撰文:1912212.eth,Foresight News

1 月 7 日,赵长鹏曾发推称「10 万美元的比特币太无聊」。如果 10 万美元略显无聊,那么 9.12 万美元的比特币呢?可能剩下的只有动摇与不安。市场一度以为接下来的行情会继续上扬,结果迎来的却是截然相反的结局:比特币自 1 月 7 日不断下跌,最后一度下探至 9.12 万美元附近。

今日加密货币恐慌与贪婪指数降至 50,昨日为 69(上周均值为 74),市场情绪骤降至去年 10 月水平。加密市场行情并未如投资者所期待的梦幻开年,反而是起起伏伏,自去年 12 月以来,币价走势宛如过山车,不少市场参与者,尤其是山寨币持有者在微涨暴跌中心力交瘁。

数据不会说谎,据 Coinglass 数据显示,随着比特币近期不断下探,当前主流 CEX 及 DEX 资金费率显示市场已普遍看跌。市场情绪与币价双双萎靡之下,大咖如何看待后续市场行情?

Real Vision 联合创始人:市场正在进入「香蕉奇点」区域,盘整过后将出现山寨季

Real Vision 联合创始人兼首席执行官 Raoul Pal 表示,加密货币市场正在进入「香蕉奇点」区域,或「一切都在上涨」的时期。(「香蕉区」是 Raoul Pal 创造的一个术语,用来描述价格大幅上涨的时期。)

Raoul Pal 表示,市场仍处在香蕉区中,本轮牛市的第一阶段是去年 11 月的突破。接下来会是一段类似于 2016/2017 年周期的盘整期,这种情况不会持续太久。「香蕉区」的下一阶段是「香蕉奇点」,即一个「一切都会上涨,随后出现更大范围的盘整」的山寨币季节。

CryptoQuant CEO:山寨币市场正处于零和 PvP 博弈,只有少数项目能存活

CryptoQuant 首席执行官 Ki Young Ju 在其社交平台表示,「山寨币市场目前处于一场零和的 PvP(玩家对玩家)博弈。尽管比特币的市值已经翻倍,但山寨币的总市值仍低于此前的历史高点,只是在市场内部轮动,而没有新的资本流入。只有少数拥有强大应用场景和叙事的山寨币能够存活下来。」

交易员 Eugene:BTC、ETH 与 SOL 面临关键支撑位失守,市场开始出现恐慌情绪

交易员 Eugene Ng Ah Sio 在社交媒体上发文表示,「这是大多数人开始恐慌的时候,原因如下:

· BTC、ETH 和 SOL 正在重新测试 12 月 5 日的区间低点,市场开始接受这些支撑位可能无法守住的事实。

· BTC 的下一个支撑位在 85,000 美元,非常遥远。

· 人们对「一月牛市」的心理依赖开始减弱,大多数人意识到他们手中未卖出的资产已经经历了一轮完整的涨跌循环,开始承受亏损,进而发现自己不仅完全回吐了利润,还发觉在市场大幅下跌时对自己持有的币种已经不那么喜欢了。」

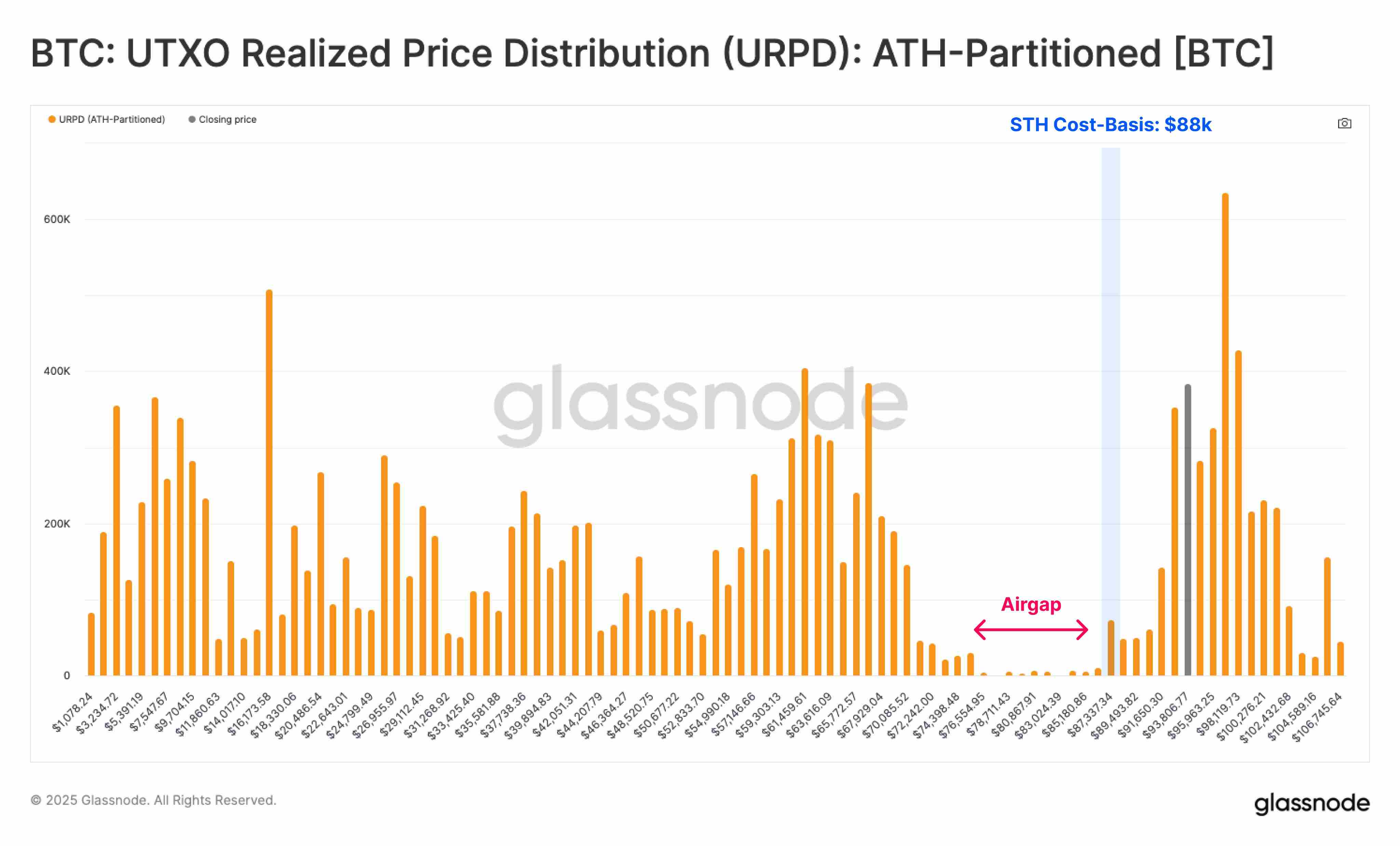

Glassnode:比特币若跌破 8.8 万美元或将导致进一步下跌

Glassnode 发文称:「短期持有者成本基准(8.8 万美元)仍然是评估比特币价格动能的关键水平。通过使用 URPD 指标可以发现,短期持有者成本基准以下的交易量较少,这表明若跌破该水平,可能会导致进一步的下行趋势。」

交易员 TraderS:短期比特币将盘整震荡,本周五非农数据需重点关注

推特 KOL 交易员 TraderS 发推表示,短期行情而言,92750 美元可能就是短期低点了(或者次低),近期大饼在 9.2 万 -10.2 万美元震荡,上下限放宽一些的话就是 8.8 万 -10.8 万美元震荡。在川普 1.20 宣誓就职之前,时间周期及情绪上可能都还来得及且有一次回 10 万以上甚至摸下前高的欲望。如果有的话,会清掉大部分仓位观望川宝就职后的实际表现,如果 1 月 20 日前没给机会的话可能就要按玄学惯例等春节到三月中的小阳春了。而周五晚的大非农可能就是奠定上下基调的最重要参考数据,需要重点关注。

加密 KOL Ansem:市场将进入横盘整理,但链上仍有机会

加密 KOL Ansem 发文指出,目前的基本观点是,8 月至 12 月为山寨币季,其中 10 月至 12 月经历了首轮 AI 代币迷你泡沫。他预计市场将进入较长时期横盘整理,直到投资者普遍认为牛市结束。期间,会有一些链上项目表现优异,同时会有很多新项目值得参与。

交易员 Kruge:市场过分悲观,美联储降息周期并未结束,仍期待历史新高

知名交易员 Kruge 在推特上发长文谈到市场行情的看法时表示:人们现在太过于看空了。我认为这是时间框架的问题。大多数加密原住民(crypto natives)已经疲惫不堪,甚至许多人受到了创伤。在正常情况下,这种情绪实际上可能会形成一个顶部。但这一次,传统金融(Tradfi)正在买入比特币(不仅仅是 Saylor 一个人在行动)。他们对加密原住民的创伤毫不在意。

所以问问自己:股市的顶部是否已到?这才是关键。ETF 应该会确保相关性持续存在。而要回答这个问题,你还得问自己另一个问题:美联储的降息周期结束了吗?我认为还没有。我们刚刚听到美联储宣布暂时暂停加息,这一点目前基本已被市场消化。是暂时,而非永久。看看美联储官员们在说什么,他们仍然主张进一步降息。而市场对 2025 年的降息预期几乎只定价了一次降息。三个月前,这个数字还是 7 次。

Kruge 还表示:很快市场的叙事会再次转变,不再关注鹰派美联储和长期利率的抛售。特朗普也即将登场。与此同时,鉴于我们刚刚得到的悲观经济数据和图表表现,如果 BTC 价格进入 8 万美元区间我不会感到意外。但在我看来,这只是一时的噪音,需要短期的风险管理。我确实认为交易员们现在会在 BTC 价格超过 10 万美元时更积极地抛售,从而减缓上涨速度,尤其是价格到达 10.5 万美元之前。我也认为宏观因素再次变得重要起来。我并不期待未来会有「简单模式」。容易赚钱的日子已经过去了。但我仍然期待比特币创下新高。我们还有漫长的一年要走。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。