作者:Revc,金色财经

AI Agent 赛道近期因极端波动吸引了大批投资者,其高收益潜力塑造了一种独特的交易体验。MEME 交易通过「余额过山车式跳跃」的刺激,瞬间释放的多巴胺让人兴奋又沉迷,投资者在心理和情绪层面接受着考验。

对于投资者来说,在享受市场波动带来收益的同时,需警惕上瘾心理的侵蚀,避免陷入情绪化操作。同时,通过深入研究项目的长期价值和技术潜力,可以在波动中找到更稳健的投资方向。市场需要兼具理性与激情,而非被单一的刺激所主导。

目前 MEME 项目筛选遵循着两条线,「投机」与价值发现,本篇对高频「投机」式的操作方法进行分析,揭示专业 MEME 创建者们如何消耗投资者的精力和本金。

1 小时 15 倍的案列

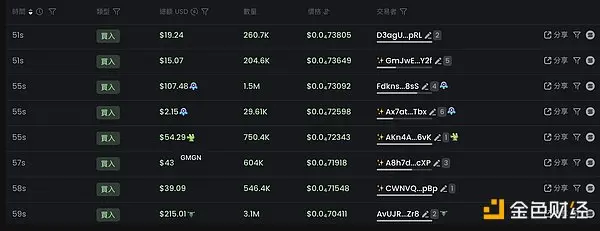

以 MEME 代币 Agora 为例,投资者经初步判断项目有上涨的潜力,随后进行 Scalping 交易套利,多笔 Scalping 使得投资者本金迅速翻倍,而这仅仅是开始,倒数第二笔买入后,Agora 在 30 分钟内迅速拉到 15 倍涨幅,由于 Web 端的交易界面没有止盈止损,实际利润远未达到 15 倍,但在 15 倍涨幅的刺激下,投资者陷入继续投机的循环,最终在波动中损失殆尽。

PS:Scalping 是一种高频交易策略,交易者通过捕捉股票、期货或其他金融工具的短期价格波动来获取利润。Scalping的核心理念是利用市场的短期波动快速进出交易,每笔交易获取较小的利润,但通过多次交易累积收益。

30 秒分析到 10 分钟本金归零的「策略」

MEME 交易是一场信息捕获与快速执行的高强度博弈,而 PVP 交易已进化出框架化的指标体系用于筛选项目。在此模式下,分析和执行环节被极度压缩,通常仅需数分钟完成,特别是在项目市值刚刚达到 N 倍内盘市值(约 6.8 万美元)阶段时。此时,N 通常小于 10,即市值低于 60 万美元,市场竞争异常激烈。然而,一旦项目冲高回落,这类新盘往往迅速被投资者抛弃,热度骤减。

1.项目判断与筛选:在新盘页面中,根据推出时间进行排序,此时项目通常具有交易量为市值的 3-5 倍的特征,蓝筹指数在 0-1.2% 区间。在一级页面快速筛选时,可重点关注以下指标:地址数量增长速度快、市值较低(避免选择市值达到千万美元级别的项目)、以及 1-5 分钟时间段内未出现剧烈回调且仍在持续创新高的项目。

2. 发布时间:30 分钟通常是一个关键分界线,大多数项目会在发布约 30 分钟后开始出现砸盘和收网的迹象(数据采自北京时间下午 6 点左右)。

3. 市值大小:市值在 30 万美元左右的项目通常较为合理,而市值达到千万美元级别的项目则可能存在较高的跑路风险。

4. 跑路风险:GMGN 平台会标注开发者在历史项目中的操作记录,例如撤池子、砸盘或开发者跑路等情况,这些标记是评估项目稳定性的重要指标。

5. 蓝筹指数:作为增长性指标,蓝筹指数通过分析投资者持有的蓝筹代币情况,反映投资者的购买力和社区共识,为判断项目健康状况提供侧面依据。

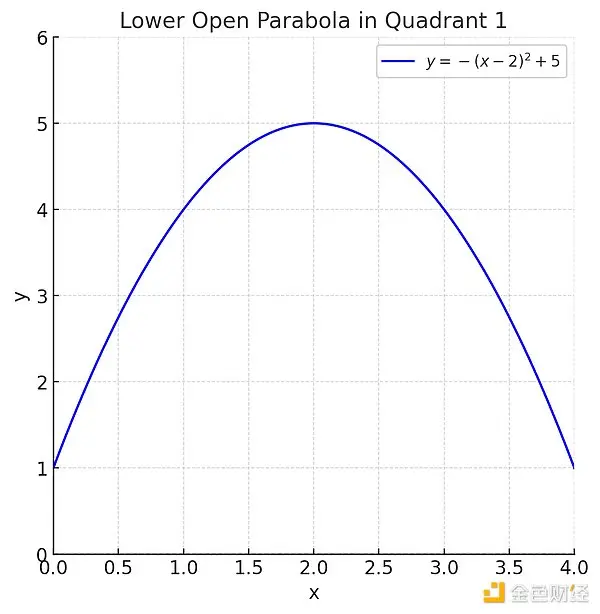

6.订单簿健康指标(X=交易量 / 市值 ):通常在项目初期,X值接近于 2,随后呈现下开口抛物线的变化趋势。当抛物线达到顶峰时,交易量创下新高,市值接近周期高点,这通常表明 PVP 交易活动达到了高潮。之后,交易量下降、市值降低,「聪明资金」开始撤离。

此外,通过交易量可以对代币进行初步判断。例如,单笔交易金额创新高可能意味着大资金的进场,这对行情具有积极意义。然而,目前许多交易平台尚未提供单笔交易金额的趋势变化或交易频率的统计,仅依赖交易量数据可能不足以全面分析市场动向。

7、带标交易者:通常是头部的 MEME 社区和 DEX 平台,反应宣发是否覆盖了主流社区,但通常此类地址撤池子速度也较快。

8. TOP10 地址指标:该指标用于分析代币持有量前十的地址,其持仓占总供应的比例。一般来说,前十地址的持仓比例低于 20% 较为健康,表明代币分布更为分散,社区共识较强,抛售风险相对较低。

9. 盈利期望公式:随着代币市值从 30 万美元向 300 万美元增长,其成功率往往极低。投资者通常在单个项目中投入 1-10 SOL 的资金,然而过度添加流动性可能导致价格暴涨,引发持有者的贪婪心理并快速止盈。例如,假设投资者筛选项目的成功率为 P=10%,失败后资金归零,则按照 1/P=10 计算,单个项目需要实现 1000% 的收益率才能实现盈亏平衡。这种情况下,市值在几十万美金的项目更像是一场概率博弈。

10. 新币优先策略:随着 MEME 代币的筛选与分析框架趋于成熟,创建者往往倾向于发行新代币,以便更容易操控相关指标。这种新币发行模式不仅迎合了市场对「创新」的偏好,也增加了短期内吸引资金流入的可能性。

11. 相同概念,优先选择 Base:以近期马斯克推动的 Percy 概念为例,Base 网络的表现显著优于 Solana。这是因为 Base 网络的用户多为 DeFi 资深用户,其购买力通常是 Solana 用户的 3-4 倍。此外,Base 上的交易更频繁出现鲸鱼入场,这进一步增强了其市场表现和资金流动性。

12. 翻倍出本策略:由于 PVP 是一种高频且高风险的交易模式,用户在此过程中容易受到情绪波动的影响。「翻倍出本」策略是一种相对科学且心理负担较小的方法。通过在收益翻倍后取回初始投资,投资者能够更轻松地长期持有剩余部分资产,从而摆脱短期情绪波动带来的压力和困扰。

13. 池子调整的动机解析:在中大型项目中,投资者通常会将代币与 SOL 配成交易对投入 Raydium 流动性池,以获得高达 999.99% 的 24 小时 APR。DeFi 的核心本质是做空波动率,而当配对资产出现单边行情时,流动性提供者可能面临无常损失。投资者增加流动性池资产,通常意味着他们看好对应资产短期上涨,但幅度可能有限,反映出短期盘整的信号。而当投资者减少池子资产时,往往是对某一资产持看空态度,可能伴随着抛售或重新调整资产的兑换比例。

14、新地址的动作观察:有规律的做市视为危险信号,如大笔金额对敲买入卖出,也可以研究开发者地址的交易习惯。

通过了解上述方法,对内盘类项目有了一个初步的分析后,那么恭喜,你即将掉入职业 MEME 操盘者的陷阱中,他们会在指标上打造一个完美的 MEME,符合你项目分析筛选框架,随后营造故事性,AI+ 创始人互动 + 黑客松种种,加之高频交易带来的情绪起伏,使得对项目的判断力迅速丧失,交易的纪律被打破,亏损随之而来。所以本文是一篇「MEME 戒瘾文章」,无论投资者在哪个渠道了解的「财富密码」,信息差仍旧存在,因为 PVP 一定要让人来接盘,所以 Web3 新用户应避免沉迷在 MEME 赛道,去慢慢培养价值发现的能力。

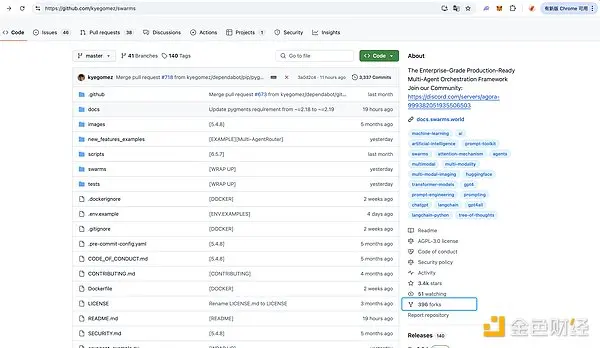

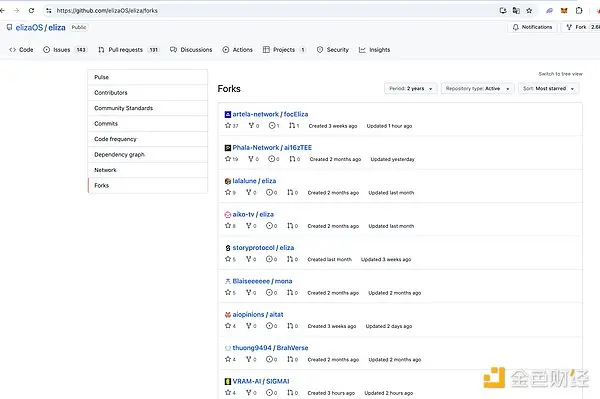

对于框架类 AI Agent 项目,可以关注 GitHub 代码库中的 Forks 页面,以查看哪些项目引用了 Eliza 的代码。但即使如此,也需谨慎评估项目的开发进展和实际潜力,避免盲目跟风投资。

最后一个 MEME 冲击建议——合理安排时间,注意休息!!

小结

MEME 交易不仅是一场对创新和风险承受能力的考验,也充分展现了如 AI Agent 等前沿概念在技术突破和去中心化叙事中的潜力。这类高波动性市场为敏锐的投资者提供了快速获利的机会,同时也推动了区块链技术、代币经济模型和 AI 应用场景的探索与发展。投资者在这种环境中,需要不断优化即时决策能力和市场适应能力,从而在高风险的市场中找到优势策略并加以运用。

然而,MEME 市场的高频波动性也蕴含着极大的风险。剧烈的价格波动容易诱发情绪化交易,使得投资者陷入「盲目投机」的循环。短期收益带来的多巴胺快感可能让人忽略长期价值投资的逻辑,而过度依赖短线交易往往导致本金的大幅亏损。尤其是那些缺乏扎实技术支撑或真实应用场景的项目,在热度消退后,极易沦为纯投机工具,令投资者蒙受高额损失。这种损失不仅打击了个人的投资信心,还可能对整个加密行业的健康发展带来负面影响,进一步加剧市场的不稳定性。

对于投资者而言,理性和长期视角尤为重要。在参与 MEME 交易时,应结合技术分析和项目价值挖掘,避免被短期波动裹挟。唯有在风险与收益之间找到平衡,才能在这片高波动的市场中实现真正的可持续盈利。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。