作者:YettaS

USDT 凭借在全球范围内的广泛流通和庞大资产规模,已经成为离岸市场中最重要的流动性工具,但我们对Tether的疑问从未停止:为什么说Tether是我们行业事实上的央行?美国监管对它的态度为何如此拉扯 —— 既不完全打压,也未给出明确支持?它的存在到底对美国金融市场意味着什么?在这种拉扯中,它的破局点又在哪里?这篇文章将帮助你站在一个更加宏观的角度来思考稳定币的意义,这是这个领域突破的前提。

Tether是怎样一门好生意?

Tether最新发布的Q3数据展现了它超强的盈利能力。截至 Q3,其资产总额达到 $125bn,其中美债约 $102bn,Q3净利 $2bn,全年累计利润$7.7bn。相较之下,BlackRock Q3 利润为 $1.6bn,Visa 为$4.9bn,而Tether的人数不到他们的百分之一,人效是他们的百倍以上。

source: primitive ventures

来源:原始企业

其实Tether并没有多么炸裂的开端,它从一个小小的需求开始。当时所有交易所全是BTC交易对,两边价格都在浮动,结算很不方便,而Bitfinex发现了这个问题,于是推出USDT作为记账单位(UoA),这是它找到的第一个场景;2019年孙哥发现了稳定币在交易所间跨链的需求,ETH转U又贵又慢,而Tron上又便宜又快,孙哥立马开始大规模补贴挤占市场,花了数亿元(当然来自Tron节点收益)来补贴TRC20-USDT的交易所充提,凡在当时充提基本能享受16%-30%的收益,作为交易所间转账的交易媒介(MoE)这是它找到的第二个场景;随后的故事大家就都知道了,USDT被链下世界大规模采用,在恶性通胀的国家作为价值存储(SoV),在各种灰色地带作为交易媒介(MoE),变成影子美元是它的第三个场景。三次进化,Tether随着USDT的市值和流动性一起成长。

关于如何做好一个稳定币,Dovey的这篇文章里有非常详细的教学,欢迎学习。

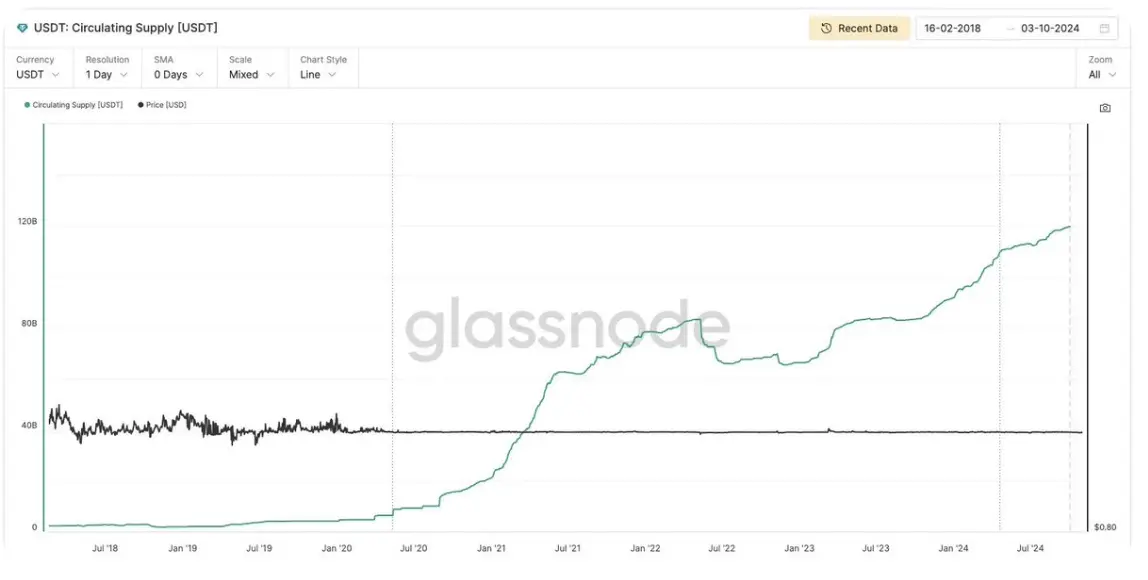

source: Glassnode

来源:Glassnode

目前,Tether资产超过80%投资在美债,这使得 Tether 几乎具备了美国政府型货币市场基金的特征,即资产安全性高、流动性充足。作为SoV,它的安全性高于存款,存款有银行资产端风险,SVB破产对USDC的影响就是一个例子,而国债是最低风险的金融产品。

同时,它也优于货币基金,因为货币基金没有货币结算功能,它只是销售的产品,不能成为货币流通本身。这也是为何Tether能如此高人效的原因,USDT作为MoE在减小货币流通的摩擦角度远远优于现有的跨境结算或支付渠道 ,而作为名义上的影子美元和共识最强的UoA,各类渠道和兑换平台都成为了Tether打工人帮它把网络铺向全球。

这就是货币生意的魅力,Tether结合了支付、结算、Treasure管理而成为了我们行业实际的美联储,这些都是在没有crypto前无法想象的。它的网络效应随着流动性扩大而扩大,这不是把5%的yield分给用户并用token vampire attack 就能颠覆的。

说到这,我们就能理解为什么Paypal要发稳定币,因为随着它业务的扩大已经实现了资金沉淀与收付结算,而稳定币是这一切的最佳载体。那换个角度,美国的银行与货币基金会不会眼红这门生意?

从大而不倒到深而不倒

美国要干掉Tether其实非常简单,因为美债的托管非常中心化,而且Tether自2021年被司法部介入调查,并在22年年底转给Souther District of NY的当红炸鸡检察官Darmian William(基本所有高阶的crypto 犯罪案件都在他手里,包括SBF案件),所以不是不能,而是不想,那么不想的原因是什么?

首先,是美债市场的流动性风险。Tether 的资产中有 80% 是美国国债,若监管对其采取极端限制措施导致 Tether 不得不大规模抛售美债,这可能会引发美债市场的动荡甚至崩盘。这是大而不倒。

更重要的是USDT作为影子美元的全球扩展。在全球通胀严重的地区,USDT 被视为一种价值存储手段;在金融制裁与资本管制的地区,USDT 成为地下交易的流通货币;在恐怖组织、毒品、诈骗、洗钱的地方都能看到它的身影。当USDT在越多国家被越多渠道越多场景所使用,它的反脆弱性会得到巨大提升。这是深而不倒。

对此,美联储一定喜闻乐见,明面上美联储有维持物价稳定与实现充分就业的双重使命,但更深层次是加强美元霸权,掌控全球资本流动。而正是USDT 和 USDC 的广泛流通帮助美元扩展了离岸流动性。USDC 是受监管的美元 on/offramp 工具,而 USDT 则凭借其广泛的渠道将美元渗透至全球,USDT 的地下银行系统和灰色汇款服务,实际上是在为美元流通和跨境支付提供便利。这帮助美国在全球金融秩序中继续发挥主导作用,美元霸权得到进一步深化。

Tether受到的阻力来自哪里

尽管 Tether 从多个方面帮助了美国金融霸权延续,但其与美国监管机构的博弈依然存在,Hayes曾说“Tether 可以在一夜之间被美国银行系统关闭,即使它一切照章办事”。

首先,它无法支持美联储的货币政策。Tether 作为完全储备型的稳定币,不会随美联储的货币政策调整流动性,无法像商业银行那样参与美联储的量化宽松或货币收紧。这种独立性虽然提升了其信用,但也让美联储难以通过它来实现货币政策目标。

其次,财政部要警惕它造成美债市场动荡。假如 Tether 因突发事件崩溃,将不得不大量抛售美债,这会给美债市场带来巨大压力,这在10月29日的财政部借款咨询委员会上被广泛讨论,是否有可能通过一些方法直接tokenize 美债而减轻USDT对美债市场的影响。

最后也是最重要的,Tether实质在挤压银行与货币基金的生存空间。稳定币的高流动性、高收益吸引了越来越多的用户,银行的存款吸收能力与货币基金的吸引力都受到巨大挑战。与此同时,Tether的生意太赚钱了,那为什么银行与货币基金不可以做呢?今年四月lummis-gillibrand payment stablecoin act 被提出,它鼓励更多银行与信托机构参与稳定币市场就是一个力证。

Tether的发展其实是一部波澜壮阔的奋斗史,背负着原罪的监管套利给了它巨大的发展机遇与空间,如今终于有一些角力可以开始与旧势力抗衡,可以走到哪儿谁也说不准,但任何具有突破性的创新都是对过去权力与利益结构的再分配。

超主权货币体系的可能

要超越美元体系,Tether的未来不仅仅在于维持全球的支付与流动性角色,而是更深层次地思考如何构建一个真正的超主权货币体系。我认为它的关键在于与BTC的挂钩。2023年,Tether率先迈出了这一步,将其利润的15%用于配置比特币,这不仅是一次资产储备的多元化尝试,更是事实上使BTC成为支撑其稳定币生态的重要组成部分。

未来,随着Tether的支付网络扩展和BTC在全球市场作为超主权货币的深化,我们有可能见证一个崭新的金融秩序。

一场革命往往从边缘开始,在对旧时代信念衰败的裂缝中萌芽。对罗马的崇拜,让罗马文明主宰世界变成了一种“自我实现的预言” 。

新神的诞生过程也许随机,但是旧神的黄昏已经注定。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。