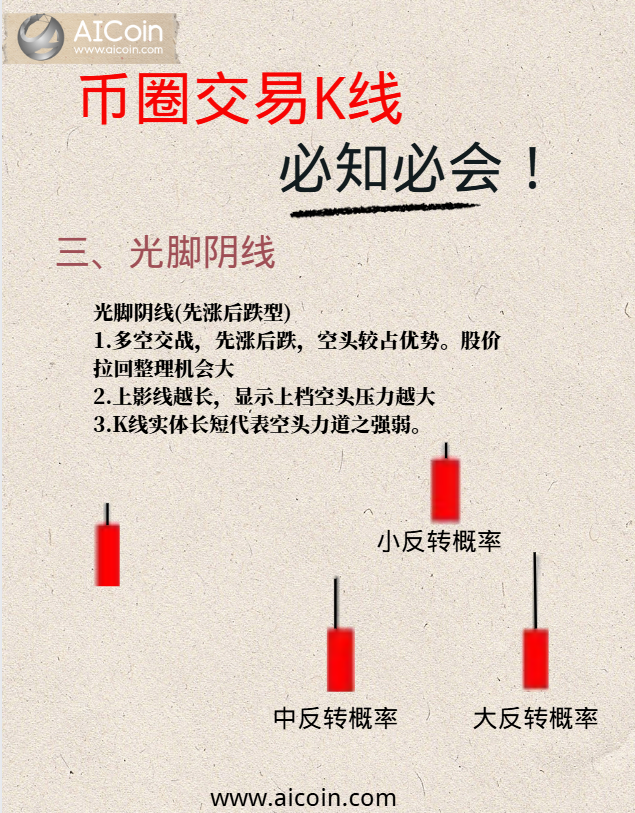

看懂K线图,是币圈交易者必备技能之一!

公园大爷都能看懂的“光脚K线”极速讲解

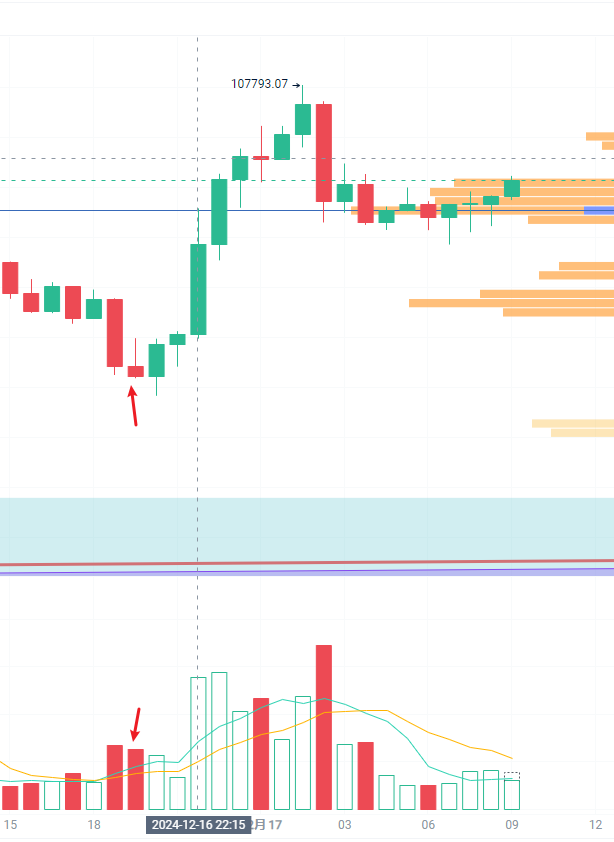

以 BTC 45分钟线近期实盘为例

欢迎打开AICoin BTC 行情同步画线分析👇

我们看到当放量下杀后,出现了一个光脚阴线(也可以看作是倒垂子线),产生反转信号,并且该K线放量,增加了反转概率。

开盘时,多方急速上冲,但由于空头占优,产生长引线,最后收盘。

这里可能出现的变盘情况如下:

- 空方被消耗,子弹被打完

- 多方太弱,上涨乏力

我们需要看下一根K线来判断该反转是转多还是转空?

可以看到第三根K线是放量的阳线,我们就可以初步判断短线情况会迎来一段上涨行情!

果不其然,BTC冲向新高!!!

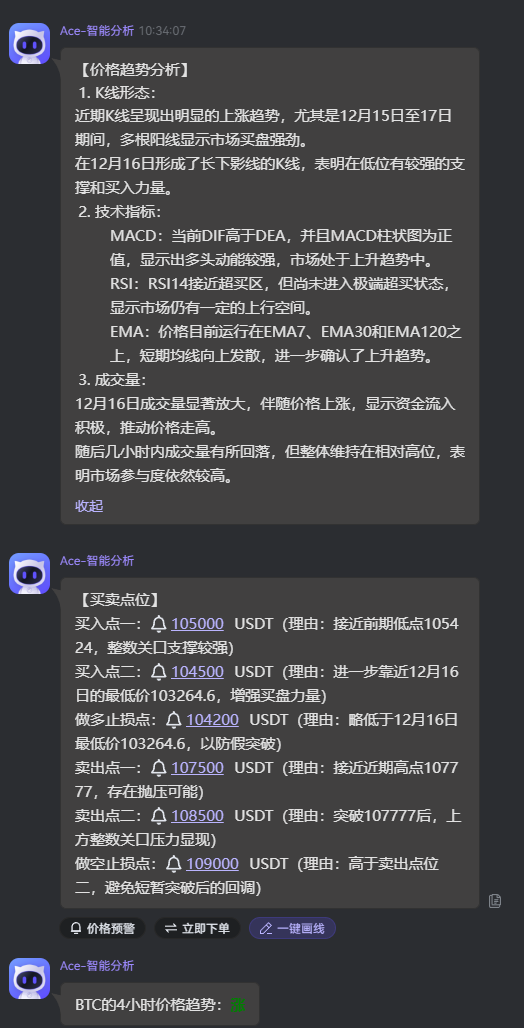

Ace智能分析:

⚠注意:以上操作建议均不构成投资建议,不推荐任何币种,请各位投资者在能力范围内理性交易!

如有疑问,您可通过以下官方渠道联系我们:

AICoin官网:www.aicoin.com

邮箱:support@aicoin.com

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。