The Christmas bells have just rung, but the crypto market is like a mischievous child, giving investors quite a "surprise." Amid the festive atmosphere, the fluctuations of Bitcoin and altcoins have become the main focus of the market, with investors' moods rising and falling accordingly. Let’s analyze the logic behind the market and search for the investment secrets hidden within the volatility.

The Retreat of Smart Money: Why Did the Christmas Market Suddenly "Change Its Face"?

The sharp market correction before Christmas was like a sudden cold wind. A "hawkish" remark from Federal Reserve Chairman Powell successfully pulled Bitcoin down from its historical high of $108,000 to around $90,000. The altcoin sector was even more dismal, with most tokens experiencing a prolonged decline. This widespread sentiment of market downturn seemed to cast a shadow over the entire crypto market.

Data from AICoin indicates that the U.S. spot BTC ETF market was also restless, with outflows reaching a historical high for two consecutive days. On December 19, the outflow amounted to $671.9 million, followed by another $277 million the next day. Such a scene makes one sigh, as "smart money" seems to have started its "holiday" before Christmas.

It is worth noting that this phenomenon of capital outflow is not an isolated event but is closely related to the macroeconomic environment and market sentiment. Investors' uncertainty about the global economic outlook and concerns over a high-interest-rate environment have further exacerbated the market's panic.

Trump's Crypto Dream: The Collision from "White House" to "On-Chain"

If Powell's remarks were the fuse for the market correction, then Trump's crypto project is the "fluff news" of the holiday market. The Trump family's DeFi project, World Liberty Financial (WLFI), has attracted much attention since its launch. However, despite Trump's successful tenure in the White House, the project's performance has been worrisome.

Data from AICoin shows that WLFI raised about $10 million on the first day of its token sale, but the overall sales have fallen far short of expectations. As of now, only 507 million tokens have been sold, leaving a long way to go to reach the target of 20 billion tokens. Even with the strong resource background of the Trump family, it is difficult to change the market's lukewarm attitude towards its project. Interestingly, well-known crypto figure Justin Sun has also participated in this project, investing as much as $30 million, becoming one of its largest investors. This move has sparked widespread speculation in the market: does Sun's involvement have deeper meaning? Is he optimistic about Trump's political influence, or is he seizing the opportunity to lay out in the DeFi market? These questions have made WLFI a hot topic in the market.

Echoes of History: Is the Christmas Market a Treat or a Trap?

When it comes to the "Christmas market" in the crypto space, many veteran players are likely familiar with it. Historical data shows that the phenomenon of market rises around Christmas is not coincidental but is caused by regular changes in capital flow. In simple terms, during the holiday period, most investors tend to take profits, increasing selling pressure; meanwhile, some funds choose to temporarily withdraw from the market, waiting for a more favorable time to re-enter.

According to AICoin data, from 2014 to 2023, the "Christmas market" has occurred 8 times over the past decade. The total market capitalization of the crypto market has averaged an increase of 0.69% to 11.87% during the week from December 27 to January 2 of the following year. Bitcoin, as the main force in the market, has also shown a certain upward trend during this period. However, this historical pattern does not always hold true. From Bitcoin's performance, although it has risen in the week before Christmas 7 times over the past 10 years, it has also frequently turned down after Christmas. Therefore, investors should remain cautious when anticipating the "Christmas market" and avoid blindly chasing highs.

Future Indicators: Opportunities Hidden in Volatility

Regarding the future market trends, analysts' opinions are quite polarized. On one hand, the crypto market is currently in a low liquidity environment, which means that greater volatility may occur in the short term. Especially on December 27, Bitcoin is set to face the largest options expiration event in history, which could very well become a turning point for the market.

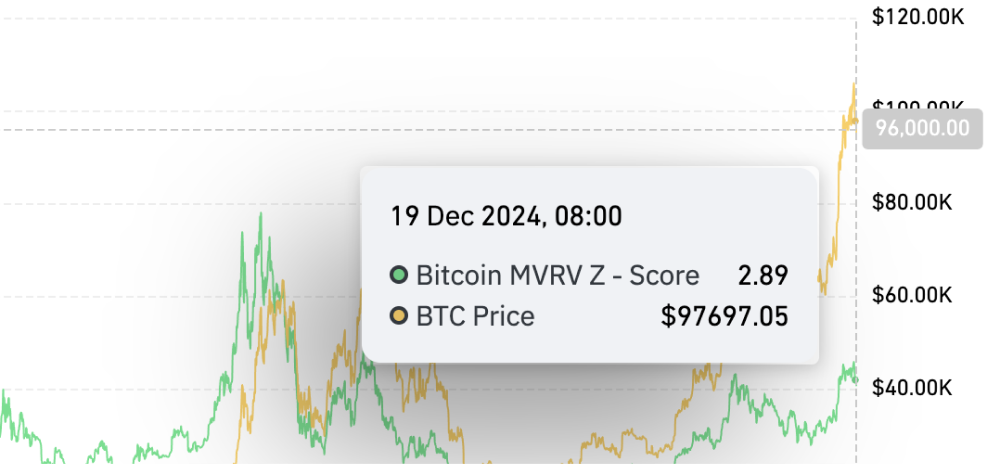

On the other hand, some market indicators are sending out positive signals. For instance, according to CoinGlass data, the Market Value to Realized Value (MVRV) indicator for Bitcoin shows that even with the recent price pullback, its current valuation remains undervalued. Historical data indicates that when the MVRV-Z score is below 3.7, it usually signifies a good buying opportunity in the market. Currently, Bitcoin's MVRV-Z score has dropped from 3.3 last week to 2.89 (as of December 19), undoubtedly giving bulls a glimmer of confidence.

Additionally, as the 2025 halving cycle approaches, many institutional investors have begun to position themselves for future upward trends. Considering the long-term impact of the halving effect on Bitcoin's price, this timing will undoubtedly become a focal point for the market.

Cold Reflection After the Holidays: How to Find Direction Amidst Volatility?

In summary, the crypto market during Christmas is like a "roller coaster," full of challenges and opportunities. For ordinary investors, the most important thing is to remain calm amidst the volatility and avoid emotional trading. Here are some strategies worth considering:

Focus on the Macro Environment: The Federal Reserve's policies and global economic trends remain core factors influencing market movements. Investors should closely monitor relevant developments and adjust their investment strategies in a timely manner.

Reasonable Positioning: In a situation of increased market volatility, diversifying investments and gradually building positions are effective means to mitigate risks.

Leverage Historical Data: Although historical data cannot fully predict the future, it provides important decision-making references. For example, the MVRV indicator and halving cycles are key tools for assessing market direction.

Beware of "Star Projects": Projects like WLFI, while carrying a halo, still require a return to fundamental analysis to avoid blindly following trends.

In this "unconventional" Christmas of the crypto market, the market volatility may feel tense, but for those adept at spotting opportunities, it may just be the best time to accumulate positions. Will the future market continue to decline or welcome a rebound? Perhaps only time will reveal the answer.

If you have any questions, you can contact us through the following official channels:

AICoin Official Website: www.aicoin.com

Telegram: t.me/aicoincn

Twitter: x.com/AICoincom

Email: support@aicoin.com

Group Chat: Customer Service Yingying、Customer Service KK

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。