The Trump administration has pushed the trade war between the United States and other countries into a "mutually assured destruction" nuclear deterrence phase with a single document.

When the S&P index confidently pulled out a bullish line in Friday's early trading, traders were unaware that Washington's midnight fax machine was churning out astonishing documents that would rewrite the script of globalization— the Trump administration has pushed the trade war between the United States and other countries into a "mutually assured destruction" nuclear deterrence phase with a single document.

Following the article from the day before yesterday, the relatively mild tariff scenario I had anticipated did not occur; instead, there was a comprehensive tax increase, with only the energy sector exempted, and Canada did not back down, immediately retaliating with a 25% equivalent tariff on $155 billion worth of U.S. goods.

This triggered the U.S. tariff cross-retaliation clause, indicating that the situation is escalating, so the expectation that Canada would quickly capitulate has also diminished significantly. However, both China and Mexico have threatened retaliation, though they have not yet made explicit announcements, leaving some room for de-escalation between these two countries and the U.S. (though the likelihood is low).

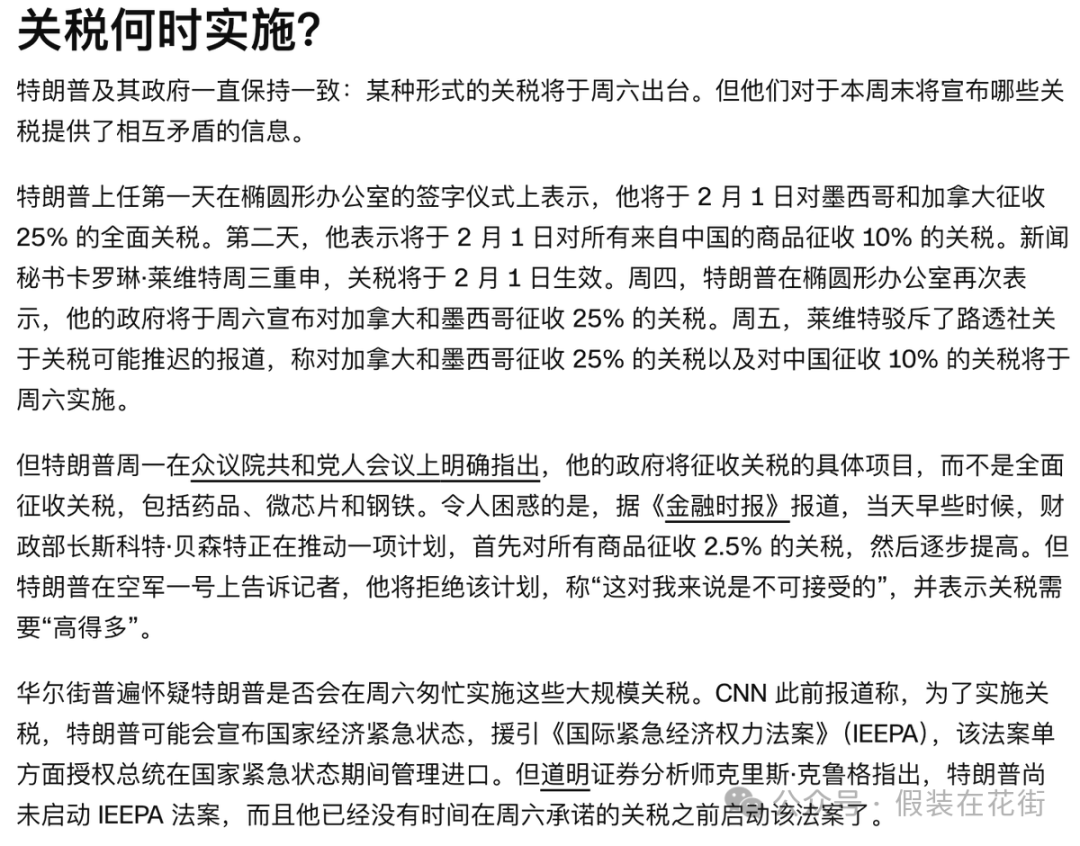

It has been previously stated that the market underestimated the tariffs because Trump had initially said he would impose them on his first day in office, yet nearly two weeks passed without action, and then he initiated a 301 investigation, which is an inquiry that could take several months to a year. Therefore, most analysts firmly believe that imposing tariffs on allies is a "maximum pressure" negotiation tactic, and that any tariff increases are a matter for several months down the line.

CNN's summary is excellent, providing another perspective that illustrates how policies are communicated verbally, with vague expectations, which explains why there was not a widespread belief that tariffs would be "comprehensive" and why there was no pricing in for this:

The violent rebound of U.S. stocks last week, with indices returning to high levels, confirms that this impact was not priced in; had there been a drop last week without a rebound, it might have been better.

The real focus on this possibility began last week, particularly in the latter half of Friday. Thus, there was no time to price it in. The cryptocurrency plunge over the weekend clearly indicates that the market is gradually beginning to pay attention to this matter and how delayed that attention has been.

On Monday, the U.S. stock market gapped down and experienced a double whammy of stock and bond declines, which was inevitable. If gold also drops, it would indicate a liquidity crisis, leading to overselling, which would present a good buying opportunity.

The marginal impact on China is smaller than that on allied countries because China already has an average tariff of 20-30%, so an additional 10% is manageable. In contrast, Mexico and Canada have average tariffs in the single digits, making the marginal changes much more significant. Therefore, the decline in the Chinese stock market may be limited.

Additionally, in conjunction with the policy, Trump also posted a message urging everyone to "tighten their belts" and live frugally, which will further strengthen market expectations that high tariffs may persist for a longer time:

Thus, against the backdrop of insufficient pricing, every additional day that high tariffs are maintained will lead to more negative impacts over time: the longer these tariffs remain without constructive engagement or signs of retaliation from other countries, the more likely they are to be viewed as permanent—resulting in increasingly negative market reactions.

For those optimistic about the future, three directions should be noted: first, whether there is progress in negotiations and reconciliation with China, Mexico, and Canada; second, whether there are any court injunctions within the U.S.; and third, whether Trump, having seen market concerns about the economy, will introduce favorable policies such as regulatory relief, liquidity assistance, and tax cuts, such as for personal income tax. If any of these measures are introduced, it could help halt the decline.

To further explain the second point, in fact, Trump’s imposition of tariffs on Saturday was based on the "International Economic Emergency Powers Act" (IEEPA). Theoretically, as long as this is invoked, the president can not only arbitrarily change tariffs but also freeze the assets of any foreign individuals or governments, and this freezing can extend beyond domestic assets to international ones (requiring foreign cooperation), effectively giving Trump control over the life and death of all countries. (The arbitrary invocation of such legal provisions provides legitimacy to unconventional means, which will only further solidify the global decoupling from the U.S. and undermine the long-term credibility of the dollar.)

However, since the IEEPA has historically been used mainly for economic and financial sanctions, this is the first time it has been used to impose import tariffs. Therefore, relevant parties (such as U.S. import and export businesses claiming their interests are harmed) may seek temporary injunctions, and the courts are likely to support the president's actions. Thus, the coming days will be a significant test of Trump's power, potentially leading to additional market volatility.

Some group members believe that this situation is akin to the temporary prohibition of birthright citizenship signed by Trump on his first day, as this is an internal political conflict rather than a unified external conflict, so the courts cannot interfere. "In such international games, one cannot bind their own hands," I agree with this, but it is also important to note that the possibility of court intervention is not zero, and it could even be a coordinated effort with Trump, where the latter instructs U.S. importers and businesses to file lawsuits, and then the courts pause for a while, which would minimize economic impact while exerting maximum pressure on opponents. Of course, this scenario is not highly likely.

In any case, keep an eye on this point; if there is news, a violent rebound is certain.

However, I personally increasingly feel that he genuinely wants to use tariffs to subsidize personal income tax, as the U.S. indeed did not have personal income tax a century ago, and Trump believes the economy can still develop well.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。