撰文:Brian McGleenon

编译:Centreless

摘要:

-

Bitfinex 的分析师表示,比特币能否突破 10 万美元,取决于短期需求的增加能否平衡长期持有者的获利了结。

-

Copper.co 的研究主管表示,现货比特币 ETF 的强劲需求可能是推动比特币价格上涨的关键因素。

Bitfinex 的分析师认为,比特币的上涨动能取决于短期持有者(STH)需求与长期持有者(LTH)供应之间的平衡。

分析师表示,STH 的供应量已接近周期高点 328 万个比特币,这一水平在历史上与牛市高峰的开始相关。「这表明散户兴趣正在上升,但也凸显了需要新需求的迫切性以吸收长期持有者的获利回吐,」分析师

长期持有者获利回吐的增加给比特币的上涨势头带来了压力,可能会阻碍这一市值领先的数字资产的进一步上涨。

他们表示:「过去两周,长期持有者进入比特币市场的供应一直保持稳定,而缺乏现货需求来吸收这些供应可能会导致价格进一步回落。」

比特币突破 10 万美与比特币 ETF 资金流入相关

当加密货币投资者猜测比特币可能达到 100,000 美元的里程碑时,一位分析师表示,现货交易所交易基金的流入可能是推动数字货币突破这一界限的催化剂。

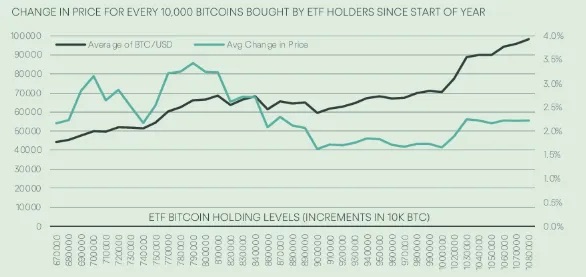

Copper.co 研究主管 Fadi Aboualfa 强调了 ETF 驱动的需求对比特币价格的潜在影响,并指出最近的 ETF 流入数据描绘了一幅乐观的图景,表明 10 万美元的里程碑可能触手可及。

他在邮件中表示:「每新增 1 万个比特币的 ETF 持仓,历史上比特币的价格平均上涨 2.2%。考虑到目前 ETF 持有的比特币量为 108 万个,比特币 ETF 流入约 19 亿美元,将足以购买额外的 2 万个比特币,并可能在一到两周内推动比特币价格突破 10 万美元。」

本周三,现货比特币 ETF 的资金流入仍然强劲,累计吸引了价值 6.76 亿美元的数字资产。BRN 分析师 Valentin Fournier 向《The Block》表示:「这些大规模资金流入突显了机构投资者的兴趣增长,并表明存在坚实的支撑位。」

Fournier 预测,比特币将从这些持续的机构资金流入中受益。「我们预计比特币将在未来一周内受益于持续的机构资金流入,并有可能尝试突破,」Fournier 说。

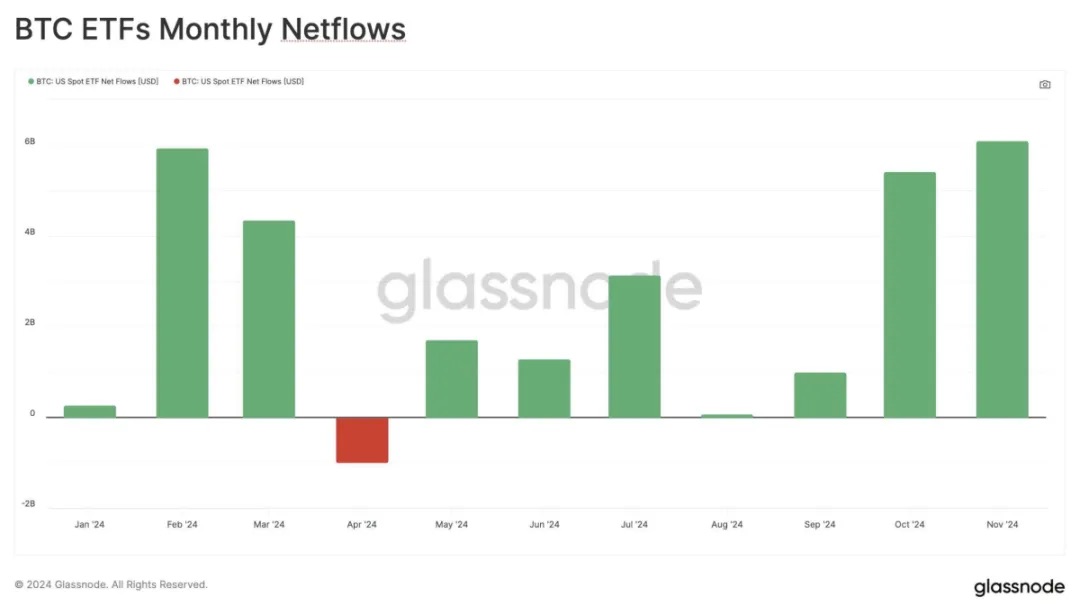

根据 Glassnode 的数据,11 月现货比特币 ETF 创下了新纪录。过去一个月,比特币 ETF 共吸引了 61 亿美元的资金流入,其中 54 亿美元流入了 BlackRock 的 IBIT 基金。

与此同时,比特币市场本周遭遇了一些不利因素,有报道称美国政府对比特币进行了重大调整。根据 Arkham 周二在 X 上的一篇帖子,政府当局将约 1.98 万个比特币(价值 19 亿美元)转移到了 Coinbase Prime 钱包。这些资金是根据「丝绸之路」案件被扣押的。

在 ETF 资金流入增加的背景下,比特币的价格在过去 24 小时内上涨了约 2%,目前交易价格已突破 10 万美元大关。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。