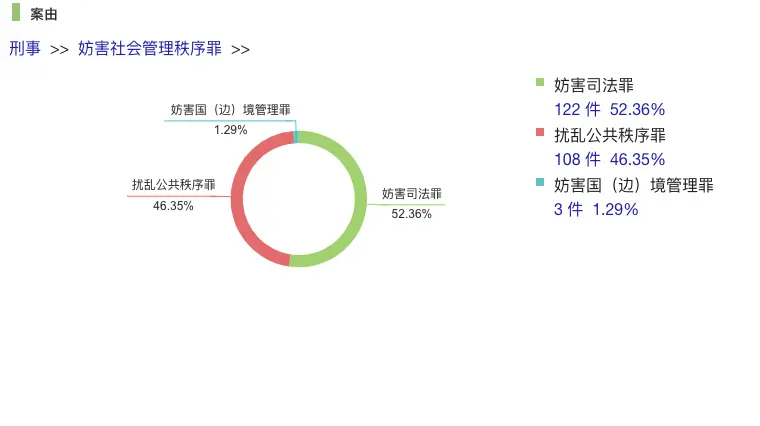

而在涉妨害社会管理秩序罪中,具体来说,涉妨害司法罪的案件占比最高,共 122 件,占比 52.36%,且该 122 起案件均涉及掩饰、隐瞒犯罪所得、犯罪所得收益罪。

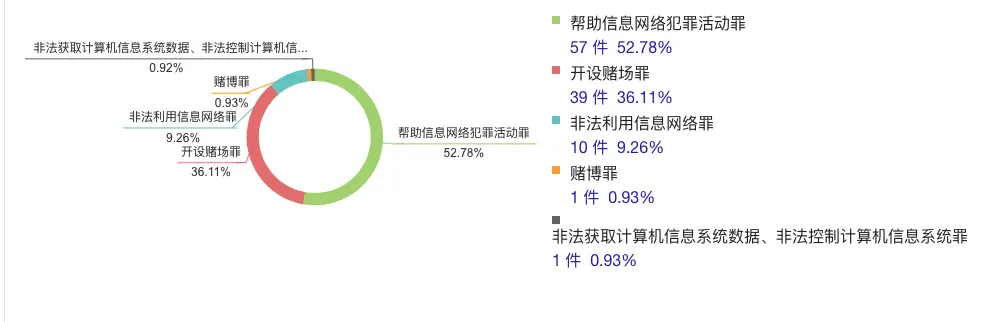

另外,涉妨害社会管理秩序罪中,涉扰乱公共秩序罪的案件数量占比第二,共 108 件,其中包括帮助信息网络犯罪活动罪 57 件,开设赌场罪 39 件,非法利用信息网络罪 10 件,赌博罪1件,非法获取计算机信息系统数据、非法控制计算机信息系统罪 1 件。

二、2024 年我国监管、打击虚拟货币违法犯罪活动的最新动态

2024 年间,我国主要在外汇违法犯罪、洗钱犯罪领域,加强对以虚拟货币为犯罪工具实施犯罪相关行为的关注与打击。以下将结合 2024 年相关违法犯罪领域出台的新规及典型案例来了解虚拟货币是如何被利用实施非法换汇、洗钱等违法犯罪活动的,及司法实践中对犯罪成立的认定要点。

(一)利用虚拟货币从事非法换汇犯罪活动

2023 年 12 月 11 日,最高人民检察院、国家外汇管理局联合印发 8 件惩治涉外汇违法犯罪典型案例,主要涉及(非法买卖外汇型)非法经营罪、骗购外汇罪,相关联罪名还涉及帮助信息网络犯罪活动罪、骗取出口退税罪、虚开增值税专用发票罪。其中,以虚拟货币为媒介实现人民币与外汇兑换,成为近年非法买卖外汇违法犯罪活动领域出现频繁、极为突出的一种对敲换汇模式。另外,为更好统筹发展和安全,保障跨境贸易和投融资便利化,预防和遏制外汇违法违规活动,维护外汇市场秩序,2024 年 12 月 27 日国家外汇管理局发布了关于《银行外汇风险交易报告管理办法(试行)》。其中,第三条明确将虚拟货币非法跨境金融活动列为外汇风险交易行为,并要求银行对涉及此类活动的境内 / 外机构和个人客户进行风险监测和报告。

在虚拟货币从事非法换汇犯罪活动的案件中,行为人通常在境内收取客户的人民币,再将等额的外汇存入客户指定的境外银行账户,资金在境内外实行单向循环,双方形式上进行的不是人民币和外汇直接买卖,而实质上已完成买卖外汇的一种行为。常见的有资金跨国(境)兑付,是指不法分子与境外人员、企业、机构相勾结,或利用开立在境外的银行账户,协助他人进行跨境汇款、转移资金活动。这类地下钱庄又被称为 “对敲型” 地下钱庄,即资金在境内外实行单向循环,没有发生物理流动,通常以对账的形式来实现 “两地平衡”。在该模式下,人民币和外币不发生物理上的跨境流转,因此,从表面上看,资金在境内外单向循环。然而,此类活动实质上属于变相买卖外汇行为,仍具有扰乱外汇市场正常秩序之危害性。

随着近年区块链技术的发展及基于区块链技术衍生的虚拟货币在世界范围内的普及,其经济价值得到广泛认可,在越来越多的国家及地区被允许作为一种支付工具,发挥着类法定货币的功能。在此背景下,以虚拟货币为媒介实现人民币与外汇兑换,成为近年非法买卖外汇违法犯罪活动领域出现频繁、极为突出的一种对敲换汇模式。

典型案例一:

2019 年 2 月至 2020 年 4 月,赵某组织赵某鹏、周某凯等人,在阿联酋和国内提供外币迪拉姆与人民币的兑换及支付服务。该团伙在阿联酋迪拜收进迪拉姆现金,同时将相应人民币转入对方指定的国内人民币账户,后用迪拉姆在当地购入 “泰达币”(USDT,与美元锚定的稳定币),再将购入的泰达币通过国内的团伙即时非法出售,重新取得人民币,从而形成国内外资金的循环融通。通过汇率差,该团伙在每笔外币买卖业务中可获取 2% 以上的收益。经查,赵某等人在 2019 年 3 月至 4 月期间兑换金额达人民币 4385 万余元,获利共计人民币 87 万余元。

2022 年 3 月 24 日,浙江省杭州市西湖区人民法院作出判决,以非法经营罪判处赵某有期徒刑七年,并处罚金人民币二百三十万元;判处赵某鹏有期徒刑四年,并处罚金人民币四十五万元;判处周某凯有期徒刑二年六个月 , 并处罚金人民币二十五万元。

典型案例二:

2018 年 1 月至 2021 年 9 月,陈某国、郭某钊等人搭建 “TW711 平台”“火速平台” 等网站,以虚拟货币泰达币为媒介,为客户提供外币与人民币的汇兑服务。换汇客户在上述网站储值、代付等业务板块下单后,向网站指定的境外账户支付外币。网站以上述外币在境外购买泰达币后,由范某玭通过非法渠道卖出取得人民币,再按照约定汇率向客户指定的境内第三方支付平台账户支付相应数量的人民币,从中赚取汇率差及服务费。上述网站非法兑换人民币 2.2 亿余元。

2022 年 6 月 27 日,上海市宝山区人民法院作出判决,以非法经营罪判处郭某钊有期徒刑五年,并处罚金人民币二十万元;判处范某玭有期徒刑三年三个月,并处罚金人民币五万元;以帮助信息网络犯罪活动罪判处詹某祥有期徒刑一年六个月,并处罚金人民币五千元;判处梁某钻有期徒刑十个月,并处罚金人民币二千元。

认定要点:

我国实行严格的外汇管制,未经国家外汇管理部门许可,在外币与本币之间进行资金兑换的行为属于非法买卖外汇,依据《中华人民共和国外汇管理条例》“非法买卖外汇” 主要包括私自买卖外汇、变相买卖外汇、倒买倒卖外汇、非法介绍买卖外汇四种行为模式。《刑法》第二百二十五条【非法经营罪】违反国家规定,有下列非法经营行为之一,扰乱市场秩序,情节严重的,处五年以下有期徒刑或者拘役,并处或者单处违法所得一倍以上五倍以下罚金;情节特别严重的,处五年以上有期徒刑,并处违法所得一倍以上五倍以下罚金或者没收财产:……

另外,根据全国人大常委会《关于惩治骗购外汇、逃汇和非法买卖外汇犯罪的决定》第 4 条和刑法第 225 条的规定,2019 年最高法、最高检《关于办理非法从事资金支付结算业务、非法买卖外汇刑事案件适用法律若干问题的解释》第 2 条规定,变相买卖外汇,扰乱金融市场秩序的,以非法经营罪定罪处罚。因此,绕开国家外汇监管,以虚拟货币为交易媒介间接实现外汇与人民币的货币价值转换,情节严重的,构成非法经营罪。

从刑法条文的表述来看,虽然未明确规定非法经营罪的主观要件是 “以营利为目的”,但由于构成犯罪的行为被定义为 “非法经营”,这就意味着行为人需具备通过某种活动谋取利益的意图。如果缺乏 “以营利为目的” 的动机,则无法形成 “非法经营行为”。因此,“以营利为目的” 应视为非法经营罪的主观要件之一。

事实上,这一观点已得到目前理论及司法实践中的普遍认可。广东省高院刑二庭课题组在 2016 年调研报告中指出:“不以营利为目的,通过地下钱庄将外币兑换成人民币或者将人民币兑换成外币的行为,只是一种单纯的非法兑换货币的行为,如兑换人并没有通过兑换行为本身从中谋取经济利益的,不能构成非法经营罪。”

因此,若行为人不以营利为目的,其购买外汇行为仅供自己使用,即便用于投资、偿还欠款等行为,也不构成非法经营罪,仅是行政违法行为。

综上,在具体认定时,仍需综合考虑境内外经营者是否具有营利目的,是否从事连续性的经营活动,以及人民币与外币之间是否实际发生了兑换等相关主客观因素,来判断是否构成犯罪。

(二)利用虚拟货币从事洗钱犯罪活动

2024 年 8 月 19 日最高人民法院、最高人民检察院联合举行新闻发布会,发布 “两高”《关于办理洗钱刑事案件适用法律若干问题的解释》(以下简称《解释》),自 2024 年 8 月 20 日起施行。其中,第五条明确将通过 “虚拟资产” 交易,金融资产兑换方式,转移、转换犯罪所得及其收益的列入新型洗钱行为模式范围内,进一步明确了对虚拟货币用于非法活动的否定态度,并明确规定了对利用虚拟货币掩盖非法受益或从事不法活动的行为进行规制。

1 月 9 日,成都中院通报了成都法院 2024 年度十大典型案例其中,王某某、马某等人集资诈骗、洗钱案位列 “十大案例之首” 该案案情复杂,社会影响恶劣造成 2.9 万余名集资参与人损失共计 17 亿余元人民币是涉虚拟货币、自洗钱等新型犯罪的典型案例。

在该案中,2020 年,被告人王某某等人设计了名为 GUCS 的虚拟币以及关联软件 “Wa11et Pro”APP。该虚拟币先后于 2020 年 4 月、6 月在两交易所进行公开交易买卖。王某某与被告人杨某某、谢某某等人共谋,隐瞒了其锁定 GUCS 币获取权限和数量的真相,虚构该币可像比特币一样通过算力不断产出并与国际金融、全球公益慈善等实体经济挂钩,在成都、德阳、眉山等地大肆鼓吹 GUCS 币的经济价值和投资前景,以拉人头的形式发展下线,安排段某某、王某等人以自买自卖方式操纵 GUCS 币价诱骗群众投资购买,造成 2.9 万余名集资参与人损失共计 17 亿余元人民币。

2020 年 10 月初,王某某陆续将集资诈骗获取的价值人民币约 2.49 亿元 “泰达币” 转予被告人马某。马某在明知该钱款系涉及破坏金融管理秩序犯罪所得的情况下,通过在境外外汇平台投资等形式,改变上述虚拟币的性质,并陆续通过其实际控制的银行账户向王某某指定的多个银行账户转款共计 9000 万余元。此外,马某在 2020 年 12 月至 2021 年 1 月期间多次帮助被告人谢某某将 “泰达币” 转换为人民币后转账至谢某某妻子账户共计 604 万余元。2020 年 12 月,集资参与人陆续到公安机关报案,被告人王某某等被陆续抓获归案。

成都中院经审理认为,被告人王某某、杨某某、谢某某以非法占有为目的,使用诈骗方法,向不特定公众公开宣传虚拟币非法集资,数额巨大,段某某、王某等明知王某某等人实施集资诈骗仍积极提供帮助,其行为均已构成集资诈骗罪。被告人王某某掩饰、隐瞒自己集资诈骗所得资金的来源及性质,被告人马某明知王某某等人从事破坏金融管理秩序犯罪,帮助其掩饰、隐瞒犯罪所得的来源和性质,其行为均已构成洗钱罪。遂以集资诈骗罪、洗钱罪数罪并罚判处王某某无期徒刑,剥夺政治权利终身,并处没收个人全部财产。以洗钱罪判处马某有期徒刑八年,并处罚金人民币五十万元。以集资诈骗罪判处其余被告人十五年至三年六个月不等有期徒刑及相应数额的罚金。

一审宣判后,被告人王某某、马某等人不服提起上诉。

四川省高院经审理后裁定驳回上诉,维持原判。该判决已发生法律效力。

另外,在司法实践中,对于洗钱罪与掩隐罪的区分适用方面存在一定困境。一般认为,刑法第一百九十一条规定的洗钱罪与刑法第三百一十二条规定的掩饰、隐瞒犯罪所得、犯罪所得收益罪是刑法特别规定与一般规定的关系,主要区别在于,洗钱罪上游犯罪为毒品犯罪、黑社会性质的组织犯罪、恐怖活动犯罪、走私犯罪、贪污贿赂犯罪、破坏金融管理秩序犯罪、金融诈骗犯罪,且要求行为人对上游犯罪类型存在主观明知。对上游犯罪的明知可以是概括性的认识,即认识到上游犯罪的类型,无需认识到具体的性质和罪名。而掩饰、隐瞒犯罪所得、犯罪所得收益犯罪对上游犯罪的类型没有限定,仅要求行为人对属于违法所得的情况存在概括性认识即可。

三、我国司法实践对虚拟货币自身法律属性认定的最新动向

对于以虚拟货币为工具实施的各种犯罪,犯罪成立与否判断时绕不开的一个前提为,虚拟货币自身的法律属性问题,即虚拟货币的财产属性问题。显然,如否定虚拟货币的财产属性,则不仅在非法获取虚拟货币的场合,将否定以财物为犯罪对象的盗窃罪、诈骗罪等财产犯罪罪名的适用,至多根据虚拟货币的底层技术特征,肯定非法获取计算机信息系统数据罪的成立。还会在向公众非法吸收虚拟货币、以传销组织形式骗取他人虚拟货币等多个犯罪场景下,否定相关罪名的适用。

对此,过往无论是民事司法实践还是刑事司法实践中,对于虚拟货币的财产属性虽然存在一定争议,但近年来随着虚拟货币的财产价值在域外得到普遍认可及广泛适用,我国司法实践也逐渐呈现对虚拟货币的财产属性加以认可的趋势。

对此,在过去的 2024 年一年中,更是有几起极具代表性的案例及《人民法院报》上刊载的重要文章,反映我国司法实践对虚拟货币自身法律属性认定的最新动向,以下将对这几起案例加以梳理。

1. 00 后发行虚拟币涉刑案

“00 后” 大学生杨启超在境外公有链上发行一款简称为 BFF 的虚拟币,因撤回流动性引来牢狱之灾。检察机关指控,其发行了假的虚拟币,他人受误导充值 5 万 USDT 币后,杨启超迅速 “撤资”,导致他人损失 5 万 USDT 币,其行为构成诈骗罪。2024 年 2 月 20 日,河南南阳高新技术产业开发区人民法院一审认定杨启超犯诈骗罪,判处其有期徒刑 4 年 6 个月,并处罚金 3 万元。

在该案中,辩护律师认为,根据我国现行的法律法规,虚拟货币投资行为不受法律保护,双方都是非法金融活动,投资人即便产生了损失也不应受法律保护。一审法院的认定属于 “变相支持虚拟货币与法定货币之间的兑付交易”,与国家法律规定背道而驰。

而一审法院认为,“根据我国相关政策,该虚拟货币不具有货币属性,但在现实生活中,基于其稳定性,可以在很多国际交易平台进行交易,并带来经济利益,其财产属性不可否认”,遂认可将案涉的 5 万 USDT 币折算成人民币价值作为量刑情节。一审判决还称,“至于后期被害人是否将该 BFF 币进行买卖、目前该币按照博饼平台交易规则是否显示仍存在价值、多大价值,均不影响杨启超诈骗犯罪既遂构成。”在一审庭审中,法官明确要求在判决结果生效之前,罗某不能进行买卖。

2. 2024 年 5 月 16 日《人民法院报》刊载《虚拟币 “刑法财物说” 之辨析》一文

2024 年 5 月 16 日,《人民法院报》刊登了一篇《虚拟币 “刑法财物说” 之辨析》的理论文章,该文作者华南理工大学法学院副教授叶竹盛认为,“认定虚拟币为刑法财物,违反法秩序统一性原理”。其理由是:“我国民事法律和金融政策均不保护有关虚拟币的活动,不鼓励甚至打击虚拟币有关活动,而民法上则一般以违反公序良俗认定虚拟币活动为无效的民事法律行为。如果刑法将虚拟币作为财物进行保护,则变相保障了虚拟币交易的安全,间接促进了虚拟币交易等活动,与民法和金融政策的目标是相违背的。”

3. 上海市松江区人民法院审理的一起由虚拟货币发行融资服务合同效力引发的服务合同纠纷案件

在 11 月 18 日,上海高院官方公众号发布的一篇名为《发行虚拟货币高额融资,尽头是什么?》的文章中,介绍了一起由上海市松江区人民法院审结的一件由虚拟货币发行融资服务合同效力引发的服务合同纠纷案件。对于该案,法官说法,“虚拟货币作为一种虚拟商品,具有财产属性,本身亦未被法律禁止。” 并在此基础上,分析虚拟货币相关业务活动受到严格限制,被认定为非法金融活动的理由。

4. 2024 年 12 月 5 日《人民法院报》刊载《非法窃取虚拟货币行为的刑法定性》一文

2023 年 2 月初,被告人陈某某、荆某某、黄某、罗某等人经过商议,由被告人黄某、罗某等人共同出资,约定采取利用合约码盗刷 USTD 币(泰达币)的方式进行盗窃。2023 年 3 月 20 日 15 时许,被告人陈某某、荆某某、黄某、罗某到位于涟水县某小区被害人胡某所在的公司,由黄某和荆某某与被害人胡某碰面进行扫码,陈某某负责后台操作,罗某负责开车,通过事先购买的合约码盗取被害人胡某的 USTD 币共计 57307.11 个,价值人民币 393665.461434 元。后上述被告人将部分 USTD 币进行交易后,违法所得人民币 24 万余元。

作者指出,2021 年 9 月 15 日发布的《关于进一步防范和处置虚拟货币交易炒作风险的通知》明确规定,虚拟货币不具有与法定货币等同的法律地位,虚拟货币相关业务活动属于非法金融活动,由此引发的损失由其自行承担。但这一通知只是否认虚拟货币法定货币地位,但未否认其虚拟货币财产属性。

一般认为,作为经济上的财物,必须具有价值性,包括效用性、稀缺性和可支配性。

对此,虚拟货币的财产属性体现在:

①虚拟货币的稀缺性体现在其总量恒定,并非可无限供应。

②可支配性体现为虚拟货币使用非对称加密技术,其存在 “钱包”(即地址)内,获得地址及私钥后即可控制虚拟货币。

③效用性体现为虚拟货币作为特定的数据编码,必须经过 “挖矿” 方可生成,而 “挖矿” 凝结了社会抽象劳动。

④同时,在现实生活中,虚拟货币可进行转让、交易,获得可计算的经济收益,具有使用价值和交换价值。因此虚拟货币具有财产属性,被告人窃取虚拟货币行为构成盗窃罪。

另外,作者认为,在本案中,被告人非法窃取被害人泰达币行为,使用的合约码,实则系被告人利用非法手段获取对于服务器的管理权限的手段,侵入计算机信息系统获取电子数据,进而转移泰达币的占有。故虚拟货币具有数据性,非法窃取虚拟货币的行为构成非法获取计算机信息系统数据罪。

因此,基于本案案情,作者认为,四被告人行为分别触犯非法获取计算机系统数据罪和盗窃罪,属于想象竞合,根据想象竞合择一重罪处罚原则,应认定为盗窃罪。

四、结语

以上,笔者团队对 2024 年我国涉虚拟货币犯罪总体态势,国家监管、打击虚拟货币违法犯罪活动的最新动态以及实践中对虚拟货币自身法律属性认定的最新动向进行了整理、介绍。可以看到,目前虚拟货币的财产价值已经在我国司法实践中得到了极大程度认可,而目前对于涉虚拟货币犯罪的规制重点在于以虚拟货币为犯罪工具进行非法换汇、洗钱等犯罪活动的打击。

从这一点来看,未来对于此类犯罪活动的打击将会进一步加严,而在此类犯罪中,无论从被害人合法财产的返还还是追缴或者责令退赔,罚没等方面来看,均催生了虚拟货币司法处置的现实需求。事实上,2025 年 1 月 12 日至 13 日,中央政法工作会议上强调:针对重点领域、新兴领域,司法部要主动研究提出立法建议。比如,要研究无人驾驶、低空经济、人工智能、虚拟货币、数据权属等新问题。那么作为未来虚拟货币立法的完善方向,虚拟货币的司法处置问题极有可能成为未来立法的关注重点,对此,本团队将在下期文章中进行深入分析。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。