宏观解读:加密圈内的人还是不怎么关注宏观经济数据、政策这些,刚才晚间21:30的PCE指数还是挺出人意料的,这个衡量通胀的物价指数创五个月新低了,也就是说美联储未来利率政策可能还会宽松,这就会利空美元,利多美元标价的资产比如黄金、美股和加密市场,行情也产生了立竿见影的反应。

今天加密市场完全被美股期货拖累跌了一整天,数据公布后美股期货才算是止跌反弹了点。情绪上可能会稍微缓和些,毕竟前晚的美联储会议声明和鲍威尔的表态太鹰派了。今晚数据公布后,市场预期可能美联储不会再这么鹰派的纠结于通胀水平。美股开盘也受白天期货大幅波动影响而出现跳空低开,纳指跳空低开了大概1%,算是对白天美股期货超跌的一个反应,近似于美股期货超跌反弹后的收盘位置,不过美股期货和加密市场已经在白天完成了大部分的跌幅,除非晚间继续大跌才能联动影响币市,如果美股反弹则会有利btc的反弹。

今晚全球经济界聚焦于本年度最后一个关键经济数据的揭晓,即美国11月核心个人消费支出(PCE)物价指数,这个数据意外地走低,引发了全球市场的关注和一些异动行情。美联储密切关注的通胀指标——核心PCE物价指数,其年率与月率均低于市场预期,具体表现为:

年率数据:11月核心PCE物价指数年率为2.8%,与前值持平,但低于市场预期的2.9%。这一结果打破了核心PCE物价指数通常紧贴市场预期的常态,显示了通胀压力的微妙变化。

月率数据:11月核心PCE物价指数月率为0.1%,较前值0.3%有所下降,同时低于市场预期的0.2%。这一低于预期的增长率进一步凸显了通胀趋势的放缓。

这个数据意外在哪呢?核心PCE物价指数作为美联储制定货币政策的重要参考指标,其意外低于预期的表现,可能反映出美国经济中通胀压力的减弱。此前,基于CPI和PPI数据的预测,分析普遍预期核心PCE物价指数将保持稳健增长,但实际情况却表明,通胀压力可能并未如预期般持续增强。美联储对此数据的反应可能也会出乎市场预料,尤其是在旧金山联储主席戴利此前表达了对通胀粘性的担忧之后。这表明,美联储内部的通胀预期与实际情况之间可能存在一定偏差,进而可能影响其未来的货币政策决策。

市场反应及后续影响:数据公布后,美元指数显著下跌,而黄金、美股期货、原油和加密市场等则出现反弹。这一市场反应表明,投资者对通胀压力的缓解持乐观态度,从而推动了避险资产的上涨和风险资产的反弹。同时,市场对美国政府可能于本周末停摆的担忧也加剧了市场的波动性。然而,需要注意的是,这种反弹可能只是短期内的市场反应,后续走势仍需密切关注经济数据的变化以及美联储的货币政策决策。

美股市场的未来展望:今晚美股的收盘情况对于判断市场趋势至关重要。如果美股进一步下跌,可能会加剧市场的悲观情绪,并对全球股市产生连锁反应。本周美股市场的暴跌已经引发了人们对股市健康状况的担忧,尤其是考虑到股市估值偏高以及美联储政策可能不如预期宽松的情况下。因此,市场需要警惕可能出现的第一个唱空者,这可能会成为市场走势的重要转折点。

市场分析:

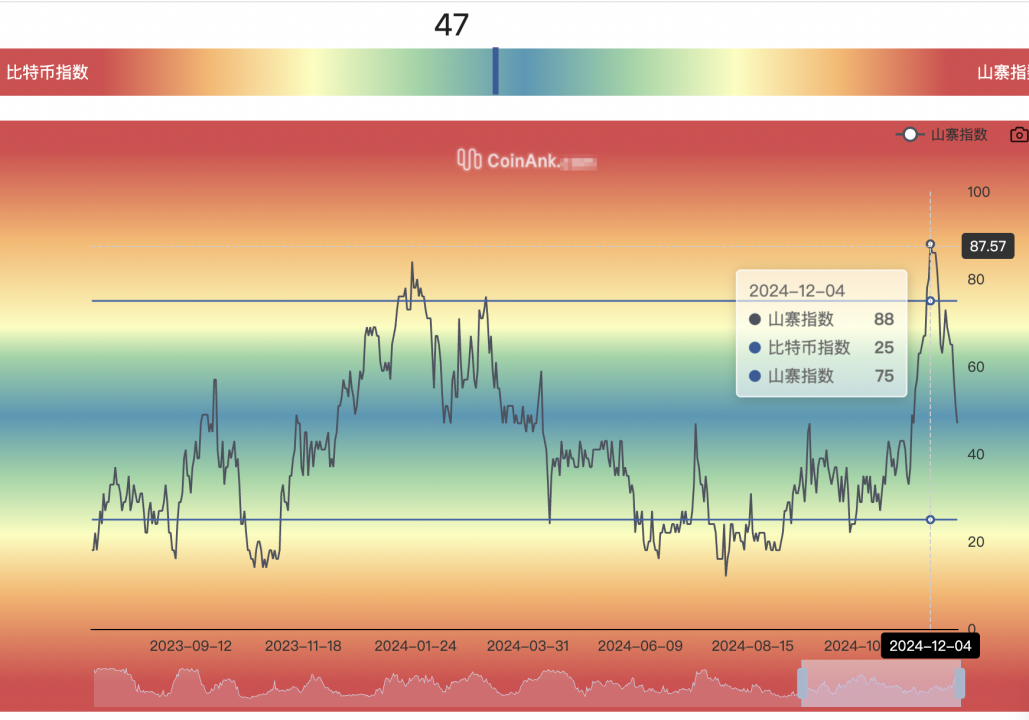

BTC 下午跌破趋势线支撑迹象,但考虑前期大幅上涨来比,跌幅也属正常回撤。但有些山寨币已经跌到11月5-6日美国总统大选时的位置了。尘归尘,土归土。加密市场普跌,山寨指数目前再度跌至48附近,预计明天根据行情更新后会更低。

关于山寨币见顶,我是在12月初,提前了一两周告诉大家如果未来山寨指数涨到85以上就要注意风险区域,实际最高88就开始大幅下跌。也一直秉承着山寨补涨不具有持续性的观念,做轮动就是拉涨后及时获利减持。

从11月下旬,到12月上旬,我关于山寨指数的提示和解读。从11月下旬发力开始的48左右的健康状态,到延续性相关提示,到后边78-80时开始预警超过85就要到风险区域了。实际后来大概没过几天就普遍见顶回落了,特别是12月10日开始大跌。

BTC四小时级别,收盘在96800美元下方,可以看作下破,跌破趋势线则代表未来中短期的趋势偏空,下方短期支撑参考92230/90500美元附近,中期支撑还是先看趋势线起点85000美元附近。

其实主要还看美股,就像我之前说的,如果美股是阶段顶部,那未来BTC也会跟随大幅回调。

目前很多人喜欢把下跌的原因全部归咎于鲍威尔关于比特币战略储备的言论,这其实是不了解宏观经济和美联储利率决议和声明本次偏鹰派的利空逻辑,仅仅停留在只了解加密行业圈内叙事,实际上从20-21年末牛市到顶部,加密市场跟宏观政策、美股顶部几乎全部趋同了。特别是近三年挖矿产业转移至北美,比特币现货ETF今年年初在美国上市交易,BTC的定价权已经几乎全部由美国市场来掌控。美股隔夜继续下跌,自然也会联动影响BTC为首的加密市场。这也是我经常在分析会提及美股、美元指数、黄金等走势的运行宏观逻辑及对加密市场的影响。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。