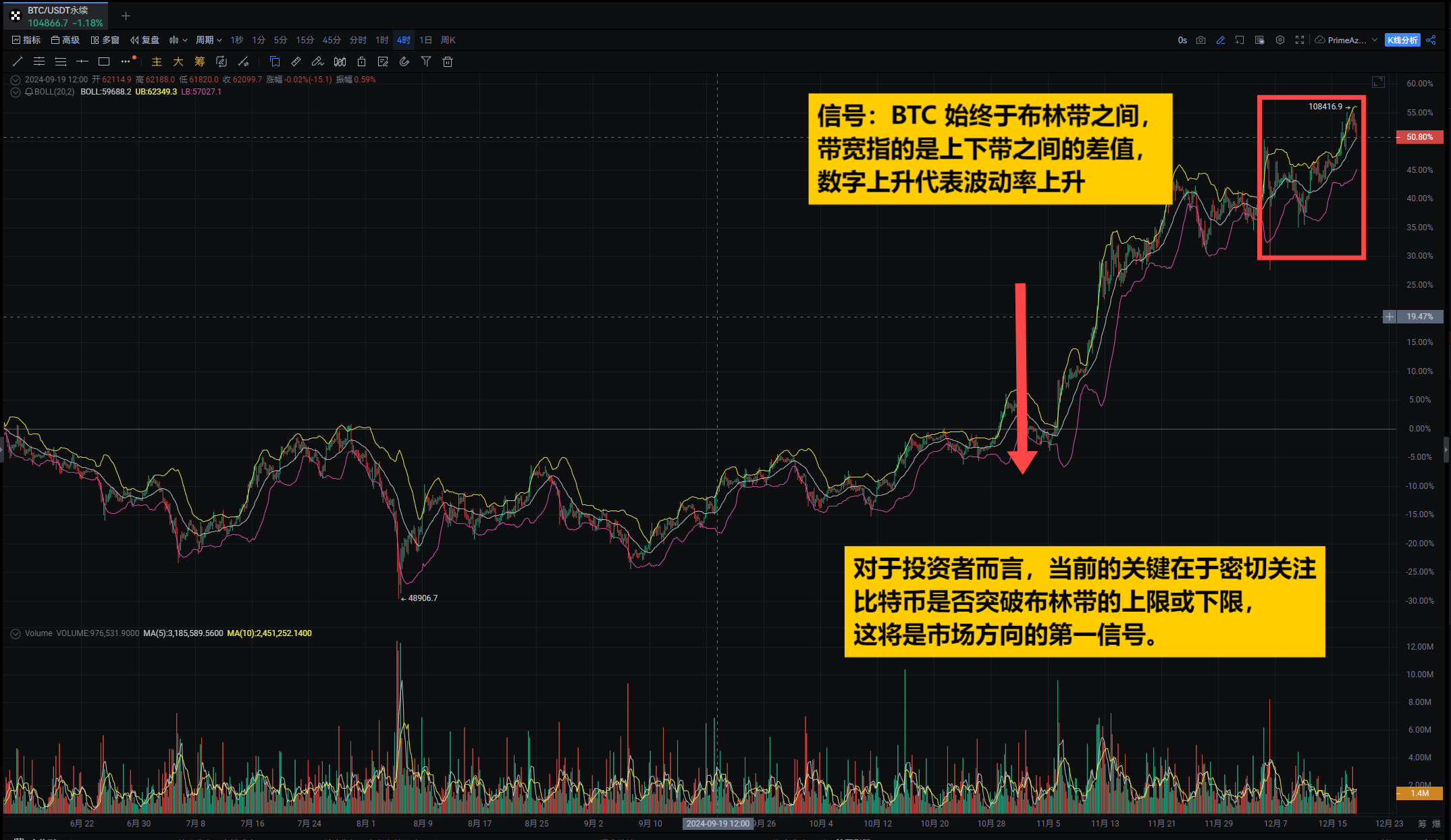

The Whisper of Bollinger Bands: Bitcoin's Bowstring is Taut, a Storm is Imminent

Bitcoin has recently entered a "quiet period," much like the oppressive calm before a storm. The width of the Bollinger Bands has once again compressed to a low volatility state of less than 10%, a situation that typically heralds a market explosion—whether a surge or a crash, intense fluctuations are just around the corner.

CoinDesk market analyst Omkar Godbole points out that this low volatility phenomenon last occurred in November 2023, after which the market quickly surged. In other words, Bitcoin is currently like a fully drawn bowstring, where any slight movement could ignite the market.

Key signal? Keep a close eye on Bitcoin breaking through the upper and lower Bollinger Bands. Whether bullish or bearish, the current strategy is to prepare in advance for significant market changes. More importantly, this is not just about Bitcoin; it could trigger a new wave of turbulence across the entire cryptocurrency market.

Trump's "Crypto-Friendly": Policy Catalyst or Double-Edged Sword?

Trump's successful re-election is undoubtedly a super event in this year's political arena, but for the cryptocurrency market, his policies act more like a massive catalyst. He has publicly expressed support for the development of cryptocurrencies and promised to introduce a clearer legislative framework. This "crypto-friendly" attitude has quickly boosted market confidence, directly driving up Bitcoin prices and igniting investor enthusiasm.

Additionally, Trump's meetings with tech giants have also been interpreted as further support for blockchain technology, making the outlook for the crypto market in 2025 seem brighter. However, the other side of the policy is the increased risk of regulation. While supporting cryptocurrencies, the government may also introduce stricter regulatory measures, which could exert significant pressure on the market.

Investors need to remain calm amid the optimism and closely track policy trends, as this "policy dividend" is likely to come with higher uncertainty.

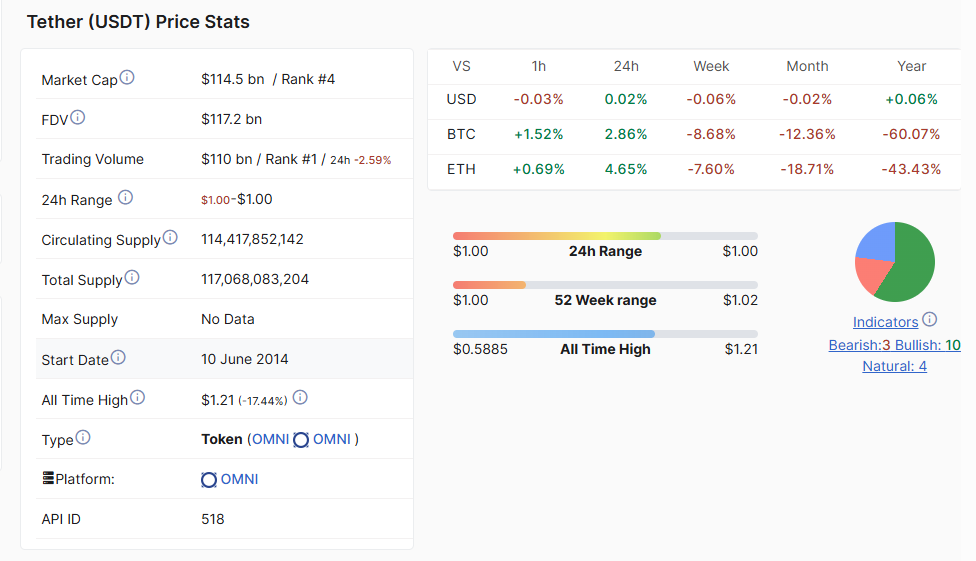

The Rise of Tether: The Liquidity Engine of the Crypto Market

The stablecoin Tether is changing the game with its "money-absorbing" strategy. In 2024, its market capitalization surged by $50 billion, surpassing $140 billion, making it one of the most powerful sources of liquidity in the crypto market. Even more striking is that Tether's daily trading volume has stabilized between $200 billion and $300 billion, indicating a continuous increase in market participation.

This growth not only represents an increase in demand for stablecoins but also reflects a massive influx of fiat liquidity into the crypto market. For investors, Tether's strong rise provides a "safe haven," allowing funds to quickly find a secure resting place amid market turbulence.

However, it is also important to note that over-reliance on a single stablecoin carries risks. Should a systemic issue arise, Tether's market cap collapse could trigger a chain reaction, affecting the liquidity of the entire market. While enjoying the benefits, investors must also be wary of potential risks.

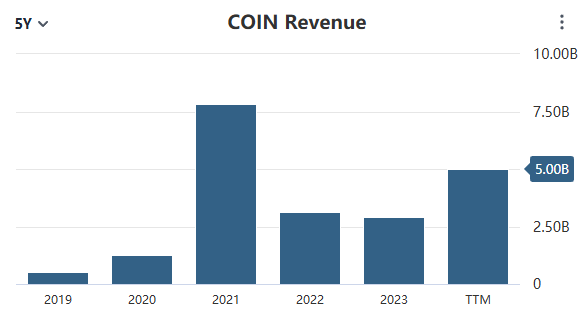

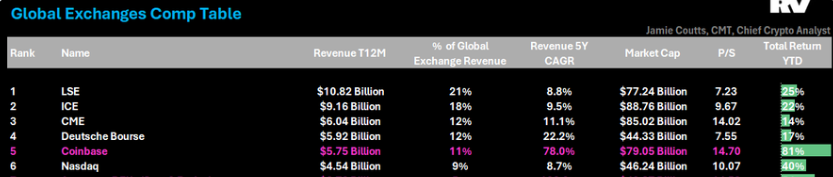

Coinbase vs. Traditional Finance: Who Will Secure the Financial "New Throne"?

Coinbase is accelerating its emergence as a "formidable rival" to the traditional financial system. In 2024, its revenue reached $6 billion, even surpassing Nasdaq and CBOE. This is not just the rise of a single company but a comprehensive signal of the crypto industry's counterattack against the traditional financial market.

At the same time, the rapid rise of decentralized finance (DeFi) poses a comprehensive challenge to traditional finance. DeFi protocols offer investors higher efficiency, lower costs, and more transparency, providing an appeal that traditional banking systems cannot match. André Dragosch, head of Bitwise's European research, even predicts that in the coming years, DeFi's returns may surpass those of mainstream crypto assets.

However, this "throne battle" has only just begun. Traditional financial institutions must either accelerate their transformation to embrace blockchain or face greater pressure from the crypto industry. For investors, observing this trend and adjusting their investment strategies will be crucial in the coming years.

Conclusion: The Treasure Map of the Next Wealth Storm

From Bitcoin's technical signals to the catalytic effects of Trump's policies, and the surge in stablecoin liquidity alongside profound changes in the industry landscape, the turbulence in the crypto market is underpinned by a complex and tightly-knit logical chain. For investors, understanding the interplay of these factors is akin to possessing a treasure map. Technical indicators reveal possible market directions, policy trends determine the market's fundamentals, while liquidity and industry competition shape long-term trends.

This is a "treasure hunt in the storm," and true opportunities often lie hidden within the most intense fluctuations. Are you ready? The next storm is on the way; have you found your wealth code?

If you have any questions, you can contact us through the following official channels:

AICoin Official Website: www.aicoin.com

Telegram: t.me/aicoincn

Twitter: x.com/AICoincom

Email: support@aicoin.com

Group Chat: Customer Service Yingying、Customer Service KK

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。