Author: Pzai, Foresight News

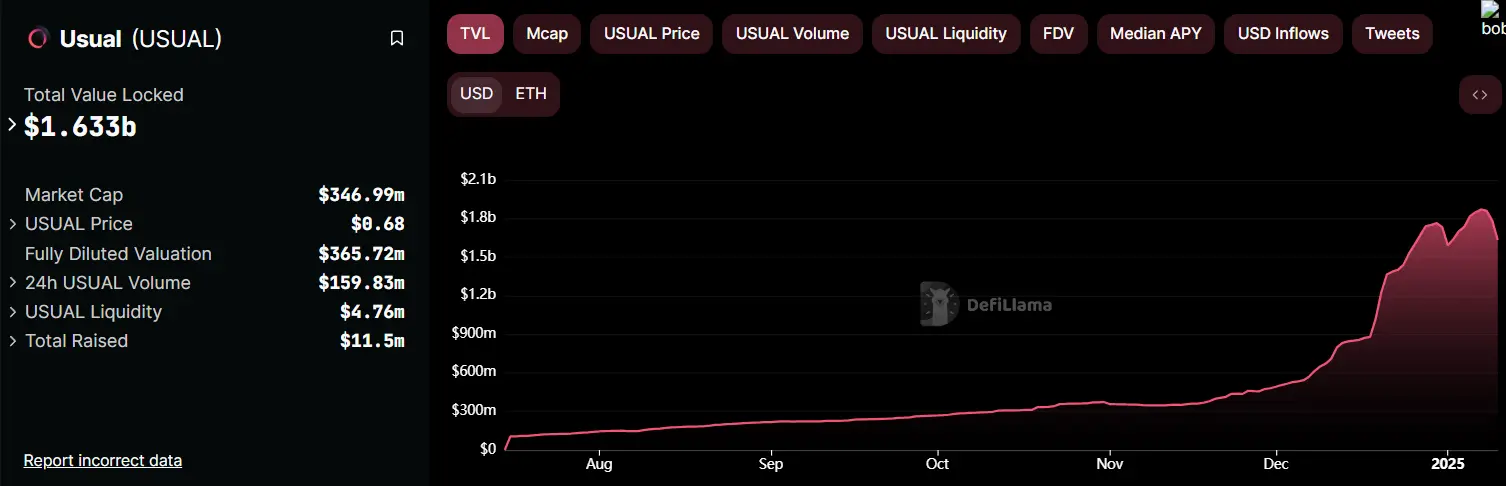

RWA stablecoins have recently become a hot topic, as their natural growth backed by off-chain assets introduces fresh vitality into the stablecoin sector and opens up ample imaginative space for investors. Among them, the representative project Usual has also gained market favor, quickly attracting over $1.6 billion in TVL. However, the project has recently faced certain challenges.

On January 9, the liquid staking token USD0++ within the project suffered a sell-off following an announcement from Usual. Meanwhile, some players in the RWA stablecoin camp are experiencing varying degrees of decoupling, reflecting a shift in market sentiment. This article analyzes this phenomenon.

Mechanism Changes

USD0++ is a liquid staking token (LST) with a staking period of 4 years, similar to a "4-year bond." For every USD0 staked, Usual mints new USUAL tokens in a deflationary manner and distributes these tokens as rewards to users. In Usual's latest announcement, USD0++ will transition to a lower limit redemption mechanism and provide conditional exit options:

- Conditional Exit: 1:1 redemption, requiring the forfeiture of part of the USUAL earnings. This part is planned to be released next week.

- Unconditional Exit: Redeem at a floor price (currently set at $0.87), gradually converging to $1 over time.

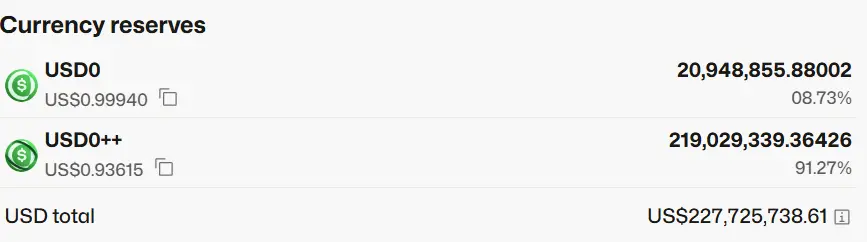

In the context of volatility in the crypto market, fluctuations in market liquidity (for example, the underlying asset of RWA—U.S. Treasury bonds—has recently been discounted) combined with the implementation of the mechanism have dampened investor expectations. The USD0/USD0++ Curve pool was rapidly sold off by investors, with a pool deviation of 91.27%/8.73%, and the APY of the USD0++/USD0 lending pool on Morpho soared to 78.82%. Before the announcement, USD0++ had maintained a premium over USD0 for a long time, possibly due to the 1:1 early exemption option provided during pre-trading on Binance, maximizing the airdrop benefits for users before the protocol launch. After the mechanism was clarified, investors began to flow back into the more liquid native currency.

This event has had a certain impact on USD0++ holders, but most of them are incentivized by USUAL, holding for a long time, and the price fluctuations have not fallen below the floor price, reflecting panic selling.

Possibly influenced by this event, as of the time of writing, USUAL has also dropped to $0.684, with a 24-hour decline of 2.29%.

Gradual Volatility

From a mechanistic perspective, USUAL has the potential to re-anchor USD0++ through USUAL tokens in the future (by burning USUAL to drive up the token price, increasing yields while attracting liquidity back), and during the liquidity "new pull" process of RWA stablecoins, the role of token incentives is also self-evident. The mechanism of USUAL lies in rewarding the entire stablecoin holder ecosystem through USUAL tokens, anchoring while maintaining stable gains. In a volatile market, investors may need liquidity to support their positions, further exacerbating the volatility of USD0++.

In addition to Usual, another RWA stablecoin, Anzen USDz, has also long experienced a decoupling process. Since October 16 of last year, possibly influenced by airdrops, this token has continuously faced sell-off waves, once dipping below $0.9, weakening potential returns for investors. In fact, the Anzen protocol also has similar functions to USD0++, but the overall staking scale is less than 10%, limiting the impact of sell-off pressure, and its single pool liquidity is only $3.2 million, far less than USD0's nearly $100 million liquidity in Curve.

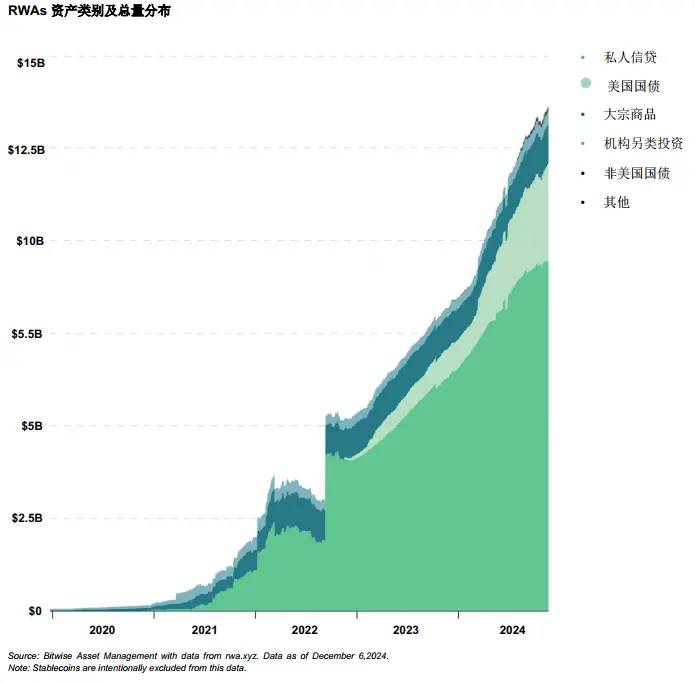

In terms of business models, RWA stablecoins also face numerous challenges, including how to balance the relationship between token issuance and liquidity growth, and how to ensure the growth of real yields synchronizes with on-chain activities. According to Bitwise analysis, most RWAs assets are U.S. Treasury bonds, and the singular asset distribution also exposes stablecoins to some impact from U.S. Treasury bonds. How to resist this through mechanisms or reserves is a direction worth considering.

For stablecoin projects, they seem to have fallen back into the "mine-sell-withdraw" cycle reminiscent of the DeFi Summer period. While this model can attract a large number of users and funds in the short term through high token incentives, it essentially does not solve the long-term value creation problem of the protocol. Instead, it is prone to causing token prices to continuously decline due to excessive sell pressure, ultimately damaging user confidence and the healthy development of the project ecosystem.

To break this cycle, project teams need to focus on the long-term construction of the ecosystem by developing more innovative products, optimizing governance mechanisms, and strengthening community participation, gradually building a diversified and sustainable stablecoin ecosystem rather than relying solely on short-term incentives to attract users. Only through these efforts can stablecoin projects truly break the "mine-sell-withdraw" cycle, providing users with tangible real returns and strong liquidity backing, thereby standing out in a competitive market and achieving long-term development.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。