编译:深潮 TechFlow

导读

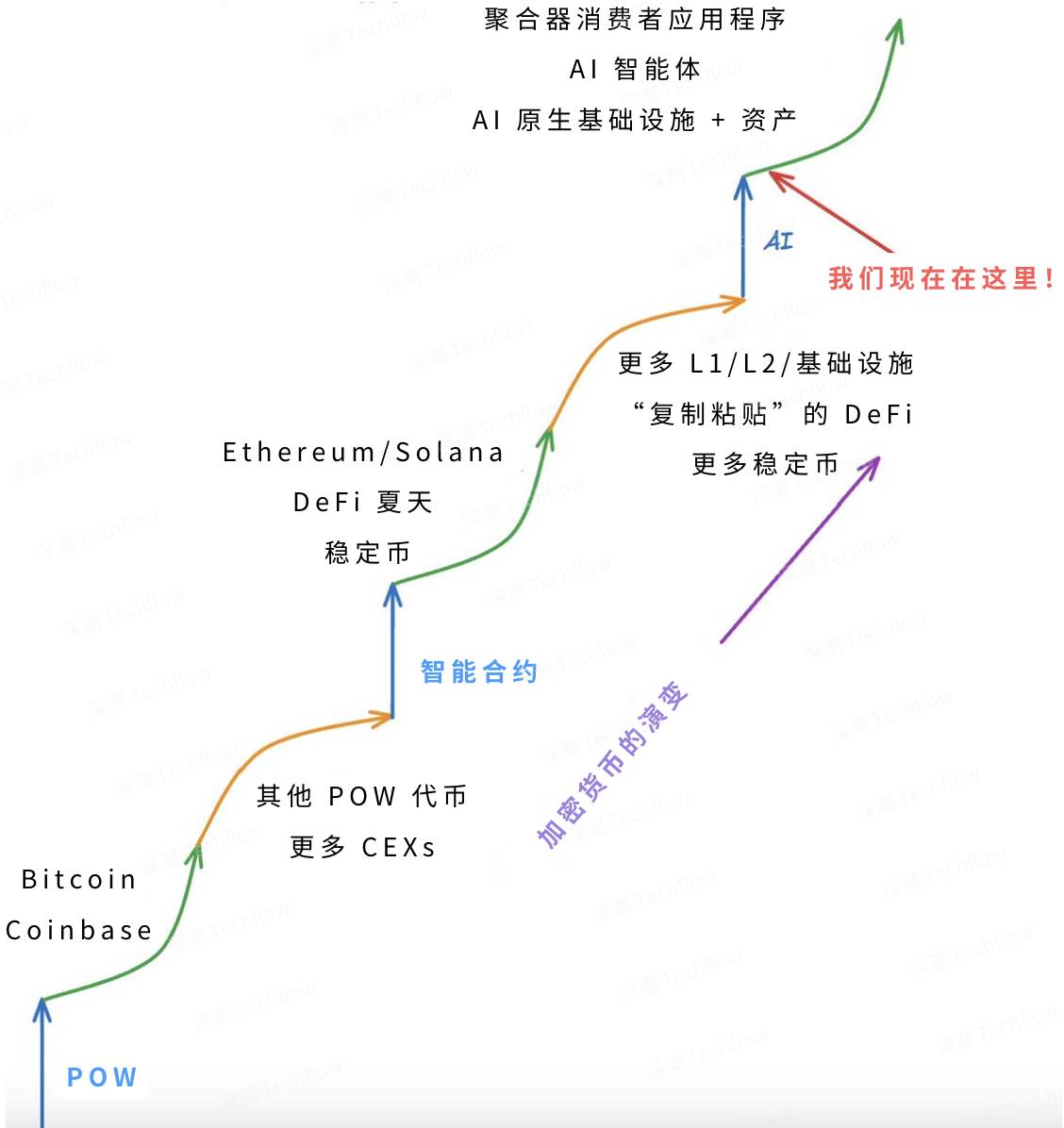

当智能合约的叙事逐渐失去吸引力时,AI 的强势加入带来破局,推动了超出预期的热度与创新浪潮。从比特币的共识层到智能合约的执行层,再到如今 AI 驱动的应用层,加密行业是否迎来了第三次技术的跃迁?

KOL @karsenthil 于不同时间发布了他对于 Crypto X AI 的观点文章,认为我们正处于加密行业下一次“起飞”的前夕。

原文内容分为两篇,结构较为零散。

在第一篇文章,作者表达了AI 将推动区块链进入下一次技术跃迁的观点。在第二篇文章中,他详细阐述了 AI 在应用和基础设施层的具体实现路径,对于投资者和建设者有哪一些潜在机会。

深潮 TechFlow 对其进行了整合与汇编,以下为完整内容。

Crypto X AI 论点 (第一部分) —— 我们正迎来“跃迁式”的发展

AI 正在推动区块链迈向下一次重大飞跃。

区块链的每个发展阶段通常遵循类似的轨迹:

-

一项“跨越式”的技术进步引发了新一轮创新浪潮;

-

随着大量模仿者的加入,技术进展逐渐停滞;

-

接着,下一次技术飞跃出现,推动行业继续向前发展。

原图来自 @karsenthil,由深潮 TechFlow 编译

加密货币的第一次重大飞跃发生在共识层,比特币和工作量证明 (PoW) 的发明标志着这一阶段的开始。从 2009 年到 2014 年,这一浪潮使加密货币的市值增长了超过 10,000 倍(从约 75 万美元增长至约 75 亿美元)。

第二次飞跃出现在执行层,智能合约的出现使区块链具备了可编程性。如今,绝大多数区块链基础设施(如 L1、L2)和应用(如代币、稳定币、DeFi)都依赖这一核心创新。从 2014 年至今,这一浪潮推动加密货币市值增长了约 500 倍,达到约 3.5 万亿美元,其中诞生于这一阶段的项目占据了约 43%(约 1.5 万亿美元)的总市值。

然而,目前的技术进展再次陷入停滞。为什么会这样?以下是我的观点(可能具有争议性):

-

智能合约的潜力已基本被挖掘殆尽。即使是最近流行的迷因币 (memecoins),也只是现有技术(如代币、绑定曲线、NFT 社区热潮)的重新组合,而非全新的发明。

-

智能合约成为用户体验 (UX) 的主要瓶颈。当前的加密应用需要直接与智能合约交互,这意味着用户必须了解合约的运行位置、功能意义,以及如何与之交互,还需要签署交易并支付 Gas 费用。

幸运的是,下一次技术飞跃已然到来——它通过提升可用性,在应用层带来了全新的创新。

AI 将成为加密技术的用户体验层

每一项新技术的普及都需要一个强大的“前端”来简化复杂性并整合功能。个人电脑有图形用户界面 (GUI) 和操作系统,互联网有网络浏览器和 FAANG,移动设备有原生应用和应用商店。

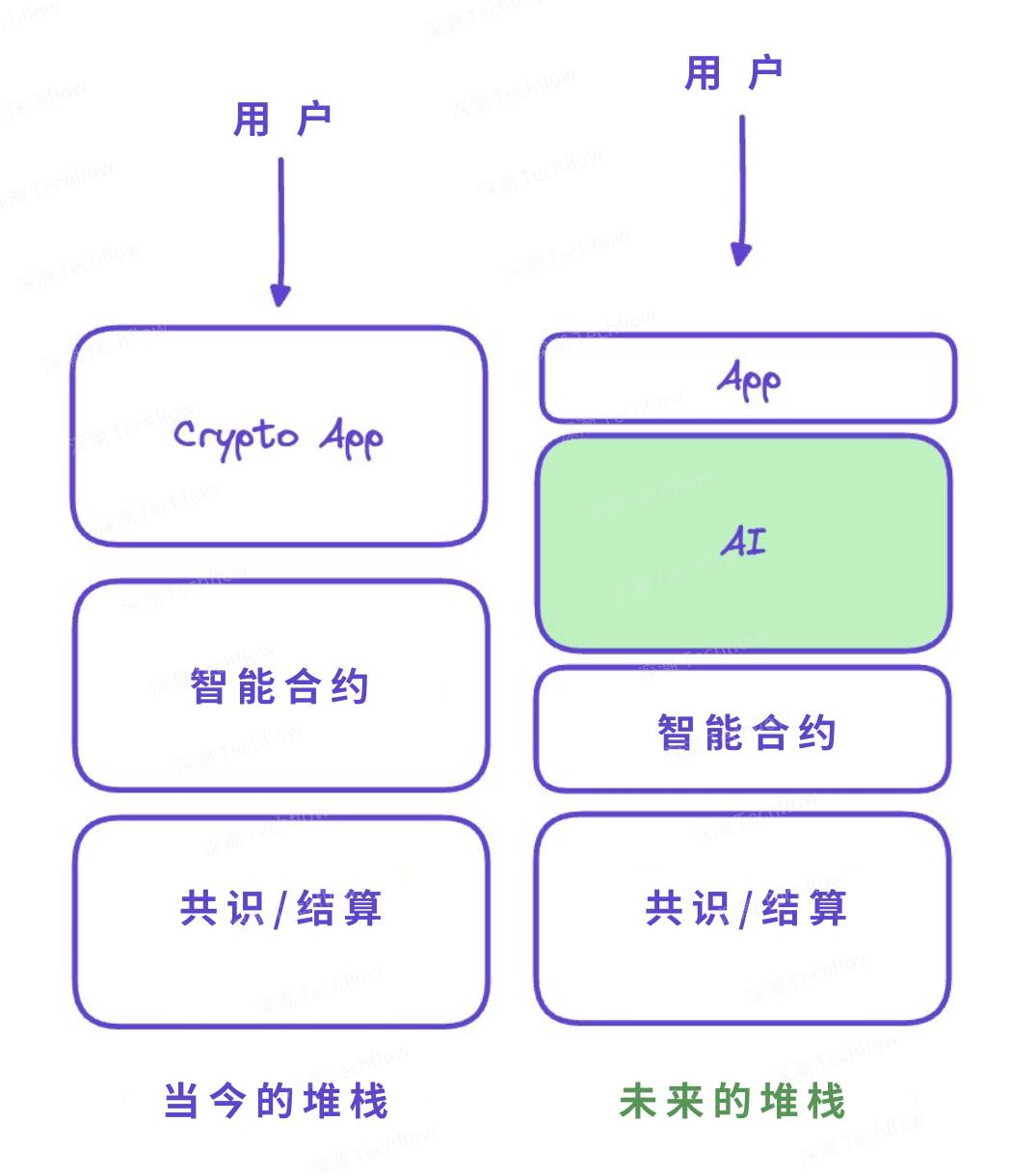

AI 将成为区块链技术的用户体验层,为用户提供数量级更好的体验,从而推动更广泛的采用。AI 能够解决加密技术中的三大用户体验难题:用户引导、复杂操作的执行(通常需要多个步骤,而大语言模型 (LLM) 非常擅长处理这些步骤)、以及功能的发现。我预测,到 2030 年,全球 40% 的人口将有过链上交易的经历,而其中 95% 以上的链上交易将通过 AI 完成。届时,人们将无意识地使用由区块链技术驱动的应用。

原图来自 @karsenthil,由深潮 TechFlow 编译

为了实现这一目标,AI 将作为连接应用层和区块链基础设施的纽带,在技术栈中向上和向下发挥作用。未来,应用将直接与 AI 智能体交互,而这些智能体将代表用户聚合并执行链上操作。此外,智能合约将演变为与 AI 深度融合的“智能代币 (intelligent tokens)”,从而为用户提供生成式和定制化的体验,而不再是当前那种一刀切的模式。

从 AI 的视角来看,区块链应用的未来变得更加清晰。例如,下一代金融超级应用可能会利用 AI 根据用户的意图和偏好(如安全性、收益率等),结合预测市场的实时信息,主动推荐并执行链上 DeFi 操作。用户无需了解 L1、L2 的区别,或者协议和资产的名称,甚至不需要知道跨链桥的工作原理。这一趋势的雏形已经开始显现。

Crypto X AI 论点 (第二部分) —— 建设者和投资者的机会

那么,谁将成为最大的赢家?

随着 AI 在应用层面的创新不断加速,答案显而易见:应用仍是重点(当然,也少不了基础设施的支持,毕竟这还是加密领域)。正如 David 在下文中提到的,我们已经开始看到从基础设施周期向应用周期的转变,而 AI 的加入将进一步推动这一趋势。

@divine_economu:“2024 年,加密货币领域迎来了两个重要的里程碑:

-

热门项目第一次以应用程序为主导

-

热门协议则是那些以创新方式支持应用程序发展的协议

这是加密历史上第一次从基础设施主导的周期,转向以应用程序为核心的周期。”

(推文详情)

我对以下四类加密产品特别看好,它们都处于发展的早期阶段,因而具有巨大的增长潜力:

-

聚合器,也称超级应用 (SuperApps)

我预测,未来“加密领域的 FAANG”将会诞生:这些超级应用将整合来自智能体的功能,这些智能体简化了链上的用户体验 (UX),并直接与用户建立联系。同时,这些应用还会垂直整合技术栈,不仅提升自身的应用能力,还通过提供基础设施(类似 Amazon 或 Google)吸引开发者的关注。在它们所属领域(如搜索与广告、金融、商业、社交等)中,这类应用将表现出垄断特性。正如 FAANG 公司如今贡献了标普指数的约 20%,我预计这一类别的应用将在 2030 年前占据类似比例的加密市场份额。保守估计,这一市场机会规模为数千亿美元,而乐观估计则可达数万亿美元。

特别是在 DeFi(或称 DeFAI)领域,我认为这是一个杀手级应用场景:想象一个下一代的一站式金融超级应用,用户可以无缝访问链上的所有金融资产,获得投资建议或创意,实时分析市场情绪,并快速执行投资决策。另一个令人兴奋的方向是“加密版 Google”,通过设计类似“PageRank”的算法,解决加密应用和资产的发现问题,同时通过广告或创新的价值流实现盈利。

这一类别的赢家将创造出超乎想象的成果,因为它们将拥有 Web2 超级应用所不具备的关键优势:Token。Token 是加密领域中唯一被证明具有强大产品市场契合度 (PMF) 的工具,它能够吸引用户、凝聚信徒与投资者,并占据市场心智。

-

作为 SaaS 的智能体 (Agents as SaaS)

我对那些能够在某一领域表现极其出色的 AI 智能体感到兴奋。这些智能体可以通过聚合器或其他智能体组合使用,就像今天的 SaaS 产品或金融产品。例如,想象一个完全自主的智能体,它接受流动性提供者 (LP) 的资金,并在加密市场中进行顶级投资(既是前 1% 的高流动性交易员,又能参与表现最佳的投资机会),同时收取比 ETF 或基金更低的管理费。或者,一个能够在预测市场或体育博彩中实现高额回报的智能体。再比如,像 @aix_bt 这样的工具,可以提供高质量的市场和投资研究数据。这些智能体将使用户能够接触到以前难以触及的市场(例如现在已经上链的美元或真实世界资产 RWAs),并提供先进的投资策略(如量化交易或风险投资)。

@Loopifyyy:“第一个能够为我进行链上交易并真正起作用的 AI 智能体,我会毫不犹豫地投入我的全部净资产。它解决了用户体验 (UX) 的问题,现在我只需通过简单的提示即可使用区块链,无论是否跨链都无所谓。”

这不仅仅局限于金融领域。我可以想象一个未来,拥有一个 AI 医生,它可以针对特定患者的个人档案进行专门训练,能够通过加密支付通道向保险公司收取费用,并开具低风险的处方。或者,一个 AI 保险代理人能够为你的房子找到最便宜的家庭保险。当然,坦率地说,我们距离实现这些场景还有一段路要走(目前大多数智能体甚至无法完成基本的链上交互)。

然而,随着这些智能体通过其原生代币(例如用户需要持有 100 AIXBT 才能获得高级服务)在客户获取、价值实现和定价机制方面不断创新,这一领域的机会几乎是无限的。随着这一趋势的深入发展,我认为专门用于交易和管理 AI 智能体的平台(类似于 Ebay 或 OpenSea 的智能体市场)也将迎来巨大的发展机遇。

-

AI 原生基础设施 (AI-Native Infra)

未来最重要的基础设施机会(例如新一代 L1)将不再仅仅关注速度或成本的优化,而是通过显著提升用户体验 (UX) 来吸引用户。这种提升将通过围绕 AI 智能体和 AI 驱动的智能合约构建核心架构实现,并原生支持以下功能:高效的链上推理能力(详见第 4 节),通过可信执行环境 (TEEs) 提供可验证的链下推理能力,支持半自主 AI 智能体操作的智能账户(内置保护机制,可代表用户执行任务),访问计算资源与模型训练能力,以及支持智能体之间双向价值流动的功能,从而推动智能体协作与经济模式的创新。

类似于当前这一时代的去中心化应用 (dApps),许多前述第 2 类中的智能体(尤其是长尾智能体)将选择部署在这些新型 L1 上,而不是自行管理基础设施,同时享受邻近性和可组合性带来的网络效应。我也对这些新一代 L1 的潜力感到兴奋,它们可能会重新定义价值捕获机制、最大可提取价值 (MEV) 和共识机制(例如,智能体是否可以成为验证者?)。

这并不意味着我对 Ethereum、Solana 或其他主流 L1/L2 生态系统持悲观态度。事实上,这些生态系统在未来几年内也会逐步引入类似的功能。但我相信,那些诞生于这一时代的新 L1 将更贴合当代开发者的需求,并因此获得巨大的发展潜力。像 ai16z 和 Virtuals 这样的项目,已经展示了这一趋势的雏形,同时也表明了在这一领域成为赢家的巨大机会。

L1 的创新仍然会持续并保持强劲发展。

智能资产 (Intelligent Assets)

目前,加密领域的一些热门应用(如稳定币、NFT、ERC-20/SPL 治理代币)是确定性和静态的资产。它们在完成既定目标时表现出色,但如果用户可以拥有动态运作、自动优化以实现特定目标(如增加持有者或提升价值)的智能资产,会如何呢?

想象一下,智能合约可以在链上执行期间动态调用模型,使资产能够进行以下操作:调整代币供应、释放计划、销毁或质押机制,甚至修改其他目前需要硬编码或依赖社会共识才能改变的参数。每个代币甚至可以根据持有者的偏好进行个性化定制,为用户提供全新层次的个性化体验。

我预计,这类智能资产的早期探索将集中在 NFT 和 DAO 领域。例如,NFT 可以完全在所有方面生成式,而不仅限于生成媒体内容。或者,一个治理代币可以根据协议历史和用户偏好,自动撰写提案或代表用户投票。

随着技术的不断成熟,这一类别的主要应用场景可能会转向金融领域。例如,想象一下,Ethena 的 USDE 稳定币可以根据宏观经济条件动态调整其合成美元策略。这将是一个令人振奋的未来!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。