原创|Odaily星球日报(@OdailyChina)

作者|Wenser(@wenser2010)

近几日的加密市场迎来普遍回调,但Solana生态在上个月的表现仍然极为亮眼,有望在之后迅速修复价格,继续生态牛市。

据统计,2024 年 11 月,Solana 原生 DApp 获得了 3.65 亿美元的收入,创月度新高;收入占比近 84%来自DeFi 生态,钱包和基础设施占比不到 15%。此外,有 20 个 Solana DApp 月收入超过 100 万美元,pump.fun 成为“有史以来第一个月收入超过 1 亿美元的的 Solana 协议”。Odaily星球日报将结合 Syndica 相关报告,于本文对 Solana 生态11月相关表现进行梳理,供读者参考。

起底 Solana:生态收入与协议收入双双创下新高

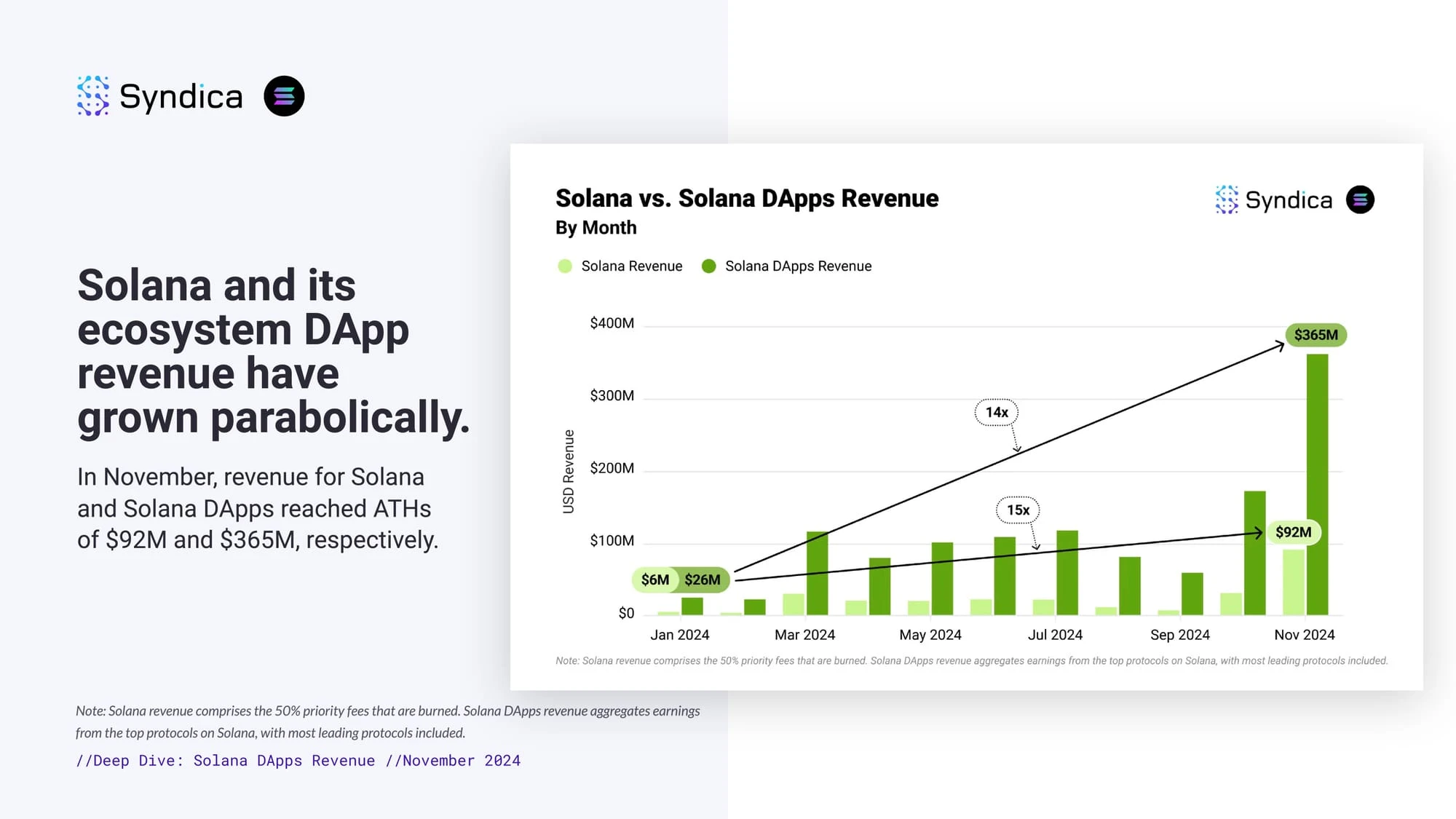

根据统计,11月,Solana 生态收入与DApps 收入分别达到9200万美元及3.65亿美元,双双创下“本年度新高”。其中,前者年初仅为600万美元,增长了15倍;后者年初仅为2600万美元,增长了14倍。

值得一提的是,Solana 生态收入的 50% 主要用于 SOL 代币回购销毁;DApps 收入统计则主要来自头部协议数据,是不完全统计。

与此同时,据 Coingecko 数据,SOL 年初价格仅为101美元左右,此前于11月23日一度突破263美元的新高,目前回落至 188美元左右,年度涨幅仍保持在88%左右。

Solana生态及DApps收入图

Solana 生态协议:pump.fun 一枝独秀,月收入超1000万协议达10个

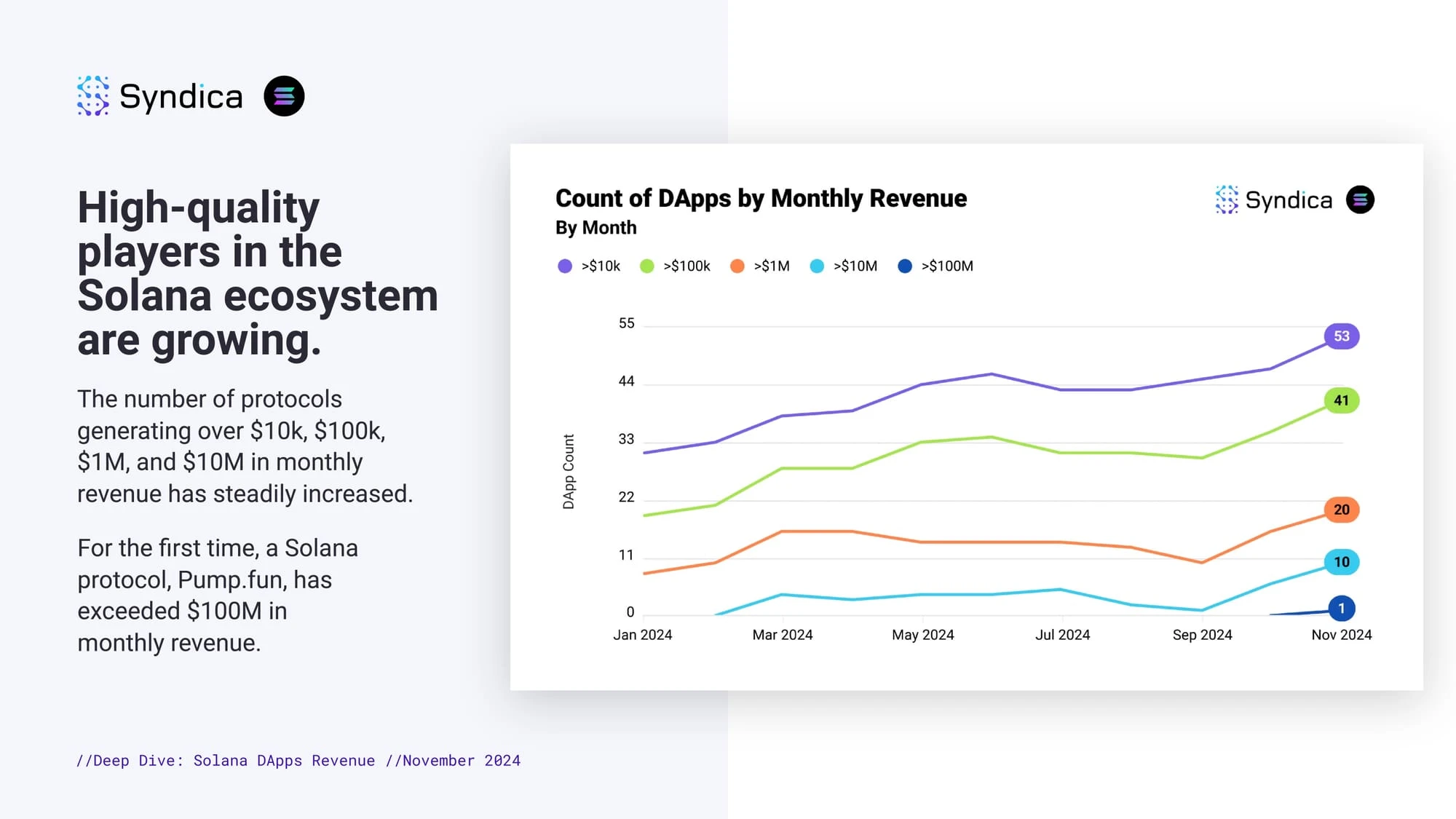

Solana 生态快速发展另一例证,则是收入亮眼的协议数量,其中,11月月收入超10万美元的有41个;月收入超100万美元的有20个;月收入超1000万美元的有10个;月收入超1亿美元的,则仅有 pump.fun 一个。

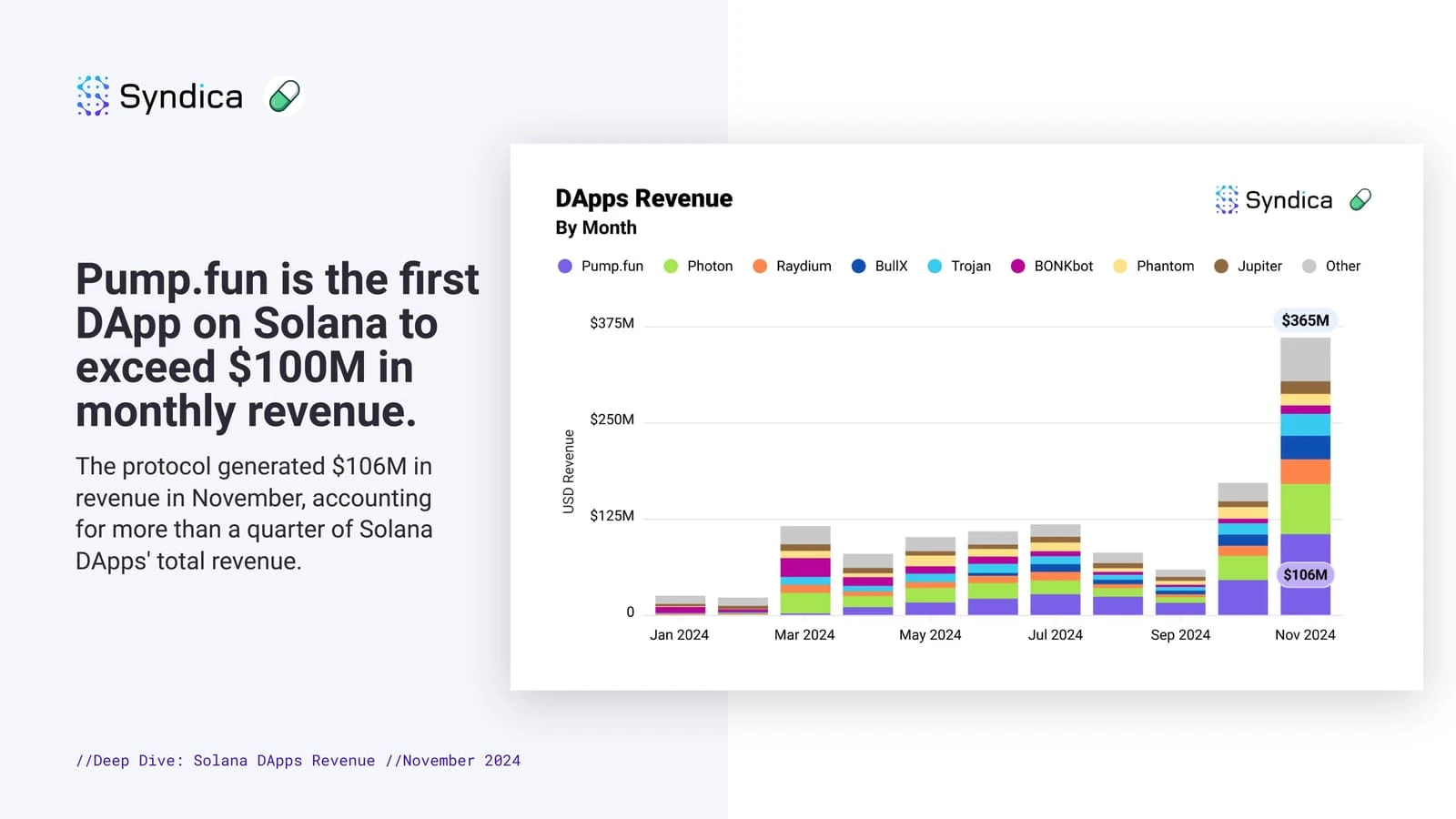

据 Syndica统计,pump.fun 以 1.06 亿美元的收入在11月 Solana 协议收入中位居领先地位,由此摘得“Solana生态首个月收入超1亿美元协议”的桂冠;排名前列的其他Dapps 包括 Photon、Raydium、BullX、Trojan、BONKbot、Phantom、Jupiter 等DEX、Telegram Bot、钱包等基建项目。

Solana生态Dapps 月收入分段统计

协议收入排名前8名数据

Solana 增长主因:DeFi 板块为王,Meme生态暴涨超300倍

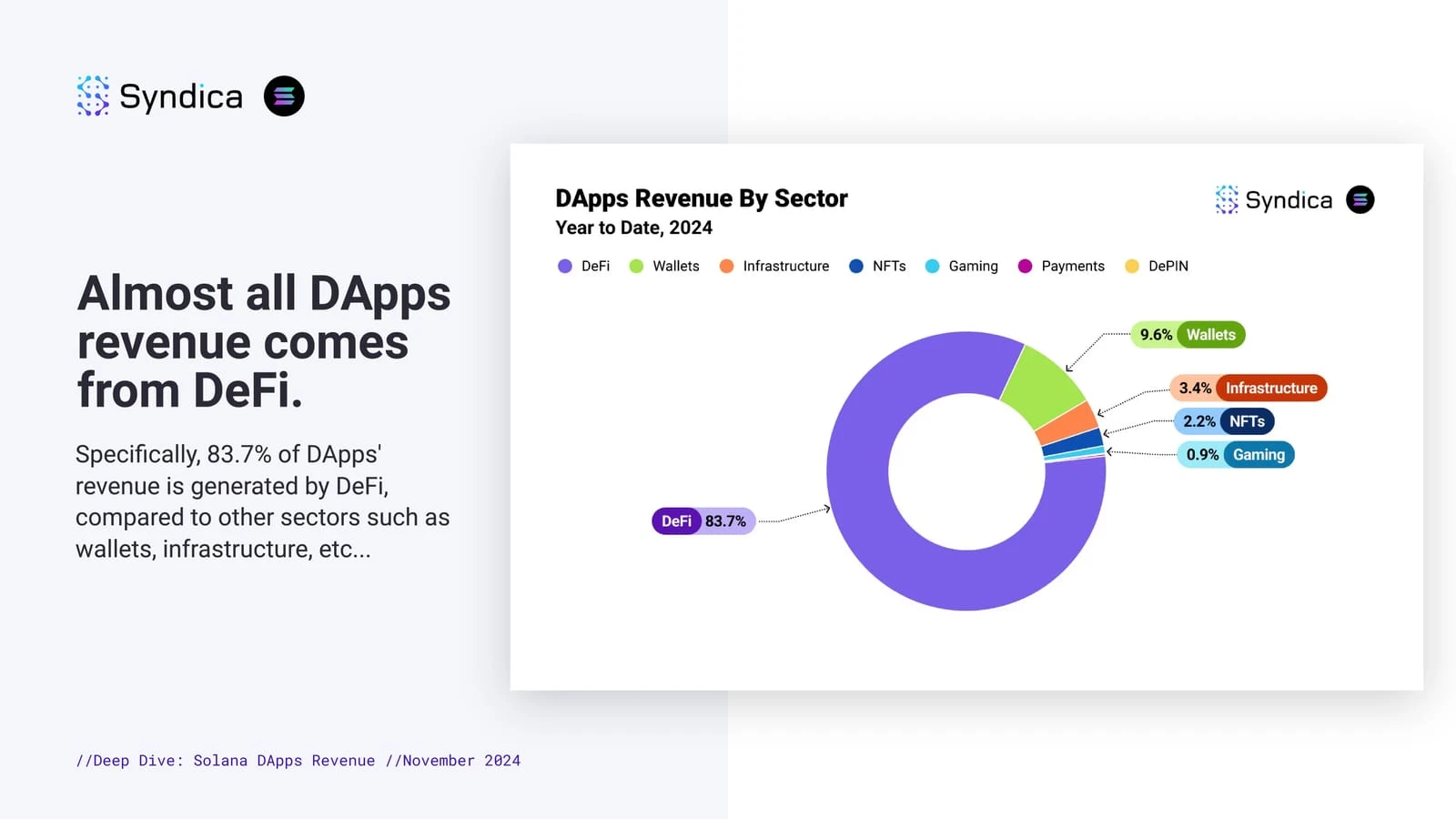

据统计,83.7%的Solana 生态协议收入来自DeFi板块;与之相对,钱包相关协议收入占比9.6%;基建类项目收入占比为3.4%;NFTs板块收入占比仅为2.2%;游戏板块收入占比更少,仅占0.9%;最少的则是支付板块、DePIN板块,占比不足1%。

从另一个角度来看,Solana 生态目前仍存在大量市场空间,游戏板块、支付板块、DePIN板块大有可为。

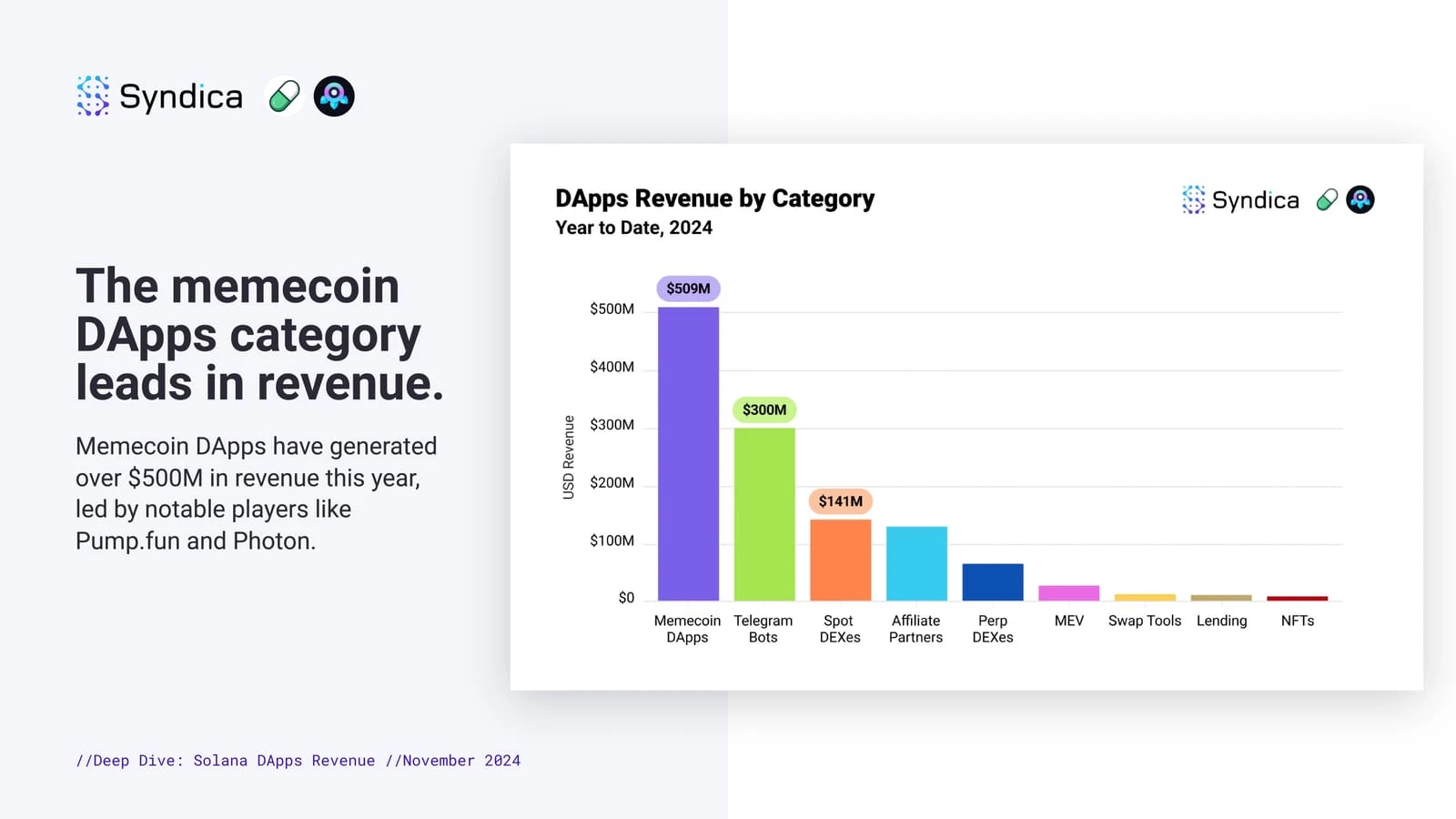

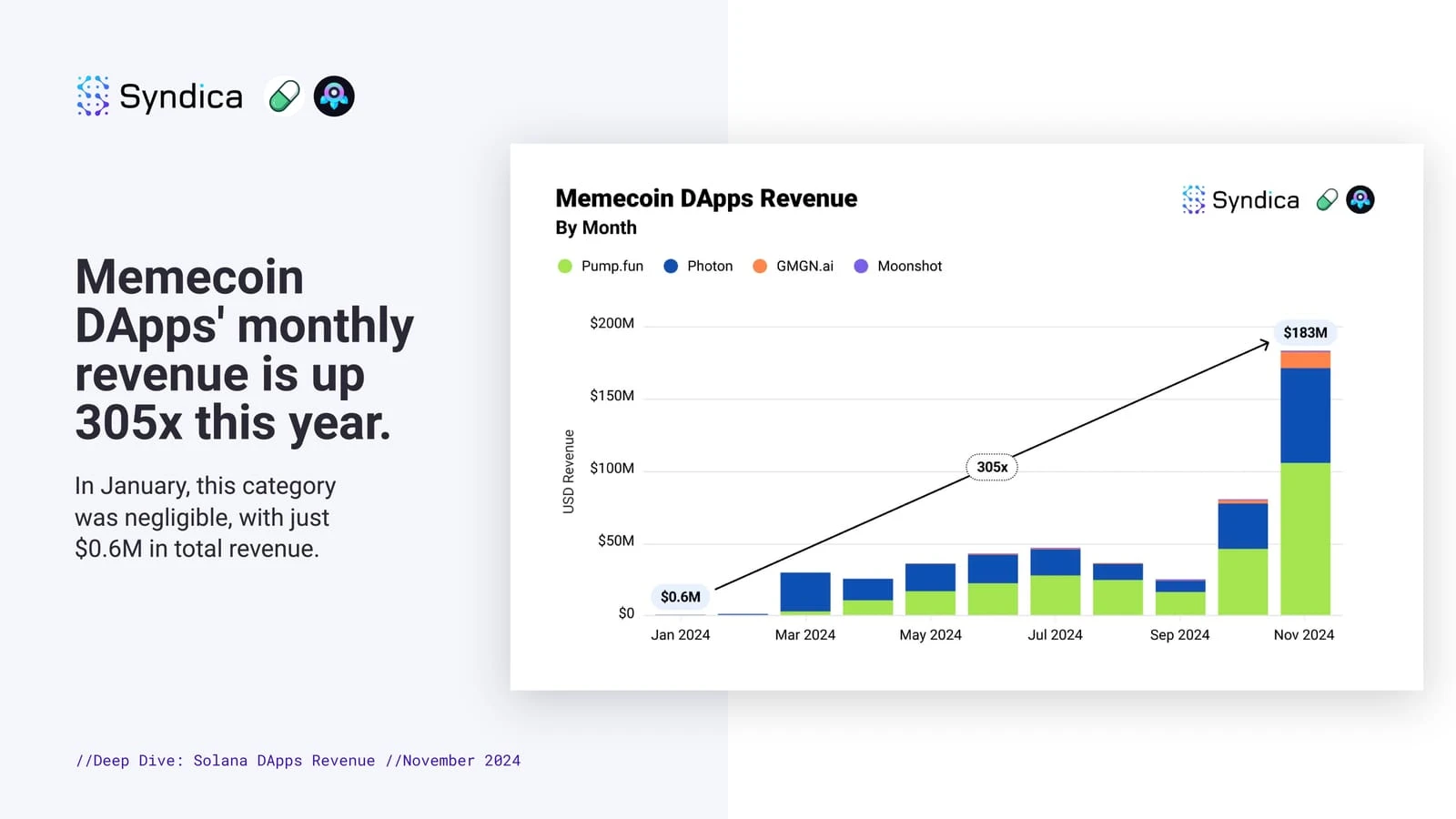

而在Solana生态占主导地位的 DeFi 板块中,Meme 币和支持 Meme 币的协议收入占比最大,年度收入高达5.09亿美元;紧随其后的,分别是 Telegram Bot板块,年度收入为3亿美元;现货 DEX 位列第三,年度收入为1.41亿美元。值得一提的是,Meme 币相关 DApp 月收入从1月的60万美元,增长至11月的1.83亿美元,增长倍数高达 305 倍,堪称“行业奇观”。

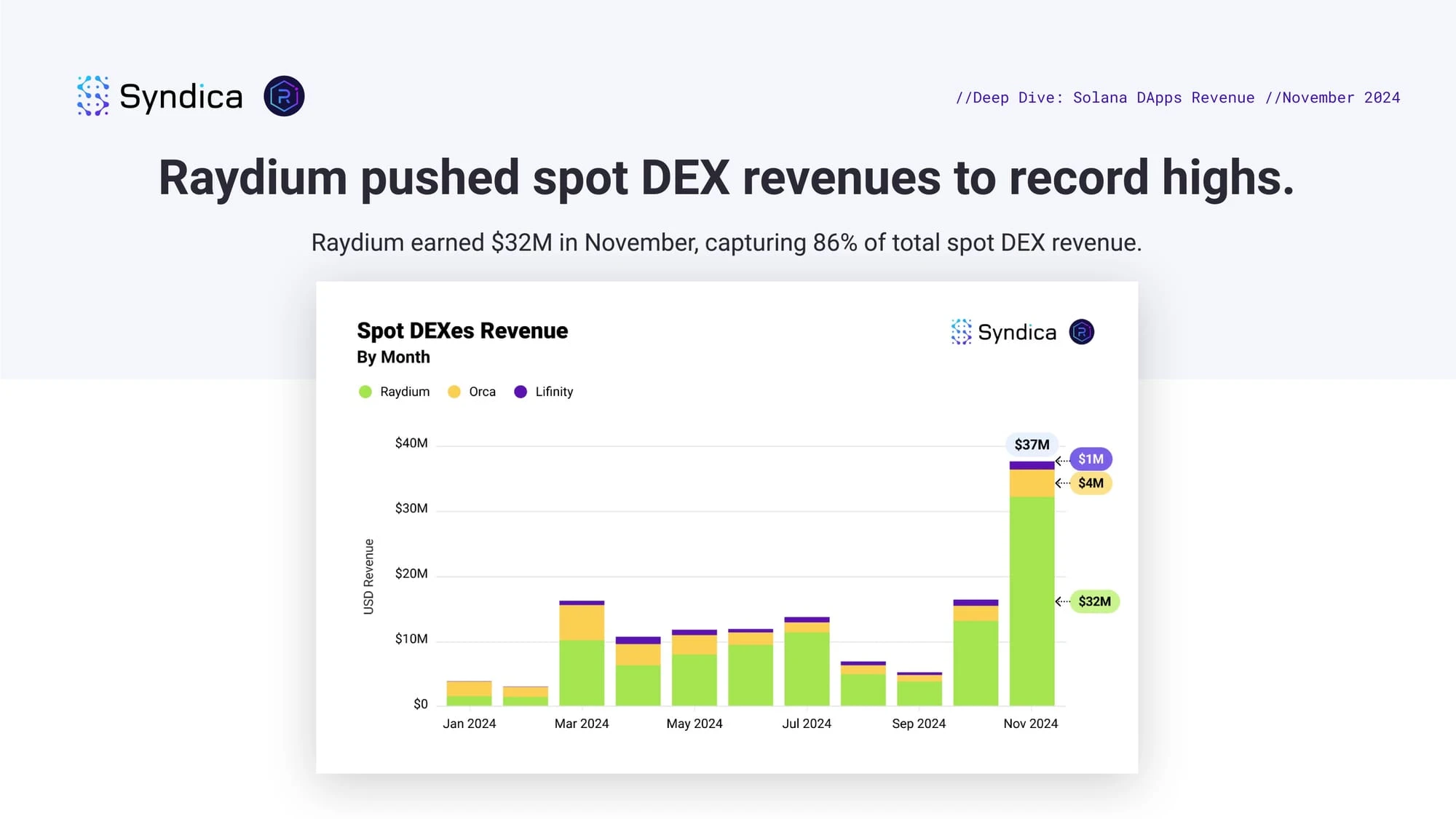

此外,得益于 pump.fun 的带动,Raydium 也成为该板块的“最大受益者”,11月平台月收入高达3200万美元,远超 Orca、Lifinity,相当于 Orca 月收入的8倍;相当于 Lifinity 月收入的 32倍。此外,自4月以来,DEX代币的 FDV 与协议月收入比值渐趋稳定,逐渐保持在85%±10%的范围内。

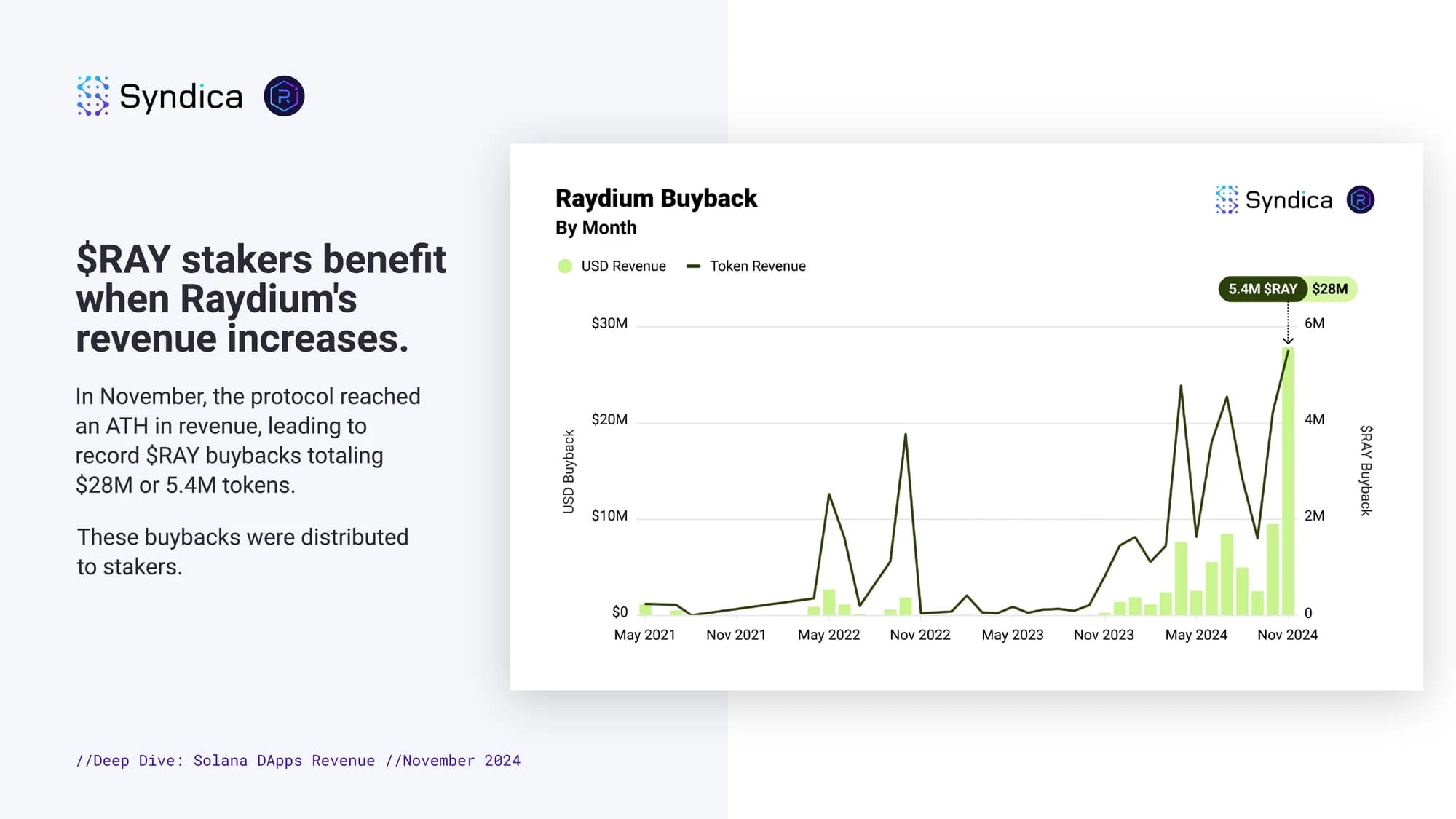

得益于项目的良好表现,Raydium 11月共回购了540万枚 RAY,价值高达2800万美元,用于质押者分配。

Solana 生态板块收入占比统计

Meme币相关DApps独占鳌头

Meme币相关 DApps 增幅惊人

Raydium 引领现货DEX赛道

RAY代币持有者享受Raydium 溢出效应

潜力无限的细分赛道:Telegram Bot 成生态造富机器

同样受益于蓬勃发展的 Meme币生态,Solana 也为一大批 Telegram Bot 提供了成长的土壤。

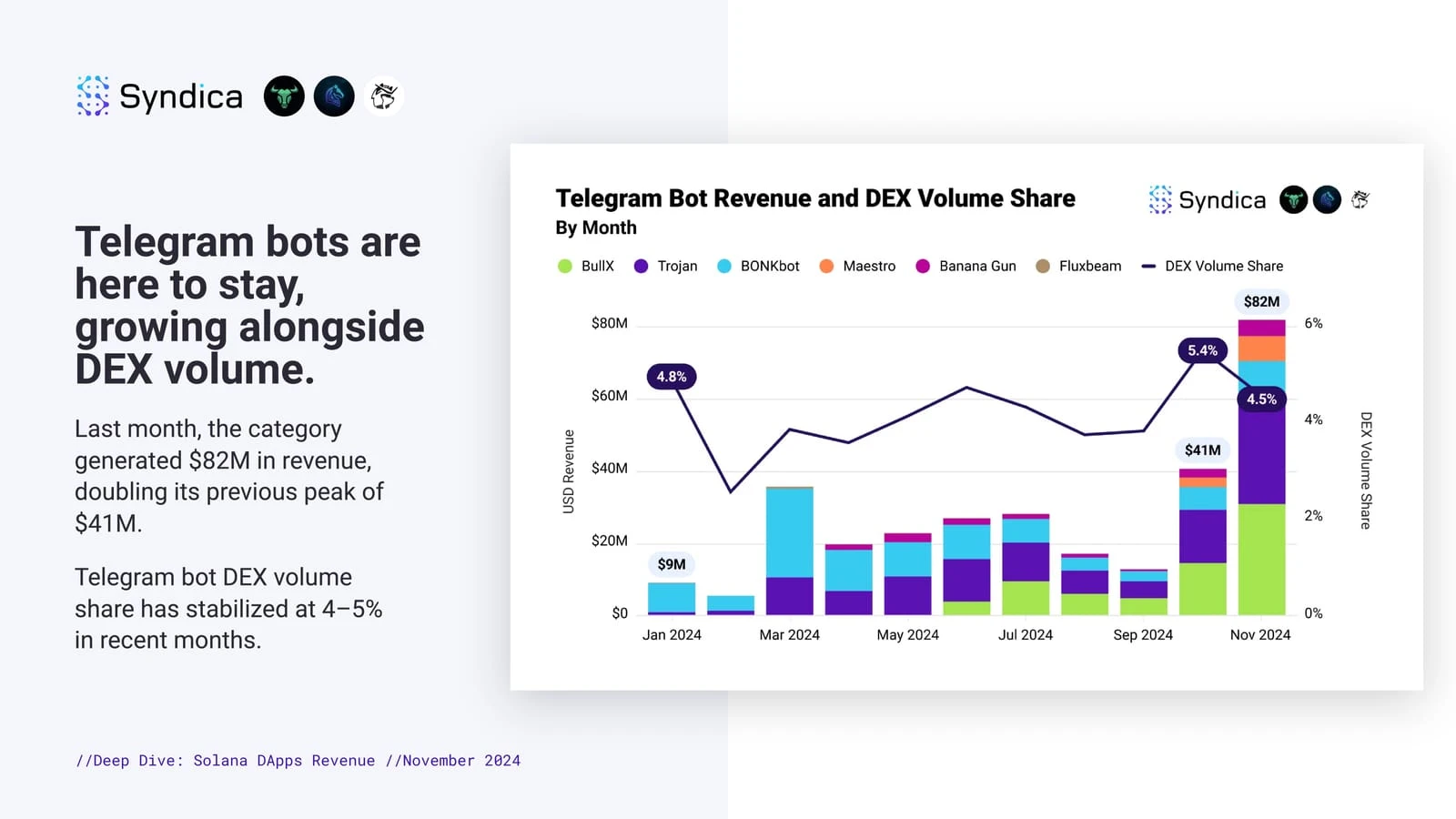

伴随着DEX交易量的增长,Telegram Bot 相关协议总体收入高达8200万美元,是10月总收入的2倍;占 DEX 交易量份额中的4.5%,且该占比日趋稳定。BullX、Trojan 成为该赛道的头部2大DApp,月度收入均超2000万美元,总和收入接近6000万美元。

Telegram Bot 成细分赛道吸金能手

Solana生态的“超级应用”:Jupiter 的JLP成最佳标的

11月,在 Jupiter 永续合约的带动下,其协议收入增长至 1700万美元。75%的永续手续费被分配用于奖励 JLP LP,剩余25%则返还给 Jupiter 协议,因此,JLP 成为众多资金涌入的热门投资标的。

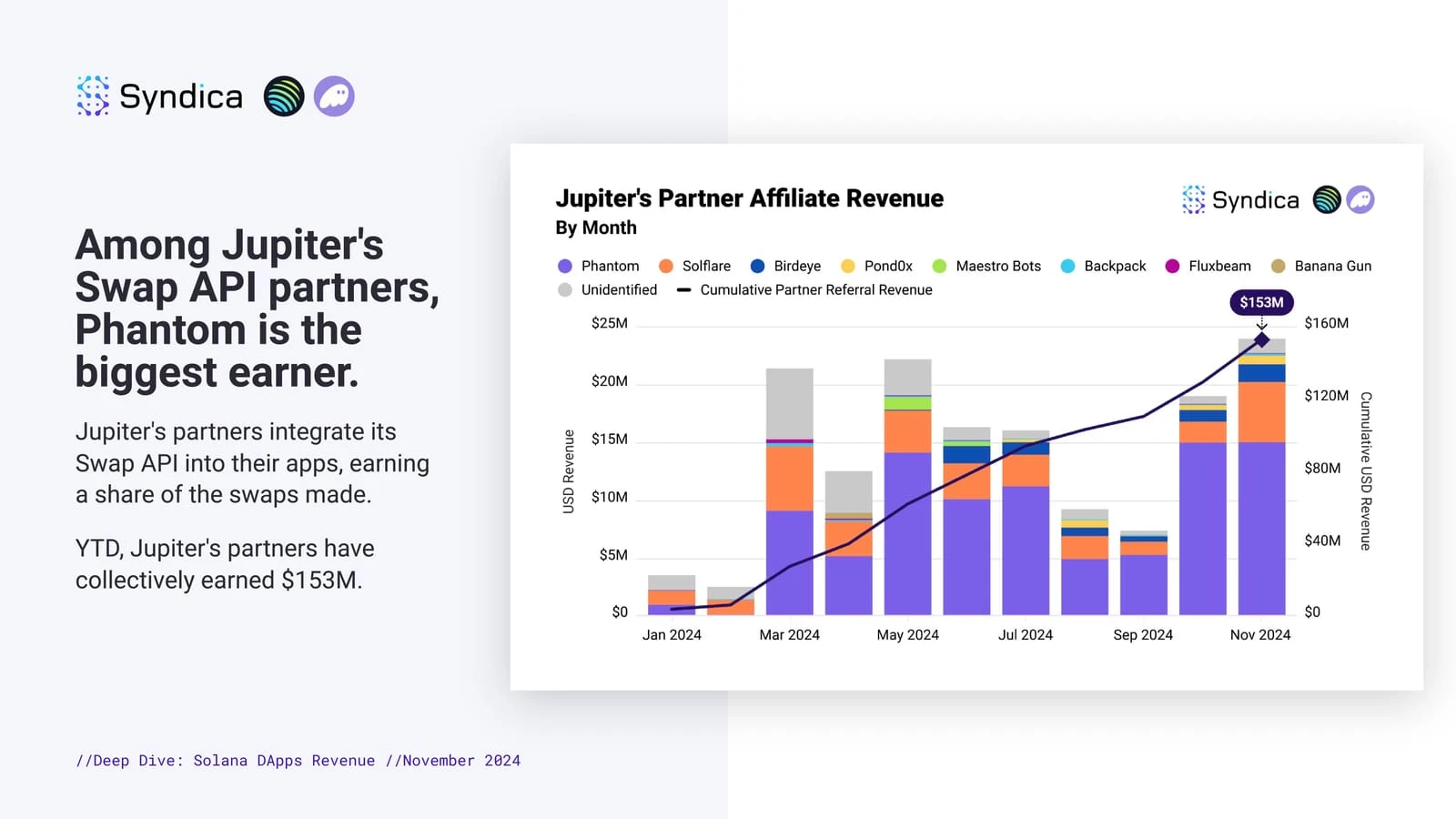

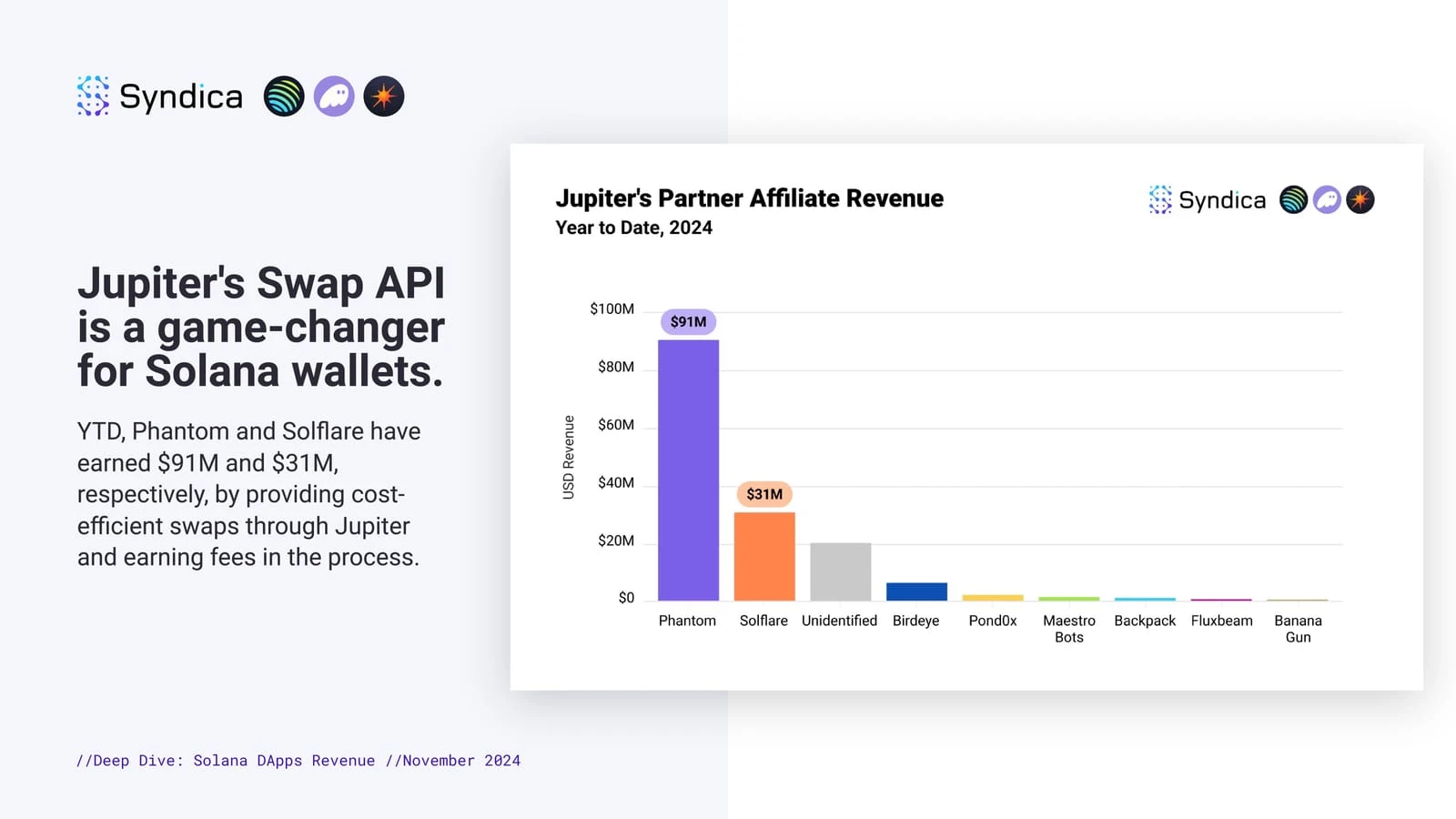

至于集成了JupiterSwap API 的合作伙伴,今年以来,其整体协议收入已增长至 1.53亿美元,其中Phantom 钱包居首位,年度收入高达9100万美元;Solflare 则以3100万美元的收入屈居第二;Birdeye 等聚合类平台紧随其后。

Jupiter 2024年月收入一览

Jupiter Swap API 合作伙伴收入一览

Phantom 成最大赢家

Solana 生态潜力板块:借贷、NFT、支付、DePIN

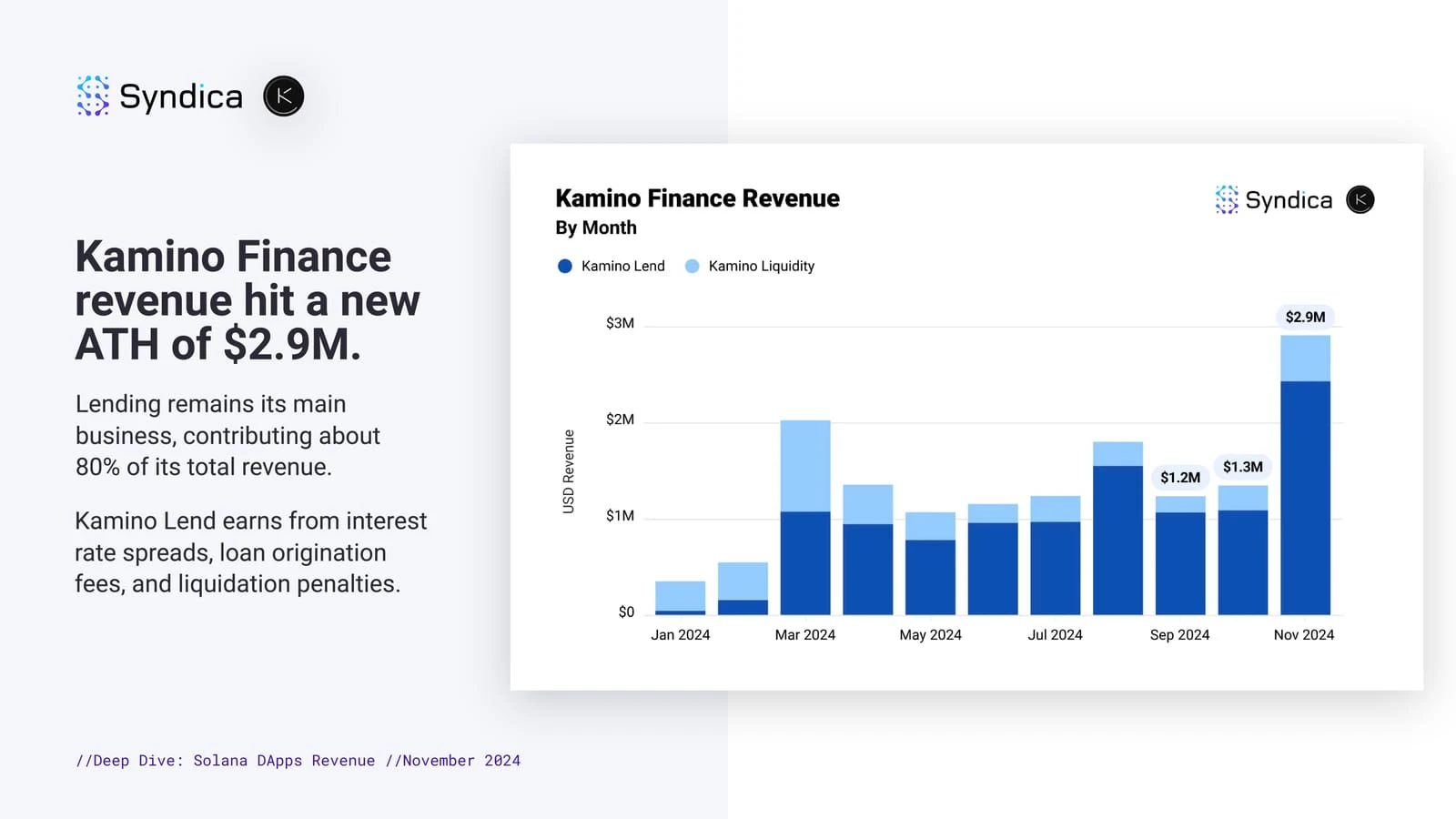

11月,Solana 生态头部借贷平台 Kamino 表现也极为亮眼,其协议收入突破新高,达到290万美元,其中80%的收入来自于借贷。

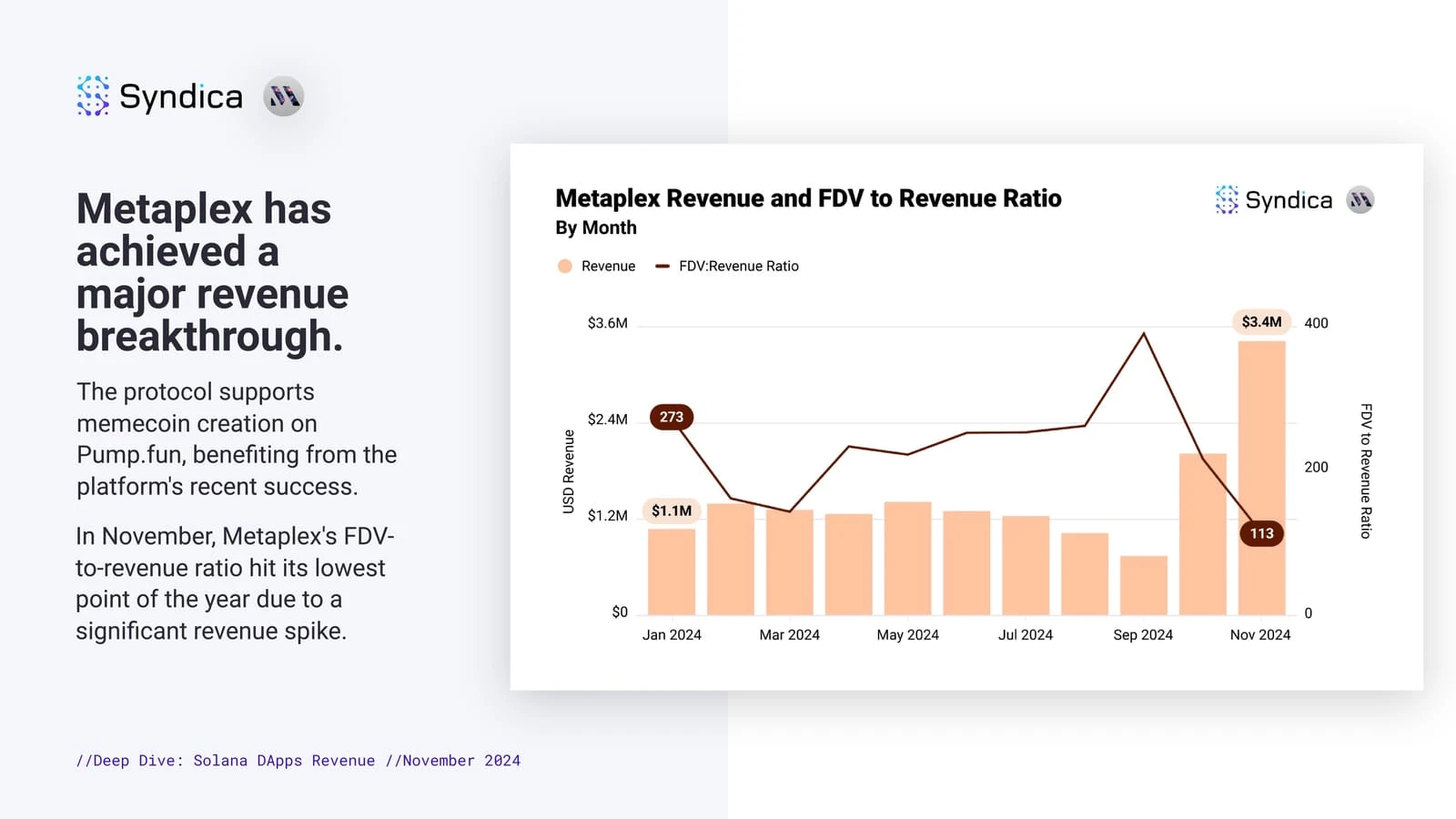

Solana 生态 NFT 平台 Metaplex 则是一位“低调到几乎隐身”的选手,作为 Solana 网络上几乎所有代币、Meme币和 NFT 的底层区块链协议,其于11月同样创下历史最高协议收入,高达 340万美元;且其 FDV/协议收入比率也从1月的273下降到11月的113,项目运行稳定度提高不少,少了几分此前的“虚胖”。其代币 MPLX 曾因 Metaplex基金会于9月宣布推出Aura网络一度涨超 20%。

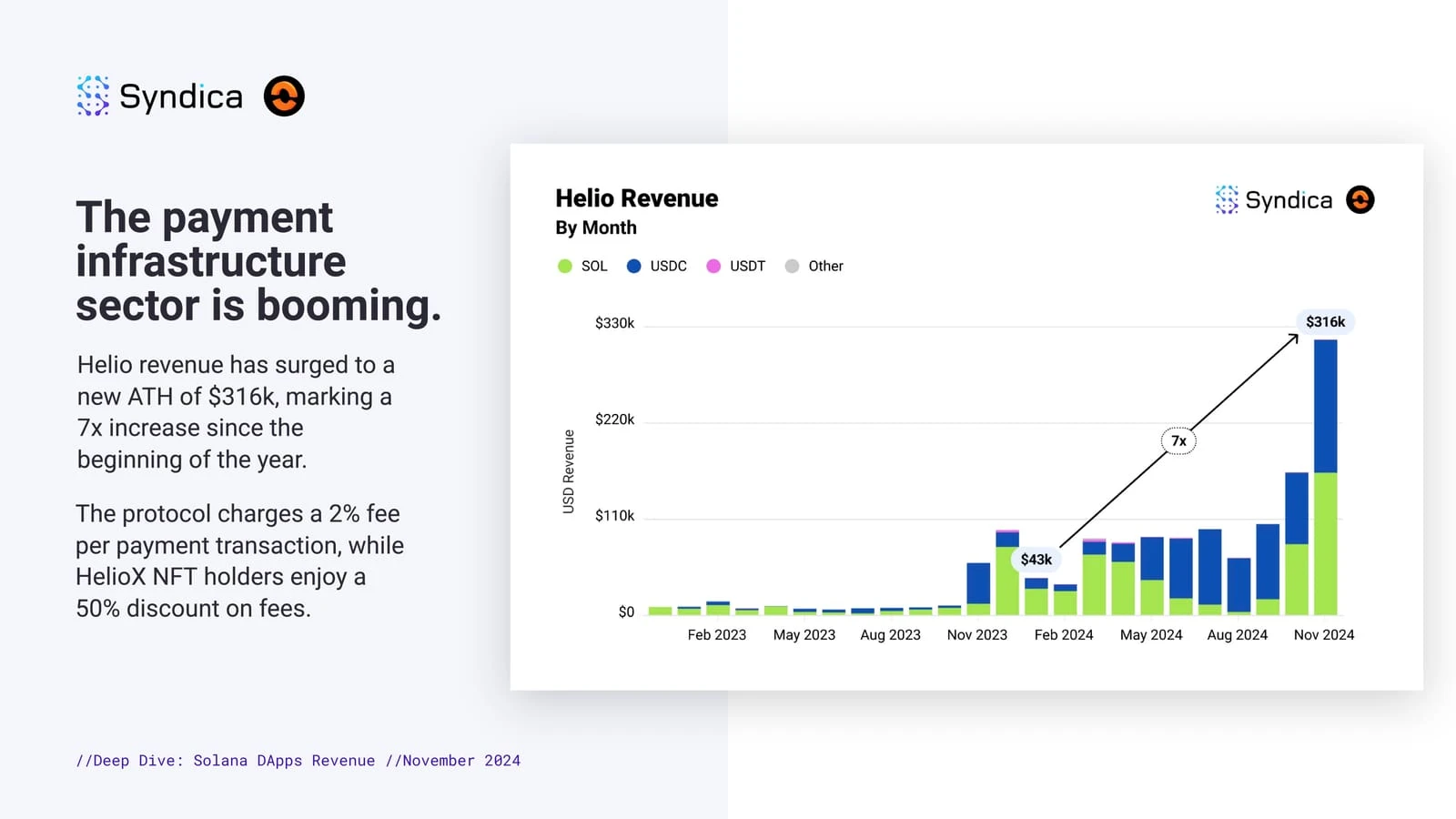

支付板块,Solana 生态的诸多项目如今看起来正处于“爆发前夜”,其中,加密支付公司 Helio 的月度收入从1月的4.3万美元增长至31.6万美元,增长近7倍。该项目每笔转账支付收取 2%的手续费,HelioX NFT 持有者享有5折优惠,仅需1%手续费。

DePIN 板块,Solana 生态的头部项目主要包括 Render Network、Nosana、Helium、Hivemapper,四个项目的月度收入从1月的15万美元左右,一路稳步增长,11月总收入达到66.9万美元,增幅约为446%。值得注意的是,这里的收入计算是根据 RENDER、HONEY、NOS 等代币销毁价值计算的,仅供参考。

Kamino 成借贷头部平台

Metaplex FDV/收入比例大幅下降

支付基建处于爆发前夜

DePIN 板块稳中有进

结语:Solana 短中期仍属于“一条腿走路”,长期则寄希望于特朗普的加密经济利好

短中期来看,Solana生态的收入大头仍然在DeFi 及Meme币板块,一直以来被 Solana 基金会及 Solana 社区寄予厚望的 DePIN赛道尽管有SAGA 手机的“梦幻开局”,但目前仍未完全打开局面;支付板块则处于早期发展阶段,由 Solana 基金会前成员 Anna Yuan 创办的稳定币交换池项目 Perena 有望为当下现状带来新的改变,但仍需要一定时间吸引更多流动性的加入。

长期来看,Solana 生态的持续发展,仍然有赖于特朗普正式上台美国总统之后推出的一系列加密经济相关利好,让更多资金、资本以及区块链基础设施建设与美国经济产生深层次的结合,实现“生态、代币市值、代币价格”的多赢。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。