作者:Daniel Ramirez-Escudero,CoinTelegraph

编译:邓通,金色财经

随着人们越来越多地猜测,即将上任的总统唐纳德·特朗普可能会在第一天签署一项宣布比特币储备的行政命令,或者在他的任期内通过立法建立储备,许多人想知道此举是否会导致加密货币超级周期。

自从怀俄明州参议员辛西娅·鲁米斯(Cynthia Lummis)今年早些时候提出比特币储备法案以来,德克萨斯州和宾夕法尼亚州等州也提出了类似的提案。据报道,俄罗斯、泰国和德国正在考虑自己的提议,这进一步加大了压力。

如果各国政府竞相保护自己的比特币库存,我们是否会告别加密货币价格的四年繁荣-萧条周期?

加密货币贷款机构 Nexo 的分析师 Iliya Kalchev 认为,“比特币储备法案可能是比特币的一个里程碑时刻,标志着其“被认可为合法的全球金融工具”。

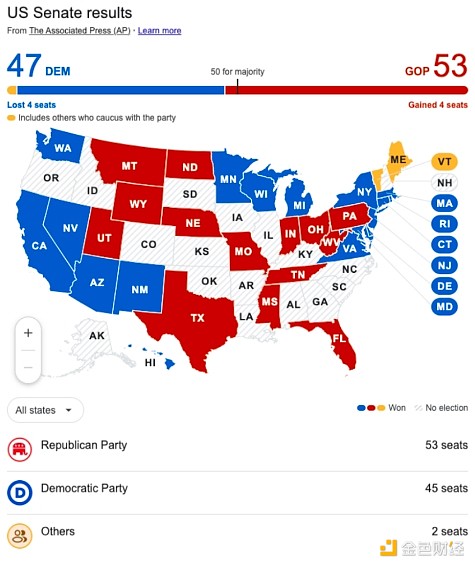

“每个比特币周期都有一个叙事,试图推动‘这轮不一样’这一想法。条件从未如此理想。加密货币领域从来没有一位支持加密货币的美国总统控制着参议院和国会。”

Lummis 提出的《2024 年比特币法案》将使美国政府能够将比特币作为储备资产纳入其国库,在五年内每年购买 20 万个比特币,积累 100 万个比特币,并持有至少 20 年。

Strike 创始人兼首席执行官杰克·马勒斯 (Jack Mallers) 认为,特朗普“有可能第一天就发布行政命令购买比特币”,尽管他警告说,这并不等同于购买 100 万个比特币。

支持比特币的美国政策法案的非营利组织 Satoshi Act Fund 的联合创始人丹尼斯·波特 (Dennis Porter) 也认为,特朗普正在探索通过行政命令启用比特币战略储备。

丹尼斯·波特宣布特朗普正在研究一项战略比特币储备的行政命令。资料来源:丹尼斯·波特

到目前为止,特朗普的团队尚未直接证实有关行政命令的说法,但特朗普在 CNBC 上被问及美国是否会建立类似于石油储备的 BTC 储备(这可能意味着立法)。

然而,行政命令缺乏稳定性,因为随后的总统经常推翻此类命令。确保比特币战略储备的长期未来的唯一方法是通过获得多数支持的立法。

由于共和党在国会占据主导地位并在参议院占据微弱多数,特朗普团队中的比特币拥护者有坚实的基础来推动Lummis的法案。然而,只有少数共和党叛逃者可能会因将政府财富交给比特币支持者而受到渐进式愤怒的影响,从而使该法案脱轨。

2024 年选举后美国参议院和国会结果。来源:美联社

“停止将本周期与之前的周期进行比较”

本月早些时候,经济学家兼宏观数字资产咨询公司 Asgard Markets 创始人 Alex Krüger 表示,选举结果让他相信“比特币极有可能处于超级周期”。

他认为,比特币的独特处境可以与黄金相比较,当时美国前总统理查德·尼克松让美国脱离金本位制,结束了布雷顿森林体系,黄金价格从 1971 年的每盎司 35 美元飙升至 1981 年的 850 美元。

Krüger并不排除比特币像过去的周期一样经历熊市的可能性。然而,他敦促加密货币投资者“停止将本周期与之前的周期进行比较”,因为这次可能会有所不同。

特朗普迄今为止的行动无疑表明了一个对未来有利的政府。在Gary Gensler辞职后,他提名支持加密货币和支持放松监管的保罗·阿特金斯 (Paul Atkins) 担任证券交易委员会主席。

他还提名支持加密货币的斯科特·贝森特 (Scott Bessent) 担任财政部长,并指定 PayPal 前首席运营官大卫·萨克斯 (David Sacks) 担任人工智能和加密货币沙皇,负责为加密货币行业制定明确的法律框架。

超级周期理论从未有过超级结果

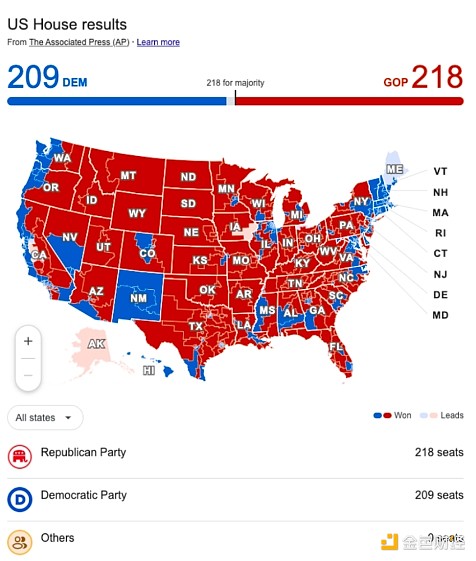

然而,“这个周期与众不同”的概念在过去的每一次比特币牛市中都出现过,每次都得到围绕主流和机构采用的叙述的支持。

在2013-2014年的牛市期间,超级周期理论得到了比特币作为法定货币的替代资产将获得国际关注的理论的支持。

在 2017-2018 年周期中,价格快速升值被认为是主流金融采用的标志,也是比特币被主流接受的开始,机构兴趣将蓬勃发展。

在2020-2021年周期中,当MicroStrategy、Square和Tesla等科技公司进入比特币市场时,他们相信许多科技相关公司也会效仿。

比特币的价格表现在之前的周期中出现了高峰和低点。资料来源:Caleb & Brown

然而,在每个周期中,超级周期的叙事都没有实现,最终导致价格暴跌,并在进入长期熊市时消灭了支持者。

三箭资本联合创始人Su Zhu是2021年以来超级周期论最著名的支持者,他认为加密市场将继续处于牛市,而不会出现持续的熊市,比特币最终将达到500万美元的峰值。

三箭当然借了钱,就好像超级周期理论是真实的一样,当它最终被清算时,消息传出后,加密货币市值下跌了近 50%,崩溃导致包括 Voyager Digital、Genesis Trading 和 BlockFi 在内的贷方破产和财务困难。

因此,超级周期是一个危险的理论,让你把一生的积蓄都押在上面。

对于风险投资公司 Placeholder 合伙人、ARK Invest 前区块链产品负责人 Chris Brunsike 来说,比特币超级周期只是一个神话。

“超级周期无疑是一种集体错觉。”

然而,考虑到美国总统的支持,美国大选结果压倒性地为比特币提供了前所未有的、极其看涨的条件,而美国总统似乎正在兑现其支持加密货币的承诺,其中包括永远不会出售美国比特币库存中的比特币。

潜在的全球多米诺骨牌效应

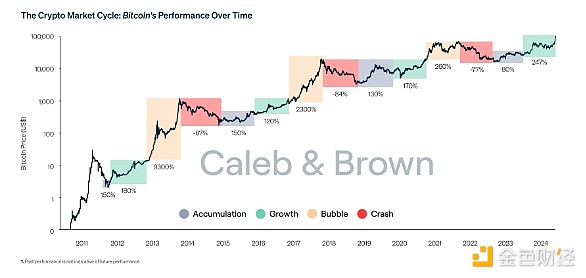

如果《比特币储备法案》获得通过,可能会引发一场全球囤币竞赛,其他国家也会效仿,以免落后。

律师 George S. Georgiades 于 2016 年从为华尔街公司提供融资咨询转向与加密货币行业合作,他告诉 Cointelegraph,颁布比特币储备法案“可能标志着全球比特币采用的转折点”,并可能“引发其他事件”各国和私人机构纷纷效仿,推动更广泛的采用并增强市场流动性。”

加密投资分析平台 Blockcircle 首席执行官 Basel Ismail 对此表示同意,并表示批准将是“加密货币历史上最乐观的事件之一”,因为“它将引发一场争夺尽可能多比特币的竞赛”。

“其他国家不会有发言权,他们将被迫采取行动。要么转向并竞争,要么死亡。”

他相信“大多数二十国集团国家都会效仿并建立自己的储备库。”

2024年G20地图。红色:G20,紫色:欧盟代表国家,绿色:非洲联盟代表国家。黄色:永久受邀的国家。资料来源:维基百科

资深加密投资者和比特币教育家 Chris Dunn 指出,各国之间这种基于 FOMO 的竞争性购买热潮可能会彻底改变当前的加密市场周期。

“如果美国或其他主要经济强国开始积累比特币,比特币可能会引发 FOMO,这可能会造成市场周期和供需动态,这与我们迄今为止所看到的任何情况都不同。”

OKX 交易所总裁指出,其他国家可能已经为这样的竞赛做好了准备。

“博弈论很可能已经悄然发挥作用。”

然而,Ismail表示,大部分比特币购买将通过场外经纪人完成,并以大宗交易的形式结算,因此“它可能不会对比特币的价格产生立竿见影的直接影响”,但会创造长期的影响。持久的需求力量最终将推动比特币的价格上涨。

新一波加密货币投资者可能会改变加密货币市场动态

如果各国成为市场买家,比特币市场可能会发生根本性变化。来自全球金融中心的新一波新投资者将涌入加密货币市场,改变市场动态、心理和对某些事件的反应。

Nexo 分析师 Kalchev 表示,虽然假设这项立法可能会破坏比特币众所周知的四年减半周期仍属推测,但一些动态可能会发生变化。

比特币是一个独特的市场,迄今为止由散户买卖推动,价格对市场心理高度敏感。新型投资者的出现可能会改变市场动态,改变历史周期。

Ismail认为,“股票市场投资者的行为将与反应过度的散户投资者不同”。机构投资者拥有雄厚的资金和先进的风险管理策略,这使他们能够以不同于散户投资者的方式对待比特币。

“随着时间的推移,华尔街的参与可能有助于建立一个更加稳定、反应更少的市场环境。”

稳定是波动性较小的另一种说法,这在逻辑上意味着熊市将不如过去的周期那么激进。

Georgiades认为,“价格周期将持续存在”,但“美国等大型买家的持续需求可能会减少波动性和我们在过去周期中目睹的波动。”

Ismail同时指出,比特币市场的表现已经与之前的四年周期不同。当前周期中比特币的价格跌破了上一个周期的历史高点(ATH),“每个人都认为这是不可能的”,然后比特币在正式减半之前达到了新的ATH。

“四年周期现在已经被多次揭穿和打破。”

比特币迄今为止只经历了四次减半,还有近三十次减半事件尚未发生。Kalchev 表示:“很难想象所有这些减半都会遵循相同的可预测的四年模式,”特别是当更广泛的宏观经济和政治因素(例如央行政策和监管发展)对比特币的市场轨迹产生更重大的影响时。

Kalchev认为,比特币的价格走势将不再受减半等内部机制的影响,而更多地受到外部因素的影响,例如机构采用和地缘政治事件。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。