U价格下跌之际,为何身边还有很多人疯狂兑换美元!

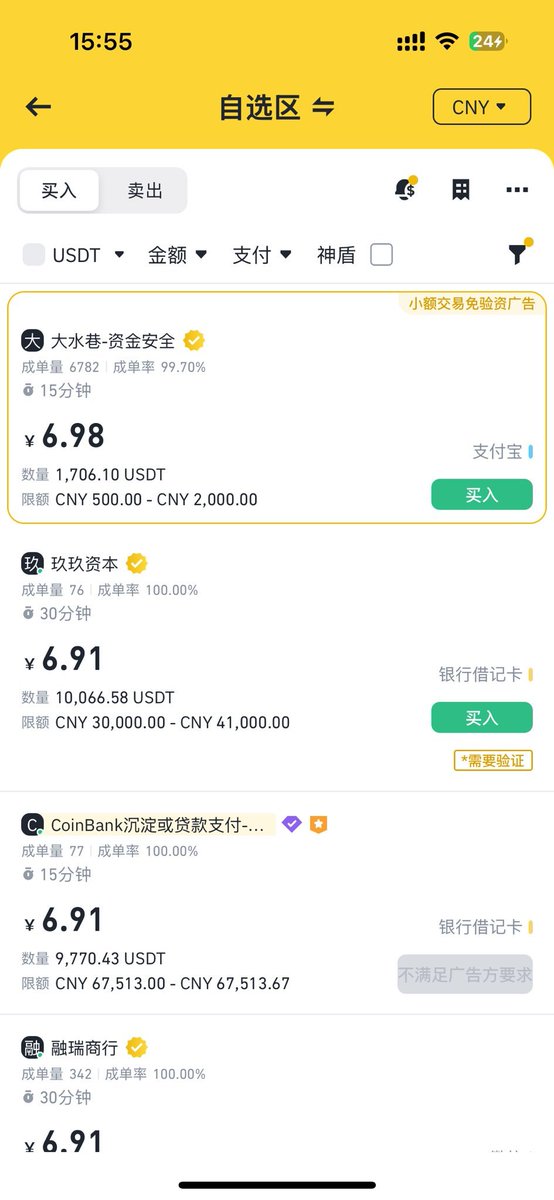

最近美元降息,使得RMB升值比较厉害,也给本来不好的出口生意,更加难做。最近很多加密圈朋友抱怨持U也被割,但身边传统行业的老板们,正在趁这一波RMB升值在加速出逃!

我讲讲大概逻辑:

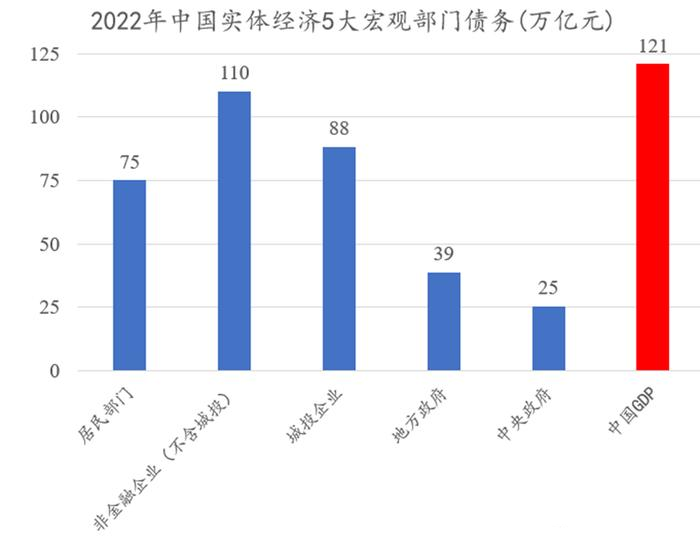

1.中美债务水平与GDP比值。这里只能拿到22年数据,目前中国整体债务水平为337万亿RMB,折合47.73万亿美金,这两年地方债更加严重,以城投为隐形债主体,体量只会比88万亿只多不少。但同期23年中国GDP为17.89万亿美金,债务/GDP比重为266.8%。(23年数据)

美国债务主要是政府联邦债务为主+居民债务+机构债,政府债务为30.2万亿美金+15.5万亿+2万亿,总体为47.5万亿美金,美国23年GDP为27.37万亿美金,债务/GDP比重为174.2%。(23年数据)

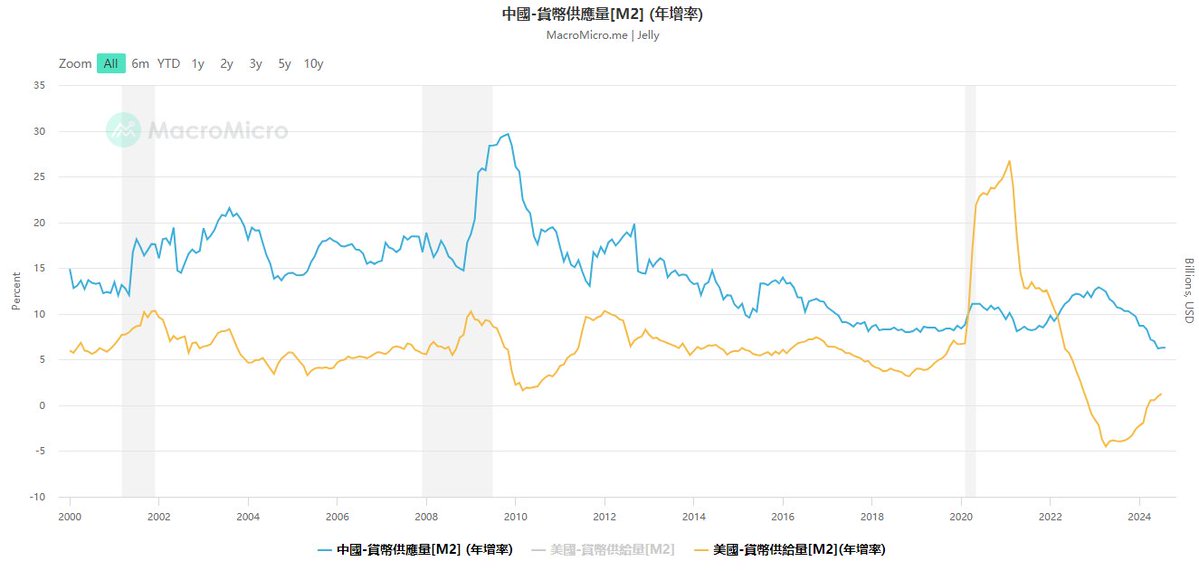

2.M2增速。中国过去10年平均M2增速为10.12%,美国过去10年平均M2增速为6.69%。M2增速可以理解为货币超发的速度。

3.肉眼可见的中美经济的状况,以及中国可实际感知的每况愈下。678三个月,无论CPI,PPI,PMI数据,都不容乐观,表征的特点就是通缩加剧。尤其是作为制造业大国,中国的PMI已经从5月份开始,就一直在荣枯线以下。叠加最近RMB升值,出口数据会更加艰难!

如上所述,最近鼓吹RMB升值,大多外行看热闹,内行看门道,而作为传统行业,征战多年的一线老板们,他们的行为和动作,会更加有代表性,也更加智慧!现在是换美金的好时间,而不是反过来!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。