作者:Frank,PANews

在加密领域,DeFi已是最成熟的赛道之一,加密借贷作为DeFi当中占比最大的业务之一也成为加密市场最重要的经济发展引擎。但这个成熟赛道仍有创新出现,也在获得资本的关注。

不久前,去中心化的加密资产借贷协议Morpho宣布获得由 Ribbit Capital 领投的 5000 万美元融资,a16z crypto、Coinbase Ventures、Variant、Pantera、Brevan Howard、Kraken Ventures、Hack VC、IOSG等多家知名机构参投。

无论是加密领域还是传统互联网,这都是一个独角兽级别的融资规模。明星阵容加巨额融资,让市场对Morpho这个老牌DeFi项目再次产生极大的好奇。

将金融基础设施变为公共设施

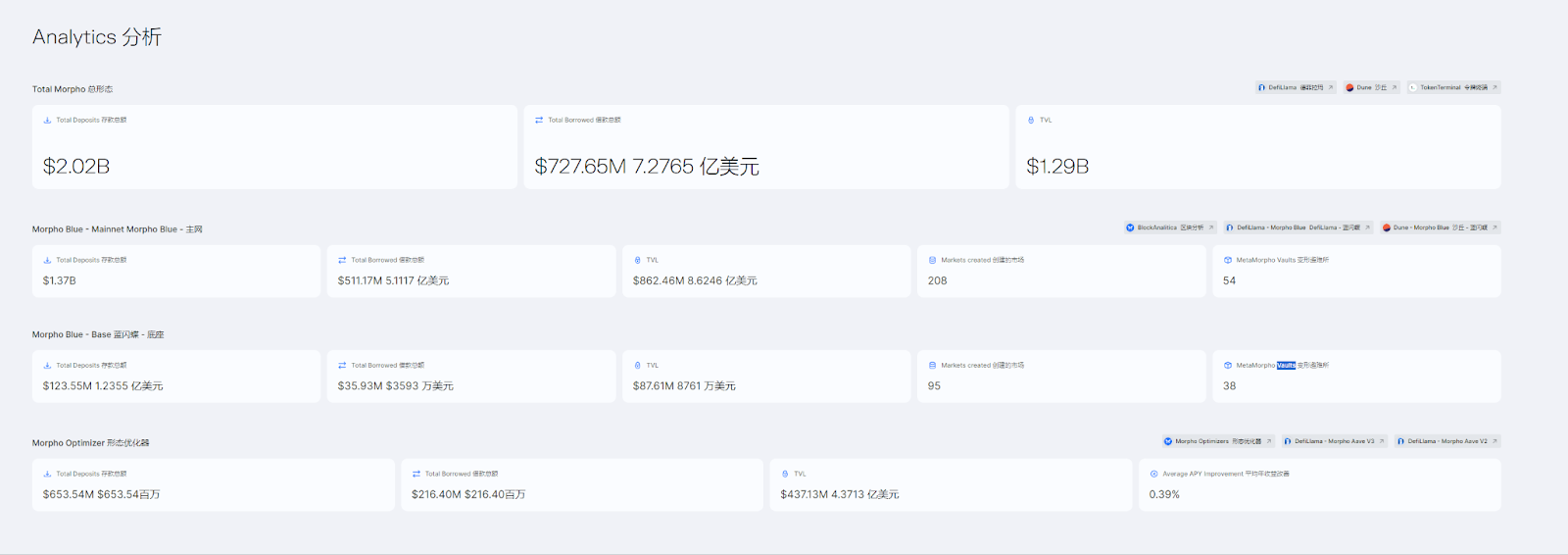

Morpho是一个去中心化的加密货币借贷协议,该项目成立于2021年,在2022年曾获得a16z 和 Variant 领投的1800万美元融资,加上本轮融资,总融资额已达到6800万美元。2022年,Morpho的主网上线,最初其主要产品是 Morpho Optimizer,一个Aave 和 Compound 之上的优化层,可以提高用户的利率。通过2年的发展,Morpho已经转变为一个完全独立的平台,不再依赖Aave或Compound。目前Morpho的资产供应量已超过30亿美元,成为加密领域应用最广泛的DeFi 协议之一。

相对于其他主流的DeFi 协议,Morpho采用无需许可的市场创建机制,使任何参与者都能设置新的借贷市场。该协议的设计主要目标是提高资金利用率和增强风险管理灵活性。具体表现在每个市场包含一种贷款资产和一种抵押资产,以实现每个市场都有不同的利率。Morpho还引入非托管的"Vaults"金库功能来优化跨市场的资金分配。

这些设计来源于Morpho的提出使金融基础设施成为公共产品的使命,Morpho提出,在该协议上创建市场和金库是无需许可的,以此鼓励竞争和创新。

“金融基础设施不应该是私有的,也不应该是国有的,而应该是全球所有的——这是全人类的公共利益,就像互联网一样”,因此,Morpho的产品主要围绕去中心化、无需许可和原始的设计。

一般来说,在底层设计上,大多数平台都是作为独立的借贷产品存在,有固定的功能和使用方式。Morpho则被设计为一个基础层,允许在其上构建各种金融产品和服务。此外,不同于传统平台由中央治理决定风险参数,Morpho允许市场自然形成,风险管理可以在协议之上以去中心化的方式进行。

年增长超180%,闯进行业前五

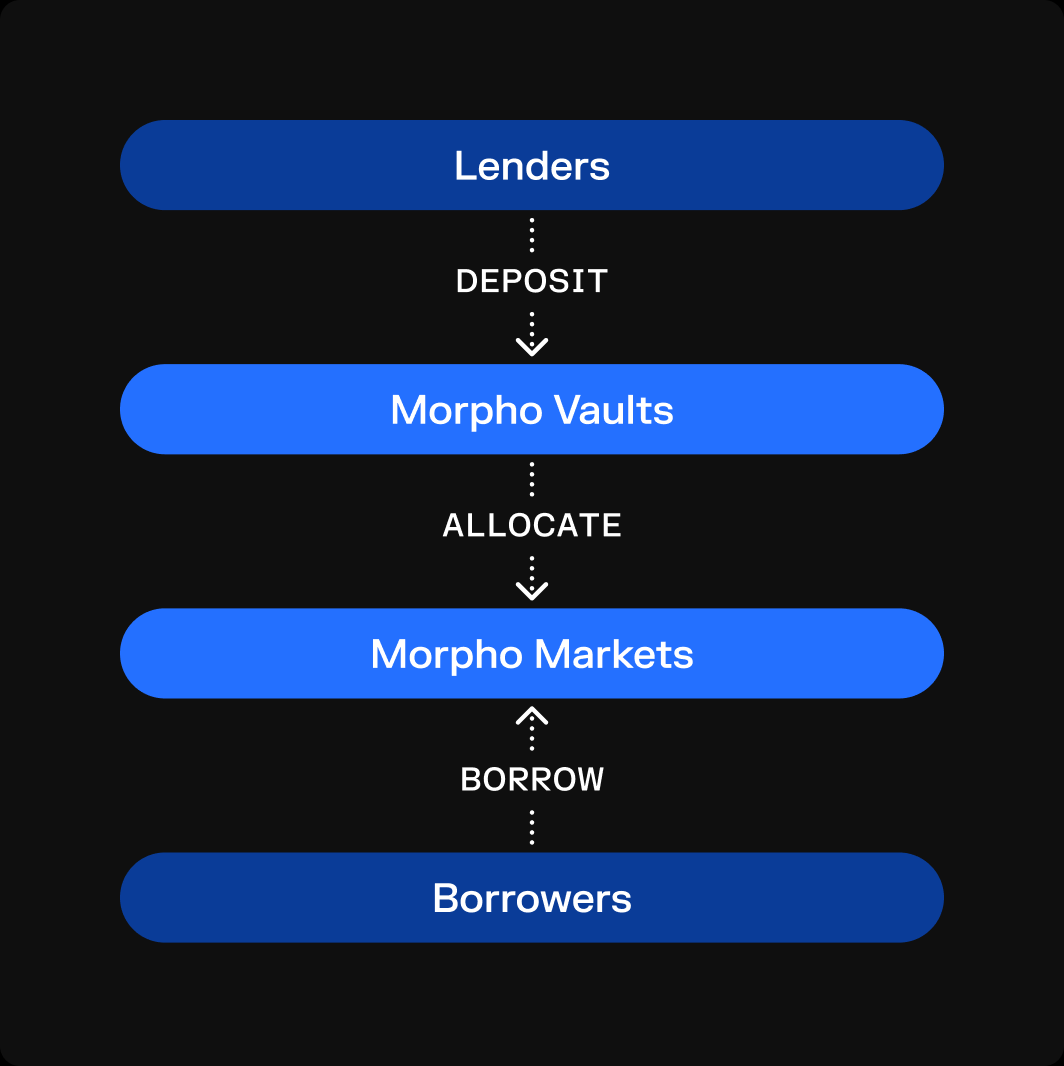

目前,Morpho推出的主要产品有两个部分,Morpho Markets和Morpho Vaults。其中,Morpho Markets是一个简单、不可变的单一贷款和抵押资产市场,其主要特点在于每个市场都是独立的,可以设置更高的抵押因子并通过利用自适应利率模型(AdaptiveCurveIRM)自动调整利率。

Morpho Markets的另一个特点是孤立的借贷市场,这一特点的优势在于当发生损失时,损失将立即由该特定市场内的所有供应商分担(即向该借贷池提供资金的用户),这种设计不需要在所有用户之间自动分担任何风险。

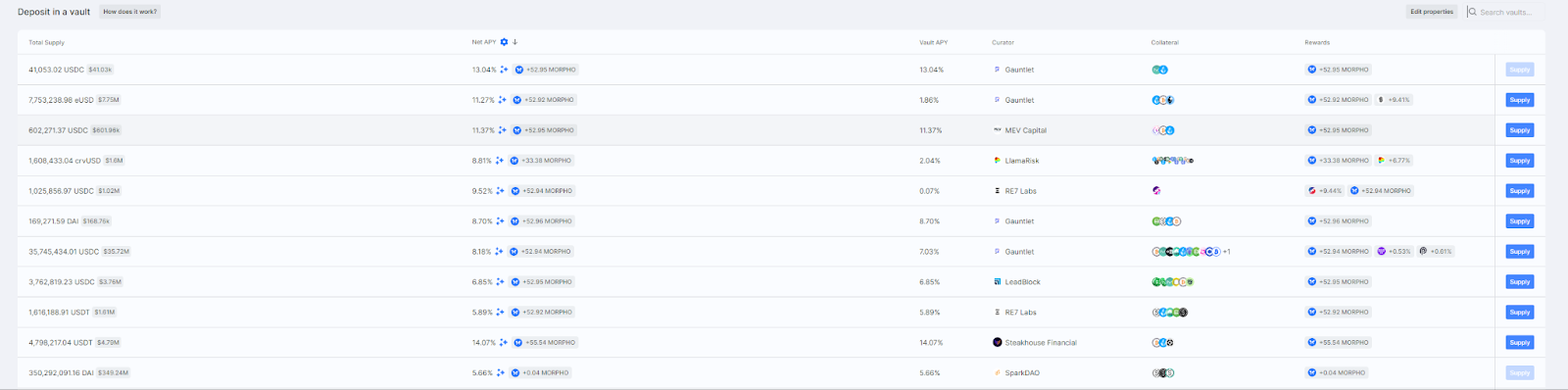

而Morpho Vaults(前身为MetaMorpho)是由外部风险专家策划的专业借贷金库,提供不同风险/回报选项。每个金库专注于一种贷款资产(如USDC),金库管理者可以从总利息中可以最高收取50%作为业绩费,不过目前来说大多数保险库只收取10%,为了吸引用户,一些保险库也选择0费用。对普通用户来说,同一种抵押品可以有多种选择。每个金库的收益和风险系数都有所不同,因此,即便只有一种资产,用户可以根据自己的风险偏好而存入不同的金库获取收益。

对个人用户而言,Morpho提供定制化的风险配置,可能实现更好的收益,和透明的非托管解决方案。而作为借款人,Morpho协议可以实现更高的抵押率,以此借出更多资金,提高资金的利用率。此外,Morpho目前的借款端不收取平台费用,而同类型的借款平台通常会收取20%~30%的费用,因此能够使得借款成本更低,利差也更小。

对开发者或企业来说,Morpho可以快速部署金库和市场,自定义策略和治理。同时对构建的金库和市场实现完全控制。此外,通过共享基础架构也可以节省开发时间和成本。

据官方数据显示,截至9月12日,在Morpho上创建的市场已经超过300个,Vaults金库数量超过90个。总存款超过20亿美元,总借款额约为7.27亿美元。近一年来,Morpho的总存款量增长了约180%,总借款增长了约72%。目前,Morpho的TVL数据在整个借贷市场当中排名第五。

从存款利率来看,Morpho目前上APY最高达到了11.4%,并有多个金库的APY在4%以上,普遍高于Aave(APY基本在3%~5%之间),而借款利率则与Aave差不多。另外,由于Morpho支持自建借贷金库,使得在Morpho上借款可以支持更多类型的资产。

从存款利率来看,Morpho目前上APY最高达到了11.4%,并有多个金库的APY在4%以上,普遍高于Aave(APY基本在3%~5%之间),而借款利率则与Aave差不多。另外,由于Morpho支持自建借贷金库,使得在Morpho上借款可以支持更多类型的资产。

年底前或打开代币转让开关

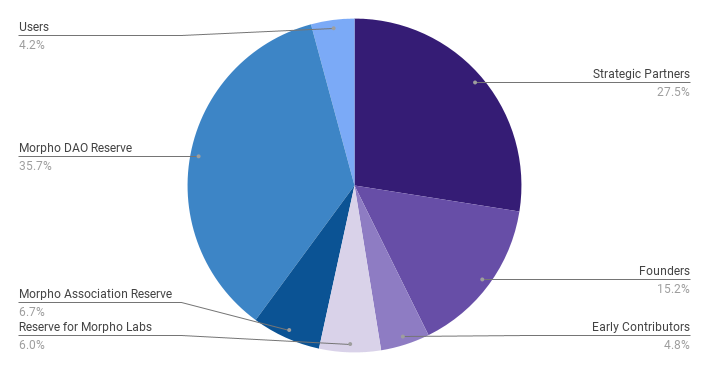

此前,Morpho曾推出治理代币MORPHO,该代币的最大总供应量为10亿枚。截至目前,MORPHO仍不可转让,主要用于投票权、激励机制和协议治理。截至9月13日,MORPHO的持有者为2059个地址。据官方介绍,当前,用户可以通过在 Morpho 协议上使用 Earn 或 Borrow 来赚取 MORPHO 代币,目前大约 4.2%的总供应量已分发给用户。

今年8月,Morpho DAO发起了关于放开MORPHO代币可转让性的讨论,从风向来看,社区内绝大多数用户对放开可转让性表示支持,如果这一治理顺利,将有较大可能在年底前正式推出代币。近期,Morpho也迎来更多合作者的加入。包括Coinbase刚推出的cbBTC和Lombard的LBTC也将在Morpho上部署。9月5日,Token Terminal上线Morpho看板。目前,已有Aragon、Contango、Safe、SummerFi 、Stream等数十个生态伙伴在Morpho 上构建了项目。

可以预见的是,Morpho近期披露获得的大额融资,加上近期正在推进的代币可转让计划,Morpho或许可将通过积分或者空投等激励活动进一步推动市场的活跃度,从而扩大自身更大的市场份额。

在Morpho官方宣布融资消息的公告中这样表述,“Morpho 的潜在影响远超当前的 DeFi 市场,因为该协议有能力成为去中心化基础设施,以支撑一个真正全球化、互联网原生的金融系统”。随着更多变化悄然发生,Morpho正逐渐成长为足以挑战行业龙头的新晋势力。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。