Original source: Matt Hougan

Compilation: Odaily Planet Daily (@OdailyChina)

Translator: Wenser (@wenser2010)

Editor's Note: As we enter 2025, with the emergence of the official Meme coin TRUMP and the short-term fluctuations in the market, the crypto market is once again at a turning point: on one hand, the process of crypto mainstreaming is accelerating; on the other hand, the alternating rise and fall of industry hotspots has led to a rapid decline in market attention. Many believe that the recent market performance indicates that the bull market of this cycle is nearing its end, while others hold the opposite view, believing that crypto ATH is still on the way, and the market is expected to double in 2025. In light of this, Odaily Planet Daily will compile and organize the recent views of Bitwise's Chief Investment Officer Matt Hougan for readers' reference.

Different Cycles Have Their Catalysts, De-leveraging is Inevitable

The traditional four-year cycle in the cryptocurrency market has ended.

This is a tweet about the changes that have occurred in the market.

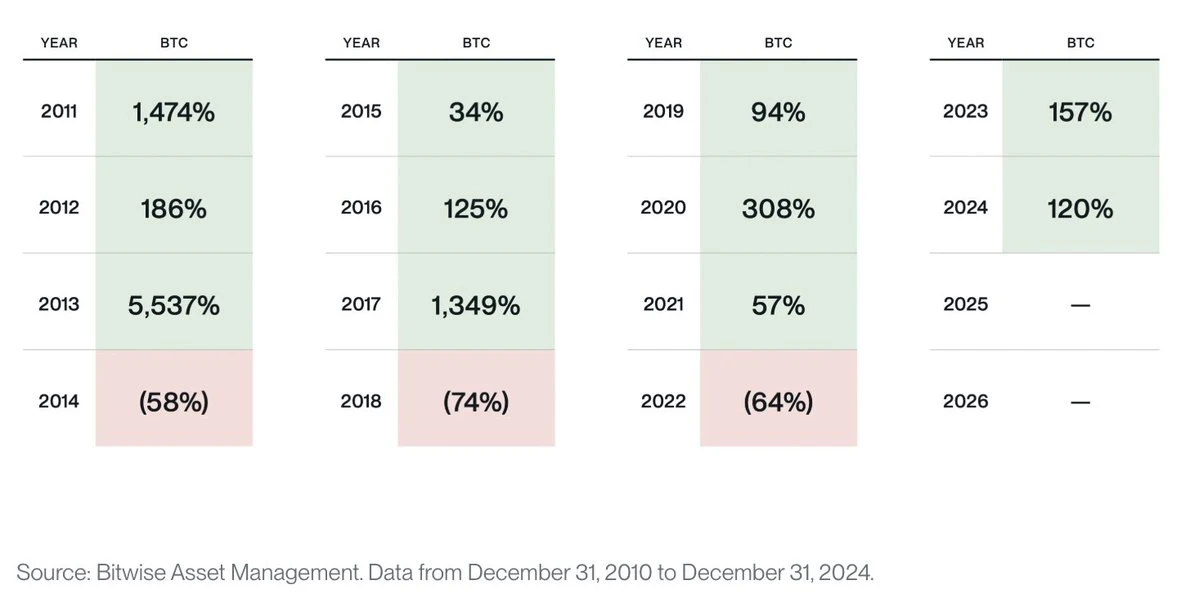

Historically, Bitcoin has followed the pattern of a "four-year cycle"—three years of growth followed by one year of correction (Odaily Planet Daily note: this can be simply understood as three steps forward, one step back).

Bitwise organizes BTC annual growth data

Broadly speaking, each rise and fall cycle is driven by the same forces, which collectively push the broader growth and recession cycles in the general economic system.

Typically, a market cycle begins with a catalyst that brings new investors and new capital into the market.

For example, in 2011, it was the creation of the first batch of crypto companies and platforms that supported individual purchases of Bitcoin (such as Coinbase, Mt.Gox, etc.).

Once a bull market begins, the crypto market gains its own growth momentum:

Price increases attract widespread attention, followed by more capital. Eventually, investors become extremely greedy and increase leverage. Bubbles and fraud emerge. Sometimes, traditional infrastructure ultimately collapses under significant pressure.

What Ultimately Happens in Different Crypto Cycles?

In 2014, Mt.Gox collapsed;

In 2018, the U.S. SEC launched a strong crackdown on ICOs.

Regardless of the reasons, corrections are painful, accompanied by rapid de-leveraging and ensuing despair. However, ultimately, the crypto market experiences a new breakthrough, opening a new cycle.

The current cycle stems from the large-scale de-leveraging actions that occurred after numerous industry scandals in 2022: such as the FTX collapse, the downfall of Three Arrows Capital, the bankruptcy of Genesis, the collapse of Blockfi, and the downfall of Celsius.

The catalyst event for this upward cycle occurred on March 10, 2023, when Grayscale convincingly won the opening debate against the SEC regarding the approval of a Bitcoin ETF. Although the final ruling took months to settle, from that moment on, the arrival of Bitcoin ETFs became inevitable. This also signifies that cryptocurrencies have officially entered the mainstream.

Indeed, the Bitcoin spot ETF was officially launched in January 2024, setting records for subsequent price trends—the market price rose as expected.

2026 may be a correction point, with early signs of industry leverage emerging, and Washington becoming the center of crypto development

In the classic four-year cycle pattern, we are preparing for a correction in 2026.

Frankly, I do see early signs of leverage building within the crypto industry, as some companies issue debt to purchase Bitcoin, and the growth rate of "Bitcoin-backed loans" is rapidly increasing.

However, in this cycle, the crypto industry is experiencing some new changes: Washington (referring to the U.S. government) has shifted its attitude towards cryptocurrencies.

Crypto executive orders have become one of the factors to consider: previously, Washington referred to cryptocurrencies as a "national priority," which laid the groundwork for a regulatory framework to some extent. Additionally, the U.S. government may plan to establish a "national-level crypto reserve."

The change in Washington's attitude has paved the way for mainstream institutions to enter the cryptocurrency market in large numbers.

But the reality is: mainstream investment institutions will not act in accordance with the expectations of the crypto-native community.

The change in Washington's attitude is the result of years of efforts, not a shift that occurred in just a few months.

Under the best-case scenario that has become a foregone conclusion, the cryptocurrency industry still needs about a year to align with the new crypto regulatory framework, while many large companies and institutions also need a similar amount of time to prepare from planning to action. Wall Street and mainstream investment institutions are more like giant oil tankers that cannot quickly change direction, rather than speedboats that can swiftly turn. If such institutions only start to genuinely pivot towards cryptocurrencies next year, will a new "crypto winter" in 2026 arrive as we previously anticipated?

To be honest, I am not sure. After all, the scale of funds in traditional financial institutions is simply too large. The Bitcoin spot ETF will bring hundreds of billions of dollars and new investor capital into the cryptocurrency market; in contrast, the changes that Washington can lead will bring trillions of dollars in liquidity.

Since the early stages, the crypto market has always followed the four-year cycle pattern. However, the changes brought by Washington (referring to the U.S. government) will lead a new wave, which will continue to play a role in the next decade.

My personal guess is that when the classic "de-leveraging action" begins next year, this emerging, larger trend is likely to overshadow it.

What does this mean?

It does not mean that the traditional "four-year cycle pattern" has completely disappeared. There is no doubt that leverage will still be generated; excess debt and liquidity will still appear; and poorly performing participants such as market tumors and fraudsters will still emerge.

At some point, these issues and individuals may be eliminated, while bringing more liquidity into the market.

Additionally, I personally estimate that any corrections will be shorter and shallower compared to the previous years.

There is no doubt that we are in a new mainstream era of cryptocurrencies, an era that is both exciting and intriguing.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。