关键点速览

-

加密货币可以理解成“数字版的货币”,而且它的用途越来越多,比如储存价值、玩游戏等等。

-

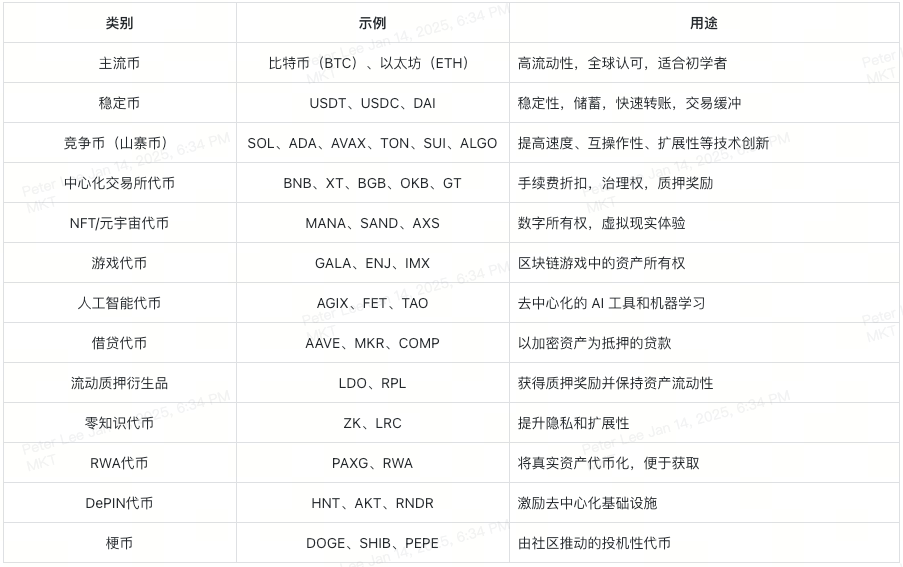

加密货币分很多类别,各有各的用途:有像比特币和以太坊这样的主流币,也有靠社区热度推动的梗币,还有NFT专门用来做数字藏品等等。

-

风险与研究很重要:加密货币价格波动大,所以请一定先做好功课(DYOR,Do Your Own Research),并且不要投入超过自己能够承担风险的资金。

-

下一步:你可以根据自己的节奏,慢慢探索不同类别。我们也会在后续文章中,继续深入介绍加密货币世界里更多好玩的东西。

如果你对加密货币还是一头雾水,其实你可以把它当作一种利用“密码学”(高级数学技术)来保护交易安全的数字货币。自从 2009 年比特币首次亮相后,整个加密货币领域就像火箭一样蹿升,从 NFT(数字收藏品)到 DeFi(去中心化金融)等新概念层出不穷。本指南会先帮你了解加密货币里最常见的一些类别,告诉你这些类别为什么重要,并给你一些简单好用的指引,让你在这片“新大陆”里不至于迷路。

为什么要先搞清楚加密货币的类别?

说实话,现在的加密货币圈,项目真是多如牛毛。每天都有新币、新项目蹦出来。如果能先给它们分门别类(比如说是稳定币、NFT/元宇宙代币还是梗币),就能大大提升你对它们的理解,避免盲目跟风。这里有几个好处:

更清晰:

-

每种代币都有自己的目的和功能,先搞明白再出手,更不容易搞混。

风险管理:

-

加密货币波动大,想分散风险,就需要了解不同类别的特性。

战略思维:

-

想短线交易还是长线持有?先看看它属于哪一类,才能更好地决策。

Image Credit: MasterTheCrypto

加密货币到底是什么?

一句话描述

加密货币是基于区块链的数字货币。区块链就像一个公开账本,不需要银行或其他中心化机构来记账。

它有哪些“酷”点?

转账速度快且成本低:

-

跨国转账几分钟就搞定,很多时候比传统银行还便宜。

你自己掌控一切:

-

不再需要银行当中介,你是自己资金的主人。

创新层出不穷:

-

从游戏奖励到去中心化金融应用,人们一直在发明各种新玩法。

Image Credit: LinkedIn (Raajashri Sathyamurti)

加密货币的主要类别

现在,我们来看看最常见的加密货币类型,各自都有什么用处。理解它们之后,你就能在茫茫币海中做出更明智的选择。

主流币(Mainstream Coins):加密货币的核心

示例

为什么重要?

-

这类币通常流动性最高,全球知名度也最高,适合新手入门。

-

相对来说,它们的波动性虽然也有,但已经被市场广泛接受,比较容易“上手”。

小贴士

稳定币(Stablecoins):在动荡中寻找稳定

示例

-

Tether (USDT):锚定美元的一种稳定币。

-

USD Coin (USDC):透明度高、有审计报告背书,同样锚定美元。

-

DAI:去中心化稳定币,靠智能合约维护其与美元的锚定关系。

主要用途

-

用来减小加密货币的价格波动。你可以在市场不稳定时,把资金先“停放”在稳定币上。

-

也有人用它来快速转账或短期储蓄,部分平台还能给你的稳定币提供利息。

你知道吗?

-

一些 DeFi 平台允许你把稳定币存进去赚收益,风险相对波动性大的币会小一些(但仍要谨慎评估平台安全性)。

竞争币/山寨币(Altcoins):驱动创新

示例

-

Solana (SOL):以高交易速度而出名,常用于 DeFi 和各类 dApp。

-

Cardano (ADA):注重安全和可扩展性。

-

Avalanche (AVAX):主打可扩展的区块链,用于 dApp 和 NFT。

-

Toncoin (TON):重启后主打金融应用场景,背后有不少社群支持。

-

Sui (SUI):强调易用性和效率的创新型区块链。

-

Algorand (ALGO):追求安全性、可扩展性,为去中心化应用提供基础。

为什么这些币有价值?

-

它们往往代表了区块链技术的新方向,比如更快的速度、跨链协作、治理功能等等。

可执行的步骤

-

可以先在市值排行前 10 的山寨币里,选择一个让你感兴趣的,读一下它的白皮书或深度解析,看看团队和技术路线能否打动你。

中心化交易所代币(CEX Token):交易所的“亲生代币”

示例

-

Binance Coin (BNB):在 Binance 平台用它交易能享受费用折扣。

-

XT Token (XT):XT.COM平台上的生态与激励代币。

-

Bitget Token (BGB):Bitget 交易所的“平台币”。

-

OKX Token (OKB):OKX 生态内用于交易、治理和费用减免。

-

GateToken (GT):Gate.io 的平台币,赋能交易和其他生态权益。

价值点在哪?

-

持有这些代币,通常能享受更低的交易费,或参与平台治理,还可能拿到质押分红等福利。

知道吗?

-

如果你经常在某个中心化交易所做交易,合理使用它的代币能省下一笔手续费。

NFT/元宇宙代币(Metaverse Token):数字所有权与虚拟世界

示例

-

Decentraland (MANA):可用于购买虚拟土地和体验内容。

-

The Sandbox (SAND):让玩家创造并变现虚拟空间。

-

Axie Infinity (AXS):通过玩游戏、交易角色(Axies)来获取收益。

为什么很火?

-

让虚拟物品也能“属于你”,比如你可以真正拥有一片数字土地或独一无二的游戏角色。

小建议

-

如果你从来没玩过元宇宙类项目,不妨先去这些平台开个免费账户,逛一逛,了解一下社区氛围和玩法,再决定要不要投入。

游戏代币(GameFi Token):娱乐与收益的结合

示例

-

Gala (GALA):专注区块链游戏,让玩家拥有并交易游戏内资产。

-

Enjin (ENJ):为游戏内 NFT 提供支持。

-

Immutable (IMX):解决 NFT 高昂的“矿工费”,让玩家零gas费铸造、交易。

有啥好处?

-

真的可以“边玩边赚”(Play-to-Earn)。同时,让你对游戏里的数字物品有完全的控制权。

实用步骤

-

如果你对链游感兴趣,找一款门槛不高、免费或成本很低的游戏先试试水,看自己是不是喜欢这种新玩法。

AI 代币:区块链与人工智能的碰撞

示例

-

SingularityNET (AGIX):去中心化的 AI 服务市场。

-

Fetch.ai (FET):用 AI 代理自动处理现实世界任务。

-

Bittensor (TAO):旨在去中心化的机器学习协作奖励。

新颖之处

-

让 AI 更加去中心化、开放,让更多人可以参与到 AI 的开发和使用中。

你或许不知道

-

未来,AI 代币可能会在预测模型、AI 工具和去中心化市场中扮演重要角色。

借贷代币:加密货币的金融“新玩法”

示例

-

Aave (AAVE):可把币存进去赚利息,也可抵押借出资金。

-

MakerDAO (MKR/DAI):抵押加密资产后,生成 DAI(稳定币)。

-

Compound (COMP):去中心化平台,用加密资产进行借贷。

如何运作?

-

出借:把你的币存到平台,赚利息。

-

借款:用你的币做抵押,借出资金,不用把币卖掉。

温馨提示

-

抵押借贷要时刻关注抵押率,如果市场剧烈下跌,可能会被“平仓”——就是借贷平台把你的抵押品卖掉。

流动质押衍生品 (LSD):质押也能有流动性

示例

-

Lido (LDO):质押 ETH后获得 stETH,依然可以在 DeFi 里用。

-

Rocket Pool (RPL):更加去中心化的以太坊质押方式。

为什么它很酷?

-

原本质押后,币就“锁住”了,不能再动。但有了衍生代币,你可以一边拿质押收益,一边还能在别的项目里继续投资。

可以怎么做?

-

先看看不同平台提供的年化收益率和风险,然后决定把多少 ETH 拿去质押,做个“小实验”也不错。

零知识 (ZK) 代币:隐私与可扩展的利器

示例

-

zkSync (ZK):使用 ZK-rollup 为以太坊降费提速。

-

Loopring (LRC):实现快速且隐私的去中心化交易。

为什么重要?

-

ZK 技术能保护用户隐私,又能让区块链网络跑得更快、更高效。

常识拓展

-

零知识证明是以太坊扩容的热门方案之一,让网络处理更多交易时还能保证安全性。

RWA 代币:让“真实世界资产”也能数字化

示例

-

PAX Gold (PAXG):你持有的代币锚定着真实黄金。

-

RWA.Inc (RWA/USDT):提供各种类型资产的代币化服务,让更多人能轻松参与。

好玩的地方

-

你不用去租保险箱或担心物流,直接在区块链上买“黄金”或别的实体资产份额。

简单建议

-

可以先看金子、房地产之类的传统资产是怎么被代币化的。对比一下它的币价和实体黄金的价值,看看两者之间的差别。

DePIN 代币:去中心化基础设施的“基石”

示例

-

Helium (HNT):通过搭建物联网无线网络节点来获取代币奖励。

-

Akash Network (AKT):去中心化云计算平台。

-

Render (RNDR):分布式 GPU 渲染服务,让数字创作者用去中心化方式获得渲染资源。

为什么值得关注?

-

这些项目通过代币奖励来鼓励更多人建设“网络、算力等”硬件或软件基础设施,形成一个去中心化的资源网络。

实用建议

-

如果你对跑节点感兴趣,可以看看 Helium,买台设备在家里当热点,顺便赚点代币,但要评估硬件成本和市场状况哦。

模因币(Meme Coins):社区热度的产物

示例

-

Dogecoin (DOGE):最早的“梗币”,一度爆火。

-

Shiba Inu (SHIB):拥有非常活跃的社区与生态扩展。

-

Pepe (PEPE):以经典的“青蛙表情包”为灵感。

有啥需要特别注意?

-

这些币价格严重依赖社交媒体和社区的狂热程度,波动常常非常猛。

-

如果你想试一把,千万记住只投入自己输得起的资金,别因为 FOMO(害怕错过)就倾尽所有。

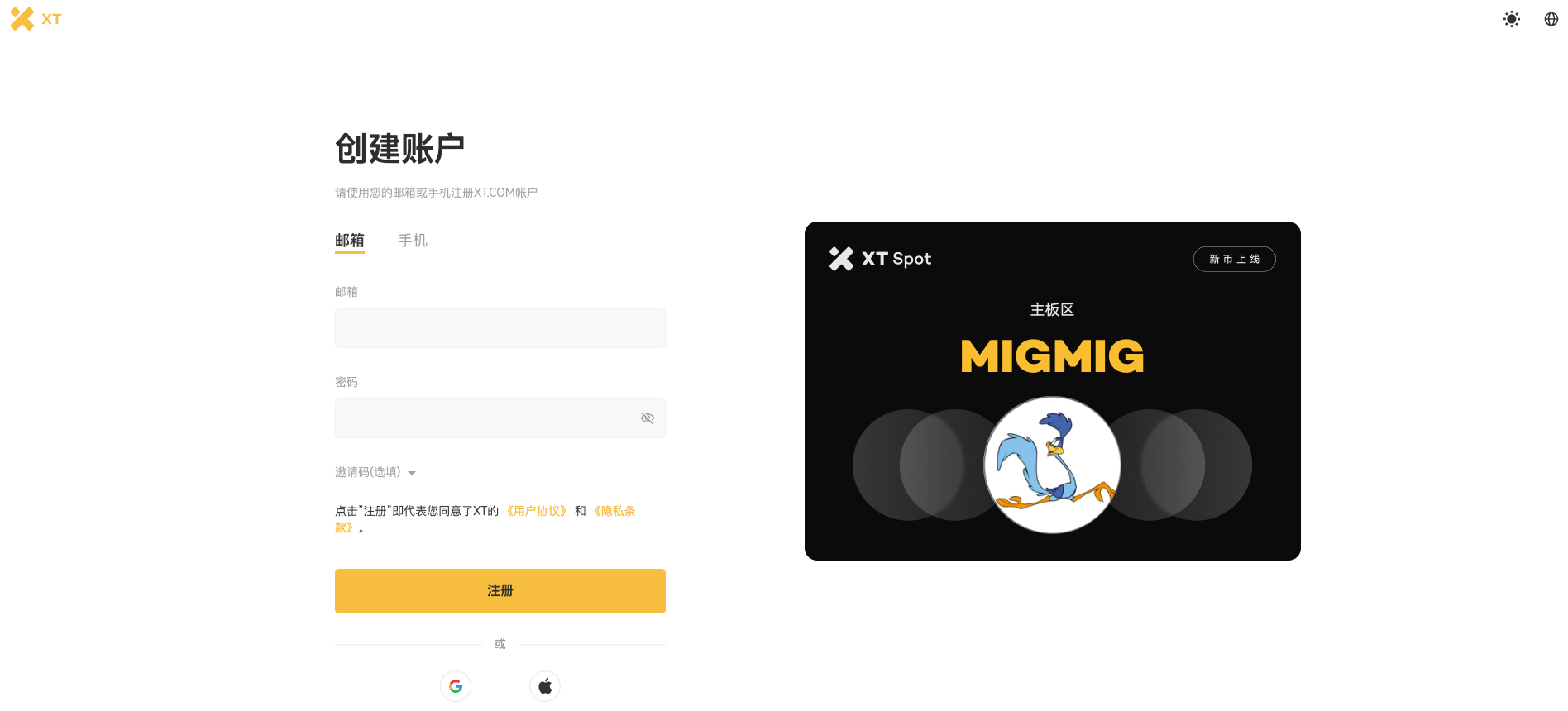

如何购买你的第一笔加密货币?

1. 选一家交易所

-

先看它安全性如何、操作是否友好、口碑怎么样。(比如 XT.COM)

2. 注册账户并通过身份验证

-

大多数正规交易所都会要求你进行 KYC(实名认证),这是正常流程。

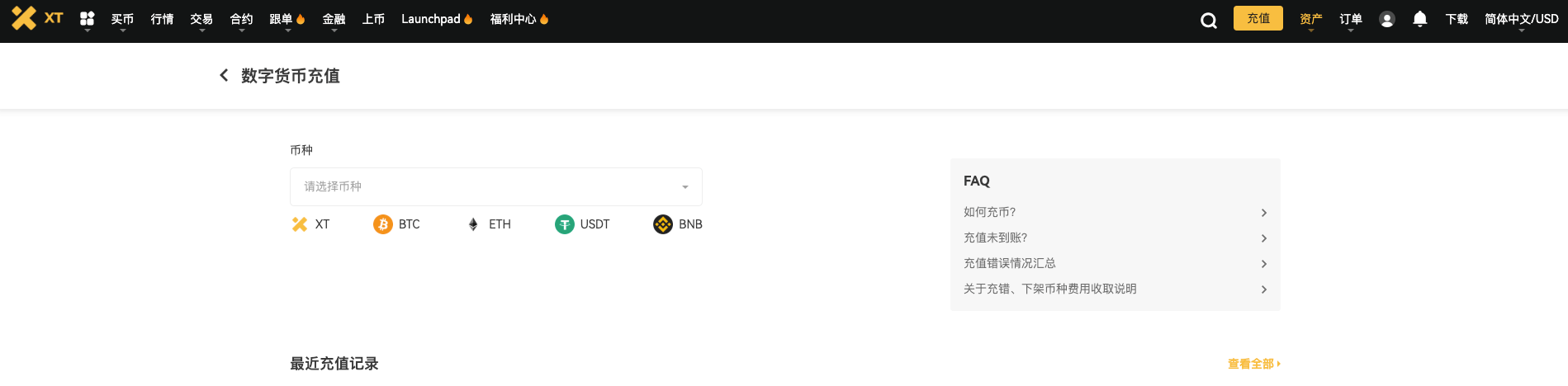

3. 充值资金

-

你可以充值其它加密货币,或者通过银行转账、信用卡等方式充入法币(如美元)。

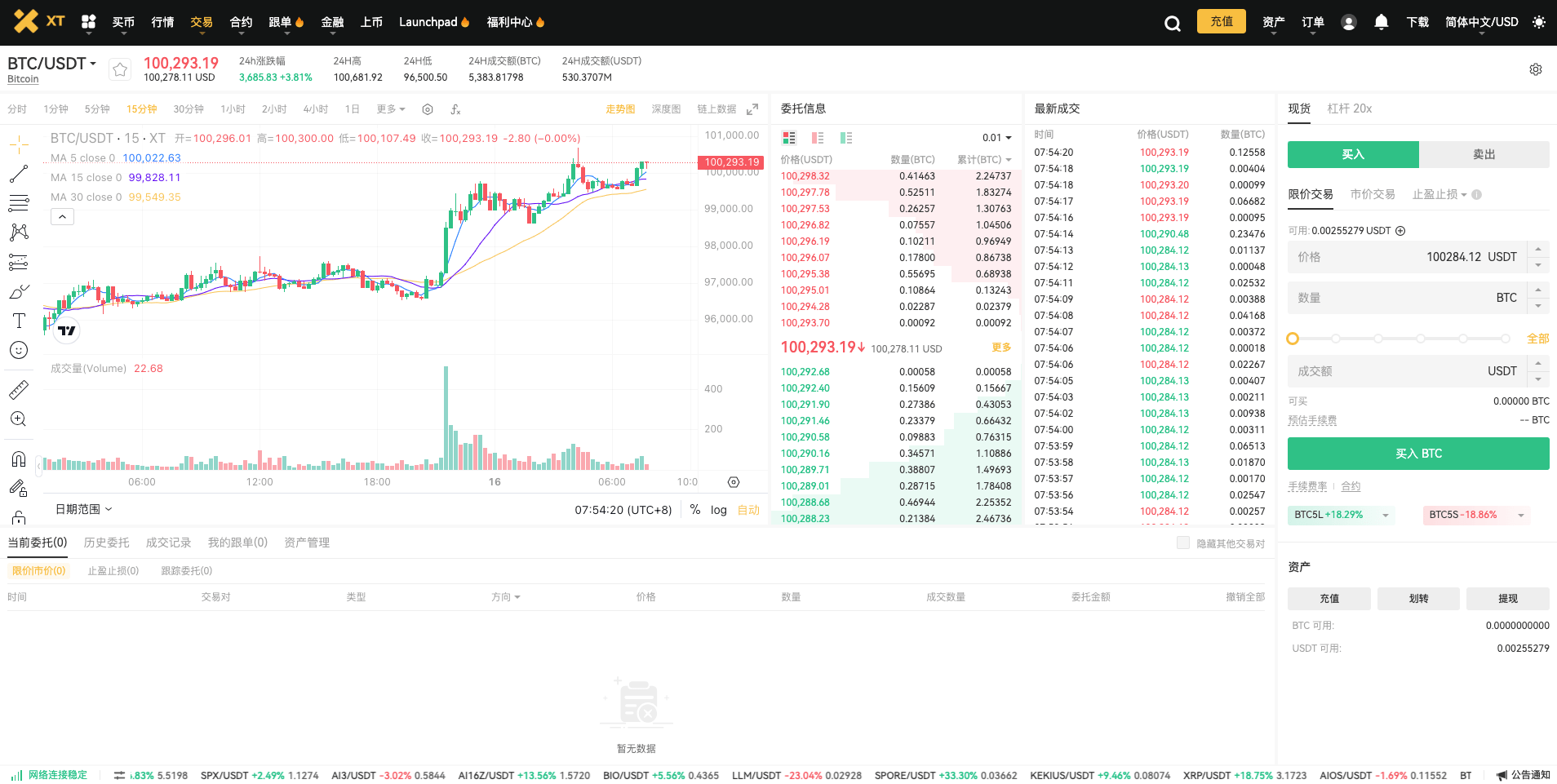

4. 选择一个币种

5. 确认手续费并点击“购买”

-

每家交易所都会收交易费或网络手续费,买之前先了解清楚。

XT.COM如何助力你的加密之旅

如果你想更深入地探索加密世界,XT.COM可以提供一系列工具和服务,帮助你更轻松地学习和交易:

-

丰富的币种选择:几乎覆盖上面提到的所有类别,让你有更多探索空间。

-

专业但不复杂的交易工具:不管你是小白还是老手,都能找到顺手的功能。

-

教育资源:提供各种教程、文章和指南,帮助你从零开始了解加密世界。

-

社区支持:我们有活跃的电报群、Discord 频道,以及快速响应的客服团队,可以解答你的疑问。

(小提示:如果你是新手,不妨先看看平台的“新手教程”,先熟悉界面和安全功能。)

最后的提醒与鼓励

这份“初学者地图”只是你加密货币旅程的起点。整个加密世界里还有很多有趣的角落等待你去探索。不过,在享受乐趣的同时,也要保持谨慎:

FOMO(错失恐惧症) & 价格波动:

-

别被市场情绪牵着走,只投资自己能够承担损失的资金。可以考虑“定投”来平滑进场。

安全意识:

-

设置强密码,开启 2FA(双重验证)。

-

提防钓鱼网站,登录前先确认网址是否正确。

-

绝对不要把“助记词”给任何人,并且最好离线保存。

硬件钱包存储:

-

如果准备长期持有币,可以考虑买个硬件钱包(比如 Ledger、Trezor),让资产处于离线状态。

保持好奇心:

-

区块链技术一直在演变,多关注权威和可靠的信息渠道,持续学习。

无论你只想搞清楚基础概念,还是打算深入研究各种高阶项目,现在你已经有了一张加密世界的“地图”。

祝你玩得开心,也欢迎来到这片充满无限可能的新世界!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。