引言

2024年12月6日,香港通过公布开创性的《稳定币法案》,在数字资产行业迈出了重要一步。这一举措彰显了香港希望巩固其作为全球数字资产监管领导者的雄心,并为其他应对这一新兴市场复杂性的法域树立了标杆。

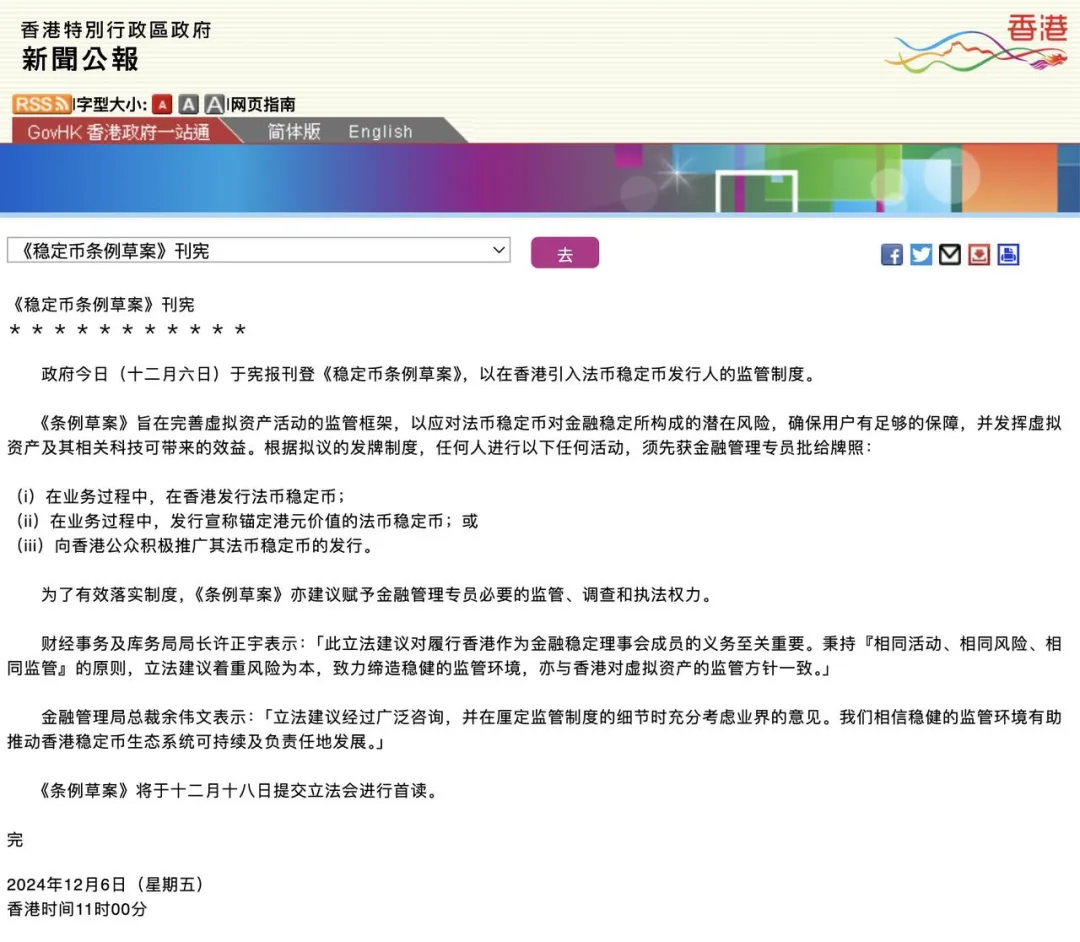

▲相关新闻截图

稳定币常被誉为传统金融与区块链技术之间的桥梁,已经在全球范围内迅速增长,其提供的价格稳定性以及在支付、汇款和去中心化金融中的应用潜力,推动了其广泛应用。然而,缺乏全面的监管暴露了稳定币的脆弱性,从系统性风险到消费者保护问题,迫使政策制定者必须采取行动。

拟议的立法旨在寻求微妙的平衡:在推动Web3经济增长的同时,确保金融稳定并保护公众信任。但它是否能够成功实现这一目标?本文将深入分析该框架是否能够与香港在快速发展的稳定币市场中的创新与谨慎并行的双重目标保持一致。

监管的必要性

对法币挂钩稳定币(“FRS”)的监管对于促进一个安全且具有创新性的金融生态系统至关重要。监管透明度的一个主要好处是增强投资者信心。通过制定明确的规则,监管机构可以确保稳定币发行者的操作更加透明,从而减少欺诈或管理不善的风险,并吸引那些原本可能犹豫的机构和零售投资者。

此外,稳定币的监管在防范系统性风险中起着关键作用。稳定币,特别是那些与法定货币挂钩的稳定币,越来越多地融入到金融体系中,成为支付、交易和流动性管理的载体。如果没有监管,诸如突如其来的赎回、操作失败或对波动性担保品的依赖等问题可能会波及传统金融市场,进而影响更广泛的经济稳定。

监管还促进了与全球标准的一致性,从而实现跨境互操作性,并增强国际利益相关者的信任。欧盟通过《加密资产市场(MiCA)》法规,美国也在进行有关稳定币的立法讨论,正在朝着制定监管框架的方向迈进。香港拟议的法律通过与这些努力保持一致,力图在全球范围内树立负责任创新的标杆。

作为一个著名的金融中心,香港采纳此项立法进一步巩固了其作为东西方之间的门户的地位。通过优先考虑投资者保护、金融稳定和监管一致性,香港的这一举措增强了其作为一个前瞻性、全球竞争力的金融中心的地位,并吸引了Web3领域的创新者和投资者。

挑战与权衡

当香港力图成为稳定币监管的领导者时,拟议框架面临着关键的挑战和权衡。这些挑战包括如何平衡严格监管与创新促进,并在全球协调的复杂环境中驾驭数字资产生态系统的迅速发展。

创新的潜在障碍

《稳定币法案》对法币挂钩稳定币(FRS)提出了严格的许可和合规要求。虽然这种做法对于确保透明度、消费者保护和系统稳定性至关重要,但它有可能将较小或新兴的市场参与者排除在外。初创公司通常是Web3领域创新的温床,但它们可能会因为高昂的审计费用、严格的治理要求和资本充足性要求而感到困难。

例如,欧盟的MiCA框架就包含了详细的合规义务。部分初创项目为了避开这些负担,选择将公司迁至监管宽松的地区,如瑞士或迪拜。如果香港的监管成本被认为过高,它也可能面临类似的挑战,从而驱使人才和创新流失。

另外,存在监管俘获的风险,即市场可能只由大型、资源充足的企业主导。例如,在美国,Circle(USDC发行者)等重要参与者已游说要求更加严格的规则,而这些规则可能会让较小的竞争者感到难以达成。如果香港沿着这一轨迹发展,可能会形成一个寡头垄断的市场,抑制稳定币设计或应用领域的创新。

全球协调的作用

稳定币由于其跨境运营的特性,需要全球监管框架的一致性,以释放其全部潜力。不同的监管框架在过去曾带来过挑战。例如,美国不断发展的稳定币监管方法—强调银行级别的储备要求—与日本的系统大相径庭,后者仅允许持牌银行和信托公司发行稳定币。这种碎片化的监管体系阻碍了互操作性,降低了稳定币在国际贸易和汇款中的效用。

香港需要小心地应对这些复杂问题。作为中国与全球金融体系之间的门户,香港拥有独特的机会与全球标准保持一致,例如MiCA或金融稳定委员会对稳定币的建议。然而,如果不能与国际标准对接,香港本地的发行人可能会面临孤立,影响他们与国际市场的互动。相反,一个灵活但又与国际接轨的框架将能够提升香港作为可信赖数字资产中心的声誉。

曼昆律师总结

香港的《稳定币法案》标志着数字资产监管发展的一个重要时刻,反映出香港在这一变革性行业中领导的雄心。通过强调透明度、稳定性和投资者保护,该立法为稳定币生态系统的繁荣奠定了坚实基础。然而,法案的成功依赖于如何在保护金融完整性与促进创新之间找到微妙的平衡。

这一议题的意义重大——不仅对香港,也对全球稳定币市场而言。这个框架会让香港成为监管卓越的灯塔,在确保稳定的同时促进创新,还是会成为一个警示案例,因过度的限制扼杀了成长并推动机会流向其他地方?

答案在于执行力、适应性和全球合作。全球都在关注,香港有机会树立行业的黄金标准。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。