在Hyperliquid上有一个有趣的基础交易,USDC的年化收益率为100-300%。

📜 以10,000美元为例:

1. 存入10K到HL

2. 买入5K的$HYPE现货

3. 做空5K的永久合约1倍,无杠杆

由于资金费率为正(意味着多头支付空头),你在做空时获得收益。

价格波动不会影响你,因为如果代币下跌50%,你在现货上会亏损,但在做空上大致会赚到相同的金额。这意味着这是一个“中性”交易,赚取资金费用。

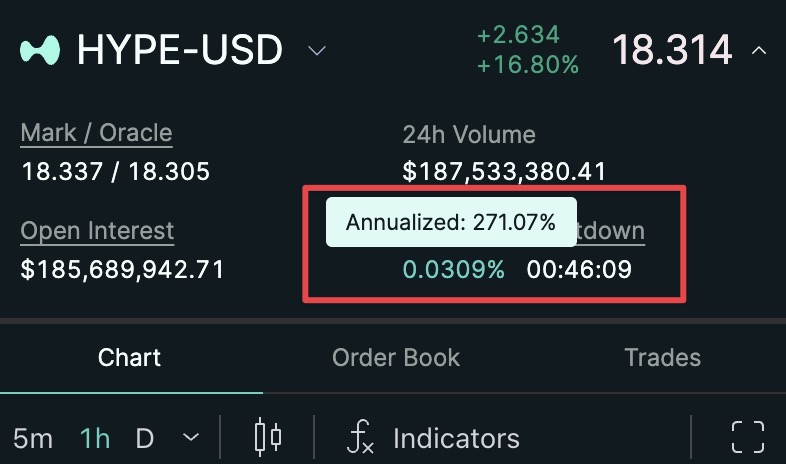

📜 你问年化收益率是多少?

它非常波动,但在过去一周,它的波动范围从50%到500%。平均约为110%。

📜 让我们讨论风险:

• 资金费率翻转(空头支付多头)

• 资金费率下降(对多头的需求低,市场情绪变得看跌)

• 价格飙升导致的空头清算:永久合约的杠杆越小,清算价格就越存在。因此请相应监控。你可以随时平掉两个头寸并重新开仓,以“重置”清算价格到更高的水平。

📜 进一步说明:

• 你获得的“年化:XXX%”是你在永久合约页面上看到的一半。这是因为你的多头没有获得任何利息。资金仅支付给做空的资本,而这只有一半。

这类交易在牛市中很常见,你只需找到一个有永久合约市场和看涨情绪的代币。但它们也需要高维护,需密切监控。

祝好运 ⚡️⚡️

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。