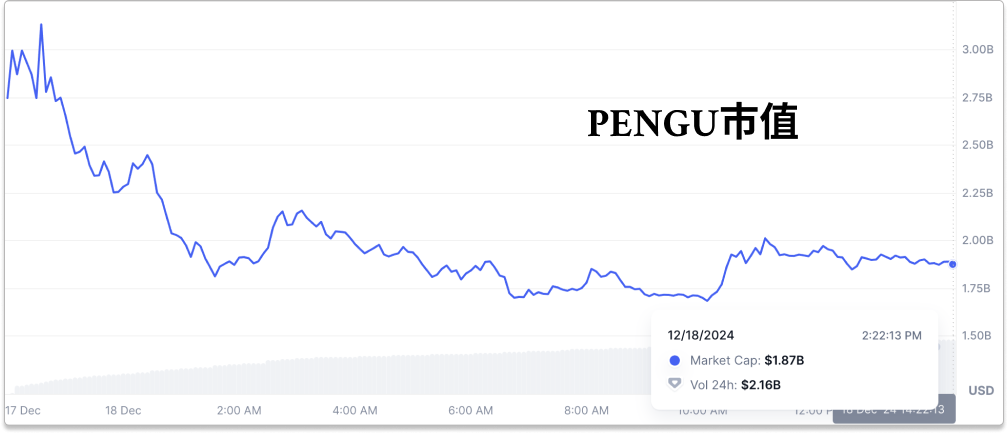

On December 17, 2024, Binance found itself at the center of public scrutiny due to the abnormal market capitalization displayed for the Pudgy Penguins project token, PENGU. This incident not only reflects the operational challenges faced by Binance as a top global exchange but also serves as a wake-up call for the entire cryptocurrency industry regarding data transparency and user trust. So, how did Binance manage to salvage the situation from this "accident" and attempt to turn the crisis into an opportunity? Let’s delve into this intense controversy.

Behind the Data Crash: The "Blunder" of the PENGU Token's Launch

Data "Delay," Market "Explosion"

At the launch of the PENGU token, traders who were initially filled with anticipation were met with an "unexpected surprise." From 22:00 to 22:37 on December 17, 2024, the market capitalization and fully diluted valuation (FDV) data for PENGU were not updated on time. This seemingly minor "technical error" directly misled some users during trading. After all, in the highly data-dependent cryptocurrency market, any anomaly can quickly trigger fluctuations like a butterfly effect.

Users noticed the abnormal market capitalization while trading, inevitably questioning their judgment and even feeling at a loss for a moment. For those frequent short-term traders, such an error was undoubtedly "fatal." The "delay" in market capitalization directly led to a "market explosion."

The "Angry Tide" of the Community

Users in the crypto space are never "easy to deal with," especially when their wallets are threatened. After the incident, Binance's community was instantly flooded with complaints and doubts from users. Various social platforms were filled with accusations, and many users directly called out to Binance for compensation: "Why should we pay for your mistake?" Clearly, this was not just a technical issue but a crisis of trust. For an exchange like Binance, which boasts both capital and reputation, such public pressure was undoubtedly a severe test.

Binance's "Rescue Show": How Did the Airdrop Compensation Calm the Anger?

Quick Response, Elegantly "Shifting Blame"?

In crisis management, speed is of the essence. Binance quickly issued a statement acknowledging the problem and partially attributing the responsibility to the data delay from its partner CoinMarketCap. While this explanation might seem a bit like "shifting blame," users were clearly more concerned about compensation. Binance then announced that it would airdrop a total of 135 million PENGU tokens to affected users as compensation. This compensation plan was distributed based on users' trading volume during the data anomaly, attempting to placate user dissatisfaction with "real money."

Airdrop Details: Making Compensation Transparent

Binance also promised to complete the distribution of compensation tokens within 72 hours. This timeline not only demonstrated Binance's efficient execution but also bought some breathing space for the exchange's reputation. After all, in the rapidly changing cryptocurrency market, everything is about "quick resolution," and delays would only increase user dissatisfaction. Although this "airdrop compensation" method cannot completely eliminate user doubts, it at least partially restored some trust. Binance conveyed a message through its actions: we do not evade problems; we are willing to take responsibility for users' losses.

The Aftermath of the Incident: A Crisis of Trust or a Wake-Up Call for the Industry?

Trust Restoration: Can Binance Win Back Hearts?

This incident undoubtedly impacted Binance's brand image, but the performance in crisis management also added points to its "score." Through timely responses and tangible airdrop compensation, Binance avoided further deterioration of the situation. However, restoring trust is not an overnight task. For those users who suffered financial losses in this incident, mere compensation may not fully soothe their emotions. How Binance further optimizes the platform's transparency and data update mechanisms in the future will be key to determining whether it can truly win back hearts.

Industry Insight: Data Transparency, the Lifeline of Exchanges

This incident also exposed a long-standing issue in the cryptocurrency industry—delays in data updates and insufficient transparency. Market capitalization and FDV data are crucial for investors, and any slight deviation can directly impact market decisions. Binance's response provides an important case for other exchanges: in the face of sudden crises, quickly implementing compensation measures is an effective way to regain user trust. But more importantly, how to fundamentally improve data infrastructure to prevent similar issues from occurring again is crucial.

Binance's "Closing the Stable Door After the Horse Has Bolted": Future Improvement Directions

Binance has also recognized the deeper issues behind this incident. In its announcement, Binance promised to strengthen cooperation with data providers like CoinMarketCap to ensure timely data updates. Additionally, its internal monitoring and emergency mechanisms will undergo a comprehensive upgrade to detect and resolve similar anomalies earlier in the future. The introduction of this series of improvement measures demonstrates Binance's determination to regain market trust through action. However, whether these measures will be effective still requires time to test.

Conclusion: Coexisting Crises and Opportunities, How Will Binance Break the Deadlock?

From the "blunder" of the PENGU token's market capitalization to the airdrop compensation of 135 million tokens, this incident allowed Binance to complete a "rescue show" under the dual pressure of trust and public opinion. Although the event itself caused some damage to Binance's image, its quick response and compensation measures also provided a model for crisis management for other trading platforms. For Binance, this incident is not just a crisis but also an opportunity for self-upgrade. As the cryptocurrency market continues to evolve, user expectations for exchanges are gradually increasing. How to better fulfill commitments to users in future competition and provide more transparent and stable services will be a common challenge for Binance and the entire industry. In the future, we hope Binance can truly turn this lesson into a driving force for progress, creating a safer and more trustworthy trading environment for users. For the entire industry, this incident is undoubtedly a profound warning: transparency and trust are the cornerstones for the long-term development of the cryptocurrency market.

If you have any questions, you can contact us through the following official channels:

AICoin Official Website: www.aicoin.com

Telegram: t.me/aicoincn

Twitter: x.com/AICoincom

Email: support@aicoin.com

Group Chat: Customer Service Yingying, Customer Service KK

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。