The Federal Reserve's monetary policy is quietly opening a new chapter. From "rate cuts" to "prudent," it seems to lay the groundwork for the market direction in 2025. In the latest meeting minutes, Federal Reserve officials rarely reached a consensus: in the current economic environment, a sudden halt to rate cuts may better align with the overall interests. Federal Reserve Chairman Powell's remarks once again pressed the "confirmation button" for this cautious strategy.

For investors, this is not just a signal adjustment but a rebalancing of strategies. So, how should the market reposition itself in the face of this "rate cut slowdown race"? What subtle games are hidden between the economy and policy?

1. The "Warm Breeze" in the Economy: Healthy Support from the Labor Market

The Federal Reserve's cautious attitude is not unfounded but is based on the "warm breeze" released by current economic data.

According to the meeting minutes, participants unanimously agreed that current U.S. economic activity is quite robust, especially the performance of the labor market. Although the risk of recession has not completely dissipated, its threat has significantly diminished.

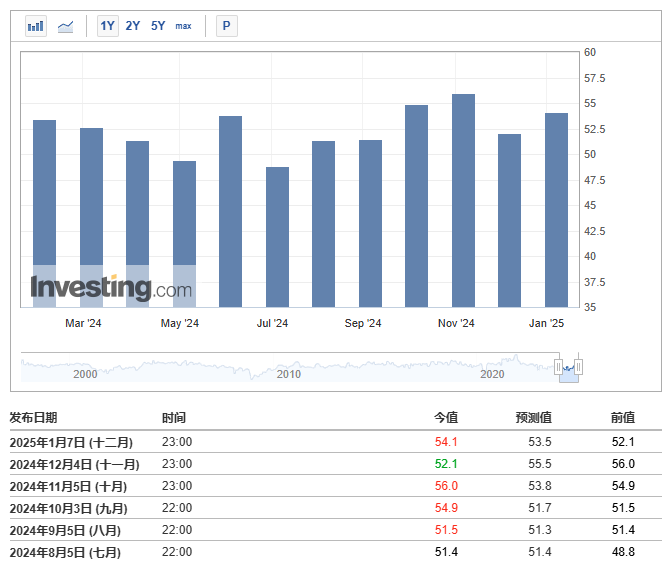

In January 2025, the Institute for Supply Management (ISM) released a non-manufacturing PMI index of 54.1, exceeding market's conservative expectations. This data indicates that the service sector is still thriving, providing the Federal Reserve with confidence in its stabilization policy. Meanwhile, the market predicts a 95% probability that the Federal Reserve will maintain interest rates this month.

However, even as investor sentiment gradually becomes optimistic, potential concerns still exist. Is the pace of economic recovery solid enough? Will the "tail" of inflation suddenly rear its head? All of this makes market participants hesitant to become too "complacent."

2. The "Emotional Battlefield" of the U.S. Stock Market: Investment Logic Behind the Volatility

Driven by the Federal Reserve's shift in tone, the U.S. stock market has already begun to feel the surge of unease. As expectations for rate cuts cool, risk assets have become the primary "emotional target." In the past two weeks, the Nasdaq Composite Index has pulled back nearly 2%, and the stock performance of tech giants has also been lackluster. Whether it's Tesla or Nvidia, once market-leading star stocks are now facing cold treatment from investors voting with their feet.

In a sense, the "ups and downs" of the stock market are not just a reflection of capital flows but also reflect the market's sensitivity to policy uncertainty. The possibility of the Federal Reserve's "brake-style rate cuts" forces investors to reassess their portfolios and seek new risk hedging strategies. At this moment, the market resembles an emotional battlefield; those who can grasp the true core logic will seize the initiative.

3. The Future Script: Prudent Rate Cuts + Data-Driven Market Rhythm

Looking ahead, the Federal Reserve's "cautious strategy" may become the mainstream voice. Most analysts believe that the Federal Reserve's rate-cutting pace in 2025 will be more restrained, with little likelihood of significant rate cuts in the short term. This prudent strategy benefits from the resilience of the U.S. economy and the health of the labor market. However, this also means that market volatility may still permeate the entire new year.

Another variable that cannot be ignored is the inflation impact that trade policy may bring. The trade protection policies from the Trump era may exacerbate price pressures in the short term, further challenging the Federal Reserve's monetary policy control capabilities. Wells Fargo's latest analysis points out that the market needs to closely monitor core economic data in the coming months to discern whether the path for rate cuts will be rewritten again.

In this situation, investors must learn to respond flexibly. After all, the Federal Reserve's monetary policy is no longer a single-dimensional "rate cut signal," but a complex system deeply tied to economic dynamics and policy variables.

Conclusion: Opportunities and Challenges for Market Hunters

In the Federal Reserve's new script of "rate cut slowdown," market uncertainty has become the norm. Although the economic fundamentals remain robust, the shift in monetary policy presents new challenges for investors: to constantly pay attention to the latest dynamics of the economy and policy, and to adjust investment strategies in a timely manner.

However, the other side of challenge is always opportunity. Those who can capture trends with keen insight will become the winners in this financial upheaval. After all, in a turbulent market, only those who truly understand the underlying logic can stand at the forefront and control the situation.

If you have any questions, you can contact us through the following official channels:

AICoin Official Website: www.aicoin.com

Telegram: t.me/aicoincn

Twitter: x.com/AICoincom

Email: support@aicoin.com

Group Chat: Customer Service Yingying、Customer Service KK

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。