原文作者:Duo Nine

编译|Odaily星球日报(@OdailyChina)

译者|Azuma(@azuma_eth)

编者按:BTC 的价格于今晨再度突破 70000 美元大关,看起来一切都在向好发展。然而,YCC 创始人Duo Nine 却指出了比特币网络的一项隐忧,其认为在比特币网络的费用结构转换之际,各大生态的封装版 xBTC 以及 ETF 等衍生投资产品实际上是在抽离比特币网络的价值,是在对比特币网络进行“吸血鬼攻击”。

Duo Nine 认为,这一隐忧暂时看起来并不严重,但却已有日渐加剧的趋势,这或许会成为伴随着比特币网络共同发展的“癌细胞”,必须在现阶段给予重视。

虽然 Duo Nine 在关于其他生态封装代币方面的态度存在一定 bitcoin maxis 般的极端倾向,但其所指出的问题仍具备一定的思考意义。

以下为Duo Nine 原文内容,由 Odaily 星球日报编译。

比特币正在陷入困境。

如果不尽快做出改变的话,情况可能会变得不太好。

我不是在谈论减半时间或是区块奖励,问题比这些要严重得多。

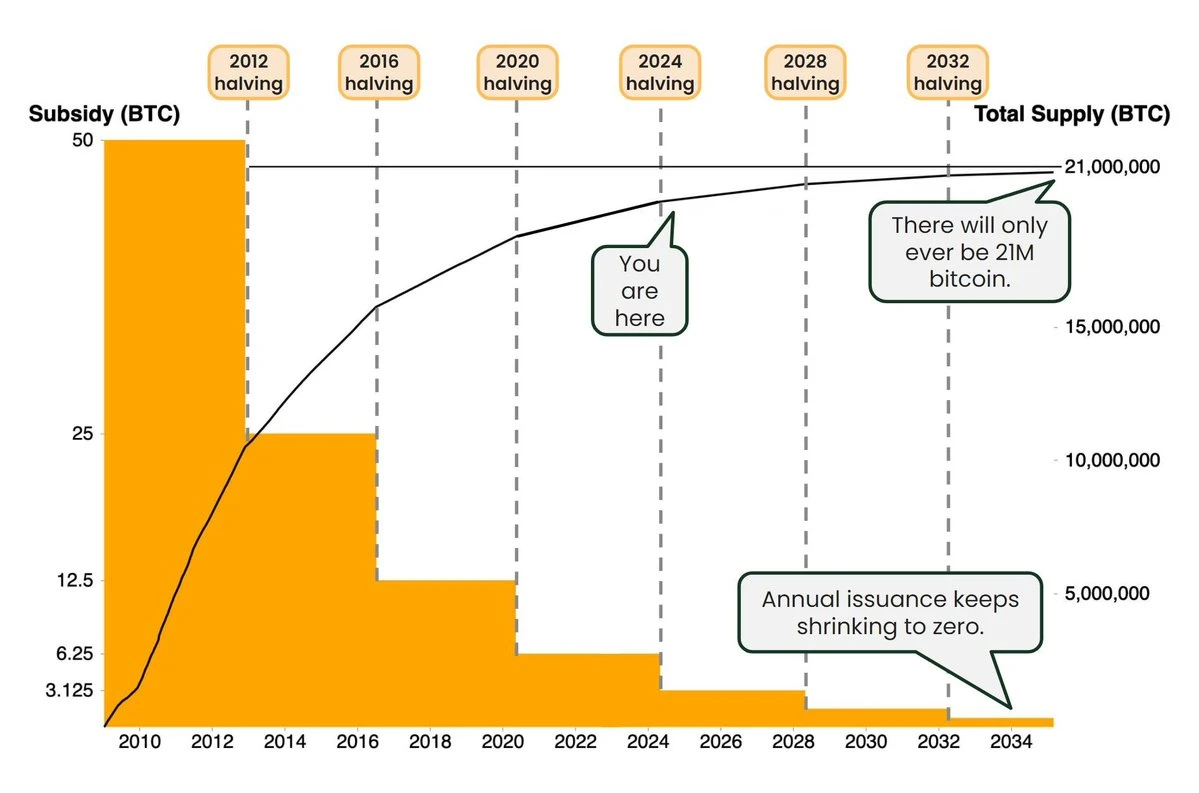

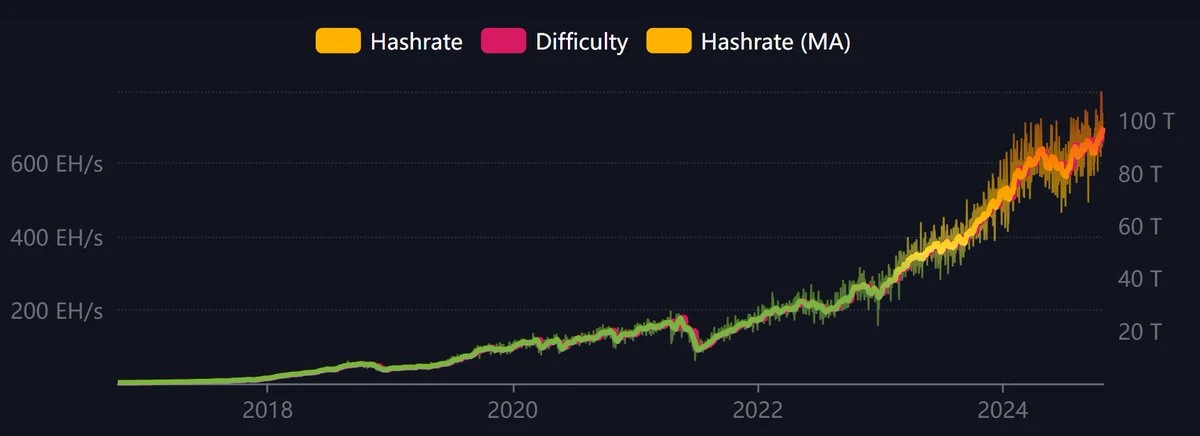

随着比特币网络的逐渐发展,交易手续费将逐步取代区块奖励成为该网络的主要费用构成。

这将是一个循序渐进的过程,需要几十年的时间。

然而,一个新的问题正在出现。这个问题比较难以预测,但现在已经出现了一些迹象。

这个问题与人们不再真正地使用比特币有关。

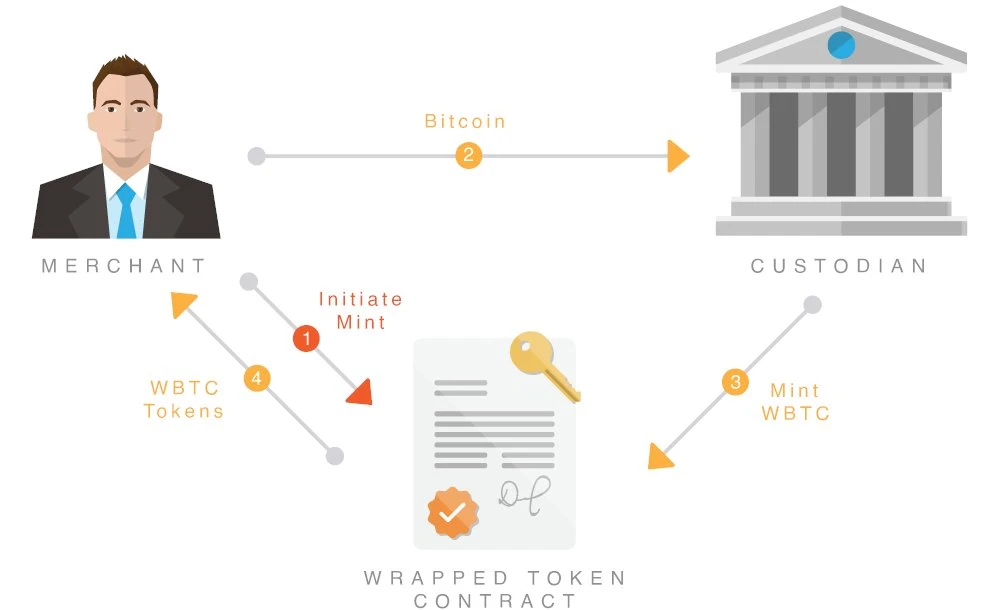

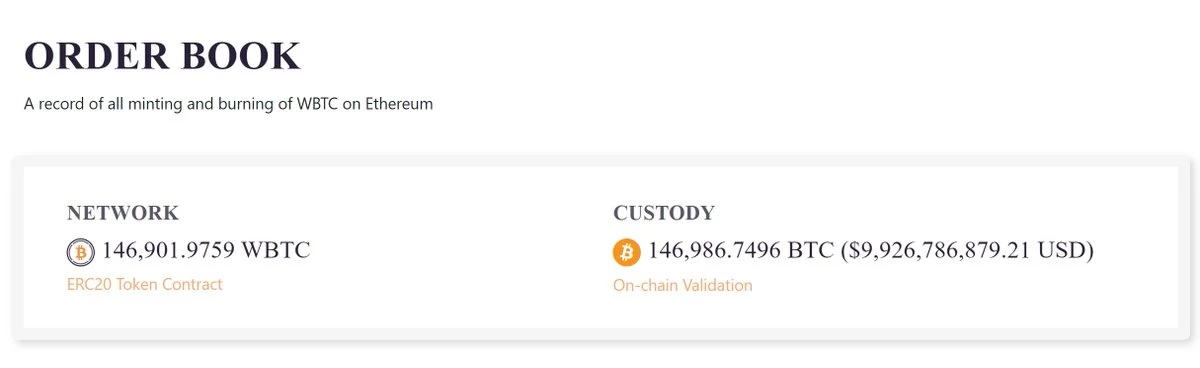

每当 BTC 被封装成 wBTC、cbBTC、tBTC、kBTC 或 solvBTC 时,都意味着原生 BTC 将被放置在网络之上的某个钱包中,且再不执行任何操作。

它不再移动,就意味着不再有费用。

该价值已被转移到以太坊或其他网络。然而这只是冰山一角。

随着 DeFi 的发展,越来越多的 BTC 将在原生网络上被静置,这些价值则将通过封装代币的形式流出。

BitGo 有 wBTC,Coinbase 有 cbBTC,Kraken 有 kBTC,Threshold 有 tBTC……显然,这种情况不会轻易停止。

十年之后,封装代币只会越来越多。

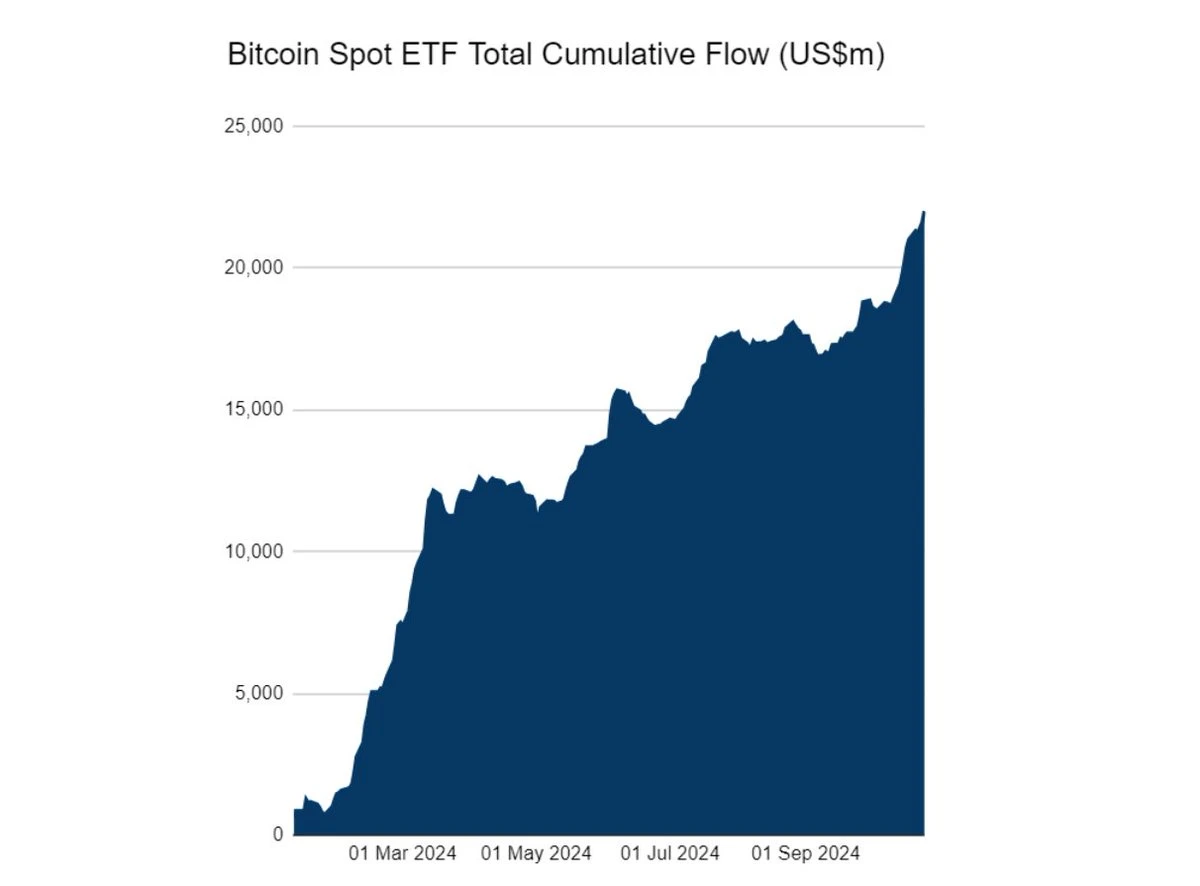

今年以来,已有 11 支比特币现货 ETF 获批,截至目前它们总计已购买了价值 200 亿美元的 BTC。

这些 BTC 在哪里呢?答案是在一些托管服务商的钱包里,它们也被静置着。

投资者们正在纳斯达克上积极交易比特币投资产品,但他们交易的是 ETF,而非原生的 BTC。

这和封装代币的情况类似,原生 BTC 的价值已被抽象而出,并流向了其他地方。

问题开始出现了。如果价值不断地流出,谁来为比特币网络的安全买单?

以太坊?纳斯达克?他们肯定不会。

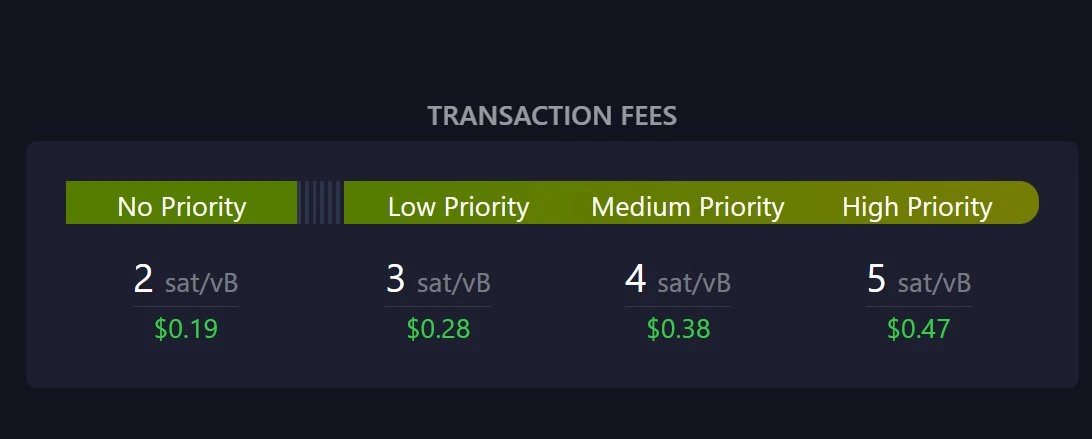

在常规预设下,随着费用结构的转换,用户本应在原生网络上继续进行交易,为矿工们累积费用。

然而实际情况却是,比特币正在被“锁进柜子里”,其价值正在被转移至其他链上,或是被抽象成 ETF 及其他形式。

在加密货币中,我们一般会将这种情况形容为“吸血鬼攻击”!

所谓“吸血鬼攻击”,即某条链或协议中的流动性和价值遭遇了虹吸,连同其用户一起被转移到了另一条链或协议中。

现在,比特币的攻击者们正在将这些价值装进自己的腰包。恭喜贝莱德,恭喜 Coinbase,你们正在胜利!

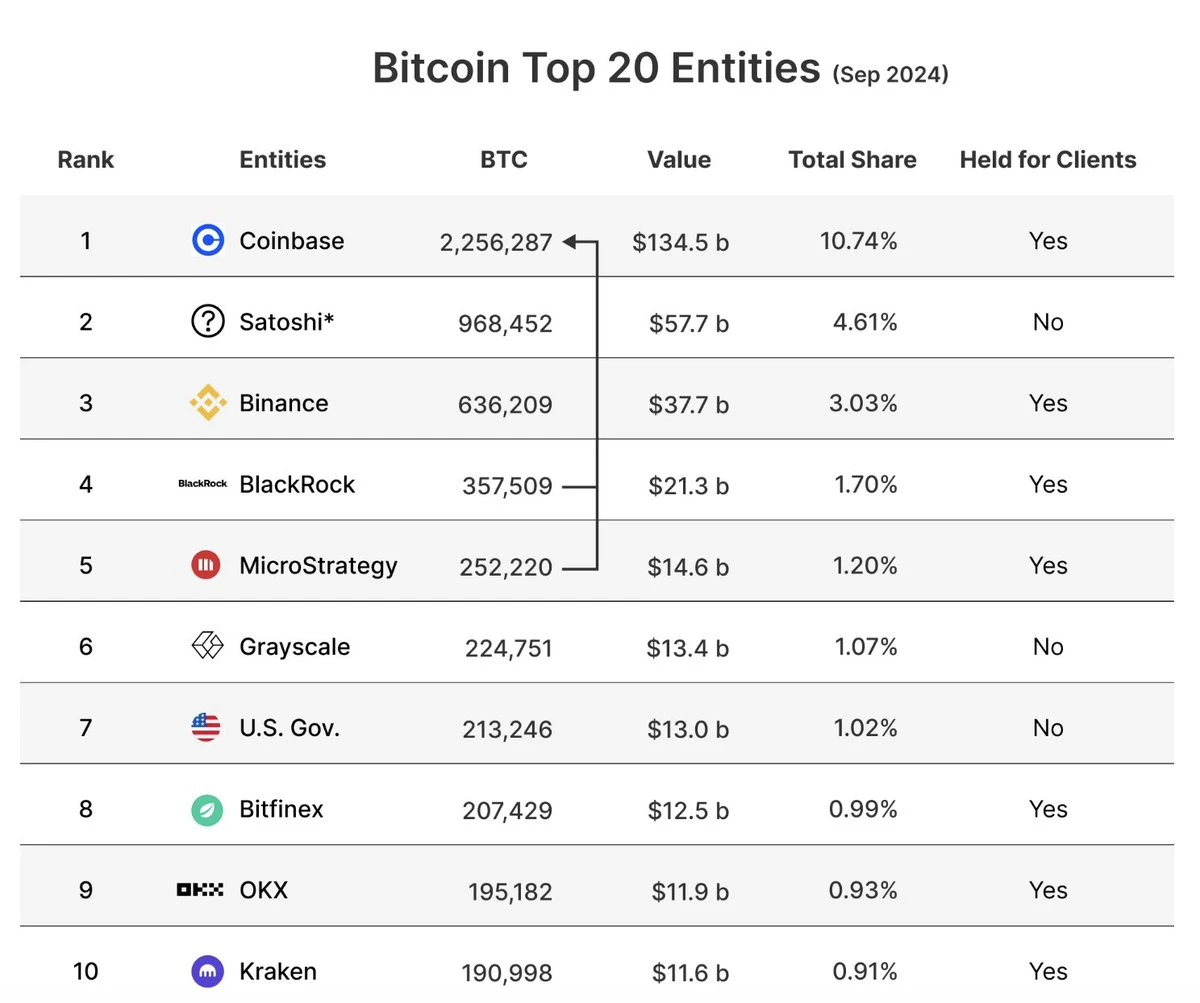

像 Coinbase 这样的托管服务商当前持有超过 200 万枚比特币,大量的 BTC 已被锁了起来,并逐渐被遗忘。

更糟糕的是,这一情况或将导致比特币落入第三方之手。

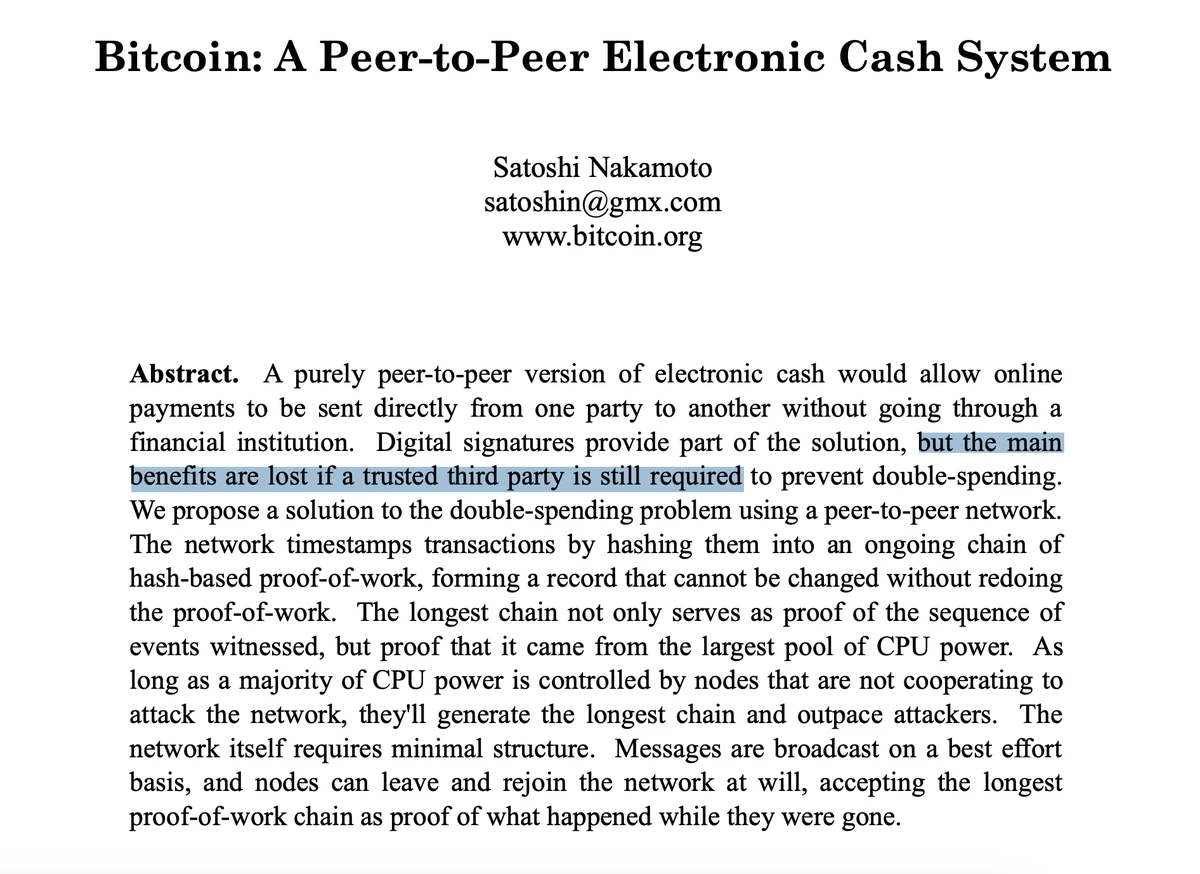

中本聪在白皮书中曾警告过我们这个问题:“只要在你和你的 BTC 之间存在第三方,价值就会丧失。”

贝莱德、Coinbase 也好,wBTC、cbBTC 也罢,他们所提供的仅仅是一张欠条。

他们保留着真正的 BTC,并给了你一个毫无价值保障的凭证作为交换(如果他们选择了食言的话)。

这对你自己以及整个比特币网络而言都是一个真正的危险。因为第三方可能会违背其承诺,第三方也可能从 BTC 的原生链中窃取价值,从而降低比特币网络的安全性。

好在,这个问题还不算“迫在眉睫”。未来二十年,比特币网络的区块奖励依旧可观。

与此同时,对比特币的需求也将继续增加,特别是来自第三方的需求 —— 他们随时准备利用比特币为自己谋利。

对此,你应该做些什么呢?

首先,尽量第三方代持你的比特币,依赖第三方就违背了比特币的初衷,也违背了你购买比特币的初衷。

最好的保管人永远是你自己。你应该在原生网络上持有比特币,而非依赖各种第三方。

其次,你应该真正地去使用比特币网络。随着ordinals 和其他一些新兴用例的发展,许多人正在比特币的原生网络上捕捉并保护其价值,在这样的操作模式下,比特币的价值永远不会被抽象而出。

继续使用比特币网络,就是对比特币的未来的最大投资。通过使用原生网络,你可以助力维护比特币的安全,你所支付的费用将被用于激励矿工保护网络安全。只要使用规模足够,费用结构的切换就可以实现无缝过渡。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。