醒来的第一件事就是去定投,然后突然想起来为什么临睡前没有买,当时已经过了10号了,BTC最低已经跌破了92,000美元,当时光顾着想89,000美元能不能买到了,反而忘记了也可以定投,结果今天起床后买了点高价筹码,不过既然打算定投,这点差价也不算什么,虽然总觉得有点亏。

但是想到我上次准备换钱,结果在Coinbase高价买了 #BTC 当时还郁闷到不行,结果不到一个月的时间高溢价买的BTC都赚了30%了,这笔钱就是老天爷赏的。这么想就知足了。

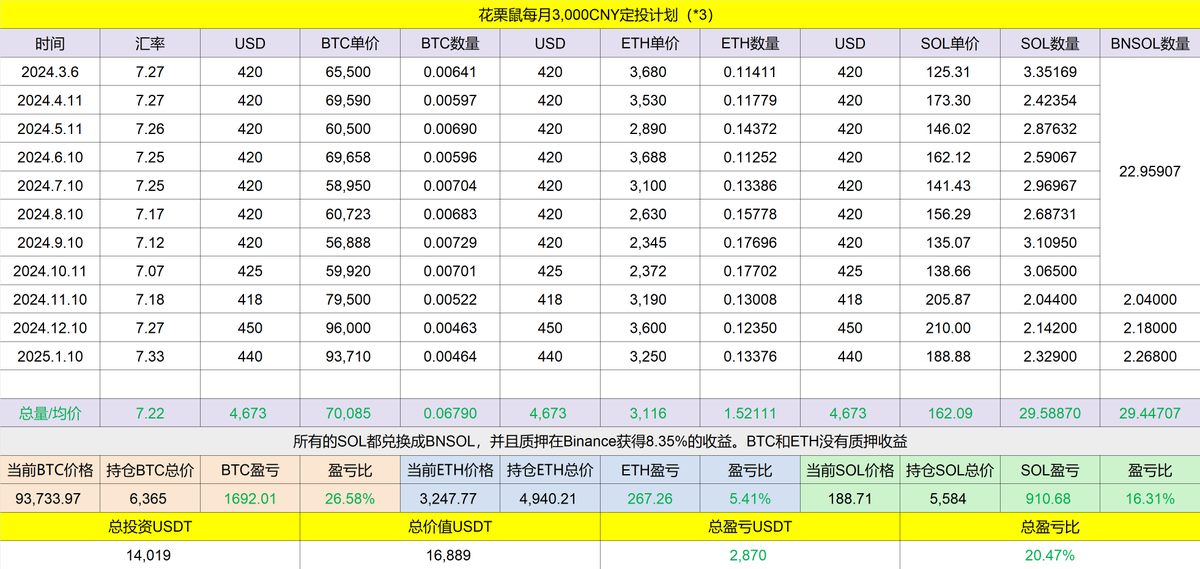

这是第十一个月的定投了,仍然是买了 #Bitcoin #Ethereum 和 #Solana ,从价值来看,$BTC 的盈利最高,超过了26%,年化收益超过26%这是个啥概念,果然投资BTC不会让人失望的,即便是每个月都投资一些。目前我持仓BTC的成本刚刚过70,000美元。

价值排名第二的是 $SOL ,也有超过16%的盈利,虽然 #SOL 的回撤挺大的,但我平均162美元的成本还是能打一下的。

虽然骂 $ETH 是政治正确,但是毕竟仓位在这里呢,平均是3,116美元的单价还没有亏钱已经是不错了, #ETH 我仍然认为有机会,毕竟我相信的是贝莱德和富达,不过确实,将近一年过去了,ETH的价格不但没有涨,反而还跌了,咬咬牙,在坚持一段时间吧。

另外虽然不在定投列表中,但 #BNB 我还是在一直增持的,尤其是 $BNB 每个月的收益基本上都能覆盖我的生活费了,目前的策略仍然是将每个月获得的空投都换成BNB本位,当然了,部分项目因为看好后边的发力所以还拿着呢,等到差不多的时候就一起都换掉了。

今年 #Binance 一个打新的收益都没有错过,现在算算这笔钱也不错了,虽然大部分都没有卖,有一些回撤,但毕竟是免费的钱,前几天算了算也是不错的收入,所以继续持有BNB,继续白嫖。

不知道还有多少小伙伴还记得我定投的初衷,当时在65,000美元的时候我还建议小伙伴们可以适当的买一些,尤其是本金不是很多的小伙伴可以先配置一部分的BTC然后用利润去博弈PVP,当时很多小伙伴和我说,BTC太贵了,我们来加密货币是来逆天改命的,而不是为了赚取100%的收益,而我的说法是先活下来,再考虑去博弈。

还有很多小伙伴说BTC太贵了,现在买已经赚不到什么钱了,而我当时的说法是,BTC是目前唯一确定性最高能赚钱的加密货币,而且不需要费劲,不需要每天去盯着图看,只要每个月定投一些,拉长时间看,一定会有不错的收益。

都说口说无凭,数据才是最好的答案,那么我就自己做一个定投,用每个月 3,000 CNY 的资金来模拟一个普通家庭闲置资金定投,看看八年以后到底能不能跑赢标普,能不能跑赢美债,能不能跑赢存款利息。八年后花栗鼠正好成年了,看看这笔钱能不能作为他的启动资金开启自己的生活。

当然我在测试的开始,很多小伙伴给了很多建议,给了很多定投的标的,最后筛选下来就是 #BTC 和 #ETH ,前者当时是唯一通过了现货ETF的,后者是当时唯一一个还在博弈现货ETF的,再后来因为ETH的收益太差了,为了对冲加入了 #SOL , 而 #BNB 其实是最早定投的,就形成了目前的这种定投格局,我也想看看,八年以后谁能给我最大的惊喜。

这本身也是一种乐趣。

本推文由 @ApeXProtocolCN 赞助|Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。