作者:Route 2 FI

编译:Luffy,Foresight News

如果你拥有了可以改变生活的未实现利润,请听我一句:你需要卖掉它。这不仅仅是一个建议,也是我从惨痛经历中学到的教训。在我职业生涯的早期,我一直犹豫是否要了结获利,我为每一次犹豫不决感到后悔。名义财富可能会随着我们交易旅程而不断变化,但基本原则保持不变。

我逐渐明白的一件事是,在足以改变生活时卖出,你会获得一个无法用金钱衡量的好处:永久改善你和身边人的生活。想象一下,点击「卖出」就能够立即改善你的生活处境。这很美妙!如果你有这样的机会,我强烈建议你抓住它。

我知道等待最佳卖出时机是多么诱人:相信只要再坚持一段时间,你就能获得更多利润。但事实是:最佳时机只是幻想。我认识的最成功的交易员并不是通过完美把握每个高峰时机而达到今天的成就的;他们是通过持续获利和保持流动性而获得成功。他们很早就明白,卖成现金是这场游戏中生存的必要条件。

我最看得开的认知之一是,机会永远都有。这种心态有助于缓解交易者在考虑卖出时经常会感到的错失恐惧。是的,放弃表现良好的头寸可能会让人感到不干,但请记住:出于 FOMO 而持有它从长远来看会让你付出更多代价。

我经常思考达到「逃逸速度」意味着什么:即你的财务状况允许你承担有计划的风险而不会危及你的生活稳定性。一旦你达到了那个水平,那时你才能开始真正玩游戏并全力以赴。

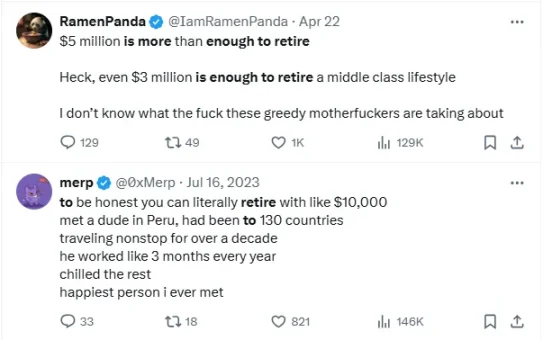

多少钱才够退休?

作为一个一直在考虑退休的人,我经常想:多少钱才算足够?虽然媒体经常吹嘘这需要一个天文数字,但我相信,对于我们许多人来说,100 万到 200 万美元可能才是最佳选择。原因如下,让我们首先从 TradFi 的角度来看待这个问题。

2022 年,65 岁或以上人士的平均退休账户余额仅为 232,710 美元。所以,突然拥有 100-200 万美元并不少,不是吗?事实上,只有约 3.2% 的退休人员储蓄超过 100 万美元。

好的,我知道了,读这篇文章的你年过 65 岁的可能性不大,你想在 65 岁之前就退休。当第一次听说美国人认为他们需要 146 万美元才能舒适地退休时,我感到震惊。但后来我意识到一件至关重要的事情:这个数字是一个平均值。每个人的需求可能大不相同。

让我们考虑一下 4% 规则,这是一条常见的退休计划准则。如果存了 200 万美元,你每年可以提取 8 万美元。对许多人来说,这足以过上舒适的生活。你的退休需求在很大程度上取决于你想要的生活方式。你打算环游世界,还是满足于更简单的乐趣?劳工统计局报告称,2021 年 65 岁及以上人士的平均年支出为 52,141 美元。100-200 万美元的储蓄可以轻松支付这笔费用。

选择退休后居住地会极大地影响你的财富使用。100 万美元的退休金在纽约市可能感觉很紧张,但在小城镇或国外却能提供奢华的生活。

心理因素

知道自己有 100-200 万美元的存款可以减轻很多财务压力,让你真正享受退休生活。

归根结底,100-200 万美元是否足以退休取决于你的个人情况。对我们许多人来说,这不仅仅是足够的钱,这比我们梦想的还要多。关键是要尽早开始储蓄,量入为出,专注于真正能给你的生活带来快乐的事情。请记住,退休不仅仅关于钱,也关于创造你喜欢的生活,无论银行里有没有数百万美元。

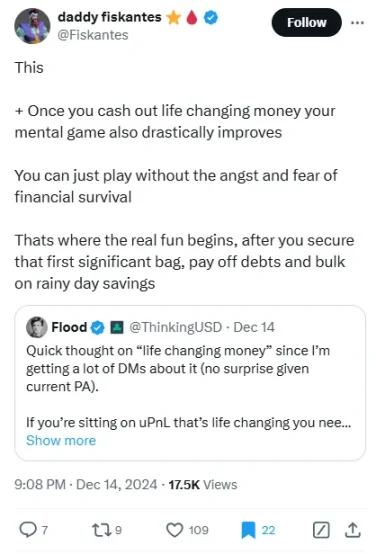

我理解 Fiskantes 上面说的话。一旦你已经将改变生活的钱存入银行或投资于房地产等,你就可以轻松地参与市场。

我所说的轻松是什么意思?好吧,我并不是说更容易赚钱,我是说你的心态更放松。你可以从容地做出更好的决定,只让交易来找你。而且,即便你输了,你至少不会失去一切,因为你已经有了保障。

正如 Fiskantes 所说:「真正的乐趣就从这里开始」。从这个意义上说,这个周期对我来说更有趣。如果一切都归零,那么至少我还有一个安全的依靠。话虽如此,有些人在压力更大的情况下工作效率更高,但我认为对大多数人来说并非如此。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。