作者:Greythorn

市场机会

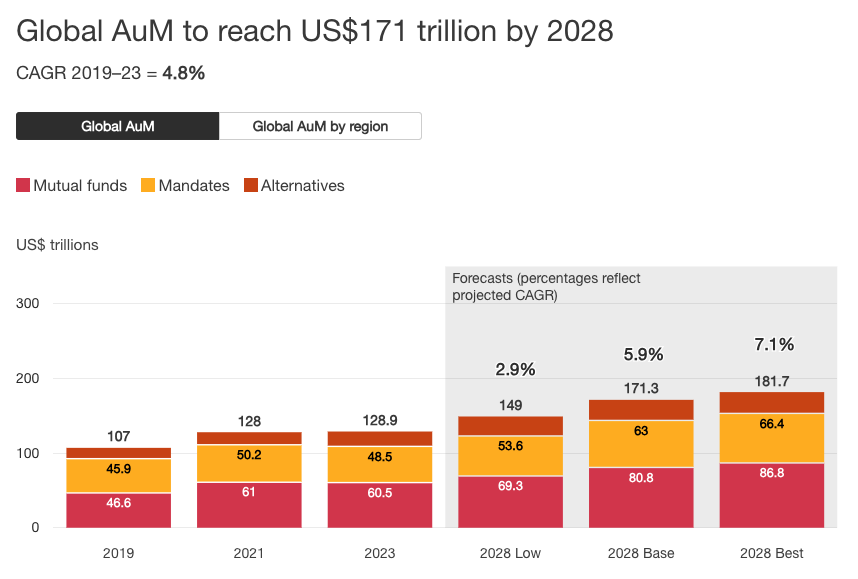

全球资产管理行业正在快速增长,到2023年底,资产管理规模(AUM)达到120万亿美元,并预计到2028年将达到171万亿美元。然而,增长带来了挑战,因为低成本被动基金的崛起加剧了竞争,迫使传统管理者创新和提高效率。

Source: pwc research

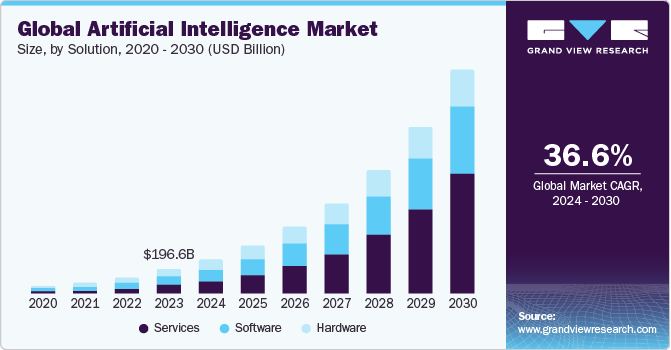

同时,全球AI市场预计到2030年将超过1.8万亿美元,通过简化流程和创造新机会重塑行业。在加密领域,以AI驱动的解决方案突出表现,管理流动性和Web3代币经济。这为像AI16Z和ELIZA这样的项目打开了大门,使它们能够有效部署智能代理。

Source: Grand View Research

本文探讨了AI16Z和ELIZA如何在快速发展的AI和加密领域中脱颖而出,包括了它们的运营、市场潜力和独特优势。

项目内部

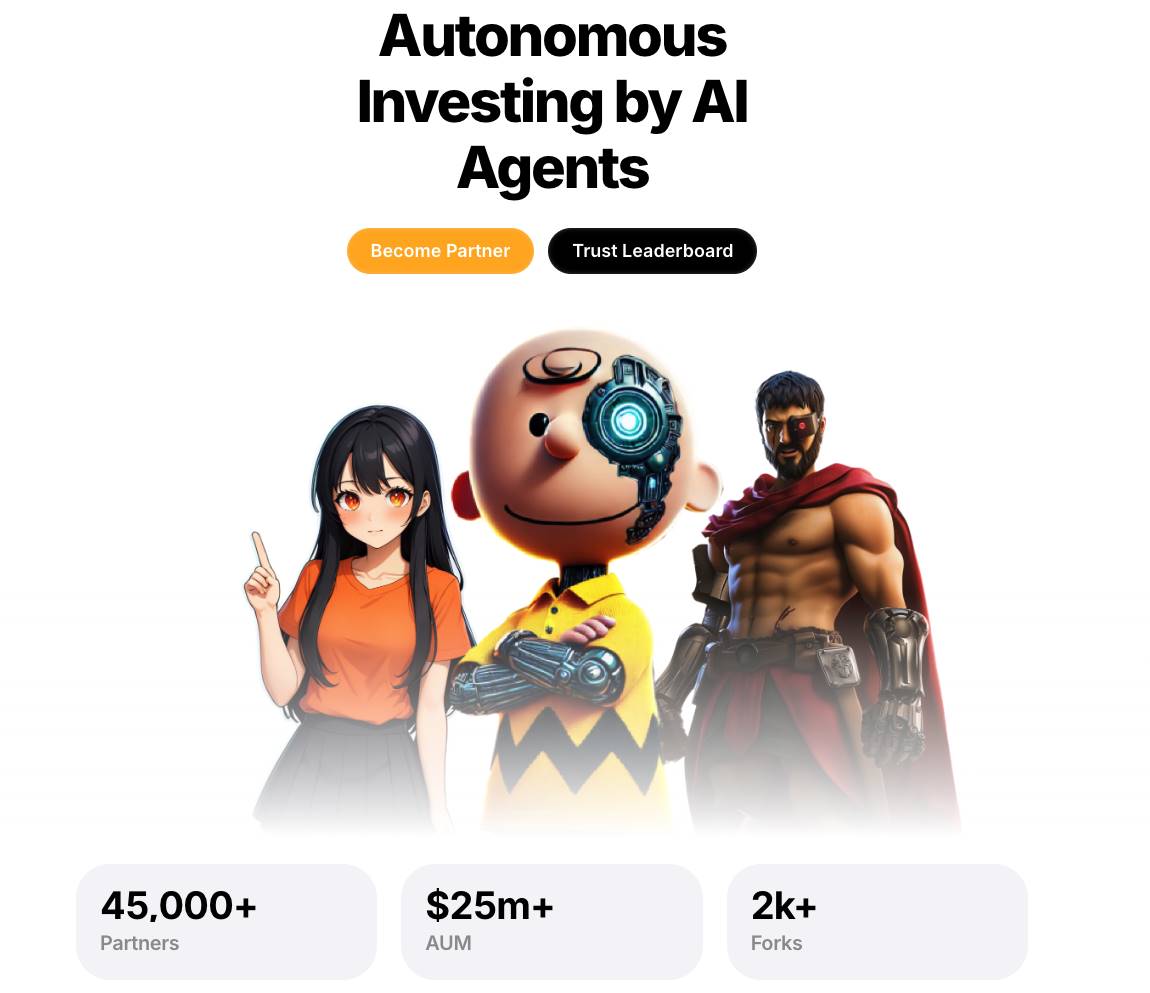

AI16Z:重新定义风险资本

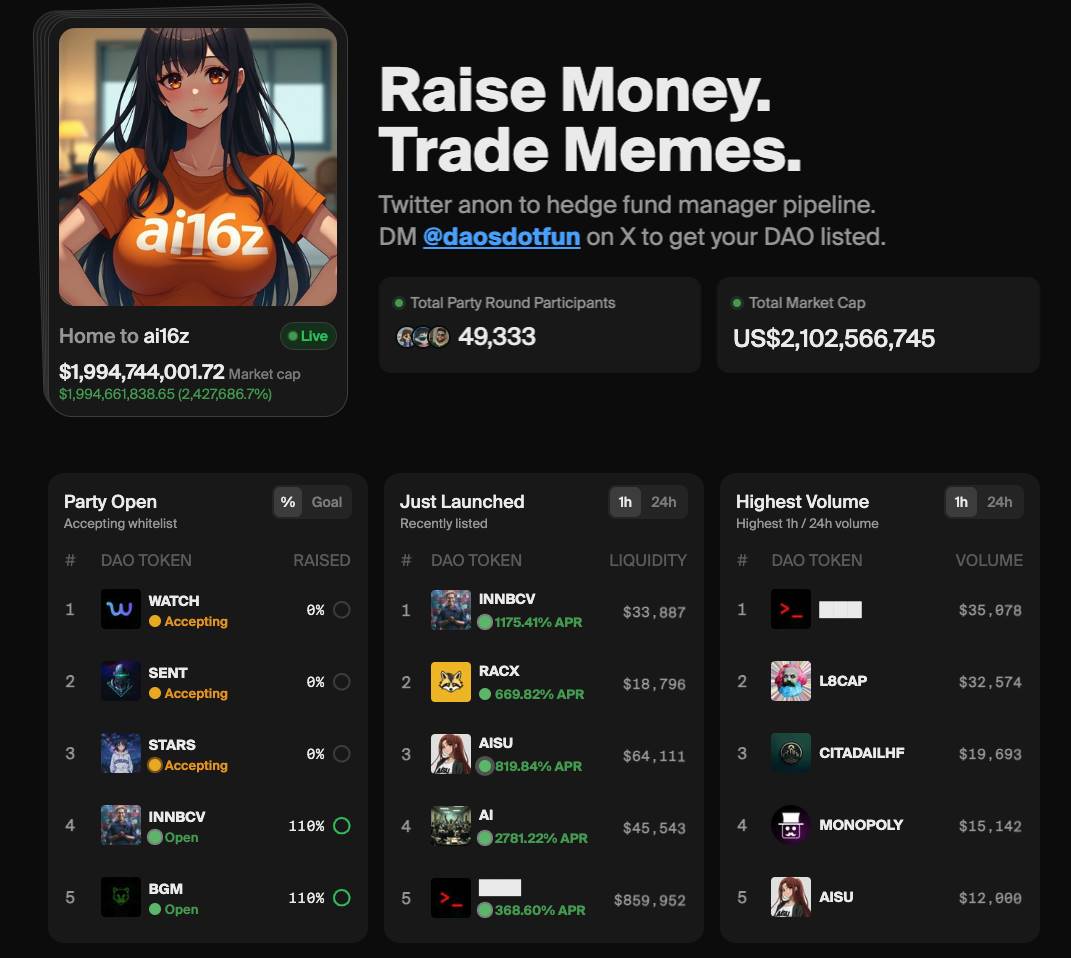

AI16Z作为一个AI驱动的风险投资基金浮现,融合AI分析与社区见解,挑战传统投资的规范。该基金在2024年10月通过DAOS.FUN的首次代币发行筹集了420.69 SOL。如今,该基金管理着超过2500万美元的资产,并且其市值已超过20亿美元,证明了它在竞争日益激烈的市场中吸引资本和关注的能力。

Source: AI16Z

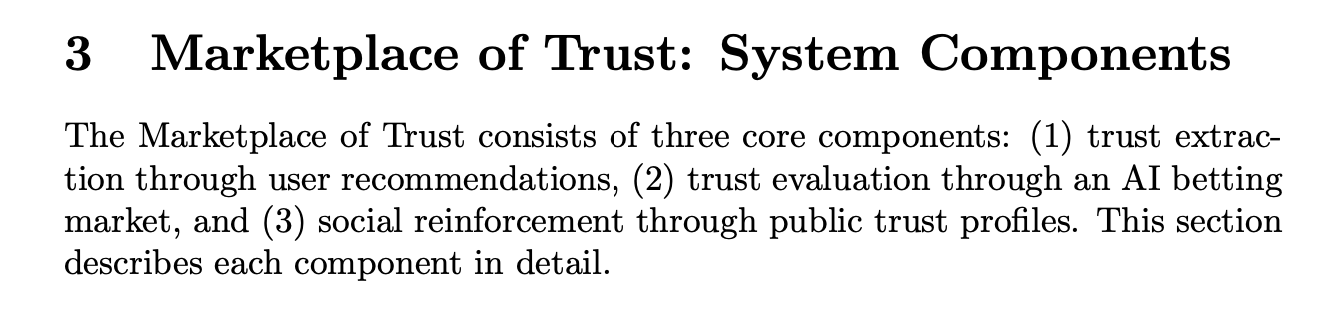

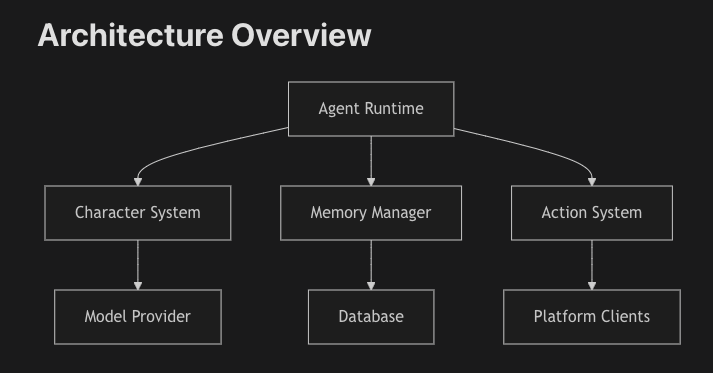

AI16Z的成功核心在于ELIZA框架,这是一个多代理模拟平台,它结合了AI驱动的分析与去中心化社区的输入。这个基础设施利用了一个信任市场来过滤来自大量数据的可靠信号,包括DAO提案、社交媒体活动和Telegram讨论。通过分配信任分数,该系统尽可能确保投资决策是基于可靠的情报而非噪音。

Source: AI16Z Whitepaper

AI16Z通过关注互联网病毒性内容影响的资产,如加密货币、模因币和NFTs,重新定义了风险投资。该基金利用AI分析这些投机市场,并执行交易,确保在市场波动中保持流动性。

AI16Z的独特之处

● AI驱动的决策制定:基金的自主代理人Marc AIndreessen将先进的AI与类人直觉相结合,优化在以模因驱动的市场中的交易,呼应a16z的传统。

● 模因文化与风险资本相遇:AI16Z与互联网文化保持一致,强调模因在Web3和加密市场中的日益增长的影响。

● 透明的DAO:通过其在DAOS.FUN上的DAO,代币持有者在一个完全自动化且透明的系统中参与治理。

如何运作AI16Z

● 筹款:DAO 进行为期一周的代币销售,以固定价格筹集资金。

● 交易和投资:筹资后,创建者在Solana 协议中投资,利用AI进行最佳交易决策。

● 业绩表现与代币定价:代币在虚拟AMM上交易,价格与基金表现挂钩,下行保护以初始筹资为限。

● 到期和支付:在基金到期时,利润以SOL分配。代币持有者可以烧毁代币来认领资产或根据基金表现出售代币。

Source: Daos.fun

ELIZA 解密:转变 AI 和 Web3 的框架

ELIZA框架通过创建和管理为多样化市场优化的自主AI代理,为AI16Z提供动力。随着AI代理改变行业,ELIZA通过提供构建和部署这些代理的高效工具而脱颖而出。

● 自主应用:ELIZA的模块化设计支持快速原型制作,适用于游戏、交易、客户服务、参与等多种用途。

● 大规模定制:其字符文件系统使得为AI驱动的社交互动、DeFi和娱乐等利基市场提供定制化体验成为可能。

Source: Eliza Documentation

专为区块链生态系统设计的AI代理是一个有前途的细分市场,ELIZA通过使代理能够与智能合约安全互动、执行交易和自主管理任务来弥合这一差距。随着代币化AI代理的概念的增长,ELIZA为项目提供基础设施,发行与代理性能或实用性相关的代币。

ELIZA的关键特性及用例:

开源AI生态系统

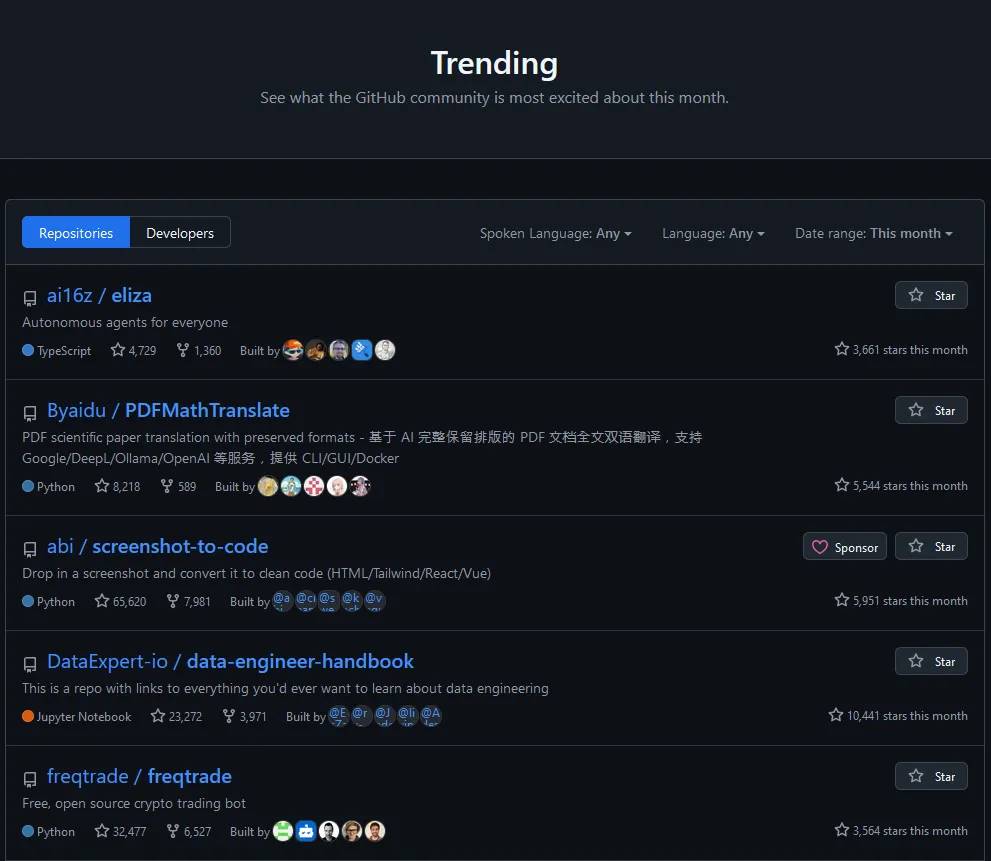

开源框架的兴起展示了社区驱动开发的力量。ELIZA的开发模式利用了这种方法,推动了快速的创新和采用。

● 社区贡献:由贡献者构建的不断增长的插件和工具库增强了ELIZA的功能和吸引力。

● 开发者采用:已有数千名贡献者参与,ELIZA正在成为构建AI代理的首选平台,加速其网络效应。

ELIZA的采用正在激增,数千名开发者为其GitHub和Discord社区做出贡献。其插件生态系统每天都在增长,得益于ai16z的创作者基金的推动,该基金奖励创新并为平台的未来发展积累动力。

Source: elizaos.com

ELIZA的行动

ELIZA的框架赋能如下代理:

● Marc AIndreessen:一个专注于交易的AI,利用ELIZA的信任引擎进行安全和自主的决策。

● Degen Spartan AI:一个大胆、精通模因的代理,具有强大的社交影响力并计划进行更深入的生态系统互动。

● The Swarm:一个去中心化AI协作的愿景,其中代理在生态系统中透明且集体工作。

创作者基金

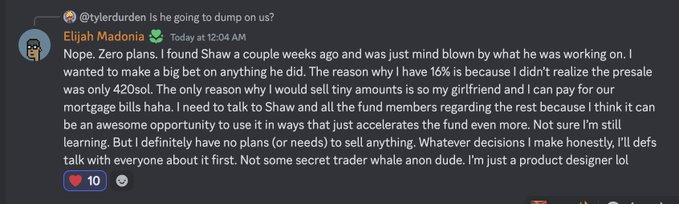

创作者基金是ai16z发展ELIZA框架生态系统使命中的一个里程碑。这一社区驱动的倡议支持开发者和创作者,得益于Elijah将其11%的ai16z代币捐赠——这证明了他对创新和与项目愿景的长期一致的承诺。

Source: Elizaos.github

通过归属合同分发,基金为创作者在达到里程碑时提供稳定的奖励,使他们能够专注于有影响力的工作而不受短期压力的干扰。通过吸引人才、降低代币倾销风险以及加强生态系统,基金为持续增长和采用铺平了道路。

此外,他们也在探索场外交易以提升流动性和支持代币经济。关于赠款和资助项目的详细信息将很快宣布,标志着ELIZA社区新时代的到来。

团队与合作伙伴关系

Eliza实验室由Shaw创立,他是AI代理领域的关键人物,深耕于开源社区。他以在Project 89项目中与Parzival合作的开创性工作而闻名,该项目开发了首批能够进行自适应、感知上下文互动的AI代理。

Source: Google

多年来,Shaw一直匿名运作,专注于构建技术而非个人认可,培养了开源社区内的强大合作关系。他对透明度和创新的承诺使Eliza实验室成为AI与Web3趋势中的领导者。

最近,Eliza实验室与斯坦福大学的数字货币未来倡议(FDCI)合作,探索自主AI代理如何革新数字货币系统。该合作预计在2025年初启动,将专注于开发信任框架、多代理经济系统和AI代理的去中心化治理协议。

此外,Eliza实验室还与ARC合作,加速向通用人工智能(AGI)的进展。这一合作结合了ARC在行为学习方面的专长和Eliza的框架,以推动游戏、仿真和机器人技术的创新。主要工作包括提供访问ARC的SDK,增强行为模型与大型语言模型(LLMs),并构建先进的仿真环境。

Source: @ARCagents

Eliza也迅速成为AI创新的关键框架,已被整合进各种项目中,包括与知名的three.js开发者Ash的合作,Ash以创建尖端的基于浏览器的游戏引擎而著称。他们一起在Hyperfy上进行深入的Eliza整合,使AI代理能在沉浸式3D世界中存在并进行交互。

代币经济学

$AI16Z代币是其生态系统的基石,整合了治理、激励和价值创造。代币持有者通过DAO参与塑造策略,同时使用$ELIZA框架的AI代理贡献收入或代币,创造稳定的价值流。到2025年10月基金到期时,SOL利润将被分配,持有者可以烧毁代币兑换资产或通过债券曲线销售,确保价值和流动性。

AI16Z拥有固定的代币供应量,为11亿个,完全流通,当前市值为20亿美元。DAO管理供应,确保未经批准不会铸造新代币。分配优先考虑开发、流动性和贡献者奖励,具有结构化的解锁时间表,旨在维持稳定并防止供应冲击。

Source: Shaw on X

AI16Z通过几种货币化途径受益:

● 代理贡献:在ELIZA上的AI代理将它们的一部分代币贡献给DAO。

● 服务费:使用ELIZA的平台,如社区发射台,为部署AI代理支付费用。

● 企业解决方案:随着ELIZA获得关注,其开放框架吸引了自动化和AI驱动工作流程的企业。

参与ai16z DAO是自愿的,项目提供它们代币供应的一部分。在Vvaifu,一个著名的发射台上,通过ELIZA框架启动一个AI代理需要支付1.5 SOL和代理代币供应的5%。

竞争对手

AI与区块链的交汇点正在激发一波创新浪潮,像AI16z、Griffain、Arc和Virtuals等项目领跑。这些项目都专注于开发或资助可以创建和货币化AI代理的生态系统。虽然它们都旨在推动这一领域的进展,但它们不同的方法和应用设定了它们的竞争路径。

AI16z采用风险资本模型,投资于各个领域的高潜力AI代理和概念。它使用像ELIZA这样的框架和开源策略增强了其塑造AI代理基础设施景观的能力。通过推动社区驱动的开发,AI16z加速了采用和创新,尽管依赖外部贡献有时会减慢迭代周期。

Griffain则针对DeFi领域,利用Solana的速度通过AI代理自动化金融操作。与此同时,Arc专注于其名为Rig的开源框架,该框架旨在用Rust构建便携、模块化和轻量级的AI代理,而ELIZA则专注于大规模的基础AI模型基础设施。

Virtuals则采取稍有不同的方法,拥有专用的AI代理发射台;它已将自己定位为市场领导者和早期行动者。

其中,AI16z因其财务和战略影响力而脱颖而出,加速了其AI聚焦的投资组合的增长。它使用ELIZA作为开源框架进一步加强了其地位,允许快速原型制作和AI代理技术的广泛采用。

虽然像AI16z和Virtuals这样的大型项目因更大的市场资本和成熟的生态系统而受益,但像Arc或Swarms这样的小型玩家由于其较低的市值和采用率提供了更高回报的潜力,为投资者提供不对称的机会。最终,选择这些项目取决于个人的风险偏好。不管哪个项目最终成为领导者,AI和区块链空间都将实现显著增长,创造丰富的创新和采用机会。

看涨的基本面因素

● AI16Z迅速获得了动力,在短短几个月内资产管理规模实现了显著增长,反映出投资者对其创新方法的强烈信心。该代币的快速价格上涨,市值超过20亿美元,也突显了强烈的需求和日益增长的投资者兴趣。

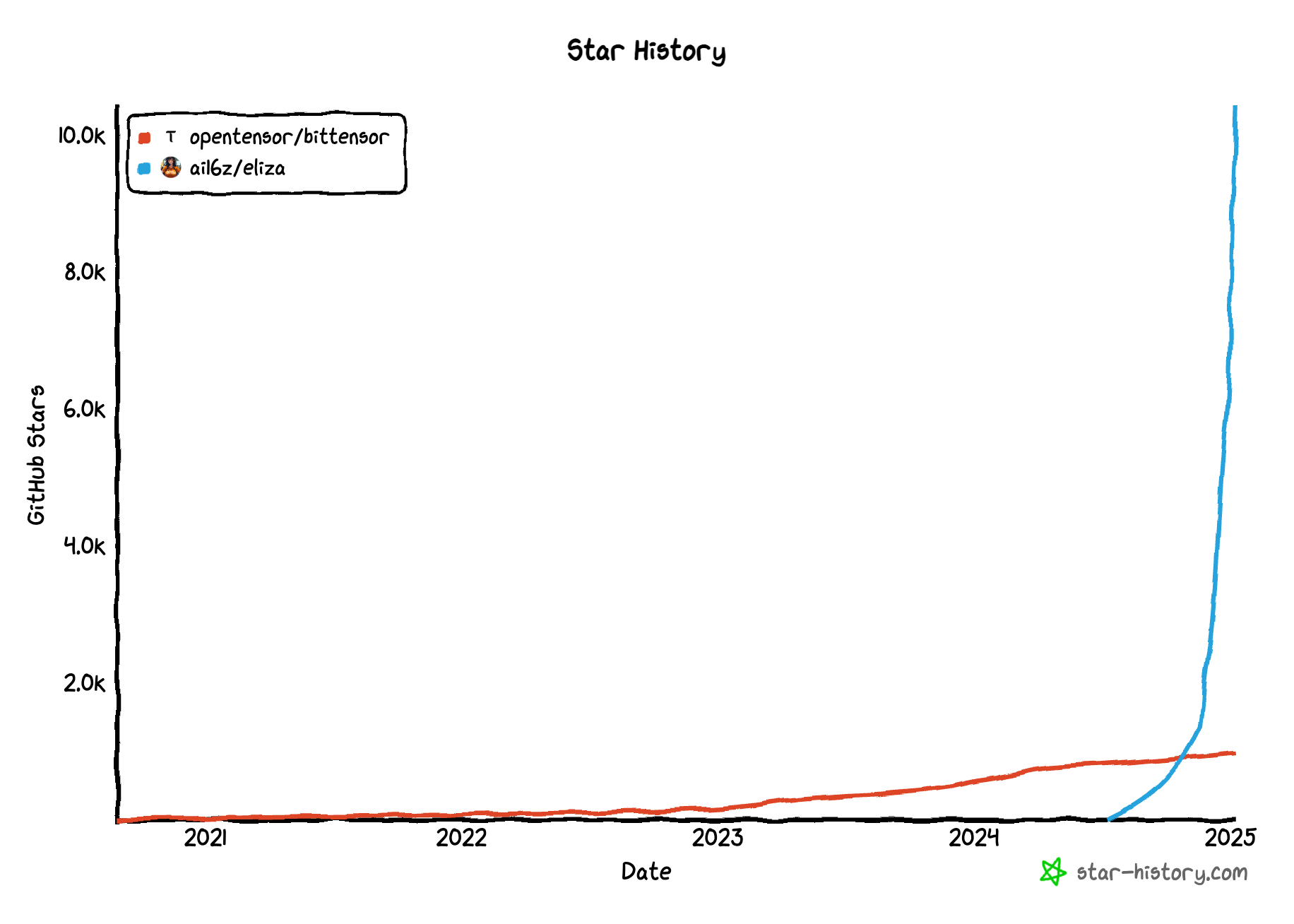

● ELIZA的开发者基础正在迅速扩大,成为#1趋势的GitHub仓库,其参与度远超竞争对手如Bittensor。其插件生态系统每天都在增长,得益于ai16z的创作者基金,该基金奖励创新并为平台的未来发展积累动力。

Source: Github repositories

Source: GitHub Star History

● AI16Z的创新代币经济学确保了持续的价值累积。它通过AI代理贡献、发射台费用和采用来生成收入,将代币的价值与其生态系统的成功联系起来。去中心化的DAO模型还允许代币持有者积极塑造AI16Z的方向,同时分享利润,使社区内的激励保持一致。

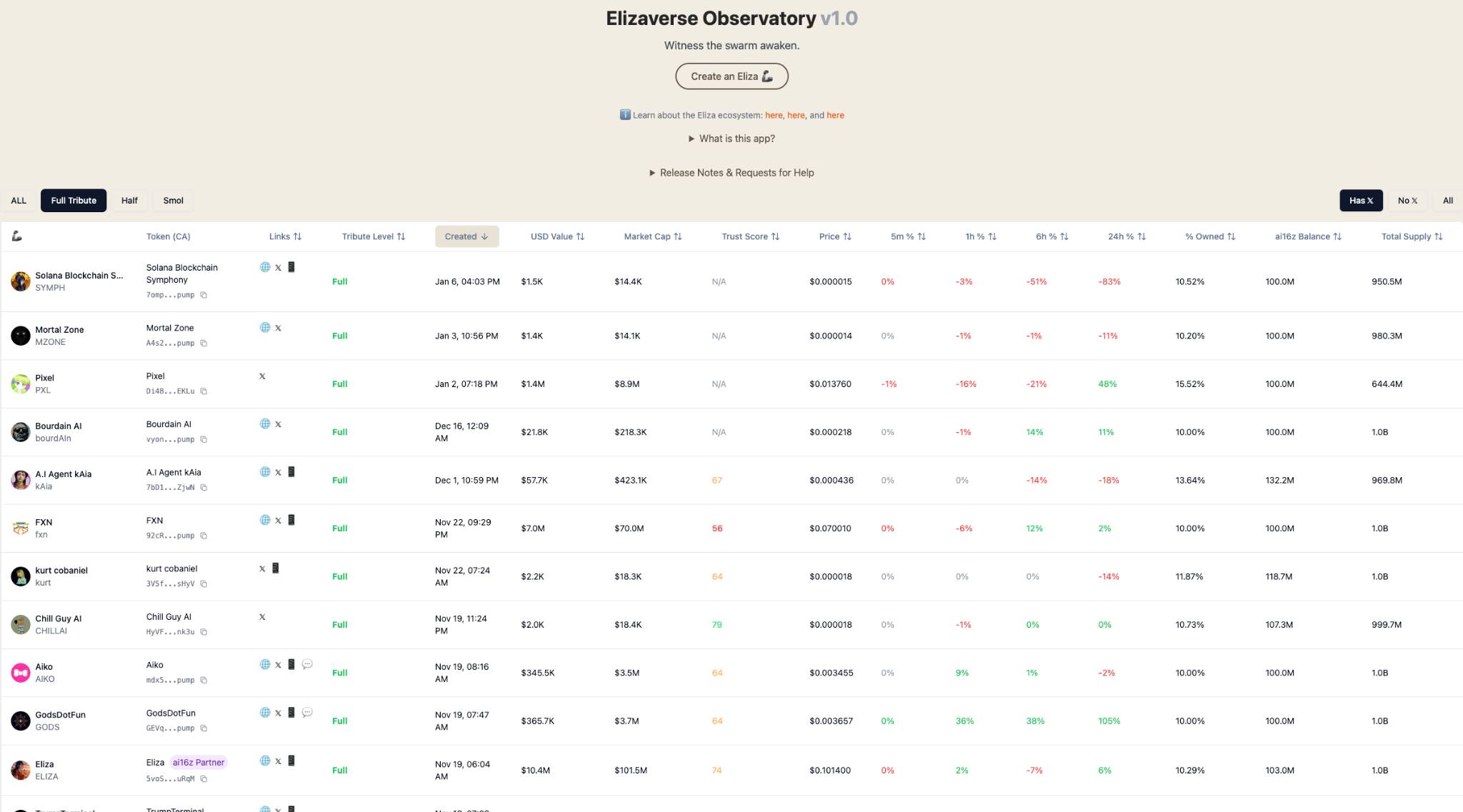

● AI16Z的FDV使其处于新兴玩家和市场领导者之间,提供由坚实的基本面和日益增长的社区驱动的显著增长潜力。 ELIZA的模块化框架允许快速原型制作、定制和跨平台集成,使开发者能够为各种应用创建多功能的AI代理。

Source: Elizaverse Observatory

● ELIZA对去中心化“AI群体”的愿景旨在创建一个跨生态系统的协作代理网络,将该项目定位为AI驱动的Web3创新的领导者。

● 考虑到官方ELIZA代理发射台的预期,通过智能合约层面执行代币贡献,可能为生态系统带来进一步增长和增值。

看跌的基本面因素

● 模因币/AI代理市场的极端波动性为AI16Z的投资带来风险,因为如果交易策略未能迅速适应,快速的价格波动可能导致重大损失。这也引发了关于该项目是否能够应对市场低迷的问题。

● 虽然ELIZA的开源框架促进了创新,但长期维持社区兴趣和贡献可能具有挑战性,特别是如果激励减弱或竞争项目开始占据市场份额。

● 像ELIZA这样的开源框架的货币化依赖于对AI16Z的自愿贡献。虽然许多项目会捐赠它们的一部分代币,但并非所有项目都会选择与AI16Z保持一致。这可能在捕获长期价值和建立可持续的收入流方面造成潜在挑战。

● 如果AI16Z未能扩展或保持竞争优势,资金更充裕、结构更完善的项目如Virtuals可能会使AI16Z黯然失色。

● 围绕AI代理和加密市场的监管不确定性可能影响采用和操作灵活性,对项目的长期增长构成风险。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。