After the festival, how should Bitcoin move today? Is it a post-holiday celebration or a survival after the disaster?

1. Recent Price Performance and Trends:

Overall Trend: Starting from the bottom low (92520.00), the price has shown a strong rebound, reaching a recent high (99963.70), close to the psychological barrier of 100000. The current price has retreated to around 98900, forming a short-term fluctuation.

2. Pattern Analysis:

Double Bottom Pattern (Potential Reversal Signal): Recently, the price has formed a clear double bottom prototype at the bottom (around 92520-93000), becoming increasingly evident. The second bottom is relatively solid, followed by a strong upward attack, breaking through the neck line (around 97500-98000), and at one point approaching the psychological barrier of 100000.

Ascending Channel: During the upward process, the price has retraced multiple times, but each retracement low has not broken below the support line and has gradually risen. Subsequently, the rebound highs have also gradually increased, forming parallel resistance lines. The candlestick fluctuates between the support and resistance lines, oscillating upwards.

3. Support and Resistance:

Support Level: Short-term support: 98500 (lower edge of the previous fluctuation range). Strong support: 97500 (double bottom neck line), if broken, it may retest 96000.

Resistance Level: Current resistance: around 99407. If it can break through 100000, it may further test 101500 or even 103000.

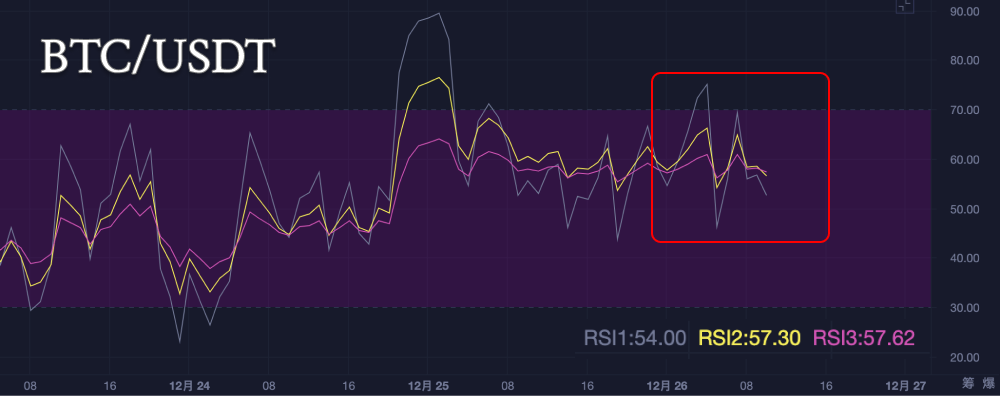

4. Technical Indicator Analysis

MACD: DIF is below DEA (DIF < DEA): The fast line crosses below the slow line, indicating that the short-term trend is weakening, and the market may enter a correction phase. The MACD histogram is negative and increasing: the current negative histogram indicates that bearish strength is increasing, but the value (-75) is relatively small, suggesting that the downtrend has just begun, and the market has not fully entered a strong bearish state.

From the data, the market may be gradually weakening from a bullish trend into a bearish phase, but the downward momentum is currently not strong. If the subsequent MACD histogram continues to expand negatively, it may indicate a stronger bearish trend.

RSI: RSI14 is currently at 56.5, in a neutral to strong area, not yet in the overbought range, indicating some room for upward movement.

EMA: EMA7 (98462.2) > EMA30 (97522.0) > EMA120 (98367.2), the moving averages are in a bullish arrangement, supporting the upward trend. Pay attention to the support role near EMA7.

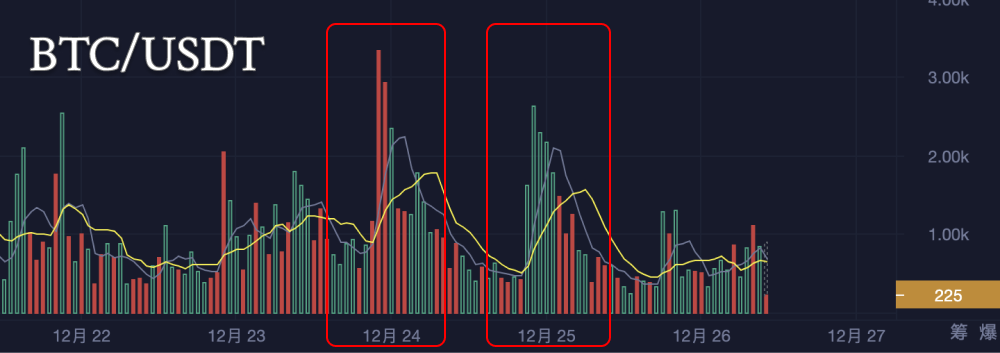

Trading Volume: Recently, trading volume has increased, especially on December 24 and 25, showing a significant increase, indicating increased market activity. The increase in volume is accompanied by intensified price fluctuations, and attention should be paid to subsequent changes in trading volume to confirm the continuity of the trend.

5. Short-term Strategy Suggestions:

Bullish Opportunity: If the price stabilizes above 99000 and is accompanied by increased volume (for example, a significant increase in trading volume), it may continue to rise, suitable for short-term bullish positions. A stop-loss can be set below 98500.

Cautious Retracement: If the price fails to break through 100000, a short-term retracement may occur, and attention should be paid to whether the 97500 support holds.

The above content is for reference only and does not constitute investment advice.

If you have any questions, you can contact us through the following official channels:

AICoin Official Website: www.aicoin.com

Telegram: t.me/aicoincn

Twitter: x.com/AICoincom

Email: support@aicoin.com

Group Chat: Customer Service Yingying、Customer Service KK

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。