More and more platforms like Pump.fun are adopting Metaplex's Token Metadata program to ensure that 90% of the tokens minted on Solana in the past three months are associated with Metaplex.

Author: Min Jung, Presto Research

Translation: Ismay, BlockBeats

Editor's Note: This article focuses on the implicit dominant position of Metaplex in the Solana ecosystem, as the core infrastructure for Solana digital assets. Metaplex supports the creation of the majority of NFTs and fungible tokens. In March of this year, Metaplex announced that 50% of protocol fees would be used to purchase MPLX and sent to the Metaplex DAO. In September, several crypto funds including Pantera Capital purchased a large amount of Metaplex tokens from Wave Digital Assets. The author analyzes the project mechanism and token economics of Metaplex in this article, demonstrating the long-term investment potential of Metaplex. As Metaplex continues to expand in the infrastructure field and broaden its support for fungible tokens, its indispensability and growth potential in the Solana ecosystem make $MPLX an undervalued asset worthy of investor attention.

Figure 1: The implicit dominant position of Metaplex in the Solana ecosystem; Source: imgflip, Presto Research

Metaplex is the core pillar of the Solana ecosystem, responsible for the generation of over 99% of NFTs and 90% of fungible tokens on the network. Through tools like Core and Bubblegum, Metaplex enables creators to efficiently mint and manage digital assets, establishing its position as the core infrastructure for Solana digital assets.

Given Metaplex's market dominance and strong revenue growth, $MPLX is currently undervalued. As Metaplex expands to more blockchains and broadens its support for fungible tokens, its influence and utility continue to grow, making it an attractive long-term investment project. The ongoing buyback plan further enhances the value of the token.

By strategically taking long positions on $MPLX and short positions on $TNSR, one can capture the benefits of Metaplex's dominant position while hedging the risks of the NFT market. Despite Metaplex's relatively low fully diluted valuation (FDV), its generated fees far exceed Tensor, and it has no direct competitors, while Tensor faces challenges from competitors like Magic Eden. This trade can capture the growth opportunities of Metaplex in a competitive market while reducing risk.

Introduction

What makes a great company? While this question can be answered from various perspectives, a clear indicator is occupying a dominant position in a growing market. In the Solana ecosystem, names like Jupiter or Pump.fun may come to mind, each with its unique advantages. However, Metaplex is a hidden giant. Despite being relatively unknown, 90% of tokens and 99% of all NFTs on Solana are created through the Metaplex protocol. Most users are not even aware of their interaction with it when paying for Metaplex services, and these fees are subsequently used for strategic buybacks of its native token $MPLX. Now is the time to consider Metaplex as a key player in the Solana ecosystem.

What is Metaplex

The Metaplex protocol is a decentralized platform built on Solana that supports the creation, sale, and management of digital assets. By providing tools and standards for developers, creators, and businesses, Metaplex supports a variety of digital assets, from NFTs and fungible tokens to real-world assets (RWAs) and in-game items. To date, Metaplex has minted over 550 million unique assets through more than 5.5 million unique wallets, making it one of the most widely used blockchain protocols and developer platforms.

Key Products of Metaplex

Core

Core is the next-generation NFT standard on the Solana blockchain. This innovation adopts a single-account design, significantly reducing minting costs and alleviating the burden on the Solana network, giving it a competitive edge over other protocols.

Its features include high cost-effectiveness, low computational power, support for advanced plugins, and mandatory royalty payments, setting a new benchmark for NFT standards.

Bubblegum

Bubblegum is the program used by Metaplex to create and manage compressed NFTs (cNFTs). Through compression technology, creators can mint a large number of NFTs at a very low cost, with the minting cost for 100 million NFTs being only 500 SOL, providing unprecedented scalability and flexibility.

Token Metadata

The Token Metadata program allows for additional data to be attached to fungible and non-fungible tokens on Solana. While NFTs are the primary use case, the program also supports semi-fungible and fungible assets. All tokens created on Pump.fun rely on Metaplex's metadata service.

Core/Candy Machine

Metaplex's Candy Machine is a leading NFT minting and distribution program that efficiently and fairly launches NFT collections. It has become the preferred solution for creators to release NFTs on Solana, ensuring a decentralized and transparent issuance process.

Other services include MPL-Hybrid, Fusion, Hydra, and Sugar, further expanding the platform's influence in various verticals of digital asset standards.

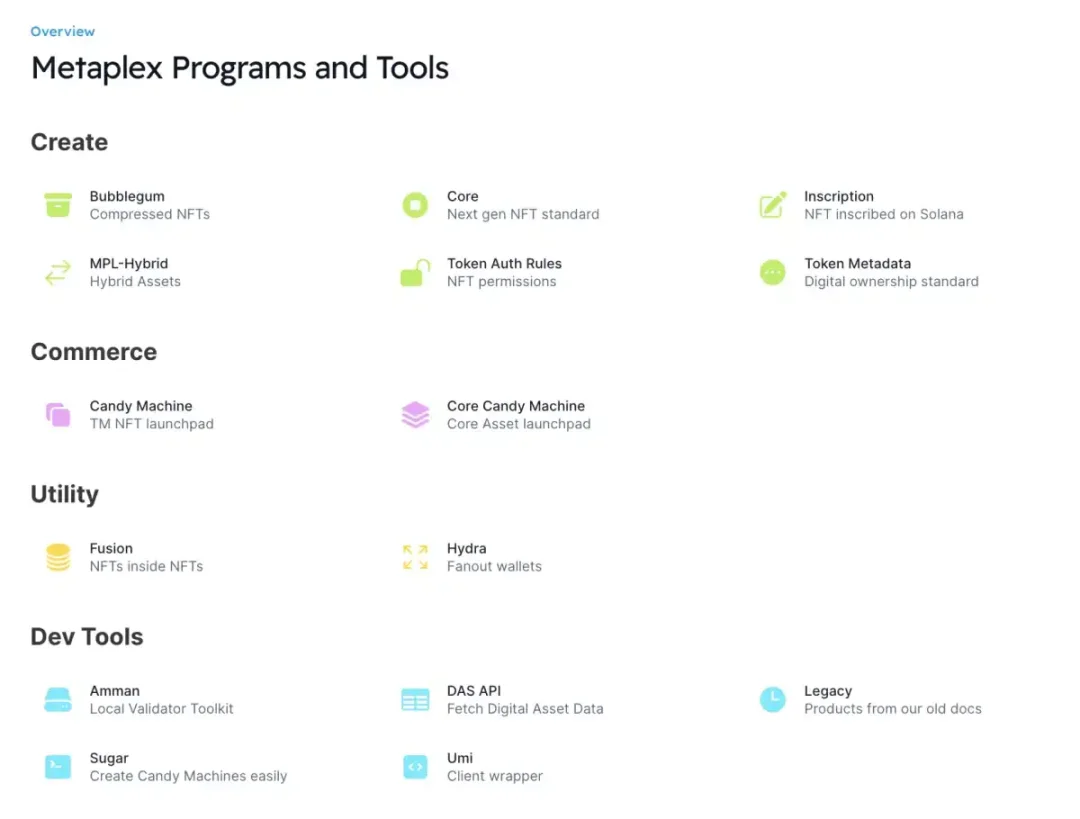

Figure 2: Overview of Metaplex projects and tools; Source: Metaplex

In summary, Metaplex is the foundational protocol supporting the creation of the majority of NFTs and fungible tokens in the Solana ecosystem, becoming the standard for digital asset creation.

Key Data

Recent performance data from Metaplex demonstrates its dominant position in the Solana ecosystem, particularly in the past three months:

(1) August 2024:

- Minted 10.2 million digital assets

- Created 382,000 fungible tokens, accounting for 90% of all fungible tokens minted on Solana

- 3.93 million unique wallets directly interacted with Metaplex

- Total number of collectors reached 57 million unique wallets

(2) July 2024:

- Minted 16.5 million digital assets

- Created 451,000 fungible tokens, accounting for 91% of fungible tokens on Solana

- 5.3 million unique wallets used the protocol

- Total number of collectors reached 56 million wallets

(3) June 2024:

- Minted 30 million digital assets

- Created 452,000 fungible tokens

- 6.57 million unique wallets interacted with Metaplex

- Total number of collectors reached 55 million wallets

Since its inception, Metaplex has created over 257,000 collections and 5.12 billion NFTs, bringing in $1.2 billion in revenue for creators.

History

Metaplex was initially incubated by Solana Labs and led by former Solana Labs product lead Stephen Hess. Since 2021, the team has been operating independently, focusing on building products to help creators and brands mint NFTs and launch decentralized applications. This solid foundation has attracted high-profile supporters, earning Metaplex a reputation as a leader in technology innovation and industry.

Some recent important news includes:

In January 2022, Metaplex raised $46 million from Multicoin Capital, Jump Crypto, with additional support from Solana Ventures, Alameda Research, and Animoca Brands.

In September 2024, Pantera Capital and ParaFi Capital acquired a large amount of $MPLX tokens from FTX assets.

Notable investors also include Modular Capital, Syncracy Capital, and Frictionless Capital.

Investment Thesis

Dominance and Expansion into New Areas

Metaplex's dominant position in the Solana ecosystem is undeniable. It supports the creation of 99% of NFTs and 90% of fungible tokens on Solana, establishing its undisputed position as a provider of digital asset infrastructure. This level of market penetration makes it difficult for any competitors to challenge Metaplex's dominant position in the short term.

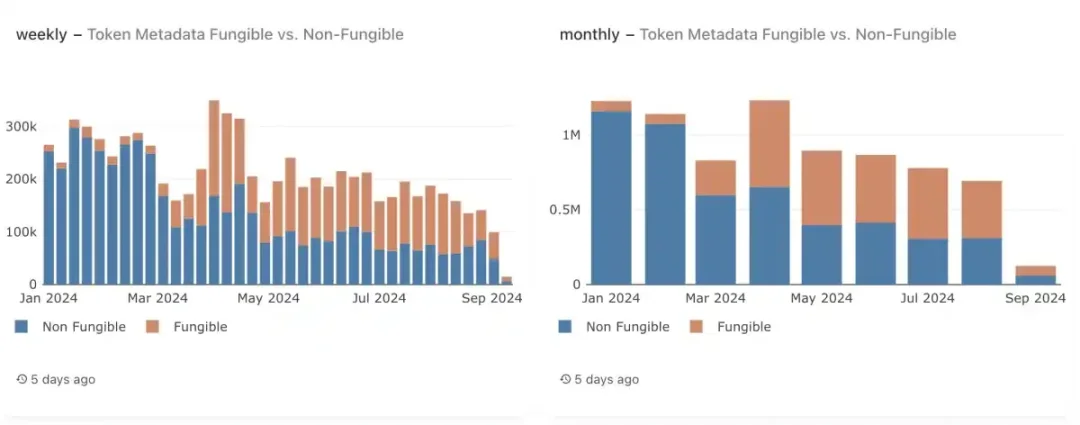

Despite fluctuations in the broader NFT market, Metaplex's role as a key infrastructure has enabled its successful expansion into the realm of fungible tokens, proving its utility far exceeds that of NFTs. More and more platforms like Pump.fun are adopting Metaplex's Token Metadata program, ensuring that 90% of tokens minted on Solana in the past three months are associated with Metaplex. This broadens its use cases and establishes Metaplex as a cornerstone for the creation of both fungible and non-fungible tokens.

Figure 3: Growth of Metaplex's influence on fungible tokens (FT)

Looking ahead, Metaplex is preparing to expand its influence to two highly anticipated networks, Sonic and Eclipse. Sonic is Solana's first Layer 2 solution designed for sovereign games, providing particularly attractive opportunities for growth. As the integration of gaming and blockchain deepens, the role of NFTs in in-game assets is crucial, and Metaplex is well-positioned to support this new wave of digital asset creation.

At a time when the NFT market may be at a low point, Metaplex is poised to benefit from a market recovery, and its expansion into the creation of fungible tokens further reduces its reliance on the cycles of the NFT market. As new layers and use cases develop within the Solana ecosystem, Metaplex's role as an infrastructure provider will become even more indispensable.

Token Economics and Buyback Mechanism

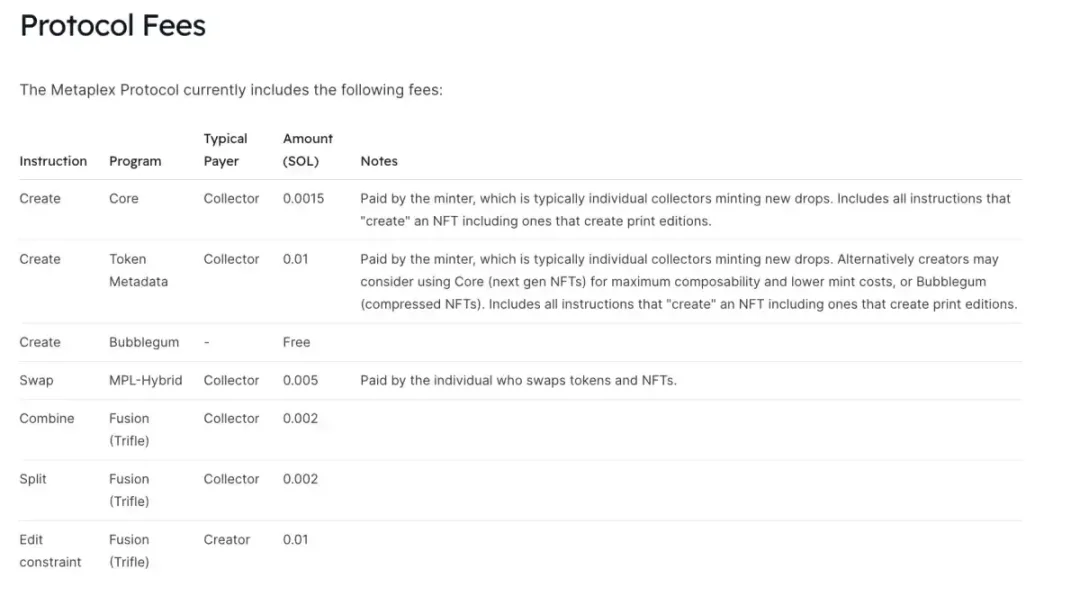

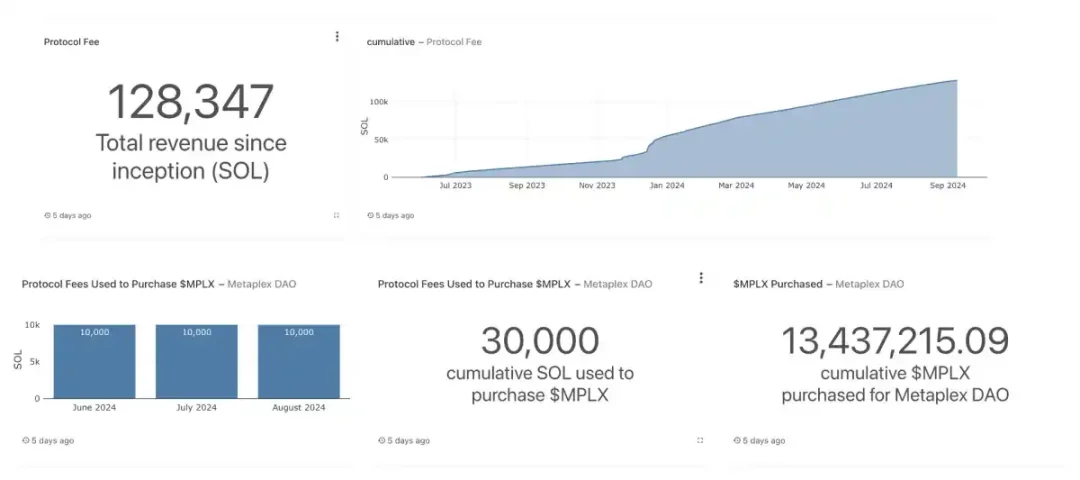

Much of Metaplex's attractiveness stems from its token economics and strategic buyback plan. In May 2023, Metaplex introduced a small fee mechanism to support the long-term development of the ecosystem, especially for projects like Core and Token Metadata. To date, the total revenue generated since its launch has reached 128,347 SOL.

Figure 4: Details of protocol fees for each project; Source: Metaplex

In March 2024, Metaplex committed to using 50% of all protocol fees to buy back $MPLX and transfer the repurchased tokens to the Metaplex DAO. This allocation includes historical fees and future fees, ensuring the continuous accumulation of $MPLX in the DAO treasury. The remaining 50% of fees is used for the ongoing development of the Metaplex Foundation.

Since June 2023, Metaplex has been repurchasing $MPLX worth 10,000 SOL per month. As of August 2023, the total amount of repurchased MPLX reached 13,437,215 tokens (approximately 30,000 SOL). With the rise in SOL price, the value of these repurchases will also increase accordingly. Currently, 10,000 SOL is approximately equal to $1.4 million, accounting for over 1% of Metaplex's market value, becoming an important and stable force in reducing circulating supply.

Figure 5: Total revenue and $MPLX buyback in the past three months; Source: Metaplex Public Dashboard

Pair Trading Opportunity: Long $MPLX, Short $TNSR

Figure 6: Metaplex's performance over the past year; Source: Coinmarketcap

Through a pair trading strategy of going long on $MPLX and short on $TNSR (Tensor), one can capture the opportunity for $MPLX to rise while hedging the risks of the broader NFT market. This strategy is based on three main reasons, believing that $MPLX is undervalued relative to $TNSR:

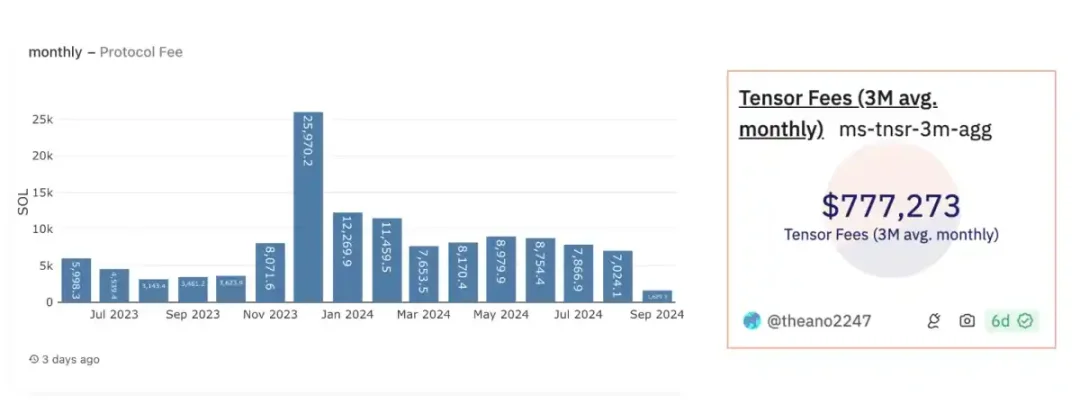

Higher fee income: Over the past three months, Metaplex has generated fees comparable to or even greater than Tensor, mainly due to its continued dominant position in the NFT and fungible token space. However, the current fully diluted valuation (FDV) of $TNSR is $350 million, significantly higher than $MPLX. This difference indicates that $MPLX is undervalued relative to its revenue potential, especially with the strong support of the ongoing buyback plan.

Monthly average fees for Tensor in the past three months: $777,273

Monthly average fees for Metaplex in the past three months: 7,956 SOL (conservatively estimated at $130 per SOL, approximately $1,034,323).

Figure 7: Comparison of Metaplex fees and Tensor fees; Source: Metaplex Dune Data Board

No direct competitors: Unlike Tensor, which faces fierce competition from Magic Eden, Magic Eden is planning to launch its own token, potentially capturing market share. Metaplex, on the other hand, has no direct competitors in the infrastructure space, consolidating its position as a pillar of the Solana digital asset ecosystem, further supporting its long-term value.

Hedging NFT Market Volatility: For investors concerned about the volatility of the NFT market, $MPLX offers a more diversified opportunity. Metaplex's influence has now expanded into the realm of fungible tokens, no longer relying solely on NFTs, providing exposure to a wider range of assets and reducing dependence on the NFT market.

The current undervaluation of Metaplex may be related to its role as a behind-the-scenes infrastructure provider—unlike more consumer-facing platforms like Tensor or Pump.fun, most users interact with Metaplex's products without being aware of it. Therefore, despite its significant impact on the Solana ecosystem, the token has not entered the public eye. However, as Metaplex's contributions to the ecosystem continue to grow, this perception may change, and market attention will also increase.

Conclusion

Metaplex has quietly become a cornerstone of the Solana ecosystem, supporting the creation of over 99% of NFTs and 90% of fungible tokens on the platform. While its critical role in the ecosystem is well known, it has not received the attention it deserves, quietly operating behind the scenes as users interact with its infrastructure unknowingly. This implicit dominance of Metaplex, coupled with a strong token economics and robust buyback strategy, makes $MPLX an undervalued asset. The protocol's stable revenue growth driven by increasing fees in the NFT and fungible token space supports ongoing buybacks, further enhancing its value over time. As Metaplex continues to expand its influence, support new use cases, and solidify its market position, the potential for an increase in $MPLX's value also grows. For investors looking to make long-term investments in the infrastructure of the Solana ecosystem, Metaplex offers a unique opportunity to invest in a project that has proven its dominance, continues to grow, and has tremendous potential.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。