Market Overview

Overall Market Situation

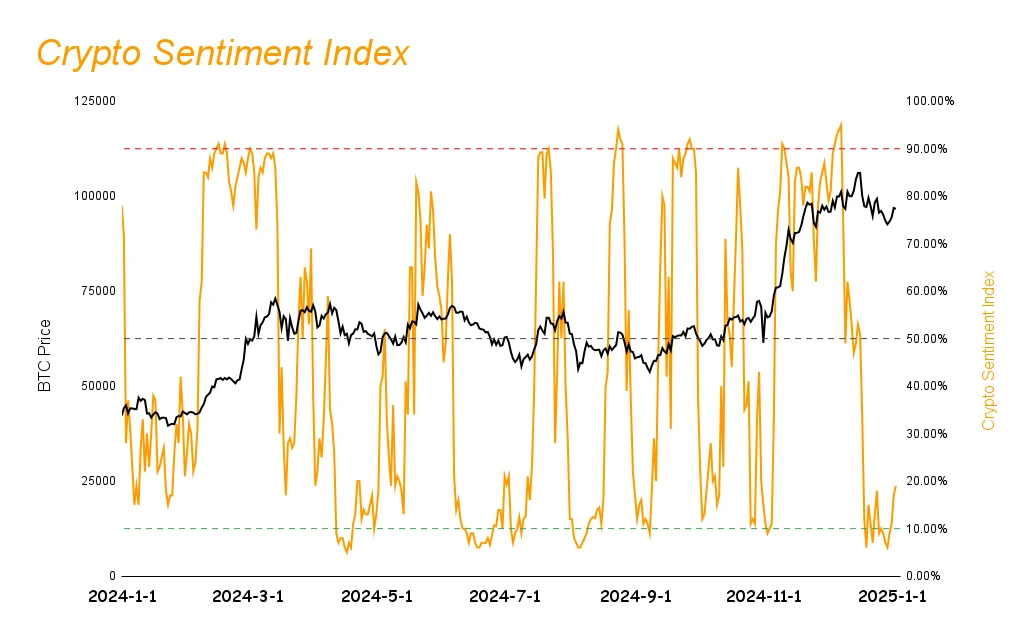

The market sentiment index rose from 10% last week to 19%. Although it remains in the panic zone, signs of recovery are evident. Despite still being in the New Year holiday period, where market liquidity has not fully returned, funds have begun to gradually flow back into the cryptocurrency market. Altcoins performed better than the benchmark index this week, but it is expected that they will maintain a synchronized trend with the benchmark index in the short term.

DeFi Ecosystem Development

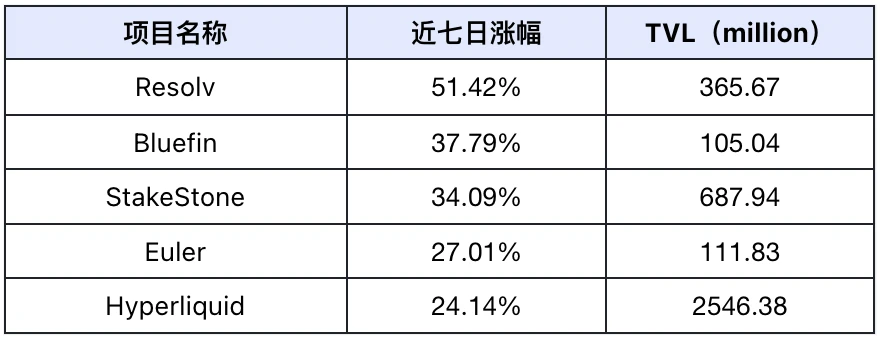

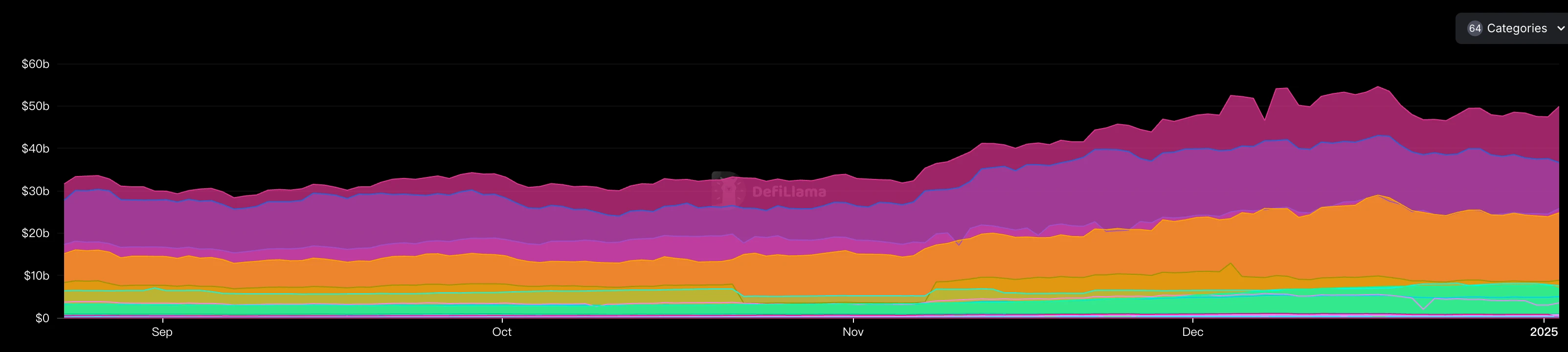

The TVL of DeFi projects increased from $52.7 billion last week to $53.2 billion, a growth of 0.95%, ending a two-week streak of negative growth. Gun pool projects and Prep DEX projects performed outstandingly, mainly benefiting from the rise in market base interest rates leading to increased yields, as well as increased demand for contract trading due to decreased liquidity during the holiday.

AI Agent Development

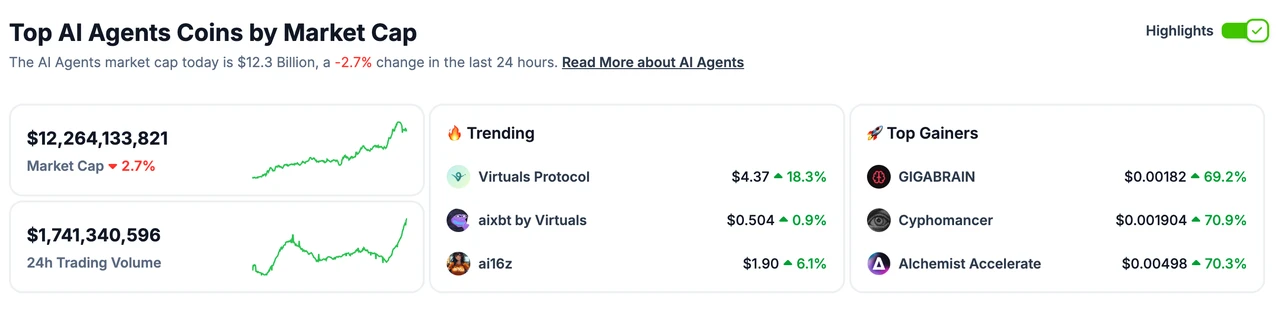

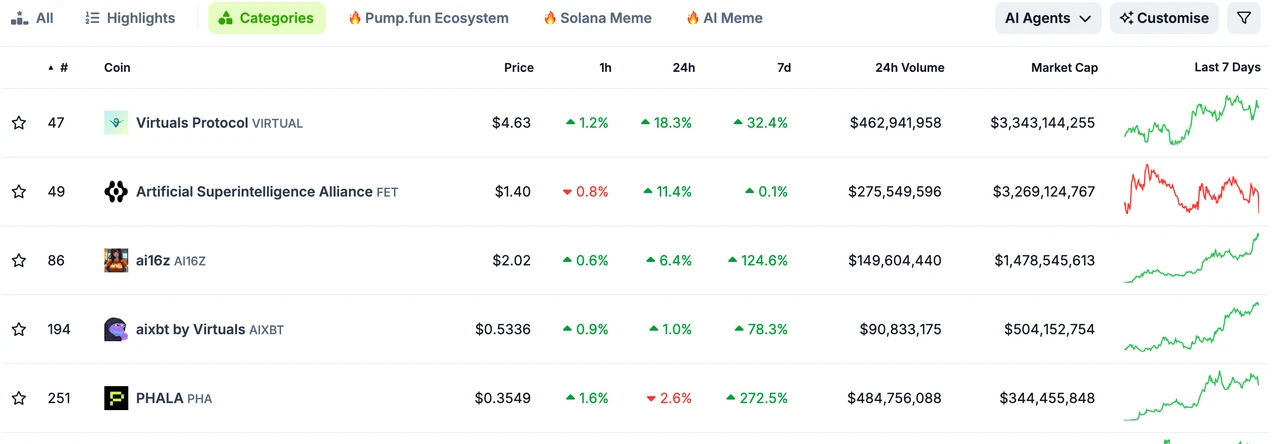

The AI Agent sector continues to maintain its status as a market hotspot, with a market size reaching $12.2 billion, a week-on-week growth of nearly 12%. Market attention has gradually shifted from AI Meme to AI infrastructure construction projects, with AI Agent's self-issued tokens becoming the most focused area, and related infrastructure projects like Phala Network performing prominently.

Meme Coin Trends

This week, the Meme coin market mainly focused on AI-related projects, benefiting from the wealth effect brought by AI Agent's self-issued tokens, leading to significant gains in AI Meme projects. This trend reflects that market funds are chasing AI-related concepts, but it also shows an increase in speculative characteristics.

Public Chain Performance Analysis

Public chain projects performed well in this week's market rebound, mainly due to the increase in APY of on-chain DeFi projects and the development demand of AI projects. Among them, public chains supporting AI development, such as Solana and zkSync Era, performed prominently, indicating that public chains are moving towards AI infrastructure development.

Future Market Outlook

Next week, the market will welcome the release of U.S. employment data, which may affect the Federal Reserve's interest rate cut decisions and is expected to bring market volatility. As the holiday ends and institutional investors return, market liquidity is expected to recover. It is recommended that investors maintain a defensive allocation, increasing the proportion of allocations to top assets like BTC and ETH, and moderately participate in high-yield gun pool and Prep DEX projects, but strictly control positions and manage risks.

Market Sentiment Index Analysis

The market sentiment index rose from 10% last week to 19%, remaining in the panic zone.

Altcoins performed better than the benchmark index this week, with most tokens showing greater gains than the overall market. Although we are still in the New Year holiday, and liquidity has not fully recovered, funds have started to return to the crypto market, and the market is slowly recovering. However, given the current market structure, it is expected that Altcoins will maintain a synchronized trend with the benchmark index in the short term, with a low probability of independent market movements.

Overall Market Trend Overview

The cryptocurrency market was in an upward trend this week, with the sentiment index still in panic.

DeFi-related crypto projects performed outstandingly, showing the market's continued focus on improving base yields.

AI Agent sector projects had high public sentiment this week, indicating that investors are actively seeking the next market breakout point.

Hot Sectors

AI Agent

This week, the overall market was in an upward trend, with most sectors also rising. The majority of tokens in the AI Agent sector were also on the rise this week, becoming a market hotspot due to AI Agent's self-issued tokens, which had the highest discussion level in the market. Any token related to the AI Agent sector saw an increase this week.

The continued focus on the AI Agent sector this week is still due to the self-issuance of tokens. Some Meme coins issued through Virtuals and ai16z saw significant increases, creating a wealth effect that attracted market investors to focus their attention and funds on AI Agent's self-issued tokens. From the gains, we can see that the hottest this week were the ai16z asset issuance platform and the infrastructure construction project of AI Agent's self-issued tokens—Phala Network. Thus, we can see that the market's attention has begun to shift from AI Meme to AI infra. Therefore, we should focus on the AI infra sector projects moving forward.

Top Five AI Agent Projects by Market Cap:

DeFi Sector

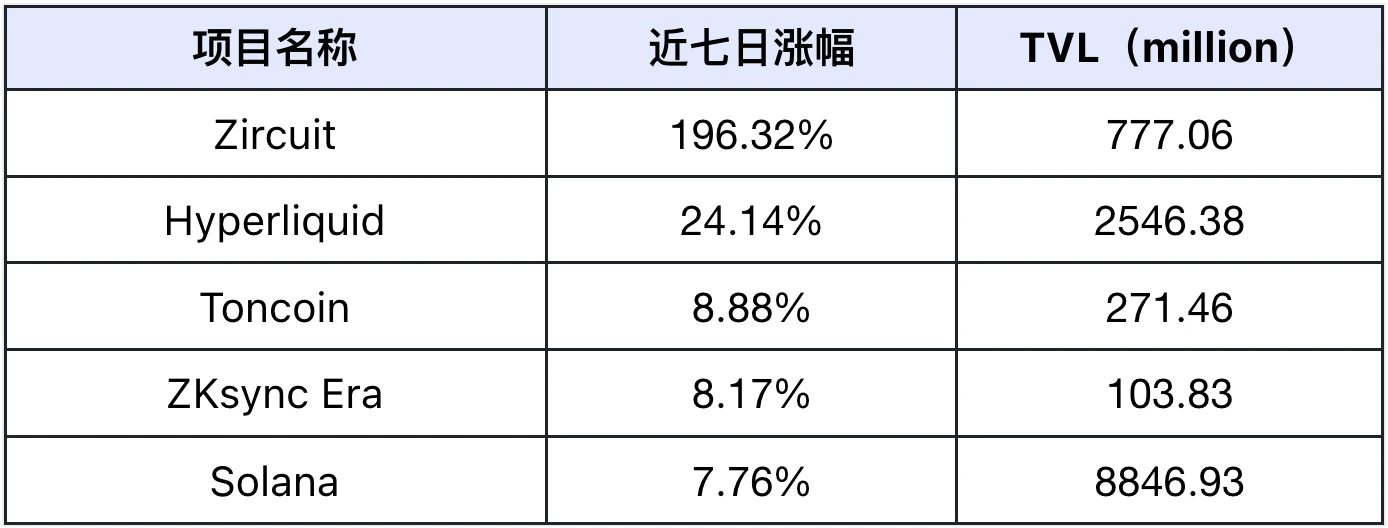

TVL Growth Ranking

The top 5 projects with the highest TVL growth in the past week (excluding projects with a TVL below $30 million) are sourced from Defilama.

Resolv (Not Issued): (Recommendation Index: ⭐️⭐️⭐️)

Project Introduction: Resolv is a delta-neutral stablecoin project that focuses on the tokenization of market-neutral investment portfolios. The architecture is based on economically viable and fiat-independent sources of yield. This allows competitive returns to be distributed to the protocol's liquidity providers.

Latest Developments: This week, Resolv successfully launched new liquidity pools such as USR/RLP and USR-GYD, and completed cross-chain expansion to the Base network. It has also established strategic partnerships with well-known projects like Gyroscope, Aerodrome, and Pendle, with Pendle pool's TVL reaching $85 million and trading volume exceeding $66 million. Meanwhile, Resolv implemented comprehensive user incentive measures through the Points Program, with the RLP product performing excellently, achieving a daily APR of 38%, attracting a large number of on-chain users. In community building, it supported 9 community contributors through the Grants Program, further strengthening the ecosystem's sustainability.

Bluefin (BLUE): (Recommendation Index: ⭐️⭐️⭐️)

Project Introduction: Bluefin is a decentralized exchange on the Sui chain, providing contract and spot trading, focusing on high-performance derivatives trading services. Bluefin has built a complete meme infrastructure, aiming to become the meme trading center of the Sui ecosystem.

Latest Developments: This week, Bluefin successfully completed the integration of the Sui Bridge, supporting cross-chain functionality for suiUSDT. Additionally, through collaboration with Transak, it significantly upgraded its payment system, adding support for Apple Pay, Google Pay, and credit card payments, greatly optimizing the user recharge experience. It also reached a listing partnership with Bitget exchange, with the BLUE token set to launch in its spot trading area, and introduced a suiUSDT liquidity mining project offering a competitive yield of over 40% APR.

StakeStone (Not Issued): (Recommendation Index: ⭐️⭐️⭐️)

Project Introduction: StakeStone is a full-chain liquidity infrastructure focused on providing liquidity staking (LST) services for Ethereum and other blockchain networks. The project aims to solve staking yield and liquidity issues in Layer 2 networks through decentralized methods while supporting cross-chain compatibility and multi-scenario applications.

Latest Developments: This week, StakeStone successfully launched the Berachain Vault supporting multi-chain access and achieved cross-chain functionality through Router Protocol's Intent Adapter. It established deep cooperation with Uniswap to create large-scale liquidity pools and launched the innovative yield-bearing asset beraSTONE. StakeStone is building a comprehensive DeFi ecosystem through collaborations with multiple strategic partners like KodiakFi, Dolomite.io, and Pendle Finance, and has rapidly expanded its user base to 80,000.

Euler (EUL): (Recommendation Index: ⭐️⭐️)

Project Introduction: Euler is a protocol built on lending protocols like Aave and Compound, allowing users to create their own lending markets for any ERC-20 token and providing a reactive interest rate model to reduce governance intervention.

Latest Developments: Euler demonstrated strong growth momentum this week, with weekly active users reaching levels comparable to Compound. It successfully established a partnership with mETH Protocol to support $mETH asset lending, collaborated with the Smart M team to achieve the highest ROE performance on the circular lending page, and integrated Midas RWA's mTBILL/USDC automated strategy, providing users with yields of up to 25% APY, attracting many on-chain users to participate.

Hyperliquid (HYPE): (Recommendation Index: ⭐️⭐️⭐️⭐️⭐️)

Project Introduction: Hyperliquid is a high-performance decentralized finance platform focused on providing perpetual contract trading and spot trading services. It is based on its own high-performance Layer 1 blockchain and uses the HyperBFT consensus algorithm, capable of processing up to 200,000 orders per second.

Latest Developments: Hyperliquid officially launched staking functionality on the mainnet this week and, in response to community demand, added leverage trading support for two AI-related tokens, AI16Z and AIXBT, offering up to 5x leverage. Due to the recent rise and sustained high interest in AI Agent tokens in the crypto market, Hyperliquid attracted a large number of users to participate in trading.

In summary, we can see that the projects with rapid TVL growth this week are mainly concentrated in gun pool projects and Prep DEX projects.

Overall Performance of Sectors

Stablecoin market cap steadily grows: USDT decreased from $144.7 billion last week to $142.7 billion, a decline of 1.38%, while USDC increased from $42.9 billion to $44 billion, a growth of 2.56%. It can be seen that although the overall market cap of stablecoins has decreased, USDC, which is primarily focused on the U.S. market, has still seen growth, indicating that the market's purchasing power remains strong.

Liquidity gradually increases: The risk-free arbitrage rates in traditional markets continue to decline with ongoing interest rate cuts, while the arbitrage rates of on-chain DeFi projects are increasing due to the rising value of cryptocurrency assets. Returning to DeFi will be a very good choice.

TVL of various DeFi sectors (data source: https://defillama.com/categories)

Funding Situation: The TVL of DeFi projects increased from $52.7 billion last week to $53.2 billion, a growth of 0.95%. Although the increase is small, it ends a two-week streak of negative growth. This indicates that although we are still in the holiday period dominated by the U.S. market, funds are beginning to flow in, and on-chain DeFi activities are starting to recover. It is expected that next week, as various institutions and investors return to the market after the holidays, the TVL of the DeFi market will continue to rise. Therefore, next week, attention should be focused on the rate and amount of funds flowing back into the DeFi market.

In-Depth Analysis

Driving Forces Behind Gun Pool Projects' Rise: The core driving factors for this round of increase can be summarized in the following transmission path: As the market was in an upward trend this week, the APY of various DeFi protocols increased to varying degrees, leading to a significant rise in the APY of gun pool projects.

Specifically:

Market Environment: The market was in an upward trend this week, leading to an increase in the market's base interest rates.

Interest Rate Side: The base lending rates have risen, reflecting the market's pricing expectations for funds.

Yield Side: The yield of gun pool projects has expanded compared to other projects, attracting more users to participate, thereby reinforcing the value support of gun pool projects and forming a positive growth momentum.

Driving Forces Behind Prep DEX Projects' Rise: Due to the recent holiday period around Christmas and New Year in the U.S. market, liquidity in the market has significantly decreased, causing market token prices to be prone to large fluctuations. During this process, investors often choose to participate in contract trading to maximize their interests. Since contract trading on centralized exchanges often experiences forced liquidation by the exchanges, once the performance and trading depth of on-chain Prep DEXs improve, investors are more willing to choose Prep DEXs for contract trading, thus driving the development of the entire Prep DEX sector.

Performance of Other Sectors

Public Chains

The top 5 public chains with the highest TVL growth in the past week (excluding smaller public chains), data source: Defilama

Zircuit: This week, Zircuit collaborated with the Gud Tech AI team to develop AI smart vaults and multi-chain trading infrastructure, expected to launch in January 2025. It has successfully established a partnership with KelpDAO and launched a multi-reward program (including 3x Kelp Miles, 2x Zircuit points, etc.), and collaborated with Reown to provide Appkit login solutions for developers. Notably, the ecological project Gud Tech AI has achieved $9 million in ZRC token staking, and the platform plans to launch a brand update in January 2025, continuing to deepen its technological advantages in AI-protected trading systems and Automated Finance.

Hyperliquid: Hyperliquid officially launched staking functionality on the mainnet this week and, in response to community demand, added leverage trading support for two AI-related tokens, AI16Z and AIXBT, offering up to 5x leverage. Due to the recent rise and sustained high interest in AI Agent tokens in the crypto market, Hyperliquid attracted a large number of users to participate in trading.

Toncoin: Toncoin is developing a TON Teleport BTC permissionless bridging solution this week, which is expected to significantly reduce BTC transfer costs. It has also reached a strategic partnership with Jupiter Exchange to develop a liquidity aggregator, and USDT has completed over 120 ecological integrations on TON, with a circulation exceeding $1 billion. Additionally, Toncoin is hosting a DeFi innovation competition (winners to be announced on February 15, 2025) and plans to launch the BTCfi hackathon (with a prize pool exceeding $1 million).

ZKsync Era: zkSync Era focused this week on promoting its strategic positioning for 2025, with the project team releasing an important declaration stating, "2025 is the year of ZK," which received a positive community response with 1,467 likes and 158 shares. The project reiterated its core philosophy of "Web3 without compromise," emphasizing its commitment to development across three dimensions: performance, security, and usability, demonstrating strong confidence in the development of ZK technology.

Solana: Solana partnered with Send.ai this week to launch the AI Agent Kit development toolkit, and welcomed the official launch of RedotPay on the Solana chain, supporting USDC and USDT for use at 1.2 million merchants globally, integrating Apple Pay and Google Pay. This week, several key projects in the Gamefi sector, such as Nyan Heroes and Star Atlas, announced plans to intensify their development on the Solana chain in 2025.

Growth Ranking Overview

The top 5 market tokens with the highest growth in the past week (excluding tokens with low trading volume and meme coins), data source: Coinmarketcap

AI16Z: ai16z released an important v0.1.7 version update this week, including over 50 improvements and fixes, adding support for multiple chains such as Cronos ZKEVM, Avalanche, AlienX, and Fuel, and enhancing AI features like text-to-3D and voice synthesis. Meanwhile, ai16z initiated early development work on Eliza V2, with its token performing well, becoming the first Solana AI token to reach a market cap of $2 billion, with over 62,000 holders. In terms of ecosystem building, the project held an AI Agent Builders offline meeting in South Korea on January 3 and plans to strengthen open-source feedback through the RGPF program.

ATA: Automata Network achieved significant breakthroughs on the technical front this week, successfully bringing TEE (Trusted Execution Environment) technology on-chain and collaborating with EigenLayer to develop a Multi-Prover AVS system. Automata also joined the Optimism ecosystem as a member of the Optimism Collective, providing TEE-compatible GPU support for Worldcoin's AMPC, and plans to hold its final community meeting of the year on January 6. Notably, Automata's success in overcoming TEE technology coincides with the current AI Agent market, and if other AI Agent self-issued token projects adopt Automata on a large scale, it could further drive up its price.

GRIFFAIN: This week, Griffain's most important action was the launch of the SAIMP (Solana AI Message Protocol) open standard protocol, which allows AI agents to send messages on public blockchains. All messages are stored on-chain and support anyone to build SAIMP clients. Griffain also proposed the concept of "@ Store" (analogous to Apple's App Store) and plans to officially launch it in 2025, integrating dedicated financial agents (@uselulo) to provide wealth management services.

VIRTUAL: Due to the recent popularity of AI Agent sector projects, Virtuals Protocol saw significant growth in various data points this week: over 200 projects have used the GAME framework within a month of its launch, with a total market cap exceeding $500 million, daily request volume reaching 150,000 and a week-on-week growth of 200%. Since its launch on Base on October 16, 2024, Virtuals has had 220,000 token holders, with a total market cap of supported AI agents reaching $2 billion and protocol revenue reaching $60 million (annualized at about $300 million). It also launched the "Virtuals Agent Spotlight" program to showcase outstanding projects and continues to demonstrate ecosystem project progress through Discord educational sessions and social media.

PHA: This week, Phala Network released its 2025 TEE x AI technology report, highlighting its technological layout in the decentralized AGI (dAGI) field, while announcing important network architecture adjustments: it will terminate PHA access on the Khala network on January 8, 2024, implementing a 1:1 ratio migration of PHA tokens from Khala to Ethereum (ERC20). Additionally, this week, the PHA token was listed on Binance Futures and Bitget, offering up to 75x leverage trading, and Phala Network announced ongoing collaborations with leading projects such as 0G Labs, SentientAGI, and NEAR Protocol.

From the growth ranking, it can be seen that all projects on the growth list this week are related to the AI Agent sector.

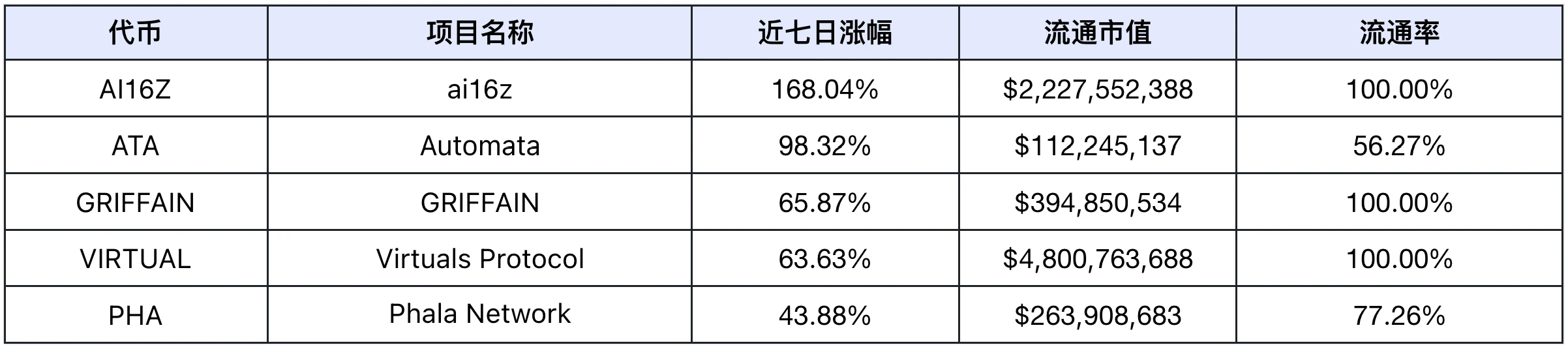

Meme Token Growth Ranking

Data Source: coinmarketcap.com

This week, the growth in the Meme sector is mainly concentrated on AI Meme projects related to AI. Recently, projects that issue their own tokens in the AI Agent sector have been highly sought after by the market, creating a wealth effect. As a result, market attention and funds have flowed into the AI Agent sector, leading to significant growth in Meme projects that issue their own tokens in this area.

Social Media Hotspots

Based on the top five daily growth statistics from LunarCrush and the top five AI scores from Scopechat for the week (12.28-1.3):

The most frequently mentioned topic is L1s, with the following tokens making the list (excluding tokens with low trading volume and meme coins):

Data Source: Lunarcrush and Scopechat

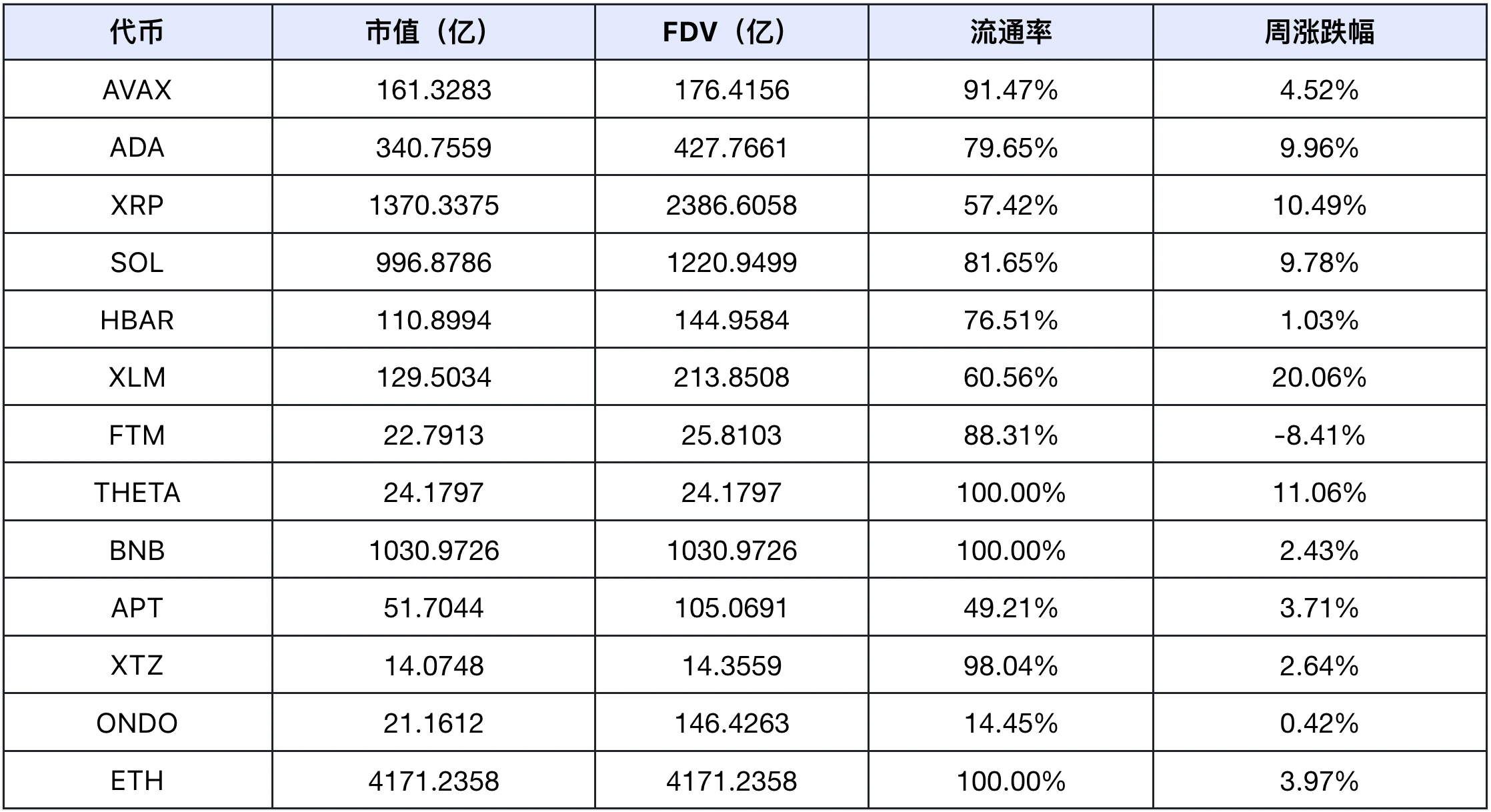

According to data analysis, the L1s projects received the highest attention on social media this week. Due to the New Year holiday, the U.S.-dominated market is still in the holiday phase, causing liquidity in the market to decline significantly as various market makers and institutions are on break. However, after a substantial drop in the entire Crypto market over the past two weeks, the prices in the Crypto market rebounded this week, with various public chains performing well in this rebound. As market sentiment improves, on-chain users are shifting their attention and funds to on-chain DeFi projects. With the overall price increase in the Crypto market, the APY offered by DeFi projects in public chains is also rising rapidly, leading to increases in both TVL and trading volume for various DeFi projects. The AI sector projects are also thriving, as all public chains support the development of AI projects, resulting in good performance for public chains during this week's rebound.

Overall Market Theme Overview

Data Source: SoSoValue

According to weekly return statistics, the AI sector performed the best, while the SocialFi sector performed the worst.

AI Sector: In the AI sector, VIRTUAL, RENDER, FET, and TAO account for a significant portion, totaling 73.36%. This week, their declines were 63.63%, 5.39%, 10.04%, and 7.89%, respectively, leading to the best overall performance of the AI sector index. Recently, the AI Agent sector has remained hot, causing the market to concentrate funds and attention on the AI sector, resulting in a general increase in various tokens within the AI sector.

SocialFi Sector: The absolute leader in the SocialFi sector remains TON, which accounts for 90.68% of the SocialFi market cap. This week, TON did not follow the broader market rebound and instead fell by 2.86%, making the SocialFi sector perform the worst.

Next Week's Major Crypto Events

Thursday (January 9): Initial jobless claims in the U.S. for the week; Federal Reserve to release minutes from the December monetary policy meeting.

Friday (January 10): U.S. unemployment rate for December; U.S. non-farm payrolls for December, seasonally adjusted.

Outlook for Next Week

Macroeconomic Factors Assessment

Next week, the U.S. unemployment rate and non-farm payrolls for December will be released. These two data points are of great concern to the Federal Reserve and will significantly influence whether interest rate cuts will be paused in January. Market fluctuations are expected around the release of this data.

As various institutions return to normal operations after the holiday, the U.S.-dominated market will become active again, restoring liquidity and providing some support for market prices.

Sector Rotation Trends

Although the current market environment for the DeFi sector is poor, investors generally expect a broad market rally in the first quarter of next year. Therefore, most investors are reluctant to sell their tokens. At the same time, to increase their holding returns, many are participating in gun pool projects to enhance yields. Additionally, due to recent market volatility, many investors are engaging in contract trading to boost returns, leading to good development for various Prep DEX projects recently.

The AI sector, particularly the AI Agent sector, continues to attract market attention, with the market size reaching $12.2 billion, a nearly 12% increase from last week. The market will still focus on AI Agent self-issued tokens this week, resulting in price increases for projects in the AI Agent self-issue sector.

Investment strategy recommendations include maintaining a defensive allocation, increasing holdings in leading assets like BTC and ETH to enhance the risk-hedging properties of assets, while also participating in some high-yield gun pool DeFi projects and Prep DEX projects. Investors are advised to remain cautious, strictly control positions, and manage risks effectively.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。