On-chain cryptocurrencies are hot, can tokens within exchanges rise?

Recently, Bitcoin's market share dropped from 60% to 55%, indicating the start of an altcoin season. The recent hotspots are numerous, showcasing a vibrant market: led by AI Agent, Virtuals Protocol reached a peak market cap of over $300 million; the Solana ecosystem's ai16z also surpassed a $1 billion market cap, while Hyperliquid's ecosystem token HYPE saw an increase of over 10 times. In terms of products, the open interest within exchanges has repeatedly hit new highs, exceeding $4.3 billion. Even the NFT sector, which was almost forgotten by the market, has seen some action, with Magic Eden and Pudgy Penguins issuing tokens, driving many ETH/SOL blue-chip NFT projects up.

From the above brief overview of various sector hotspots, it is not difficult to see that they all revolve around on-chain activities. So, have the tokens within centralized exchanges really been forgotten by the market?

Not at all. There is another narrative in this bull market that cannot be overlooked: Trump's election.

Trump's election means that cryptocurrency has officially entered the public eye. The improvement of regulations and the loosening of oversight are conducive to external funds entering the crypto space, as evidenced by the continuous net inflow of funds into BTC and ETH spot ETFs. The Trump family's crypto project, World Liberty Financial, has also set an example by making aggressive purchases of DeFi-related tokens over the past month, including ETH, CBBTC, AAVE, LINK, ENA, and ONDO.

So how have these tokens performed after being purchased by World Liberty Financial? What common characteristics do these tokens share? What other conceptual tokens are there? Let's take a look with WOO X Research.

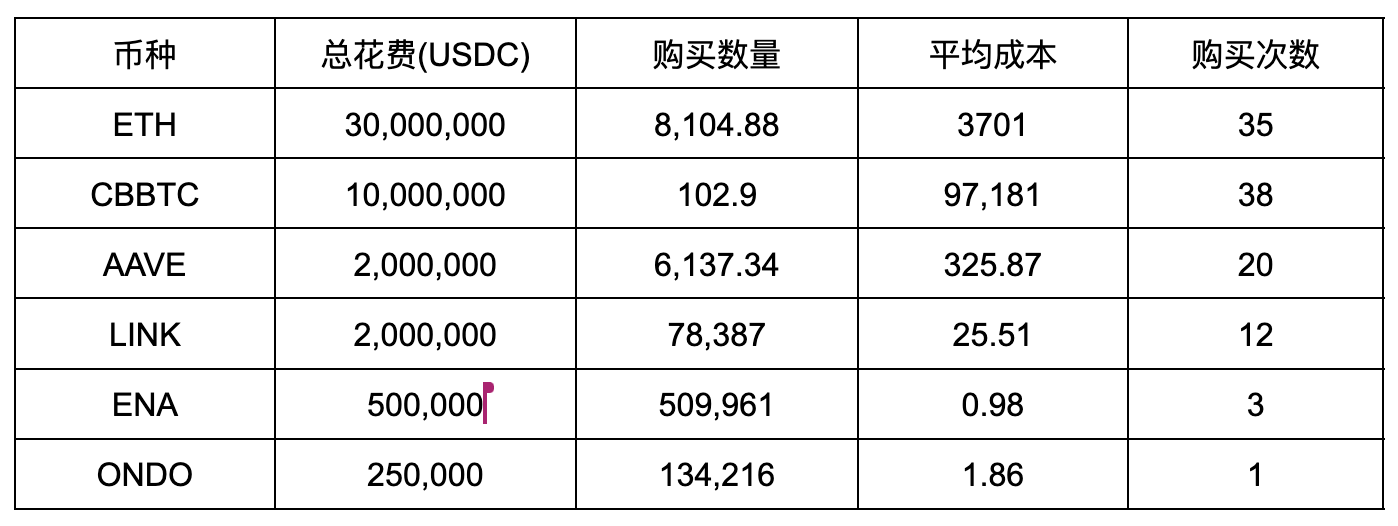

Purchase Record Summary

The table above summarizes the cryptocurrencies purchased by World Liberty Financial on November 30, totaling $44.75 million. As of the writing on December 18, all tokens held by World Liberty Financial are currently in a profit state.

Interestingly, traditional institutions have previously shown more interest in Bitcoin than Ethereum, but in their investment portfolio, it can be seen that World Liberty Financial holds significantly more ETH than Bitcoin, perhaps indicating a greater optimism for Ethereum's price trajectory compared to Bitcoin.

AAVE is the leader in the lending market and holds the top position in total value locked (TVL) among all protocols, with a deposit scale nearing $40 billion, a historical high, and its price has risen 35% within seven days. Additionally, World Liberty Financial's community voted to approve a proposal to collaborate with AAVE, which is currently in the TEMP CHECK phase at AaveDAO. If the proposal passes, it will bring new users and more real revenue to AAVE.

LINK is a well-established oracle project. On November 14, World Liberty Financial announced that it would adopt Chainlink as the standard for on-chain data and cross-chain connectivity, serving as a secure way to bring DeFi into the next phase of mass adoption.

ENA's development is closely tied to this bull market. Since the yield source of USDe is based on futures arbitrage, as market sentiment intensifies and Ethereum's funding rates rise, Ethena can benefit from this. Recently, its TVL has also surpassed $6 billion, a historical high. In terms of products, they recently partnered with BlackRock to launch the RWA stablecoin USDtb, with yield sourced from government bonds. This product launch also addresses market concerns about negative funding rates leading to an overall protocol death spiral.

ONDO is currently the leader in the RWA sector. After BlackRock announced the launch of the BUIDL fund, Ondo Finance invested over $95 million, becoming the largest holder. In terms of compliance, legitimacy, capital volume, and market favorability, ONDO is the best choice in the current RWA sector.

In addition to the aforementioned tokens, it is worth mentioning COW. When World Liberty Financial purchased the above tokens, they only used Cow Protocol for the purchases, thus it is also regarded as a Trump conceptual token.

What tokens might they buy next?

After understanding World Liberty Financial's investment trajectory, we can speculate on the targets they may focus on next.

First, from their holdings, it is best if the tokens have a cooperative relationship with World Liberty Financial, such as AAVE and LINK. Next, they prefer tokens with "clear business models" and "stable real yields." Tokens like AAVE, LINK, ENA, and ONDO all have clear product positioning, a large ecosystem of users, and actual revenue models. This indicates that they are not blindly pursuing "novel" or "pure conceptual" tokens but are more inclined to invest in protocols that can bring long-term value.

- LDO: Given that World Liberty Financial holds significantly more ETH than BTC, it is evident that they are very optimistic about Ethereum's long-term potential. With the maturation of Ethereum's staking mechanism and the potential introduction of ETF-related Ethereum staking rates, the leading protocol LIDO becomes the current top choice.

LIDO is the largest liquid staking protocol in the Ethereum ecosystem, with a TVL of $37 billion, accounting for 30% of the entire Ethereum staking market.

Pendle: Primarily focused on the yield splitting market, allowing users to trade future yield rights. As Ethereum staking rates and yields from protocols like USDe rise, the demand for yield trading markets continues to increase, making Pendle highly regarded in this bull market. Recently, Pendle's TVL has surpassed $5 billion and has established partnerships with several mainstream DeFi protocols.

UNI: Uniswap is the origin of DeFi Summer and is currently the most commonly used decentralized exchange, leading the sector. Recently, they also launched Unichain, but the market response was tepid; however, this does not diminish users' reliance on Uniswap products.

Conclusion: Blue-chip projects = Presidential crypto projects

Regarding World Liberty Financial's aggressive trading of cryptocurrencies, Nansen analyst Nicolai Søndergaard told Bloomberg: "World Liberty Financial's token purchases may be aimed at gaining more trust or drawing attention to these assets to promote the development of their own projects. Because if these assets perform well, World Liberty Financial may also benefit from it."

World Liberty Financial's active investment in blue-chip projects not only boosts market confidence in mainstream DeFi protocols but also injects more institutional funds into the crypto market. This flow of funds further stabilizes the market, pushing mainstream projects toward higher market caps and development potential.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。