撰文:JiaYi

我之前多次提到,上万亿美元体量的比特币,其实正是加密世界中最庞大也最优质的「资金池」。

上个月比特币生态规模最大的链上借贷协议 Avalon Labs,也刚刚完成 Framework Ventures 领投的 1000 万美元 A 轮融资,我旗下的风投机构 GeekCartel 也参与其中,希望能和 Avalon 及更多比特币生态的创新项目一起,将 BTC 从数字价值储存转变为更活跃的金融工具。

其实对于比特币生态来说,从 Babylon、Solv 开始,BTC 作为流动性资产和利基资产,明眼可见地进一步向更丰富的链上结构化收益场景衍生,逐步生发出一个个独具特色而又自成体系的 BTCFi 生态。

从可持续的角度看,如果能盘活沉睡的 BTC,构建一个高效安全的流动性网络,就能为 BTC 这个万亿美元级别的资产,彻底打开作为 DeFi 利基资产的全球化想象空间。

解放比特币流动性的行业实践

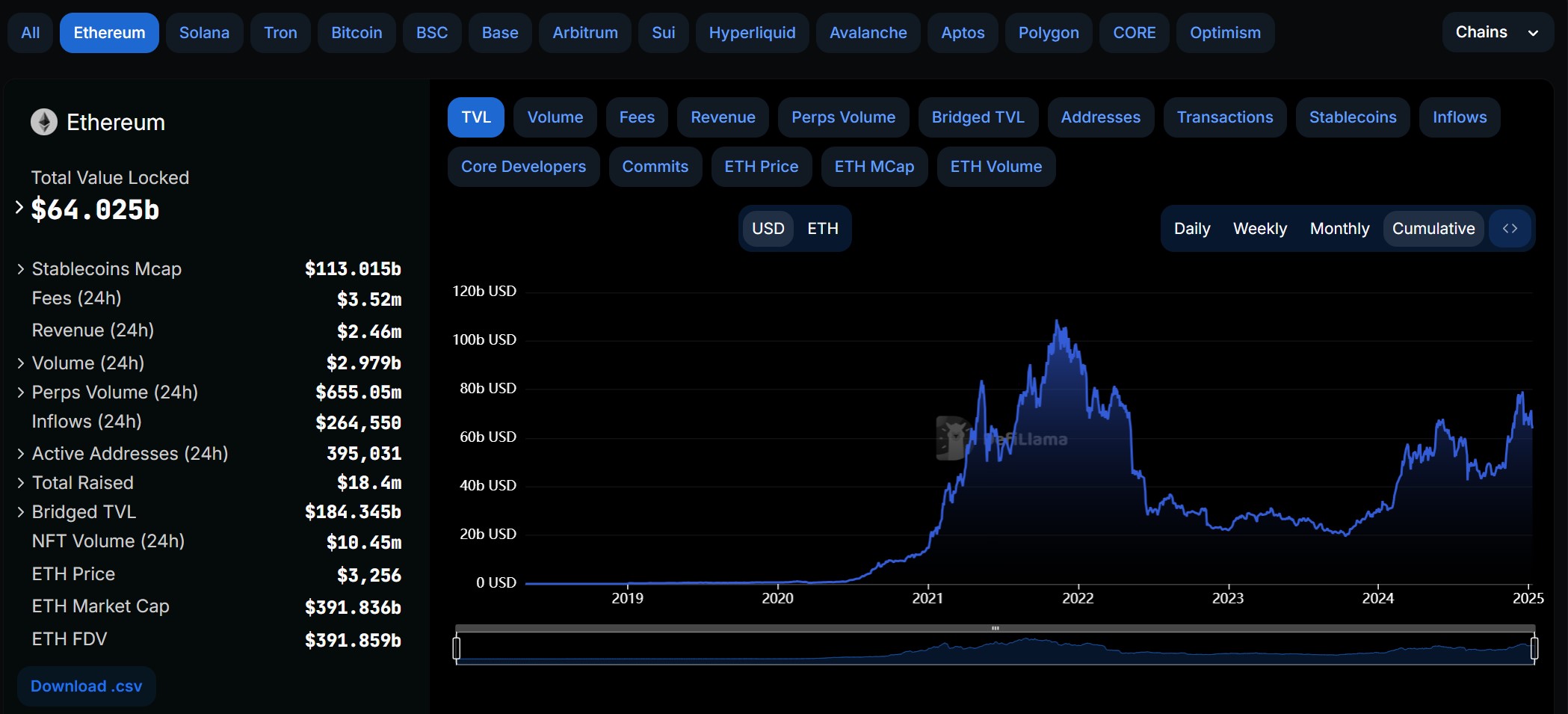

DeFiLlama 数据显示,截至 2025 年 1 月 9 日,以太坊链上总锁仓价值超 640 亿美元,较 2023 年 1 月(230 亿美元)大幅增长近 180%,只是同期伴随着 Ordinal 浪潮开始起势的比特币生态,即便 BTC 市值体量和价格涨幅都远优于 ETH,却始终追不上以太坊链上生态的扩张速度。

要知道,BTC 流动性哪怕释放 10%,就会催生一个高达 1800 亿美元的市场,若能达到类似 ETH 的 TVL 比率(链上 TVL/ 总市值,目前为约 16%),更是将释放约 3000 亿美元的流动性。

这足以推动 BTCFi 生态的爆发性增长,甚至有潜力超越泛 EVM 网络,成为规模最大的超级链上金融生态。

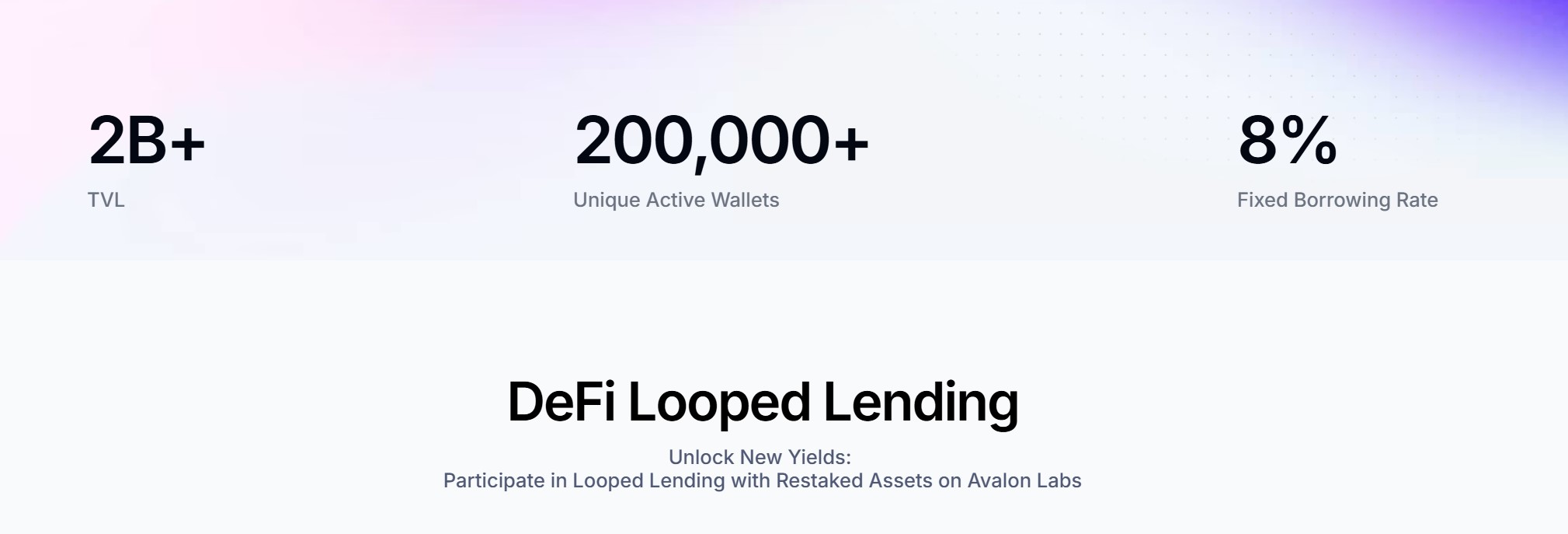

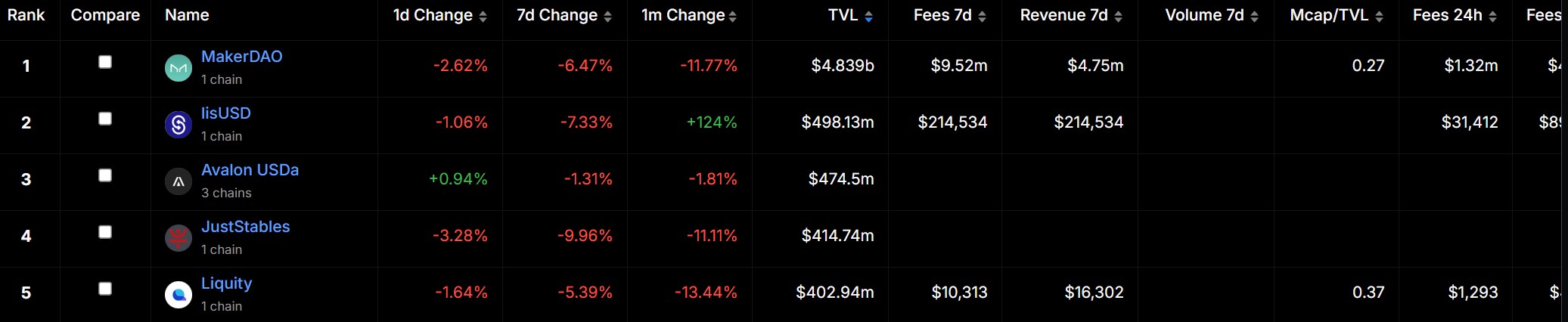

从这个角度看,Avalon 这种「让任何人都可以受益于 BTC 借贷」的比特币流动性平台的最大想象空间,也正在于此——截止目前已经成为了整个 BTC 生态里规模最大的借贷协议,仅次于 DAI 和 lisUSD。

这也创造了 DeFi 历史上 TVL 增长最快的 DeFi 借贷协议记录,据官方数据显示,Avalon Labs TVL 已突破 20 亿美元,其推出的比特币稳定币 USDa 在上线仅 1 周后锁仓量便突破 5 亿美元。

而对于目前的 BTC 持有者来说,把手上沉淀的 BTC 资产充分利用起来一定是刚需,但同时又不想自己的 BTC 承受太大的本金损失风险,最好还能够把固定的资产换成流动的方便操作。

因此基于比特币的链上借贷协议注定会迎来一个机会窗口,这也是 Avalon 的机遇所在——项目借贷的利率固定为 8%,由专业机构来托管抵押的比特币,同时借出来的稳定币无限量供应,这就让 BTC 持有者们有了更充分的流动性来参与生态内的其他项目。

这套玩法的逻辑也经过了市场的认证,值得一提的是,并且 Avalon 官方与其他 TVL 项目战略不同的是,他们关注的重点是散户在整个生态中健康的构建,并不只是大户的游戏,任何人都能够参与进来,在安全的范围内尽可能利用杠杆把收益率提高上去。

比特币稳定币价值几何?

从稳定币的角度来看,链上去中心化稳定币依旧以债务抵押头寸(CDP)稳定币为主流—— MakerDAO 的 DAI 规模最大,liUSD、USDJ 等紧随其后。

本质上讲,CDP 看起来不像贷款——借款人铸造一个 CDP,协议预言机按照 1:1 的价格计算美元价值, CDP 可以在公开市场上出售,从而借款人「借入」另一种资产,贷方收到 CDP。

说白了这是一种基于借贷场景搭建稳定币使用的扩展,相当于为那些平日里沉睡的资产创建一个额外的流动性交易池,以 Avalon 为例,它的生态系统目前就有四个核心业务板块:基于比特币抵押的收益型稳定币 USDa;以 USDa 为基础的借贷协议;连接 DeFi 与 CeFi 的混合借贷平台;以及支持 BTC 质押的去中心化借贷协议。

这也是稳定币协议和借贷协议容易互相渗透的原因所在——譬如以借贷为基本盘的 Aave 与 MakerDAO 双向奔赴,一个推出原生稳定币 GHO,一个加速构建自己的借贷场景覆盖。

因此在相同的基础上,Avalon 的流动性市场才能在基础资产「借贷」关系形成的同时,通过流动性设计构建稳定币 USDa 市场,并给用户提供固定收益产品。

一句话,Avalon 真的做到了让任何人都可以受益于 BTC 借贷,把比特币从闲置资产变的更加有流动性,这不仅帮比特币生态解决了困扰很久的稳定币问题,而且因为借助了 LayerZero 技术实现了跨链兼容性,用户还可以在不用第三方跨链桥的情况下在多个 DeFi 生态中无缝操作 USDa,这就变相的把比特币生态的流动性带到了其他链上。

要知道 BTC 大多处于闲置状态,由于相对其它山寨资产拥有足够的安全边际,所以很多 OG 或 Maxi 没有动力也不愿冒险将其跨链到以太坊等生态,这就导致大部分 BTC 长期沉睡,BTCFi 规模体量一直停滞不前。

那 USDa 在这其中算得上是比较重要的部分,一方面 USDa 算是把比特币生态里缺失的 DeFi 基础设施(借贷协议)部分给补上了,另一方面 Avalon 的 USDa 通过 CeDeFi 借贷平台的优势,允许用户使用 USDa 来从 CeFi 流动性提供者处获取 USDT,解决挂钩问题。

也为比特币网络提供了一个能够高效利用资产、激活沉睡 BTC 的基础框架,使得更多的 BTC Holder 能够安全地参与链上流动性活动,放心地将大量沉睡 BTC 放入 DeFi 流动性池中进行兑换或赚取收益。

结语

可以预见的是,伴随着比特币资产逐步走出沉睡,BTCFi 极有可能成为体量可达数千亿美元的全新 DeFi 资产方向,成为构建链上繁荣生态的关键抓手。

作为 Avalon 的投资人,几个月时间做到了绝对的 BTCFi 赛道 Lending 龙头,也让我也坚定的认为 Avalon 和 BTCFi 的未来会有更好的表现——以 BTC 为核心构建出多元的金融产品形态与 DeFi 场景,重新定义 BTC 在全网 DeFi 领域所扮演的角色。

至于 BTC 在 DeFi 领域的深度融合能否达到关键转折点,值得期待。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。