作者:深潮 TechFlow

过去一周,ETH 主网的链上行情已经不能用简单的“热闹”来形容了,老鲍一句降息让本就开始活跃的链上行情再度回春:每天一个金狗打底,到了周末更是一天出现两三波行情,主网 Gas 也一度飙升到 70Gwei 左右,在链上呼吸一下都很贵。

从找概念到卷角度,「互不接盘」的情绪蔓延到MEME上

具体到最近的链上行情本身,用“割据混战”来形容较为精准。在打工人眼中转瞬即逝的周末,对链上选手来说可谓是相当饱和充实。

Doge 创始人的狗、马斯克的「火星城」计划、特朗普银币等等各种概念携其全家桶代币轮番上阵,好像不来点新概念就浪费了这波链上的情绪和流动性。

然而市场进化到现在,新概念显然不足以满足 PVP 的热情,Meme 行情已从“找概念”升级到“卷角度”上:新的炒作概念一出现,紧接着就有各种同名代币如雨后春笋般冒头涌现,新的旧的大的小的各种自圆其说的角度轮番上阵。

远的不说,单就周末爆发的马斯克「火星城」这一个概念就出现了好几个大市值标的:$TERMINUS(火星城名称1)、$BAR(火星城名称2)、各种宇宙飞船、星际酒店、宇航员狗子......更别说每个币还要分出个大小写。

很明显,「互不接盘」这个现象已经细分到了 Meme 行情上,你买大写我就买小写,你冲三个点的 D.O.G.E 我就冲四个点 D.O.G.E. 主打一个各玩各的。各路大神疯狂找角度的行为好像是在争夺这个叙事的“最终解释权”,直到越来越多的人认可这个角度,最终从升级版 PVP 中获得胜利,为了不给别人抬轿子,大家确实都拼了。

各种叙事轮换交替带来一个又一个千万市值,各种暴富神话也接连出现。然而在链上市场有“暴富”故事,自然也有“暴负”故事。

拿捏人性弱点,阴谋集团也玩心理战?

脆弱的「叙事」

即使在众多概念与角度中赢得胜利后,土狗玩家们也还是会面临诸多“不可抗力”的威胁。就好比「V神的狗」概念中的 $MISHA,一天之内从 0 拉到 2000 万美金市值,却在第二天因为V神一句“我没有养狗”直接市值腰斩再腰斩,在短时间内持有者疯狂内卷出逃,Gas 在踩踏下跌期间飙升,与价格一起自由落体的还有无数人的暴富梦。

是的,有些瞬时而起的所谓「叙事」经常站不住脚,由名人一句话而起的脆弱热度,也能因为一句话就立刻熄灭。

然而,这种「叙事的脆弱性」却也被阴谋集团精准利用,在这个热情的周末给玩家设下一个又一个拿捏人性的陷阱。

硬核的叙事?

相较于中心化交易所,一级链上交易由于各种信息都更加透明且工具多样,个人的操作在有心人眼中几乎一览无余,所以链上世界,交易中的“搏杀”行为也更贴脸、更直接。

在周六,一个叫 $DOGGO 的代币横空出世,走势丝毫不拖泥带水,上线四个小时接近 2000 万美元市值,在许多人还在享受周末的睡眠时,$DOGGO 已经拉盘结束了。

进一步了解后,原来 $DOGGO 概念走的还是一个 OG 叙事:

狗狗币 $Doge 的创始人Shibetoshi Nakamoto在很早就将手中的 $Doge 全部卖光的事情老玩家应该都不会陌生。而这次 $DOGGO 项目方也在一开始就将 6.56% 的 $DOGGO 代币打给Shibetoshi Nakamoto, 并且Shibetoshi Nakamoto确实也给手中的 $DOGGO 全部卖了。这个「卖飞」的叙事之前就有很多项目玩过,然而这次Shibetoshi Nakamoto不仅“卖飞”,同时还在 $DOGGO 相关的话题上疯狂互动。

Shibetoshi Nakamoto这一互动行为在有心人眼中无异于模棱两可的“背书”,同时 $DOGGO 简单粗暴的 OG 叙事增添一份阴谋集团的色彩。厌倦了脆弱叙事和 PVP 的 Degen 们一看这架势那还得了,聪明钱包纷纷买入。于是在许多人还反应过来的情况下,$DOGGO 的价格一路长虹。

有人站台,有人买单,价格上涨市值飙升,似乎 $DOGGO 距离“上所”的终极目标也不算遥远。然而 $DOGGO 接下来的剧情让人再次清醒意识到链上世界并不是温柔的幻想乡,反而一直都是血腥的黑暗森林。

庄家控盘变社区接管,涅槃的背后却是阴谋集团的设计搏杀?

走势反转再反转

$DOGGO 爆火还不到一天,狗狗币创始人Shibetoshi Nakamoto又明确表示不对任何 Meme 币负责,即否认了之前对 $DOGGO 的背书行为。

此言一出,前几天刚被 $MISHA 这种脆弱叙事教训过的玩家们可能立马警觉起来,这还咋办?跑吧!再加之社区内不断的 Fud 言论,大额钱包的批量卖出,$DOGGO 的走势从回调变成了砸盘。

但这次 $DOGGO 并没有一跌再跌,最后归零。而是在许多人恐慌抛售后立马 V 反,价格直接水灵灵地拉回下跌之前的价格,甚至第二天直接宣布已经 CTO(社区接管),夜里迅猛的 Fud 暴跌好像从未发生过。即使是在宣布 CTO 之后,$DOGGO 价格仍然迎来了二次下跌,仿佛这次 CTO 也是阴谋集团为了套人的谎言,散户又慌了,$DOGGO 市值又跌到 600 万美元附近,和夜里那次暴跌相仿。

然而就在许多人认为 $DOGGO 这次真的完蛋之后,是的,$DOGGO 价格又双叒叕翻转了,这次市值从 600 万美元一路拉盘,直至突破新高到了 2000-3000 万美元区间。

看起来, $DOGGO 在两天内经历了一次又一次再一次的翻转,从阴谋集团到社区接管的“涅槃”,社区信任一步步建立,当前价格持续上涨也是“社区力量”的成果。

然而事情真的那么简单吗?

不是涅槃,更像洗盘?

在 $DOGGO 闹了那么一出后,有人指出这次事件并不像表面那么简单,$DOGGO 的所谓的“涅槃”更像一次次多重翻转的“洗盘”,社区接管什么的也只是阴谋集团深度洗盘的托辞。

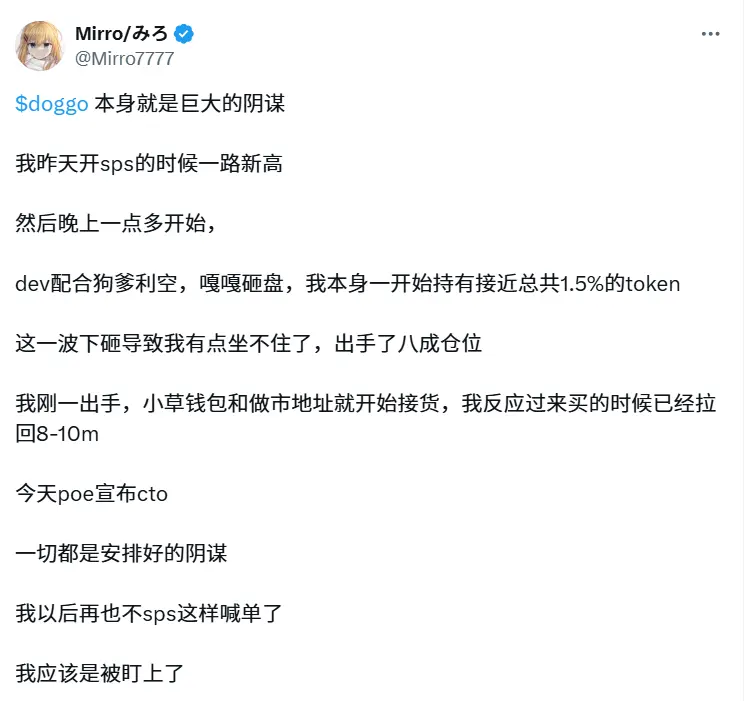

链上玩家@Mirro7777表示自己就是本次 $DOGGO 洗盘的目标之一,在深夜 DEV 配合消息面利空深度砸盘的过程中抛售了 $DOGGO 总量 1% 左右的筹码,地址也从盈利变成亏损。

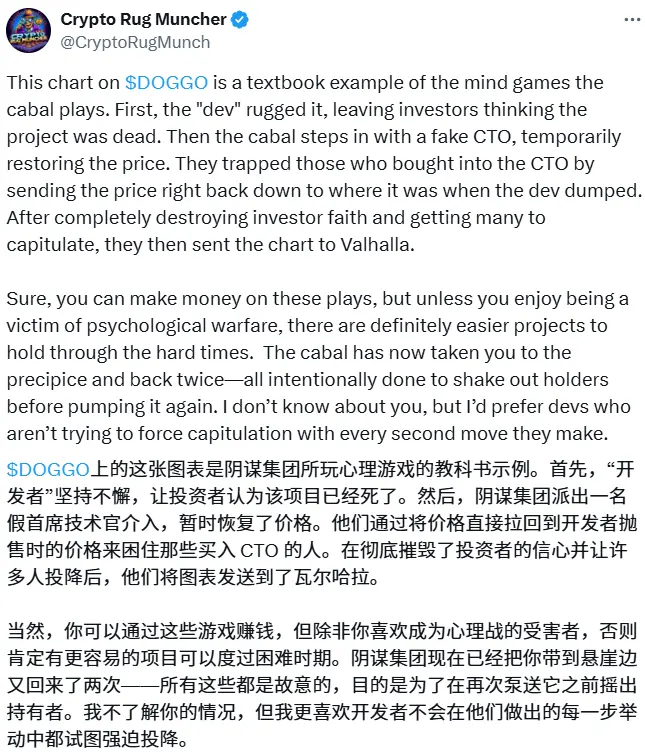

同时对阴谋集团颇有研究的用户@CryptoRugMunch也发文直言 $DOGGO 的这波花式操作是阴谋集团玩弄心理战的教科书级案例:

先砸盘+Fud 让散户恐慌抛售 → 宣布 CTO 让价格暂时修复 → 再来一次深跌彻底摧毁散户信心 → 散户纷纷抛售离场后直接拉盘破前高

同时@CryptoRugMunch也提到这次 $DOGGO 的阴谋集团从未离开过,且每次下手都是为了让散户坚定投降,除非你喜欢成为心理战的受虐者,否则市场上有更好的项目供你选择。

小结

因为利益分配问题 or 共识不同而开始卷概念、找角度“分家”这回事也早已不算新鲜,当初 BTC、ETH 的硬分叉在本质上也有相似之处。只不过不像硬分叉一般有个“体面”的由头,现在 Memecoin 的“分家”原因则更加直接了:就是纯为了利益,同样炒一个概念,我凭什么去给你接盘?

在共识与共识的碰撞中,产生一个个不同的机会,阴谋集团 VS 社区接管显然是当下 Meme 市场较为认可的对抗模式。

大小写 Neiro 的对抗证明社区力量也有暴富的可能,也为市场点燃一波社区接管叙事的热度。

只是不怕有大割,就怕大割比你还努力,从 $DOGGO 的故事中可以看出现在的阴谋集团已经知道披着一层 CTO 的皮了。

链上流动性逐渐丰盈,对资深 Degen 来说尚且有被针对的可能,更别说大部分“涉世未深”的链上玩家。对于大多数人来说,加密世界仍是不折不扣的黑暗森林,在你 Fomo 上头的那一刻,就已经有无数个地址准备对你下手了。

市场环境一直在变,然而市场是负和博弈的这点是一直不变的。根据局势灵活变通,不要被幸存者偏差一叶障目,更不要盲目梭哈,时刻谨记亏钱的人还是大多数,祝你安好。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。