作者:Kyle Cai

编译:深潮TechFlow

免责声明:Artemis 团队不认可任何特定的金融、投资或法律策略。本文仅供信息和教育用途,不应被视为金融、投资或法律建议。所有投资都存在风险,过去的表现并不代表未来的结果。在做出任何投资决定之前,请务必进行自我研究并咨询持牌金融顾问。

概述

在2024年的周期中,Solana 迄今为止表现出色,本周期的主要主题是 Memecoin,所有这些 Memecoin 都是在 Solana 上诞生的。Solana 也是今年以来价格涨幅最大的第一层区块链,上涨了约 680%。虽然 Memecoin 与 Solana 紧密相连,但自 2023 年复苏以来,Solana 作为一个生态系统重新获得了广泛关注,其生态系统蓬勃发展——像 Drift(永续合约去中心化交易所)、Jito(流动质押)、Jupiter(去中心化交易所聚合器)等协议的代币估值已达数十亿美元,Solana 的活跃地址和每日交易量超过了所有其他区块链。

在这个繁荣的生态系统中心是 Raydium,Solana 的顶级去中心化交易所。俗话说“淘金热中卖铲子”,这完美地体现了 Raydium 的角色:尽管 Memecoin 吸引了大众的目光,Raydium 通过提供流动性和交易支持着这些活动。借助于 Memecoin 交易的持续流动和更广泛的 DeFi 活动,Raydium 已经稳固地成为 Solana 生态系统中至关重要的基础设施之一。

在 Artemis,我们相信世界正越来越多地依赖于基本面。因此,本文旨在通过数据驱动的方法,从第一性原理出发,分析 Raydium 在 Solana 生态系统中的独特地位。让我们一起来深入探讨:

Raydium 简介

Raydium 于 2021 年推出,是一个基于 Solana 区块链的自动化做市商 (AMM),提供无需许可的流动性池创建、极速交易以及收益获取方式。Raydium 的独特之处在于其架构设计——它是 Solana 上首个 AMM,并在去中心化金融 (DeFi) 中首创了与订单簿兼容的混合 AMM。

Raydium 推出时采用了一种混合 AMM 模型,使得闲置的池流动性可以与中心限价订单簿共享,而当时的去中心化交易所 (DEX) 只能使用自己池内的流动性。这意味着,Raydium 上的流动性同时在 OpenBook 上创建了一个市场,可以通过任何 OpenBook DEX 图形用户界面进行交易。

虽然这一特点在早期是主要的区别因素,但由于大量长尾市场的涌入,该功能现已关闭。Raydium 目前提供三种不同类型的流动性池,包括:

-

标准 AMM 池 (AMM v4),即原来的混合 AMM

-

恒定乘积交换池 (CPMM),支持 Token 2022

-

集中流动性池 (CLMM)

在 Raydium 上,每次进行交换时都会根据具体的池类型和费用等级收取少量费用。这些费用被分配用于激励流动性提供者、回购 RAY 代币以及支持金库。

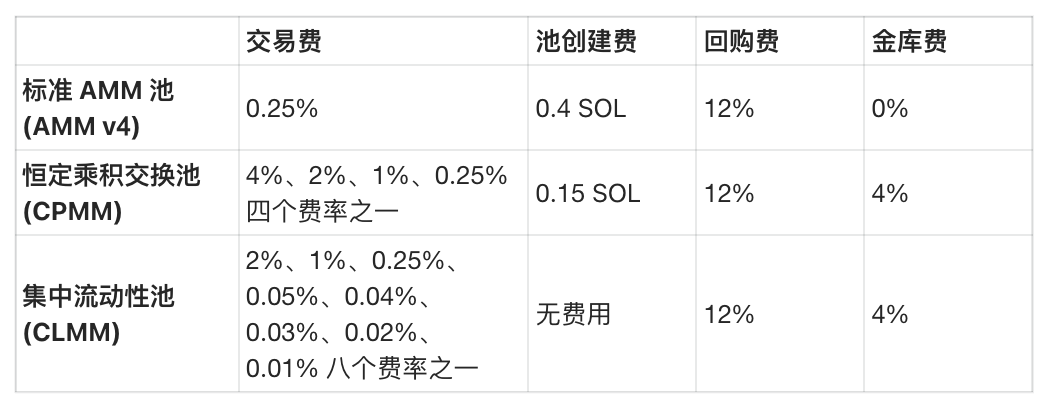

我们记录了 Raydium 不同类型池的交易费、池创建费和协议费。以下是对这些术语的简单解释及其对应的费用水平:

-

交易费:这是对交易者在进行交换时收取的费用。

-

回购费:这是从交易费中提取的一部分,用于回购 Raydium 代币。

-

金库费:这是交易费中分配给金库的一部分。

-

池创建费:这是在创建池时收取的费用,旨在防止滥用池创建。池创建费由协议的多重签名控制,并用于支付协议的基础设施成本。

图 1. Raydium 费用结构

Solana 的去中心化交易所 (DEX) 生态

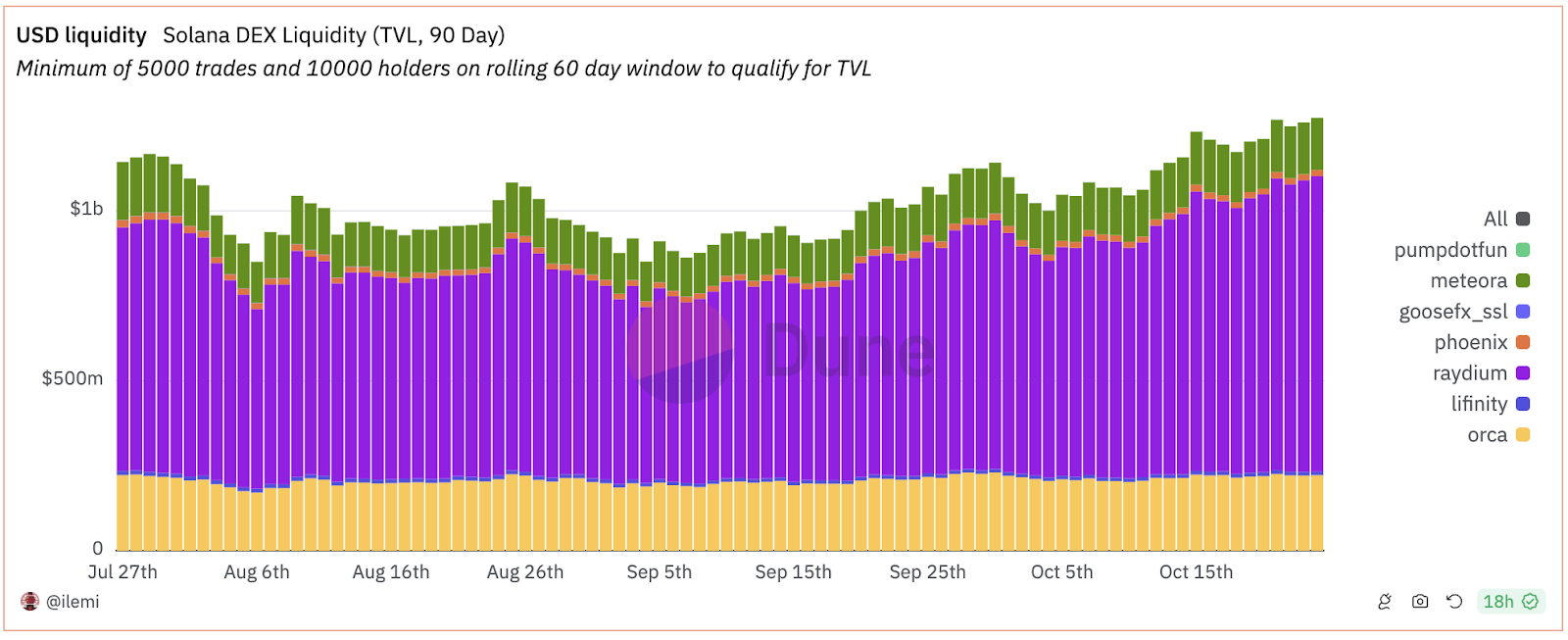

图 2. Solana 各 DEX 的总锁仓价值 (TVL)

来源:Artemis

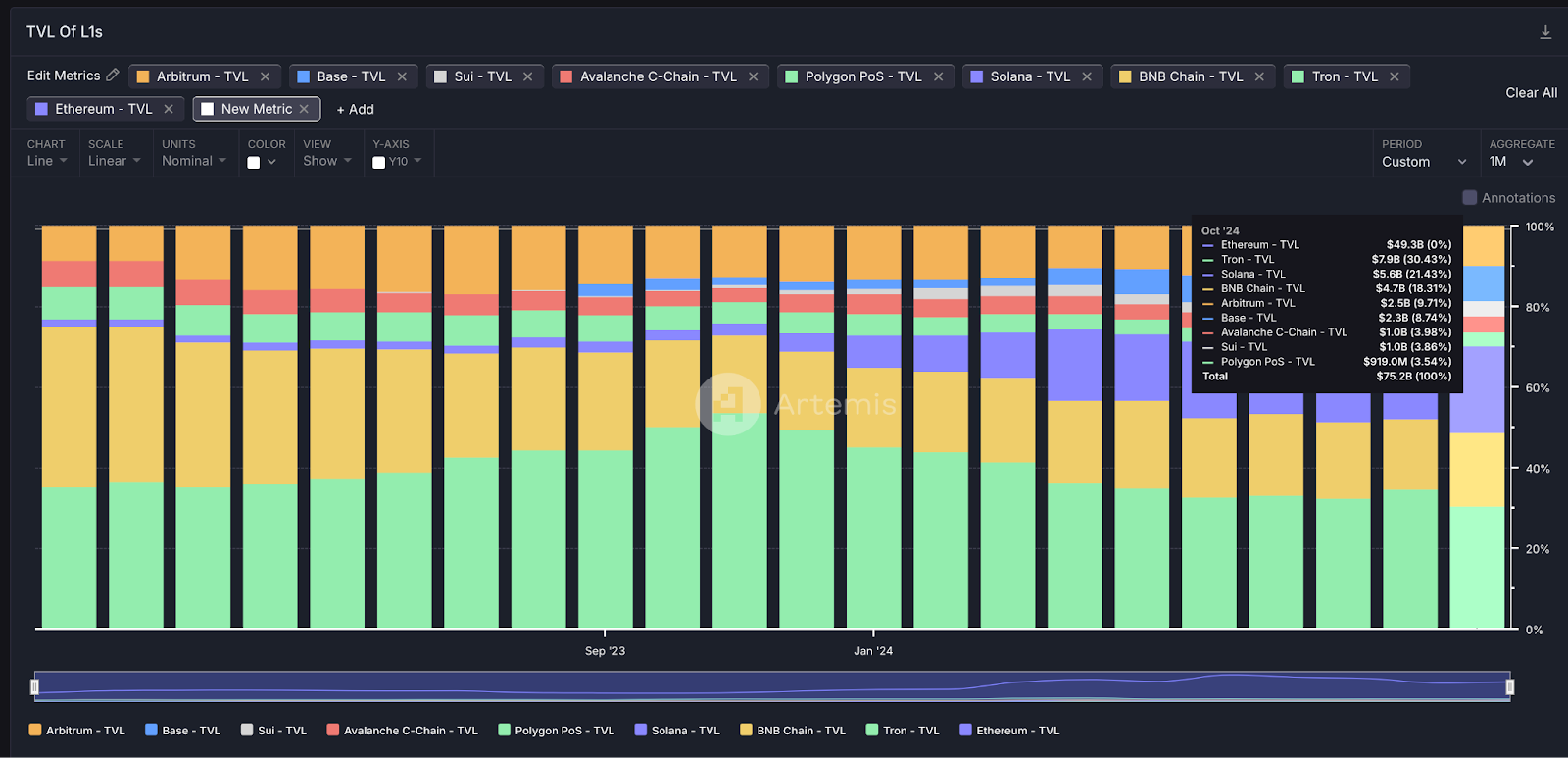

在我们详细解析了 Raydium 的运作机制之后,我们将继续评估 Raydium 在 Solana DEX 生态中的地位。显而易见的是,Solana 在 2024 年的市场周期中迅速崛起,成为仅次于以太坊和 Tron 的第三大锁仓价值链。

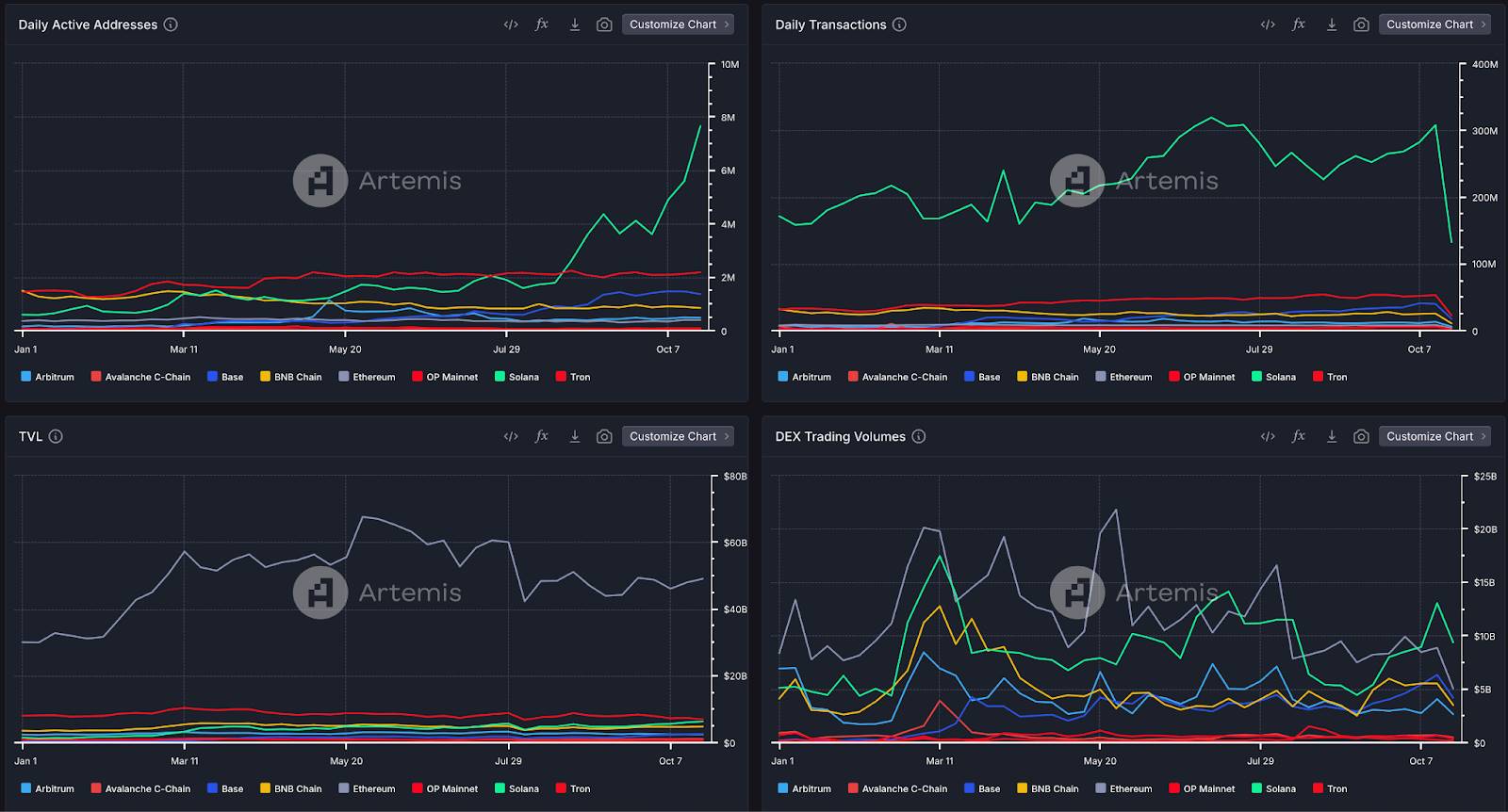

图 3. 各链的每日活跃地址、每日交易量、TVL 和 DEX 交易量

来源:Artemis

在用户活跃度指标方面,Solana 一直处于领先地位,包括每日活跃地址、每日交易量和 DEX 交易量等。这种活动和资金流动性的增加可归因于多个因素,其中最著名的之一是 Solana 上的“ Meme 币热潮”。Solana 的高交易速度和低成本,加上其对去中心化应用程序的良好用户体验,促进了链上交易的快速增长。随着像 $BONK 和 $WIF 这样的代币达到数十亿美元的市值,以及 Pump.fun 这样的 Meme 币发射平台的出现,Solana 已成为 Meme 币交易的重要中心。

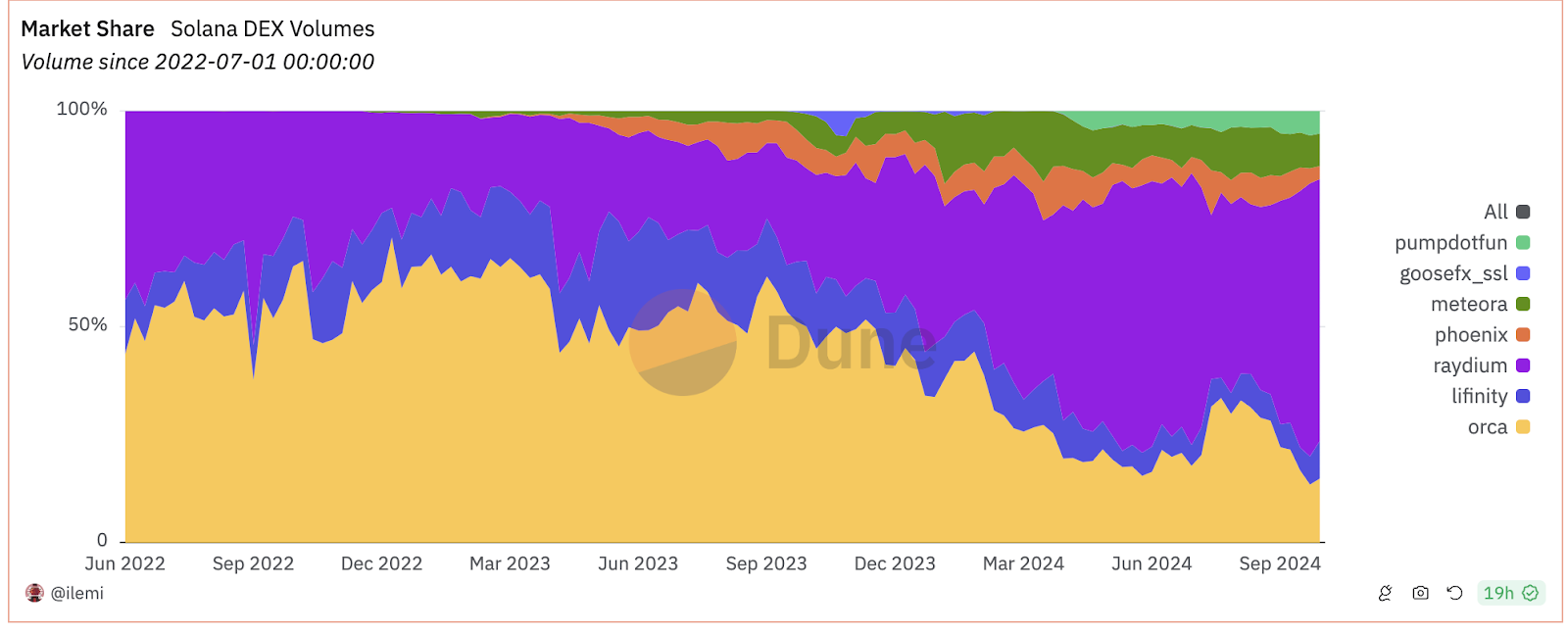

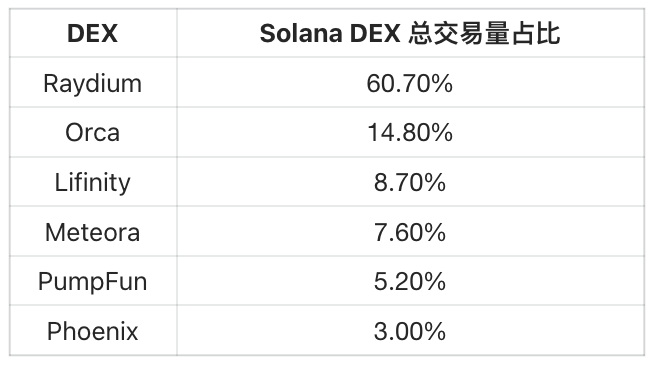

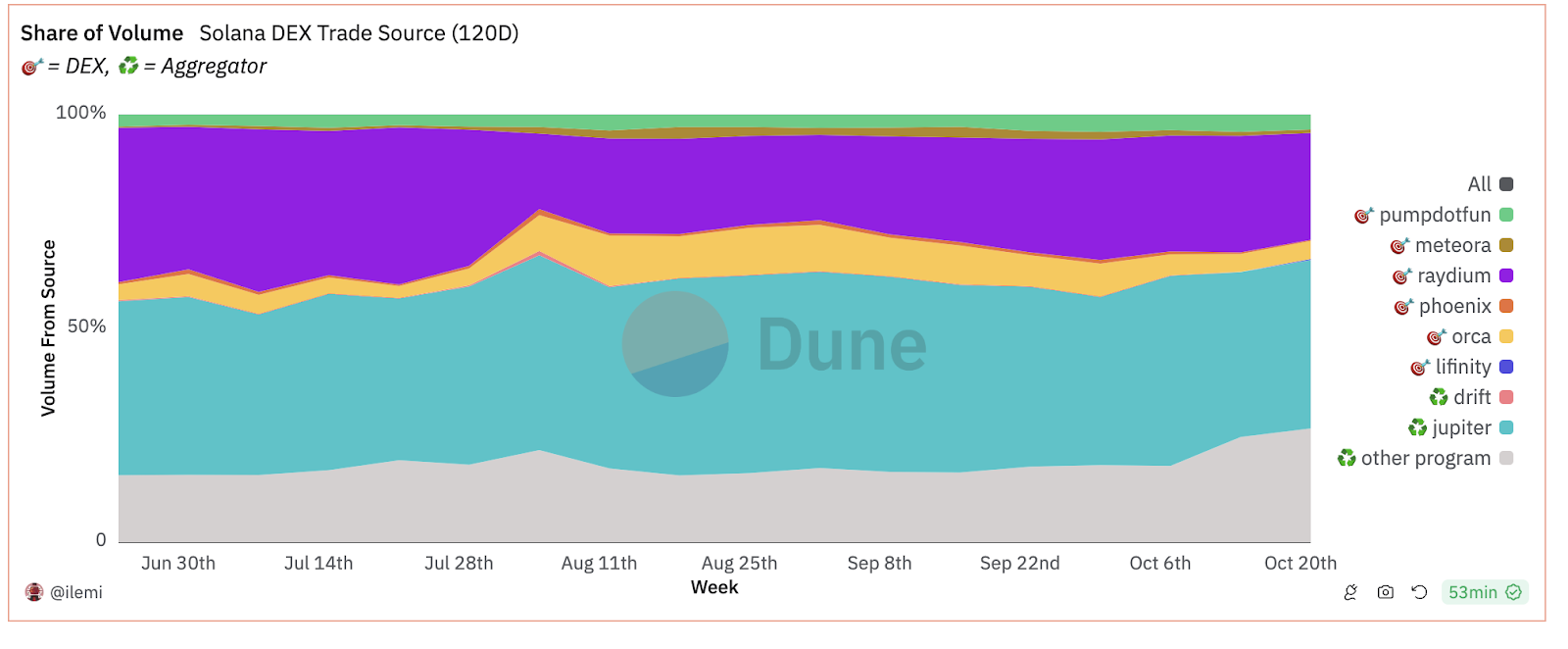

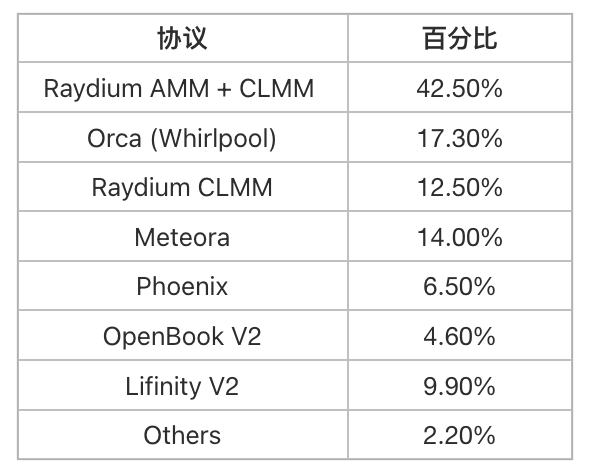

图 4. Solana 网络中各去中心化交易所 (DEX) 的交易量市场份额

来源:Ilemi’s Raydium Dune Dashboard

在本周期中,Solana 已成为最受欢迎的第一层区块链 (Layer 1),并在交易活动方面继续领先于其他 L1。随着交易活动的增加,Solana 上的去中心化交易所 (DEX) 受益匪浅——更多的交易者带来了更多的交易费用,从而为协议创造了更多的收入。然而,在众多 DEX 中,Raydium 脱颖而出,成功占据了相当大的市场份额。如下图所示:

图 4. 各 DEX 的 Solana DEX 交易量市场份额

来源:Ilemi 的 Raydium Dune Dashboard

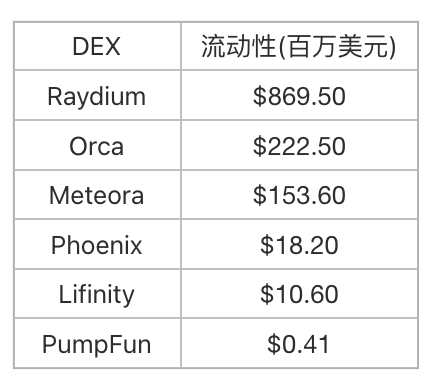

Raydium 继续保持其作为流动性最强的去中心化交易所 (DEX) 的地位。值得注意的是,DEX 的运作常常涉及规模经济的问题,因为交易者通常会选择流动性最强的交易所,以避免交易中的滑点。流动性越高,吸引的交易者就越多,这又进一步吸引了流动性提供者,他们通过收取交易费用获利,从而形成一个良性循环,吸引更多希望避免滑点的交易者。

在比较不同的 DEX 时,流动性通常是一个被忽视但却至关重要的因素,尤其是在 Solana 网络上交易 Memecoins 时,这一点尤为明显。Memecoins 通常流动性不足,需要一个集中的交易点。如果流动性在不同的 DEX 之间分散,会导致用户体验不佳,并且在不同 DEX 上购买 Memecoins 时会感到不便。

探讨 Memecoins 与 Raydium 的关系

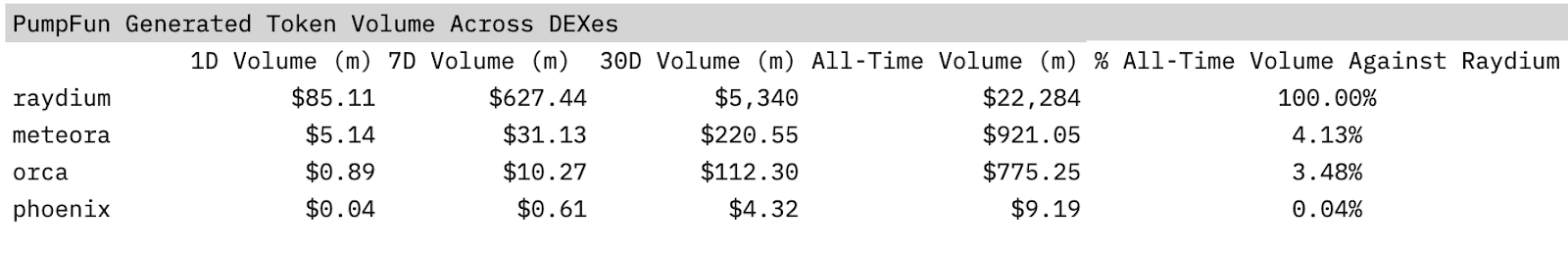

Raydium 的流行还与 Solana 上 Memecoins 的再度兴起有关,特别是由 PumpFun 推出的 Memecoin 平台。自今年初成立以来,PumpFun 已经通过其平台赚取了超过 1 亿美元的费用。

PumpFun 平台上的 Memecoins 与 Raydium 有着密切的合作。当 Pump.fun 上推出的代币市值达到 69,000 美元时,Pump.fun 会自动向 Raydium 注入价值 12,000 美元的流动性。这一机制使得 Raydium 成为交易 Memecoins 时流动性最强的平台。这个过程形成了一个良性循环:PumpFun 连接到 Raydium > Memecoins 在 Raydium 上发布 > 人们在此交易 > 增加流动性 > 更多的 Memecoins 在此发布 > 获得更多流动性,如此循环往复。

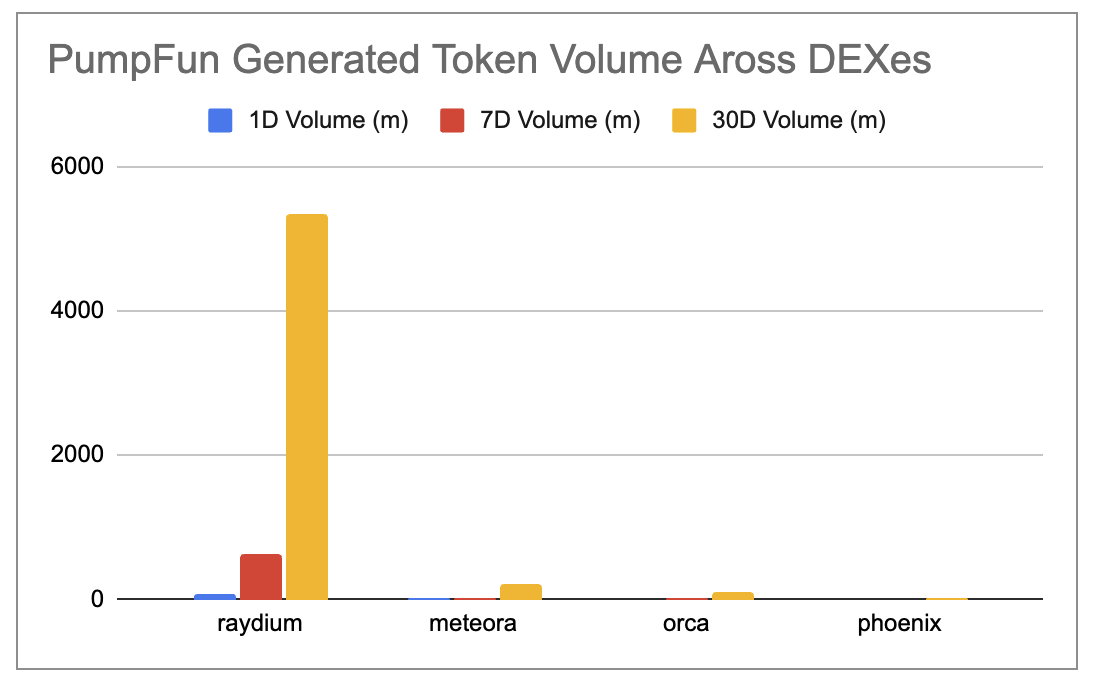

图 6. PumpFun 生成的代币在各 DEX 上的交易量

来源: Hashed_em 的 Memecoin Volume Dune Dashboard

因此,Raydium 被认为遵循幂律法则,其中超过 90% 的 PumpFun 生成的 Memecoins 都在 Raydium 上进行交易。就像城市中的一个大型购物中心,Raydium 是 Solana 上最大的“购物中心”,这意味着大多数用户都会选择在 Raydium 进行“购物”,而大多数“商家”(代币)也希望在此设立“商铺”。

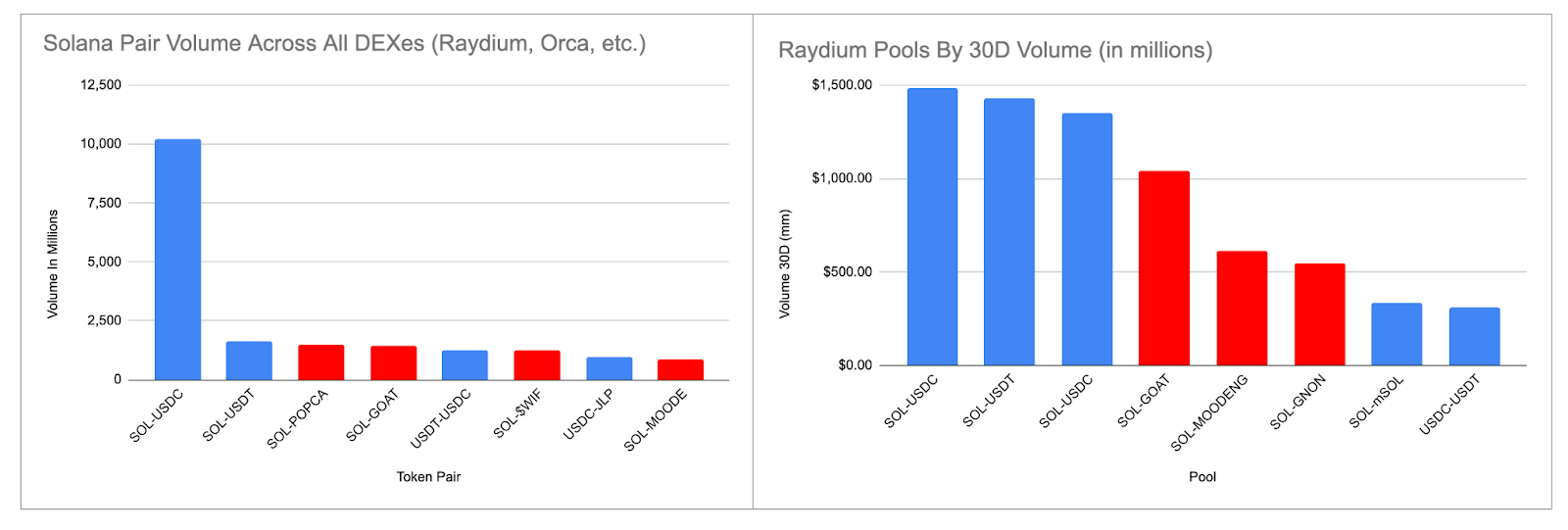

图 7. Solana 上各 DEX 的交易对 30 天交易量与 Raydium 上的交易对 30 天交易量对比

(红色代表 Memecoins,蓝色代表非 Memecoins)

来源: Ilemi 的 Raydium Dune Dashboard, Raydium

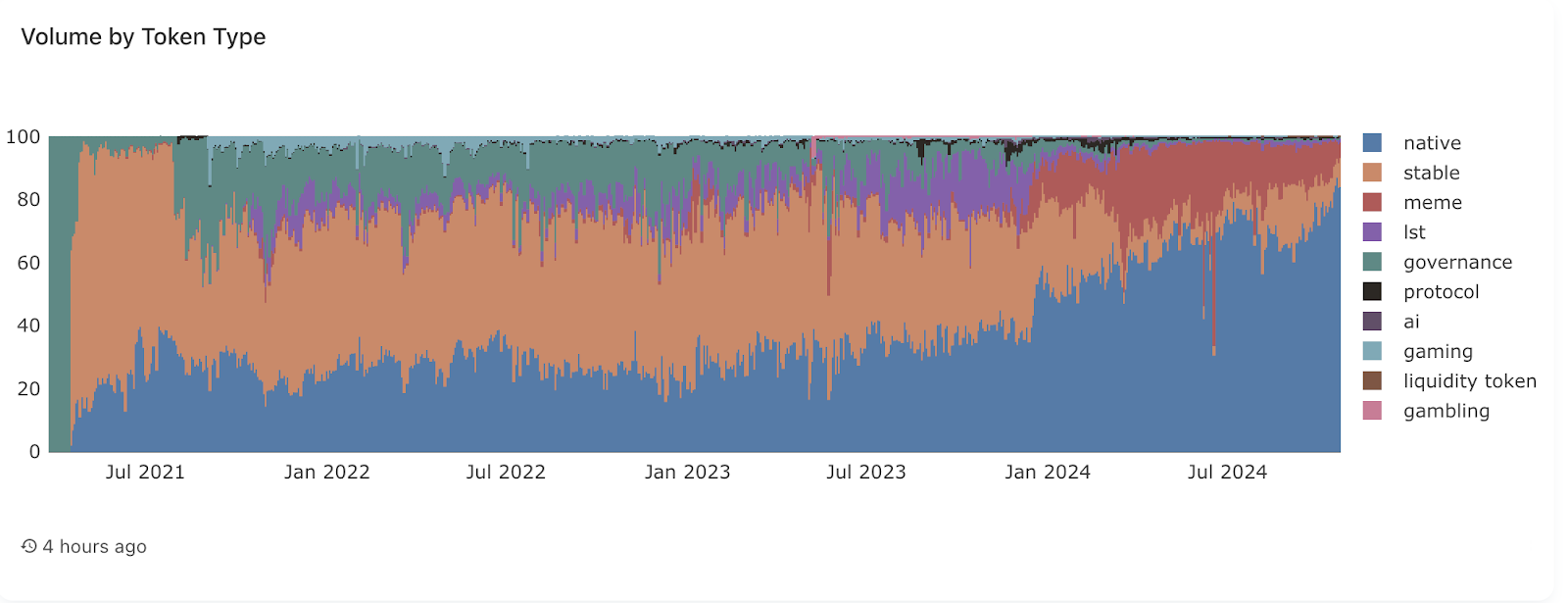

图 8. 按代币类型划分的 Raydium 交易量

然而,需要指出的是,尽管 PumpFun 依赖于 Raydium,但 Raydium 并不完全依赖 Memecoins 来维持其交易量。实际上,根据图 8,过去 30 天内交易量最大的三个交易对是 SOL-USDT 和 SOL-USDC,这两个交易对的交易量占据了总交易量的 50% 以上。(需要注意的是,这里的两个 SOL-USDC 交易对是不同费用结构的两个独立池)。

图 7 和图 9 进一步验证了这一点。图 7 显示,SOL-USDC 交易对在交易量上远远领先于其他 DEX 交易对。即便图 7 展示的是所有 DEX 的交易量,这也表明整个生态系统的交易量并不仅仅由 Memecoins 驱动。图 9 进一步展示了 Raydium 按代币类型划分的交易量,其中“本地”代币占据了超过 70% 的市场份额。因此,虽然 Memecoins 是 Raydium 的一个重要组成部分,但它们并不能代表 Raydium 的全部交易活动。

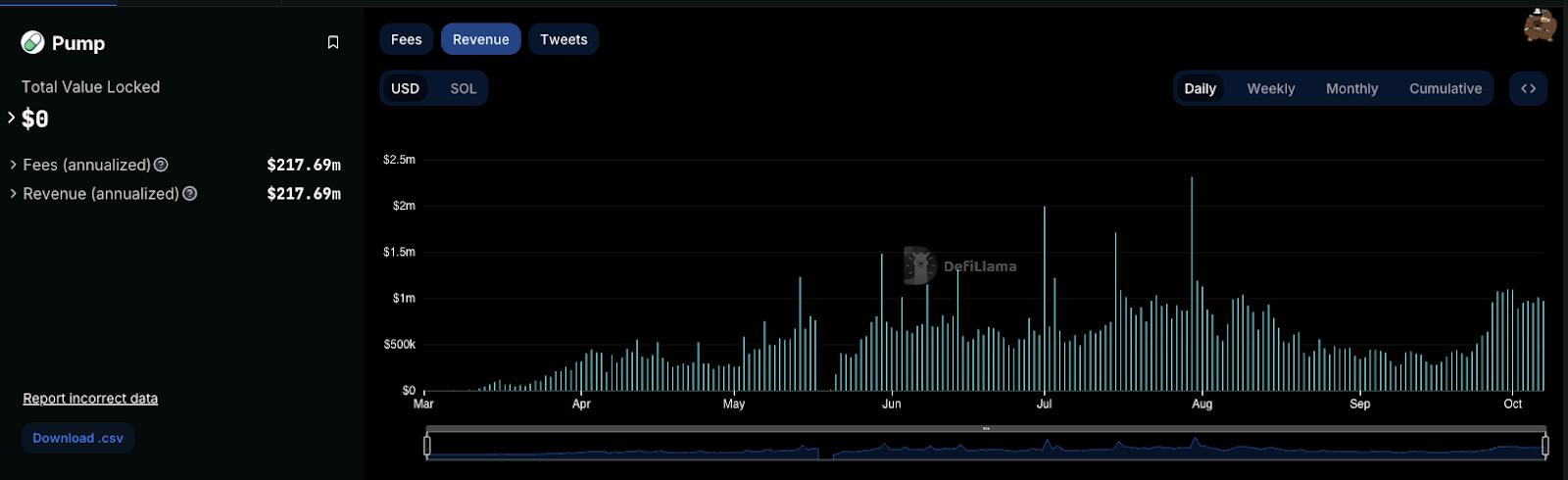

图 9. PumpFun 收入

来源:Defillama

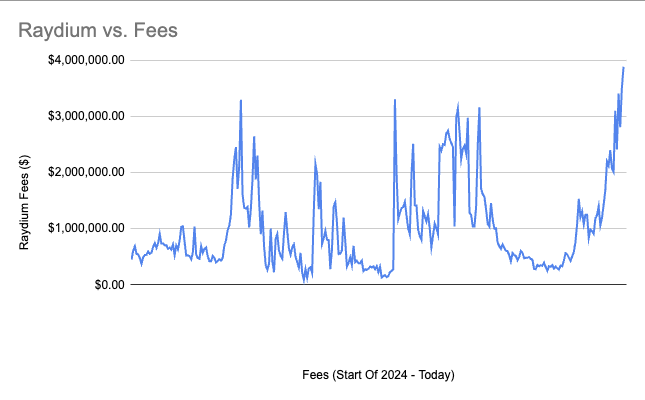

图 10. Raydium 收入

尽管如此,Memecoins 的波动性很高,而波动性大的资金池通常会收取更高的费用。因此,尽管 Memecoins 在交易量上可能不如 Solana 的资金池,但它们对 Raydium 的收入和费用贡献很大。这一点在九月份的数据中得到了体现——由于 Memecoins 是高度周期性的资产,在市场不佳时,随着风险偏好的降低,它们的表现往往会大幅下滑。PumpFun 的收入从七、八月的日均 80 万美元下降了 67%,到九月时约为日均 35 万美元;我们也观察到了 Raydium 在同一时期的费用下降。

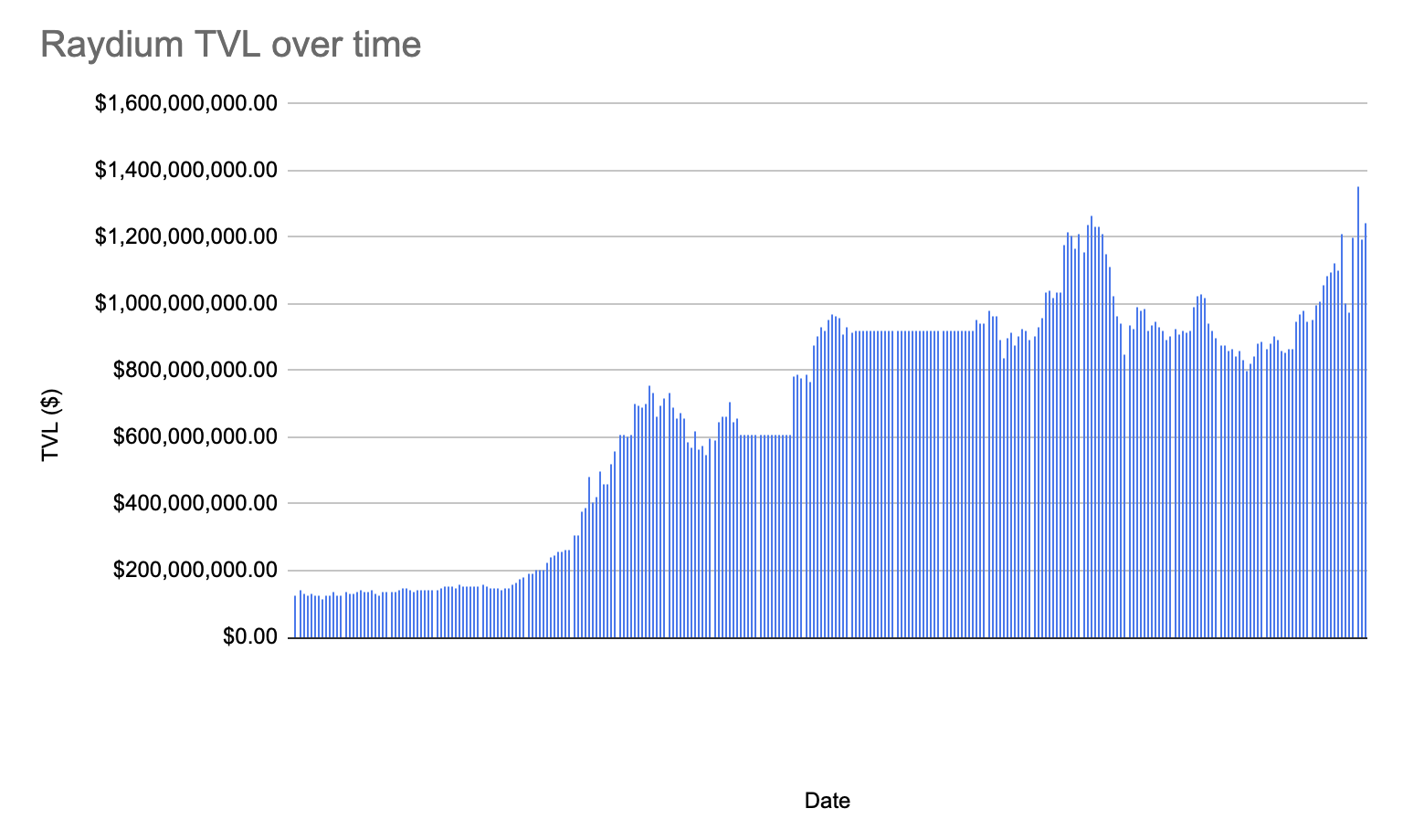

图 11. Raydium 随时间变化的 TVL

然而,如同加密货币行业的其他领域一样,这个行业具有很强的周期性,因此在熊市中指标下降是正常现象,因为风险被洗去。相反,我们可以将 TVL 视为衡量协议真正抗脆弱性的标准——虽然收入具有高度的周期性,并随着投机者的来去波动,TVL 则是一个能够反映 DEX 可持续性的指标,显示其如何经受住时间的考验。TVL 就像购物中心的“入住率”——尽管潮流会变化,购物中心的使用也可能随季节而变化,但只要入住率高于平均水平,我们就能判断其成功。

就像一个人流量稳定的购物中心,Raydium 的 TVL 长期保持稳定。这表明,尽管其收入可能会随着市场价格和投资者情绪的变化而波动,但 Raydium 已经证明了自己作为 Solana 生态系统中核心产品的地位,并成为 Solana 上最优秀且流动性最强的 DEX。因此,尽管 Memecoins 对其收入有所贡献,但 Raydium 的交易量并不总是依赖于 Memecoins,无论市场环境如何,流动性仍然会集中到 Raydium。

Raydium 与聚合器的比较

图 12. Solana DEX 交易来源

来源:Ilemi 的 Raydium Dune Dashboard

虽然 Jupiter 和 Raydium 并不直接竞争,但 Jupiter 在 Solana 生态系统中扮演着关键的聚合器角色,通过多个去中心化交易所(DEX),包括 Raydium,来路由交易。Jupiter 本质上是一个元平台,通过从 Orca、Phoenix、Raydium 等多个 DEX 获取流动性,确保用户获得最佳价格。相对而言,Raydium 则作为流动性提供者,通过为 Solana 代币提供深厚的流动性池,支持许多由 Jupiter 路由的交易。

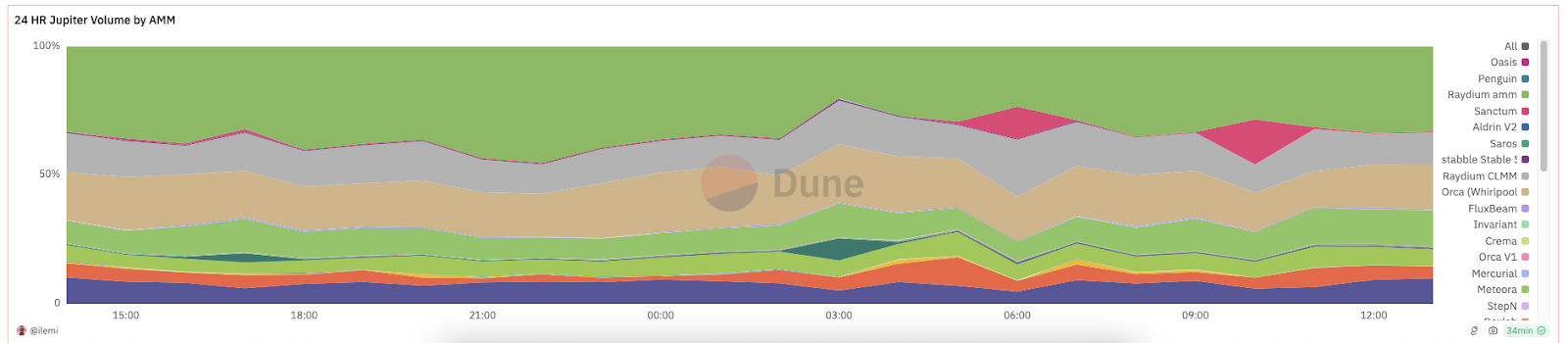

图 13. 24 小时 Jupiter 按 AMM 的交易量

来源:Ilemi 的 Jupiter by AMM Dune Dashboard

尽管 Raydium 和 Jupiter 这两个协议紧密合作,但值得注意的是,Raydium 直接产生的交易量比例正在逐步上升,而来自 Jupiter 的比例则在下降。同时,Raydium 占据了 Jupiter 制造者交易量的近一半。

这说明 Raydium 在打造一个更为强大和自给自足的平台方面取得了成功,能够直接吸引用户,而不再依赖 Jupiter 等第三方聚合器。

直接交易量的增加意味着交易者在使用 Raydium 的原生界面和流动性池时发现了价值,因为用户希望获得最有效和全面的 DeFi 体验,而无需通过聚合器。最终,这一趋势强调了 Raydium 在 Solana 生态系统中作为主要流动性提供者的独立地位。

Raydium 与其他平台的比较

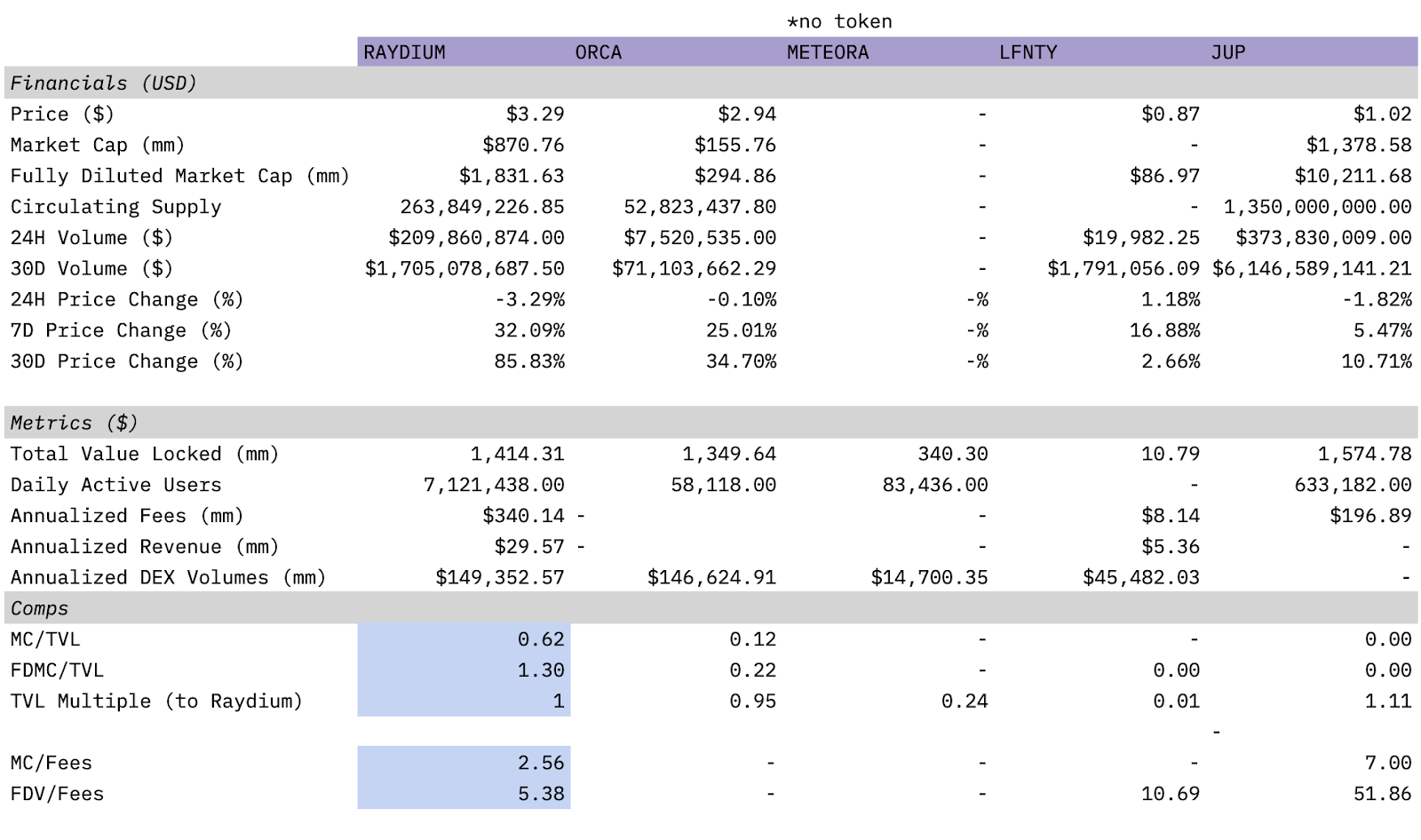

最后,我们使用 Artemis 插件制作了一张比较表,展示了 Raydium 与 Solana 上其他 DEX,包括聚合器之间的对比。

图 14. Raydium 与 Solana 上其他 DEX 的对比

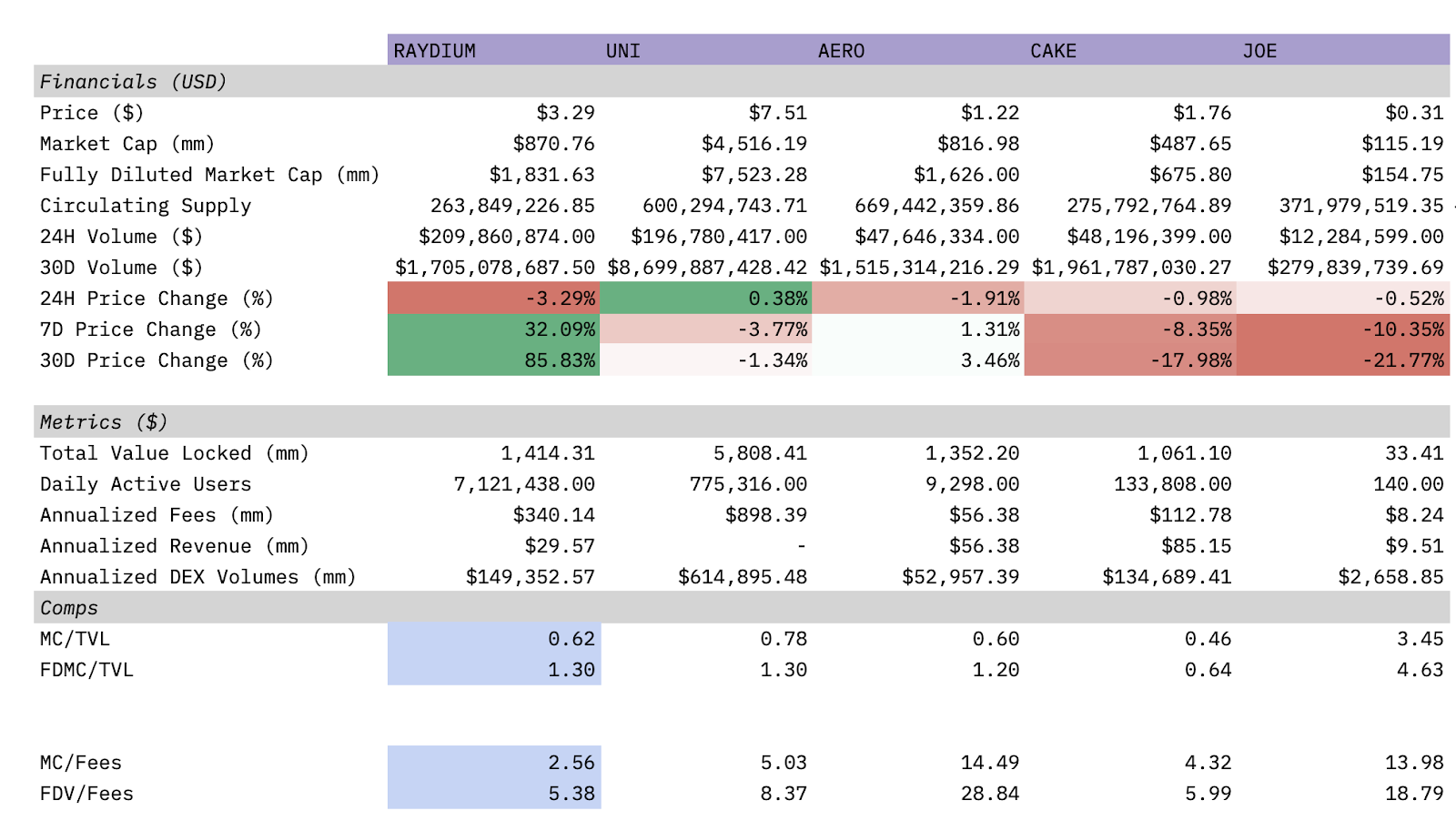

图 15. Raydium 与其他热门 DEX 的对比

在图 13 中,我们将 Raydium 与 Solana 上最受欢迎的 DEX 进行了比较,包括 Orca、Meteora 和 Lifinity,这四个平台合计占据了 Solana 总 DEX 交易量的 90%。我们还将 Jupiter 作为一个聚合器加入了比较。尽管 Meteora 没有发行 Token,我们仍将其纳入比较范围。

从数据可以看出,Raydium 在所有 DEX 中的市值/费用比和 FDV/费用比都是最低的。Raydium 也拥有最多的每日活跃用户,除了 Jupiter(被视为聚合器而非 DEX),其他 DEX 的 TVL 都比 Raydium 少超过 80%。

在图 14 中,我们将 Raydium 与其他链上的传统 DEX 进行了比较。可以看到,Raydium 的年化 DEX 交易量是 Aerodrome 的两倍以上,但其市值/收益比却更低。

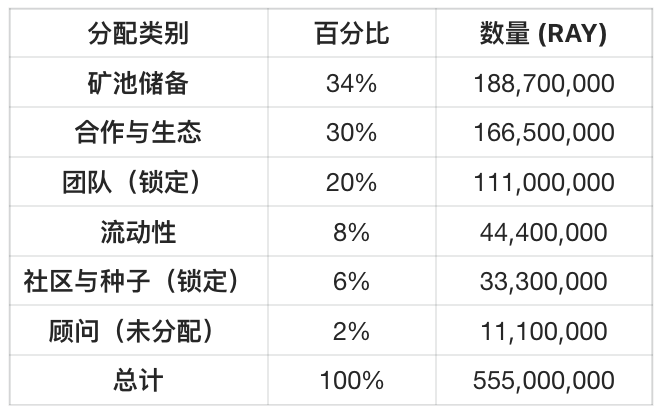

Raydium 的代币经济学

以下是 Raydium 的代币经济学详细信息:

注意:团队和种子轮的代币(占总量的 25.9%)在代币生成事件 (TGE) 后的前 12 个月内完全锁定,并在第 13 到第 36 个月内每天线性解锁。锁定期于 2024 年 2 月 21 日结束。

Raydium 代币有多种用途:持有 $RAY 的用户可以通过质押获得额外的代币。此外,$RAY 也用作吸引流动性提供者的挖矿奖励,从而增强流动性池的深度。虽然 $RAY 本身不是治理代币,但相关的治理机制正在开发中。

尽管在 DeFi 夏季之后,市场对代币的发行兴趣减弱,但值得一提的是,Raydium 的年通胀率非常低,其年化回购在 DeFi 领域中表现优异。目前,年化发行量约为 190 万 RAY,其中 165 万用于质押,与其他热门去中心化交易所在高峰期的发行量相比,这个数字相对较小。按当前市价计算,RAY 每年发行约 510 万美元的代币。相比之下,Uniswap 在完全解锁前,每天发行的代币价值约为 145 万美元,年发行量达 5.2925 亿美元。

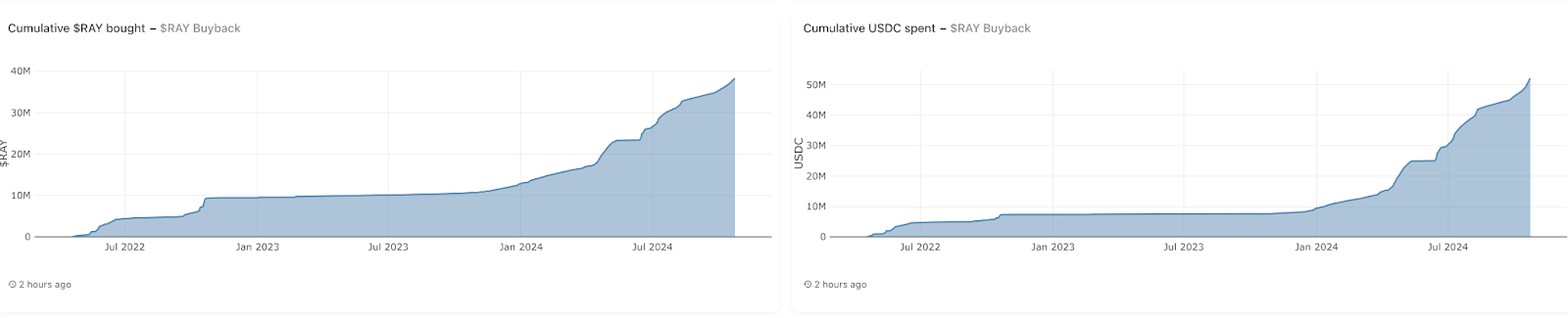

在 Raydium 的每次交易中,都会收取一小笔费用。根据官方文档,“根据特定池的费用,这笔费用会被分配,用于激励流动性提供者、RAY 回购以及充实金库。总的来说,不论池子的费用层级,所有交易费用的 12% 都用于回购 RAY。”结合 Raydium 的交易量,这一机制带来了显著的效果。

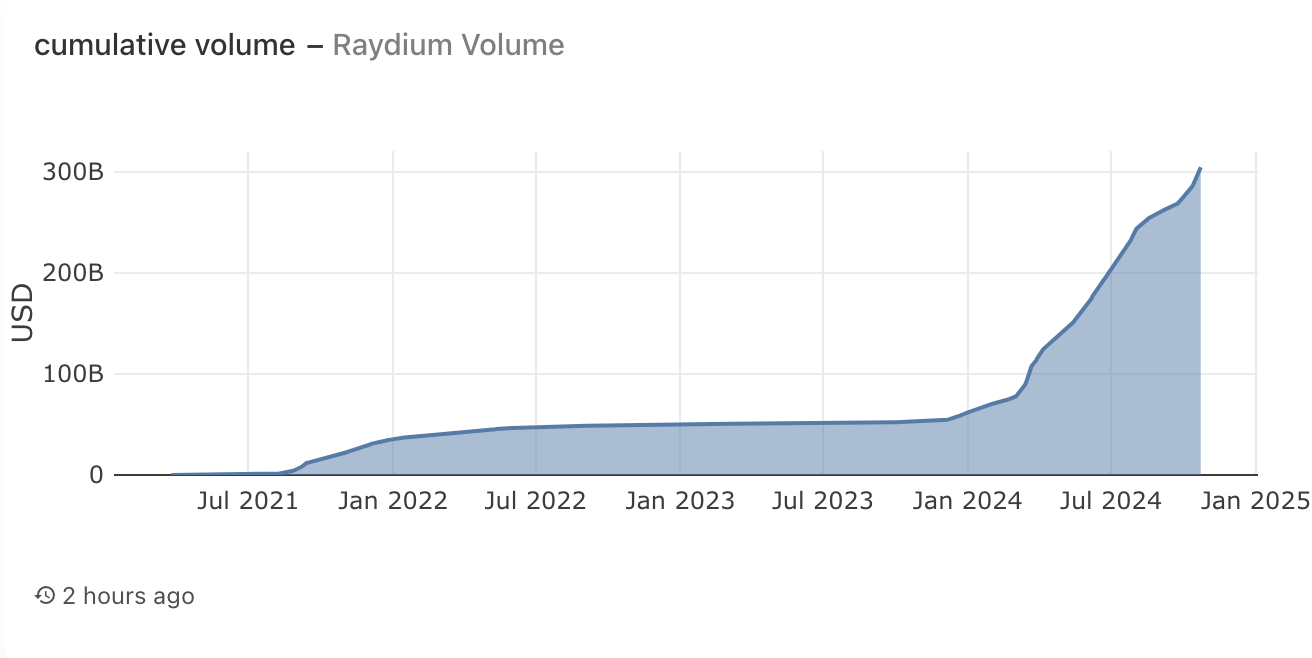

图 16. Raydium 累计交易量

图 17. Raydium 回购数据

从数据结果来看,Raydium 的表现非常突出。累计交易量已超过 3000 亿美元,Raydium 成功回购了约 3800 万枚 RAY 代币,价值约 5200 万美元。Raydium 的回购计划在整个去中心化金融 (De-Fi) 领域中表现最为强劲,这也使得 Raydium 在 Solana 网络上的所有去中心化交易所 (DEX) 中占据了领先地位。

Raydium 的发展前景

综上所述,Raydium 在 Solana 网络上的去中心化交易所中具有显著的优势,并且在 Solana 持续发展的背景下,Raydium 处于最有利的位置。过去一年中,Raydium 的发展历程令人印象深刻,随着 Memecoin 在加密货币市场中继续占据主导地位,Raydium 的增长势头似乎不会很快停滞。最近的 Memecoin 热潮围绕着人工智能 (AI) 展开,比如 $GOAT。

Raydium 作为 Solana 网络上的主要流动性提供者和自动化做市商 (AMM),凭借其独特的地位,在捕捉新兴市场趋势方面拥有战略优势。此外,Raydium 对创新和生态系统发展的承诺,体现在其频繁的系统升级、对流动性提供者的有力激励措施以及与社区的积极互动。这些因素表明,Raydium 不仅做好了适应不断变化的去中心化金融 (DeFi) 环境的准备,还具备引领该领域的潜力。

作为快速增长的区块链生态系统中的关键基础设施,Raydium 如果继续保持当前的发展势头,可以说其未来的增长前景非常乐观。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。