「毕业后,你会有一段短暂的时间可以沉迷于赌博,然后你可能成为精英,或者一辈子都只能靠工资过活。」

撰文:Ignas

编译:Luffy,Foresight News

加密货币就像一场游戏:交易代币,赚钱(和亏钱),以及在 X 上获得粉丝。

你是不是也有同样的感受?但与真实游戏不同的是,加密货币游戏的失败可能会带来严重的后果。

Terra 崩盘事件发生后,根据一位韩国父亲的网上记录,一家三口(其中包括一名 10 岁女儿)因财务损失自杀。如果公开承认加密货币是一场游戏,会让我感到内疚。太多人被骗了,失去了毕生的积蓄。

但将加密货币视作一种游戏的心态帮助我保持理智并有动力继续玩下去。因为我们在这个行业经历的疯狂只是一个层面,它最大的优势是:让普通人能够实现财务自由梦。

正如 DegenSpartan 所说:

「在你毕业后,你会有一段短暂的时间可以沉迷于赌博,然后成为精英,或者一辈子都只能靠工资过活。」

在这篇文章中,我想分享加密游戏的剧本、我的思维框架以及如何赢得加密游戏的技巧。

加密游戏的规则

一旦你发现加密货币和(尤其是 MMORPG)游戏之间的相似之处,你就无法忽视它。

在经济困难时期,没有新资本流入,PvP(玩家对玩家)模式就会盛行。在牛市中,随着新资金进入,我们就切换到了 PvE(玩家对环境)模式。

如果你不喜欢 KOL 对你施加影响,我们会想到「不要讨厌玩家,要讨厌游戏」这句话。

我们甚至设计了代币经济学,通过各种博弈论来阻止人们抛售代币。

与游戏升级一样,加密游戏也在不断进化,新的故事不断出现和消失。

例如,曾经是顶级 NFT 玩家的 Pranksy 现在已完全跟不上 memecoin 的节奏。游戏玩法已经改变,但他仍坚持玩那种很少有人感兴趣的游戏。

当然,memecoin 可能很糟糕,但几年前那些不知道如何玩 NFT 铸造和交易游戏的人也对 NFT 说过同样的话。

你在游戏中面临两个选择:要么适应并参与,要么等待游戏的新玩法。还有第三个更困难的选择,那就是改变游戏规则本身。

例如,Cobie 推出了 Echo 平台,允许散户参与风险投资并像在 ICO 时代一样购买代币。memecoin 的故事将一点一点地被那些决定改变游戏规则的玩家所推翻。

然而,Memecoins 也值得赞扬,因为他们实际上成功改变了游戏规则。

在过去一年左右的时间里,我们玩的是「积分」游戏。你将资产存入协议,累积积分,并祈祷获得丰厚的空投。我知道你喜欢这个游戏,因为「DeFi degen 的牛市剧本」仍然是我最受欢迎的帖子。

不管怎样,事实证明,很多人都被骗了。

由于更高的 TVL 意味着更高的估值,因此代币发行的 FDV 都高得离谱,受益者只有那些以低估值进入的 VC、团队,当然还有抛售空投的羊毛党。

于是,许多人转向了 memecoin,站在了 VC 代币的对立面。

虽然 Pranksy 正在失败,但 memecoin 主角 Ansem、Murad 以及加入他们部落的玩家都正在取得胜利。

「不要厌恶玩家,要厌恶游戏」

在整体游戏玩法中,我们不断引入新的小游戏。你必须决定是否参加。如果你参加,一定要了解规则,因为总会存在对手。

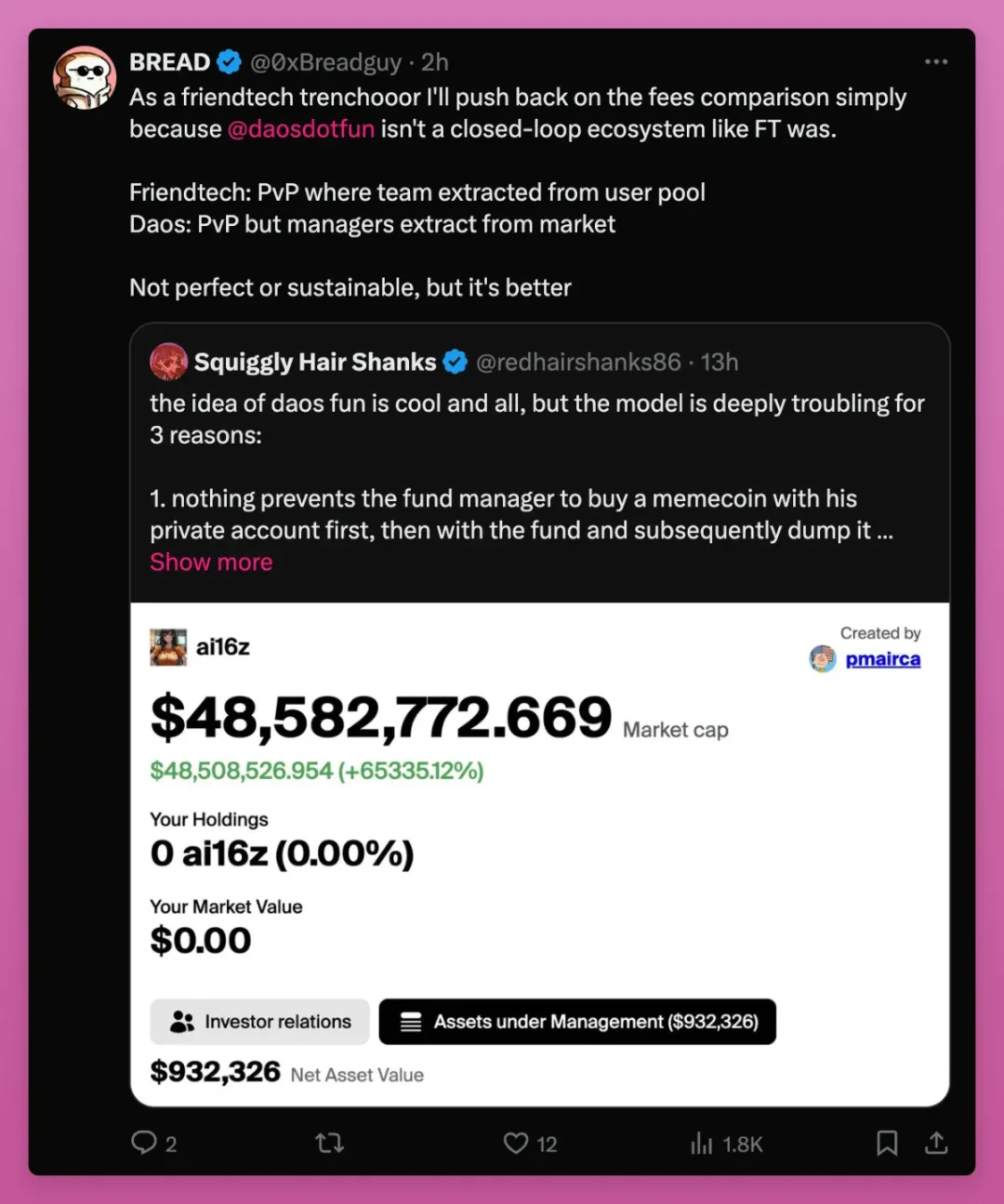

例如,daos.fun 允许交易代币化基金。然而令人困惑的是,最热门的「基金」ai16z 的交易价格是 NAV(净资产价值)的 52 倍。它的交易方式与 memecoin 类似。

玩家们都在试图理解它。Squiggly 将该基金比作「Grayscale 结构」或 Friend.tech 交易费庞氏骗局。BREAD 对 Friend.tech 部分持不同意见。

Squiggly 与 BREAD 的观点,谁是对的呢?

虽然是同一款产品,但玩家的理解却大相径庭。玩家要在游戏中寻找自己的优势,从中获利。

这可能很简单。在团队宣布计划在网站上将新「基金」列入白名单后,我预计持有其他「基金代币」的 degens 可能会出售部分旧基金代币转而投资新基金。事实上,一旦添加新基金,所有旧基金代币的价格都会下跌约 50%。

通常,玩法越令人困惑,你可以通过知识不对称获利的空间就越大。

加密货币的美妙之处在于,总有一些人会在没有经过充分调查的情况下就加入新潮流,而只要你做一点基础研究,就有机会获得收益。

话虽如此,我经常会先用一点小钱尝试新事物,然后再进行研究,了解它在实践中是如何运作的。边做边学,当知道自己能否赢得这场游戏时,再投入更多的资金。

Ton 的点击赚钱游戏之所以蓬勃发展,是因为它与复杂的 DeFi 游戏相反:你只需点击屏幕上的按钮即可赚钱。

然而,由于游戏过于简单,奖励也很低;除非你利用该系统,用人工手指点击数百部手机。

加密技术在这里变得更加有趣和复杂:有多个层次、角色和策略可供选择。如果你愿意,也可以选择支线任务。

让我举个例子。

最近,我一直致力于成为多个 DAO 的活跃代表,特别是 Lido、Arbitrum 和 Uniswap。

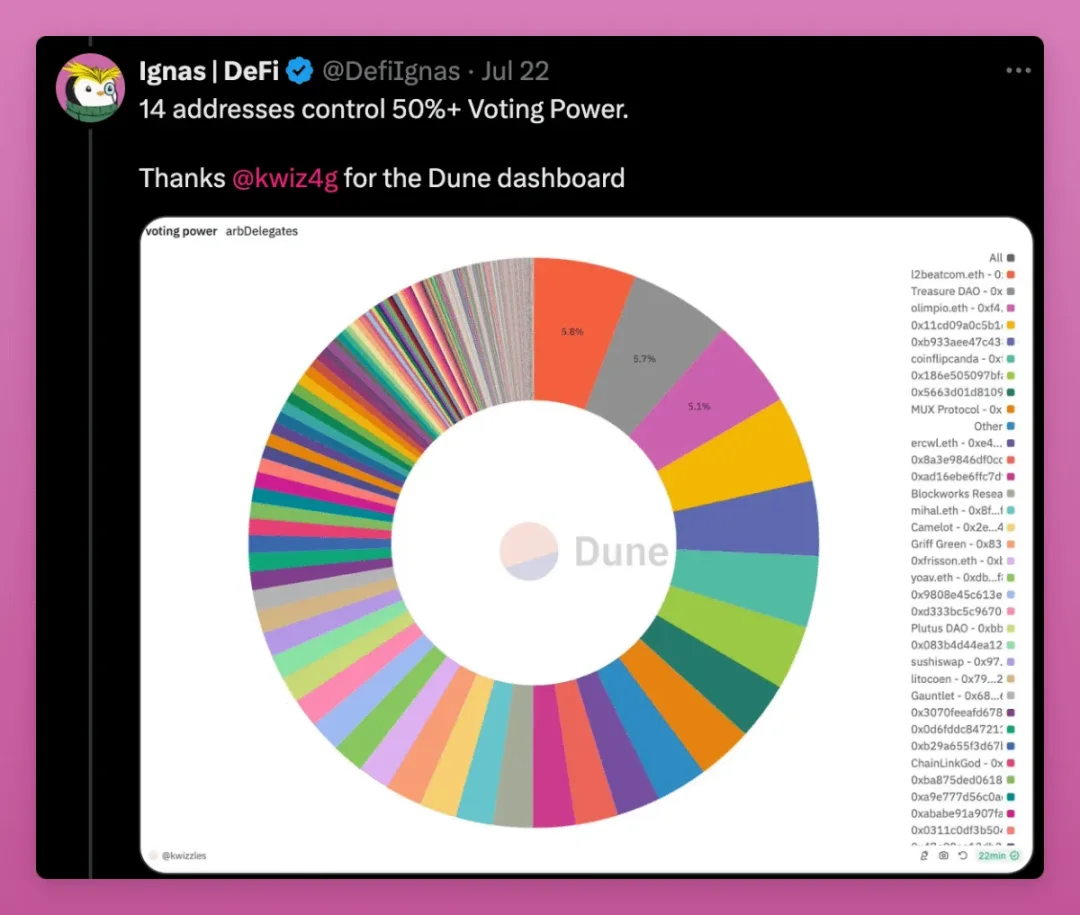

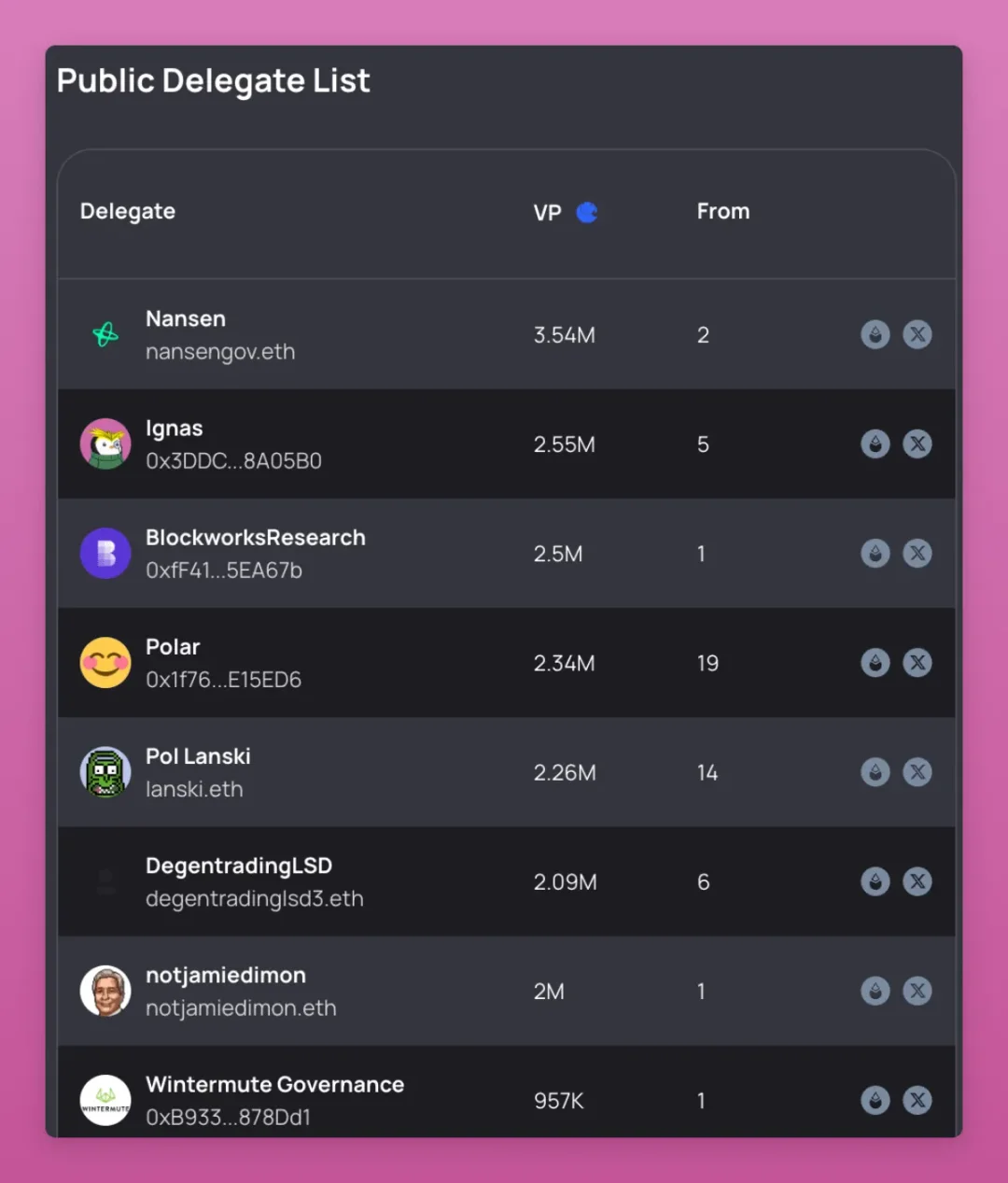

DAO 倡导去中心化组织的愿景,但现在大多数 DAO 都远未实现去中心化,这已是公开的秘密。例如,在 Arbitrum DAO 中,14 个地址控制着超过 50% 的投票权,其他 DAO 也一样。

Uniswap DAO 并不知道 Unichain 会推出 UNI 质押功能。这也解释了为什么费用开关几个月来一直没有开启。内部人士知道,一旦实施 UNI 质押,费用开关就没有必要了,而 DAO 被蒙在鼓里。

DAO 认识到投票集中是一个大问题。为了解决这个问题,他们发起了激励活动来吸引新参与者。通过成为一个 DAO 活跃的治理代表,你可以赚取 3,000 至 10,000 美元。

但这并不容易。你必须积极关注论坛讨论、发表评论并对提案进行投票。最困难的是让代币持有者将代币委托给你,这就触及到了政治游戏。

在我发布关于协调代币持有者和协议激励措施的推文后,一位匿名鲸鱼将 250 万 LDO 委托给我。坦白说,我之所以收到这笔委托,只是因为我经常在 X 上发帖而小有名气。在 X 上玩好人气游戏会为加密货币领域带来更多机会,而这些机会很少有人知道。

现在,多个协议都联系我,感谢我投票支持他们的提案,或请求我支持未来的提案。每个未出现在 X f 信息流甚至 DAO 论坛上的 DAO 都有一个重要的关系建立过程。

说实话,我喜欢这个游戏。我坚信去中心化的未来,并希望发挥影响力。

玩家心态

你是否知道 Vitalik Buterin 在「暴雪从术士的「生命虹吸」法术中移除了伤害成分」之后不久就创立了以太坊?

「我哭着入睡,那一天,我意识到了中心化服务会带来何等恐怖。我很快就决定退出。」 —— Vitalik Buterin

Vitalik 决定退出魔兽世界,因为他觉得自己无法影响游戏规则。

加密货币的奇妙之处在于我们每个人都可以发挥作用并可以影响游戏规则。

和区块链一样,加密游戏也是去中心化的。风险投资家、散户投资者、建设者、KOL:我们都有自己的角色,有些人比其他人更有影响力。

Ansem、Murad 和其他 memecoin KOL 推动 memecoin 周期,但你可以决定不加入他们的游戏。

有点跑题了,但事实上我对风险投资在塑造叙事方面影响力之小感到惊讶。加密货币风险投资应该倡导他们的投资,但他们对 X 的关注却微乎其微。

他们真的不在乎吗?还是他们在玩另一种游戏?

一个显著的例子是 Multicoin 的 Kyle,他正在努力赚钱。更多的风险投资家应该分享他们对这个行业的看法,倡导他们的投资组合协议,并提供深入的研究来阐明当前的发展。

从我对加密货币风险投资家的采访来看,一个可能的解释是,他们本质上只是钱更多散户。

当 Vitalik 在玩魔兽世界(2007-2010)时,我正在玩另一款 MMORP 游戏——天堂 2。

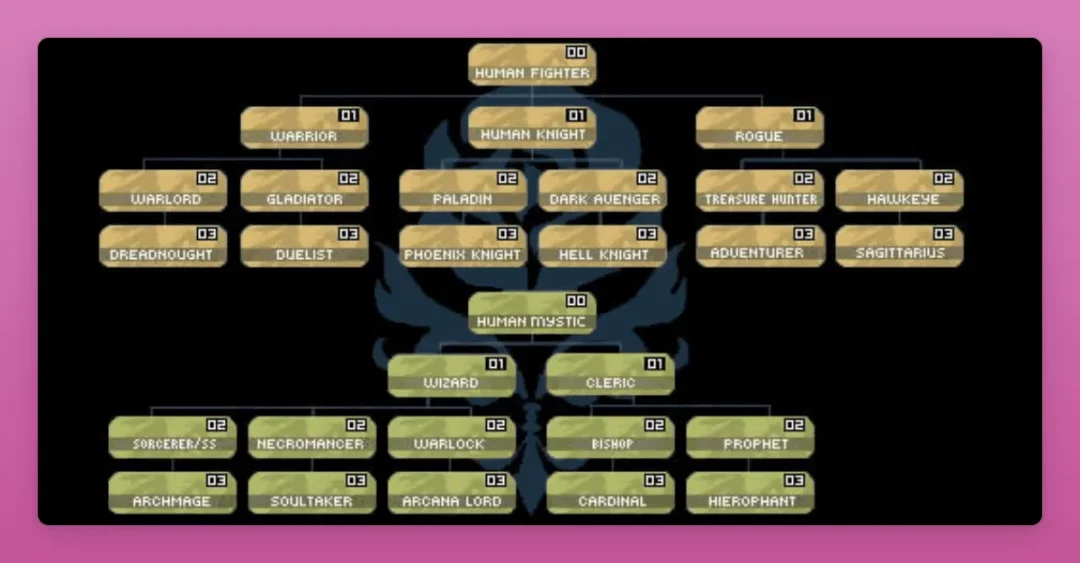

在 天堂 2 中,你可以选择一个种族(人类、精灵、兽人等)和职业(战士、神秘主义者)。

你可以通过完成任务和击败敌人获得经验(XP)来升级,升级可解锁新能力、更好的装备以及访问更具挑战性的内容。

我花了两年时间刻苦钻研,每天只睡几个小时。这些记忆深深地刻在了我的脑海里,并塑造了我对加密货币交易的看法。

就像你在游戏中获得 XP 一样,在加密货币中,你可以通过学习区块链、学习 DeFi、研究代币经济学等来获得 XP。你磨练得越多,你就会做得越好。

但你必须注意你的 HP(生命值)和 MP(法力值)。

HP 和 MP 就像是你的健康、财务稳定性和情绪恢复能力。加密货币和游戏都需要不懈的努力,你不可避免会感到倦怠。在加密货币领域,保持领先、不断监控市场和不错过趋势的压力创造了一种高压环境,就像在一场无尽的游戏中,你无法选择退出。

在上个牛市周期中我精疲力竭,所以现在我通过每三个月休息一段时间来管理我的「HP」。

以这种视角看待加密货币,我是不是很奇怪?

在人口统计学上他们也有相似之处:加密游戏以男性为主,而 MMORPG 玩家中只有约 35% 是女性。

韩国人对加密货币的痴迷程度不亚于他们对电子竞技(如英雄联盟)的痴迷程度,甚至超过了「真正的体育运动」。

我想说的是,游戏玩家的心态可以帮助你在加密货币领域脱颖而出。只需选择正确的游戏并了解你在游戏中的角色即可。

在 Naval 著名的短帖「如何不靠运气致富」中, 他 15 次提到了「游戏」和「玩」!他的建议是:

- 不要理会那些地位游戏玩家,他们通过攻击那些财富创造游戏玩家来获得地位。

- 选择一个你可以与他人进行长期合作的行业。

- 玩迭代游戏。生活中的所有回报,无论是财富、人际关系还是知识,都来自复利。

我最喜欢的一句是:

- 积累特定知识对你来说就像玩游戏一样,但对别人来说则像是工作。

那么,你在加密领域玩的是什么游戏?

你在加密货币中扮演什么角色?

近年来,加密货币变得越来越复杂。在 2020 年之前,成功就是投资 ICO 和在 CEX 上交易那样简单。从那时起,加密货币领域的新游戏爆炸式增长:DeFi、L2、NFT、RWA、Runes、Memecoins 等等。

你如何跟上?

你是专攻某一领域还是试图「一网打尽」?

在 MMPORG 游戏中,你首先要选择种族,然后选择职业。在天堂 2 中,我决定选择最不受欢迎的选项,因为我想脱颖而出,提高成为「英雄」的机会。

我选择了人类召唤师,随着经验值的积累,然后我专攻术士,然后是奥术领主。这是最不受欢迎的职业,因为它的专长是使用宠物击败敌人。

类似地,你可以从学习加密货币的基本技能开始,然后可以专注于主动交易、DeFi 收益、memecoin、DAO 等。

许多人缺乏学习特定技能的决心,经常在没有真正理解的情况下在各种叙事之间跳转。他们错过了掌握特定行业博弈论背后复杂机制所需的知识。他们成为了退出流动性。

实际上,在赚钱的同时从一个叙事跳到另一个叙事可能是一项特殊的技能。你意识到金钱轮换游戏,并设法在钱转到另一个叙事之前卖在顶部。但是,你擅长这个吗?

不过,我相信在现阶段的市场中,专业化可以带来丰厚的成果。

专业化可以是任何东西,比如:

- Crypto Koryo 擅长 Dune 仪表板创建工作并将其货币化;

- USD Denominated 专注于稳定币市场,驾驭市场的复杂性,获取最高收益;

- Andy 全身心投入模块化领域;

- wale.moca 专注于 NFT;

- Bold Leonidas 每天都会发布加密漫画。

但一定要留意有影响力的人说了什么,因为他们的动机往往与你想象的不同。他们玩的游戏与他们宣传的游戏不同。你不想玩那些规则对你不利的游戏。例如,Ansem 招募名人并以某种方式赚钱。

你认为我为什么在 X 上发帖?

我在 X 上发帖的目的是:1)随时了解市场,2)吸引客户到我的 DeFi 创作者空间 Pink Brains,最近 3)建立我的影响力并获得代币委托投票。

这种策略使我能够探索多个主题,即使我不是其中任何一个主题的专家。

但是,当你开始在 X 上增加粉丝时,你会选择一个你热衷的领域。随着你的粉丝越来越多,你的话题也应多样化。发帖可以提高你的影响力,所以每个人都应该这样做。

成为影响者就像成为天堂 2 中的英雄一样。你的角色会获得一种特殊的光环,不仅可以提升你的属性,还可以让你向整个服务器广播你的信息。我选择了最不受欢迎的角色,因为它成为英雄所面临的竞争更小。

你们中的许多人都在加密货币公司工作,工作迫使你们专注于营销、做市或销售等角色。这让你们比那些将加密货币当作业余爱好的人更有优势:利用行业关系、获得见解,甚至影响游戏规则。

专业化现在是真正的 alpha 隐藏之处。

虽然持有 BTC 或 ETH 可以稳赚不赔,但要实现 100 倍回报,你需要更深入地挖掘,就像在已开发好的领域开采黄金一样。正如 Naval 所说,找到让你感觉像在玩乐一样的工作。

无论是 DeFi、链上钱包追踪还是 DAO 论坛狩猎 alpha ,都让好奇心引领你。通过积累特定知识,你将发现别人错过的机会。这个利基市场小到可以逃脱大玩家的雷达追踪,但大到可以让你盆满钵满,加密货币游戏可能是你的金矿。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。