原文作者:Will阿望

原文来源:Web3小律

2008 年的比特币白皮书,为我们描绘了一个无需可信第三方的点对点电子现金支付网络。支付是数字货币与区块链技术最早为我们作出的承诺之一,也是中本聪面对当时失效的金融体系给出的区块链解决方案。

虽然在过去十年间,行业投入了数十亿美元来开发底层区块链基础设施,如今我们也能够看到如 Solana 这样的高性能区块链以及稳定币的爆发性崛起。但是当前市场的大多数基础设施依旧是围绕交易而构建,并不能真正支持支付的实时性和规模性,这也阻碍了 Web3 支付的大规模普及。

那么我们需要什么样的基础设施来承载现实世界的支付场景?什么又是 PayFi 的价值与意义?

在本文中,我们有幸与 PayFi 基础设施——PolyFlow 的联合创始人 Raymond Qu 进行了深度对话。与其说是对话,不如说是去理解和学习这位拥有二十多年国际金融咨询管理经验的前辈,在全球视角下对于数字金融的全方位思考与实践,以及他对于数字货币与区块链技术的深刻理解。

Raymond 对国际市场的创新金融服务具有独特的眼光。在他的领导下,汇元通(Geoswift)成为覆盖国际支付、跨境汇款、外币兑换及预付卡业务的综合性全球金融服务公司。同时,他也是全球数字金融领域的知名投资者,投资标的覆盖金融科技、数字银行、区块链、Web3 和人工智能领域的多家领先公司。Raymond 亦是加拿大国家开发银行的高级顾问,中国国务院发展研究中心金融研究所的专家组成员。

一、创立 PolyFlow 的初衷

PolyFlow 是区块链网络的基础设施层,旨在将传统支付、Web3 支付与去中心化金融(DeFi)进行整合,通过去中心化的方式来处理现实世界中的真实支付场景。PolyFlow 将作为 PayFi 的基础设施,来推动建立全新的金融范式与行业标准。

在具体谈及 PolyFlow 之前,Raymond 首先对金融交易的本质作出了解释,帮助我们能更好地理解 PolyFlow 的真正价值。

1.1 金融交易的核心

在传统的金融市场中,任何金融交易以及价值转移都离不开交易的信息流与资金流,他们共同构成了金融交易的基础。

信息流(Information Flow)是指交易流程中的信息,包含交易发起、支付和结算指令集合,它确保了交易的准确性和及时性,关注的是交易指令和数据的传输。

资金流(Fund Flow)是指在交易环节中各方发生资金转移的全过程,关注的是资金的实际流转。

信息流和资金流在金融交易中是密不可分的,两者的有效结合,共同确保了金融交易能够安全、高效地完成。

1.2 跨境语境下的信息流与资金流

由于语言、币种、监管的不同,在跨境语境下金融交易的信息流和资金流实现路径亦是不同的。例如大家耳熟能详的 SWIFT,仅专注于信息流的传递,其实并不涉及资金流。SWIFT 通过标准化的报文格式,构建了一个高度标准化和自动化的国际金融通信网络,使得全球范围内的银行能够快速、准确地交换金融交易信息。交易的信息流能够通过 SWIFT 得到充分的传递,但是资金流受限于各司法辖区外汇管制、监管合规、反洗钱等因素,并不能够做到与信息流一样实时同步。资金流依旧需要通过各国银行金融中介机构进行流转,并会涉及复杂的各国国内清算体系、结算货币的跨境支付清算体系,以及国际收付清算体系。更加阻碍全球价值流动的是,对于资金流的处理而言,就算你拥有了 SWIFT CODE,也并不代表你能够拥有参与这个网络的资格。

1.3 通过 PolyFlow 促进价值流通

这就来到了创立 PolyFlow 的初衷:搭建一个去中心化的基础设施,让更多人能够参与全球支付网络的构建,帮助减轻监管合规压力,消除资金托管的风险,同时尽可能地减少第三方的介入。

PolyFlow 的核心理念是通过模块化的设计,将此前由中心化机构掌控的交易信息流与资金流进行有效分离,用去中心化的方式使交易的各个流程能够更好地符合监管合规标准、消除资金托管风险,同时利用区块链的特性来连接 DeFi 生态,促进 PayFi 应用的大规模落地。

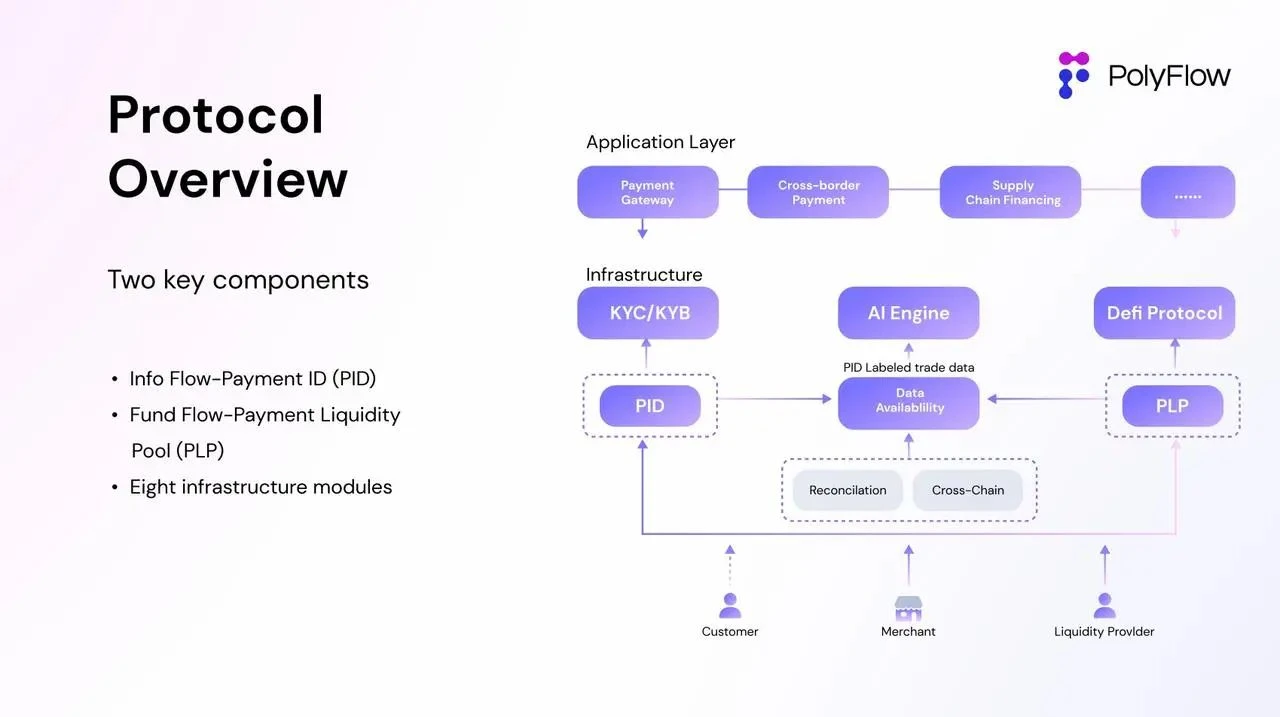

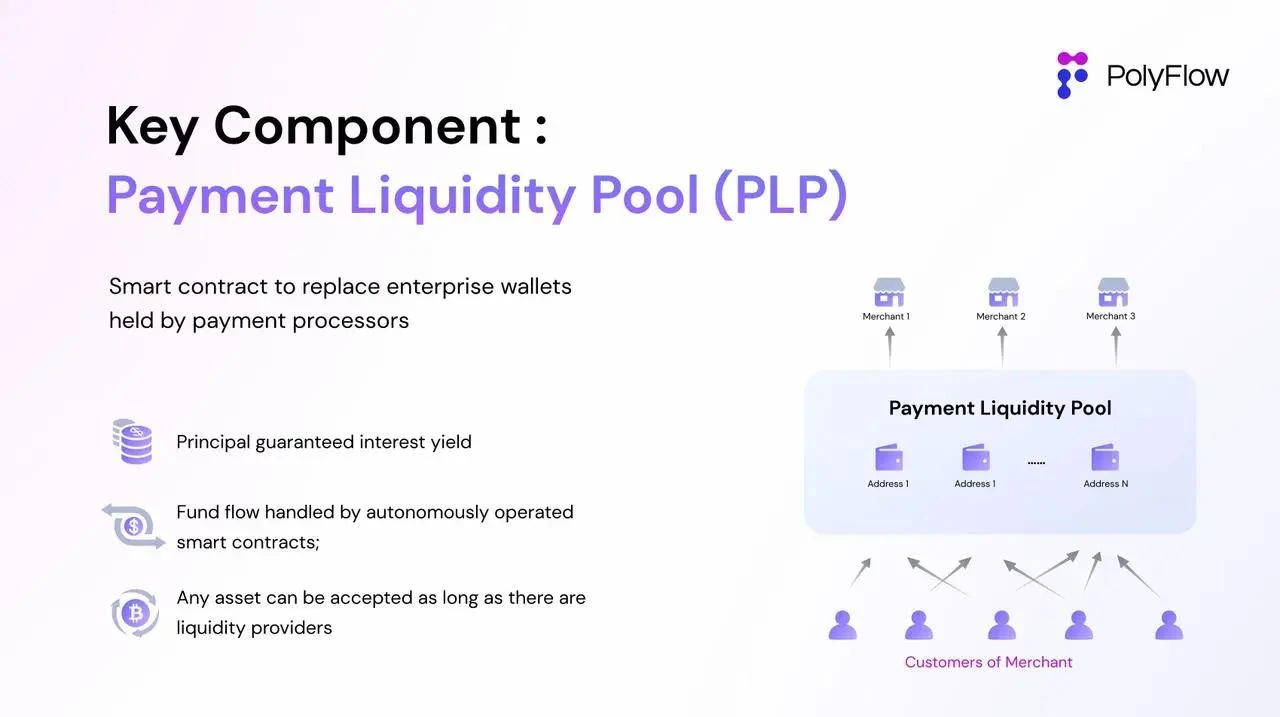

PolyFlow 推出了 Payment ID(PID)和 Payment Liquidity Pool(PLP)两个关键组件:

PID 与信息流关联,作为能够实现用户身份识别与合规准入、隐私保护与数据主权、AI 数据处理、X to earn 等功能的强大工具;

PLP 与资金流关联,由智能合约管理用于支付交易的资金,不仅能够为数字资产的流转、托管和发行提供安全合规的框架,还能够引入 DeFi 生态的可组合性和可扩展性。

由此,PolyFlow 从整体上为 PayFi 应用搭建了一个轻监管合规、无托管风险、兼容 DeFi 生态的业务架构,以及数字资产流转、托管和发行的安全合规框架。

要明白中本聪构建的比特币及其区块链网络,代表了诞生于数字时代对金融货币问题新的解决方案,不仅仅旨在解决人类社会恒古存在的问题:如何让价值跨时空、跨空间地流动,还旨在解决交易中对第三方的信任问题。这些都是 PolyFlow 旨在实现的。

二、PID——链接物理世界和数字货币钱包

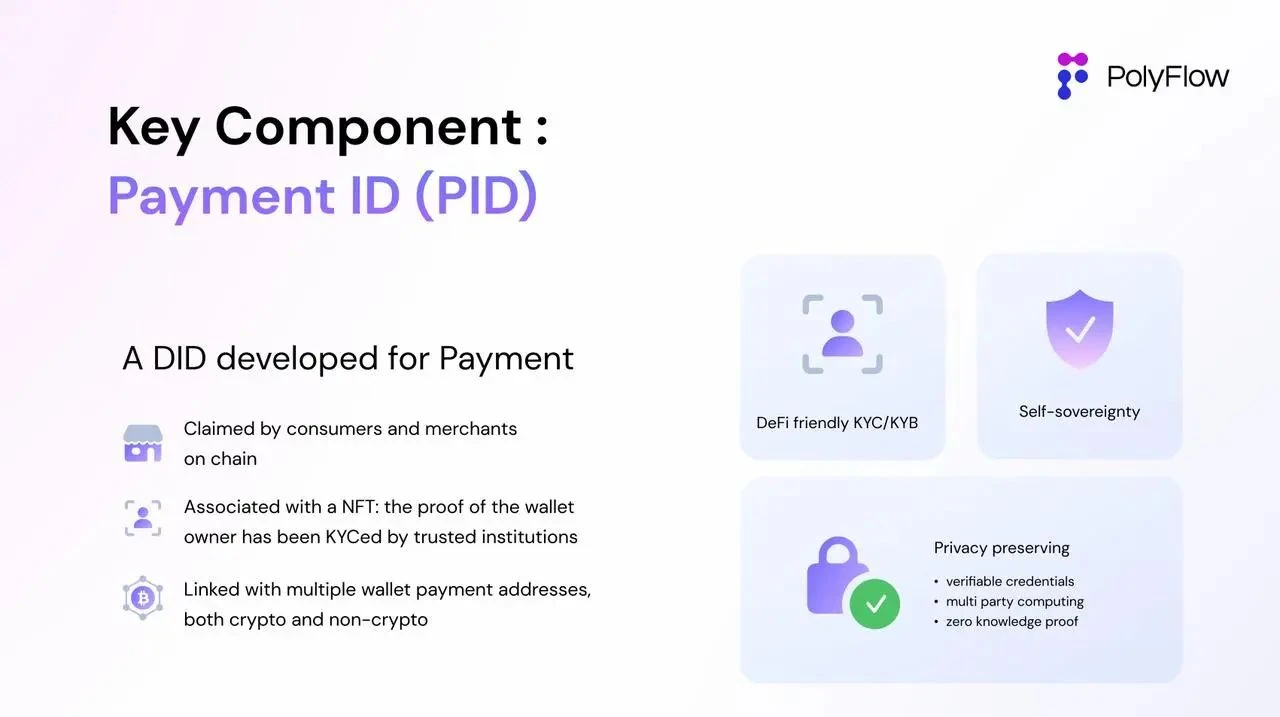

PolyFlow 推出的 Payment ID(PID)是一个去中心化的 ID,是交易信息流拆分出来的产物,能够与加密后用户隐私保护的 KYC/KYB 证明信息绑定,关联用户在多种平台上的可验证凭证(Verifiable Credentials),能够实现:

合规准入:PID 可以包含多个、不同平台之间的验证信息,有助于合作方简化验证流程。

隐私保护:PID 利用零知识证明等多种技术手段,能够在不泄漏用户隐私的情况下帮助履行反洗钱/反恐融资(AML/CTF)等义务。这是用户参与传统金融/DeFi 生态的先决条件。

数据主权:PID 一方面能够将资金往来的信息反馈给监管,满足合规要求,另一方面也能将链上的行为数据归还给了用户。

AI 驱动:PID 除了与 KYC/KYB 数据信息之外,还能够关联链下上传或链上收集的交易数据。AI 可以帮助分析丰富的日常交易数据,为 PID 所有者提取额外价值。这在建立链上信用体系中也发挥着至关重要的作用。

PID 这一创新性的引入,为作为 PayFi 基础设施的 PolyFlow 提供了变革性优势,不仅能够搭建起传统金融和 DeFi 生态之间的桥梁,还能够为用户提供一种灵活可靠的方式来管理数字身份,参与跨平台交易,构建链上信用。

那么该如何理解 PID 的目标是链接物理世界和数字货币钱包?

Raymond 表示:“PID 并不必然等于用于支付的 ID,而应该更像是物理世界的钱包。

试想一下我们口袋里的钱包除了现金,还装了什么?这可以是家人的照片(NFT),也可以是银行卡,以及驾照和身份证件(用户 ZK 支持信息的提取,数据隐私的保护)等等。

因此,从这个角度,Wallet 不能必然等于 Money Wallet,PID 能做的事情还有更多值得期待。当前围绕 PID 构建的 Scan to Earn 项目就是其中之一。”

三、PLP——凝聚资金流的共识

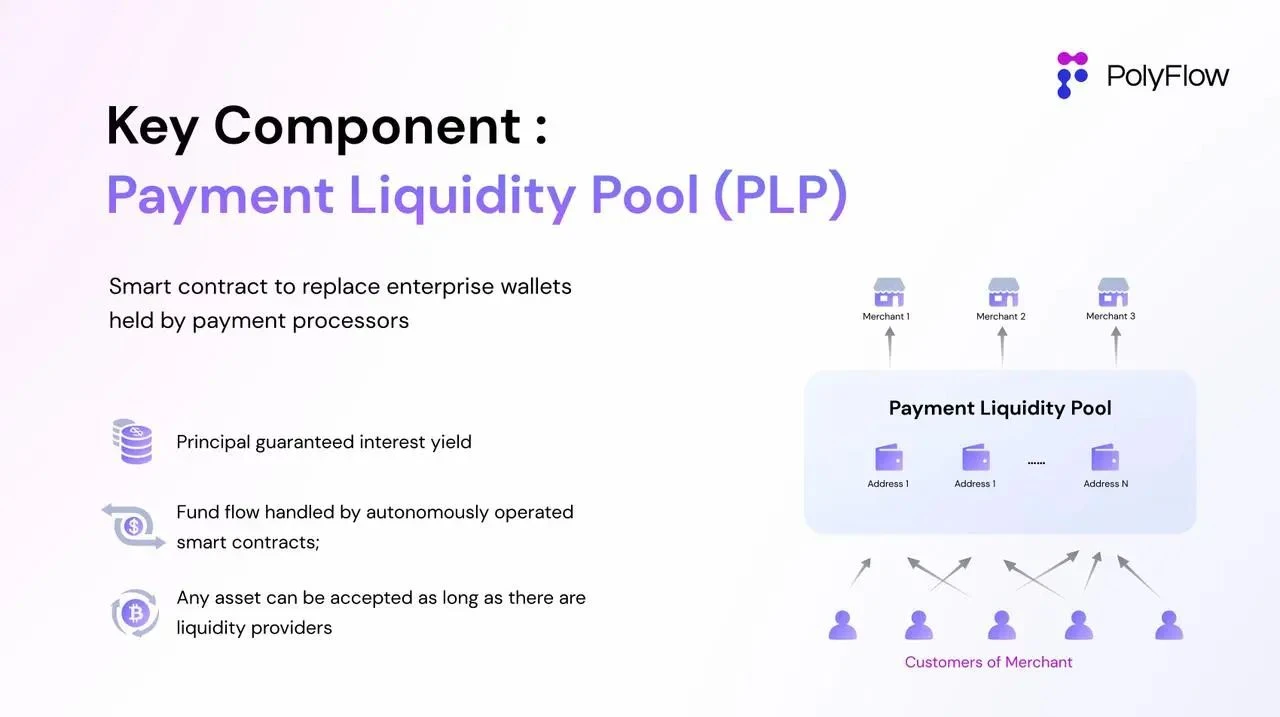

PolyFlow 推出的 Payment Liquidity Pool(PLP)是资金流拆分出来的产物,智能合约地址用于接收交易的资金,实现资金的链上托管,而非依赖于中心化机构昂贵企业钱包的传统方式。

PLP 这种更加去中心化的模式,能够实现:

去中心化资金托管:为 PayFi 应用带来便捷、安全、合规的托管方式,在保证资金安全的同时最小化对交易中介的需求。

流动性池:通过智能合约地址汇集交易资金,能够为支付交易中的融资需求提供流动性。

DeFi 兼容:中心化应用是无法与去中心化的 DeFi 生态所兼容的,架构在区块链上的 PLP 能够无缝连接 DeFi 生态,并为 PayFi 应用带去 DeFi 的业务逻辑。

无风险 RWA 收益类别:协议产生的收益能够直接反映在 PLP 中,这种基于现实世界支付交易场景的收益为 DeFi 提供了一种无风险的稳定来源。

这种 PLP 的架构,能够灵活地与 DeFi 生态结合,确保 PayFi 应用能够适应不断变化的数字资产格局。

那么又该如何理解 PLP 的目标是凝聚资金流的共识呢?

对此,Raymond 从 Web3 支付的三种结算模式来给我们逐步作出了阐释:

3.1 点对点模式

试想一个跨境汇款的场景——从 A 地址汇款到 B 地址。基于区块链特性的 Web3 支付能够实现交易信息流与资金流的同步确认,信息反映在公开透明的区块链账本上,大家共同记账并全网确认,交易信息不可篡改。

在这个相对低频的场景中,信息流与资金流的同步,能够充分体现 Web3 支付近乎即时结算、低交易成本、公开透明账本以及全球触达的优势。

但是当前这种链上点对点信息流与资金流同步的方式,并不能够满足、实现类似传统金融支付每秒/每时/每天成千上万笔交易的高频需求,这非常容易造成区块链网络拥堵。

2023 年,VISA 每天处理约 7.2 亿笔交易,这意味着 2023 年的日均每秒用户生成交易数 (TPS) 约为 8,300,是目前最高性能区块链 Solana TPS 的 8 倍。因此 Web3 支付在这种情况下相对于传统支付就会显得效率低下。

“现在区块链和分布式账本技术的效率无法支撑交易的笔笔记账。在传统金融中,仅仅需要满足交易对手双方之间的记账,但是现在的点对点模式需要全网共同来逐笔记账,很难想象全网每秒上万笔共同记账的情况。”Raymond 解释道,“要想当前加密市场总共 2 万亿规模的体量,此前就已经造成多次网络拥堵,更不用说想要将 400 万亿 - 600 万亿规模体量的传统金融市场纳入其中。”

那么我们该如何构建适合 Web3 的支付结算模式呢?

Raymond 表示:“原来我们的回答是:要相信科技的力量,随着算力的不断提升,支付清算的效率是迟早会解决的。但是我们不能用未来的技术解决今天的问题,还是需要从区块链的本质来解决——构建资金流的共识。”

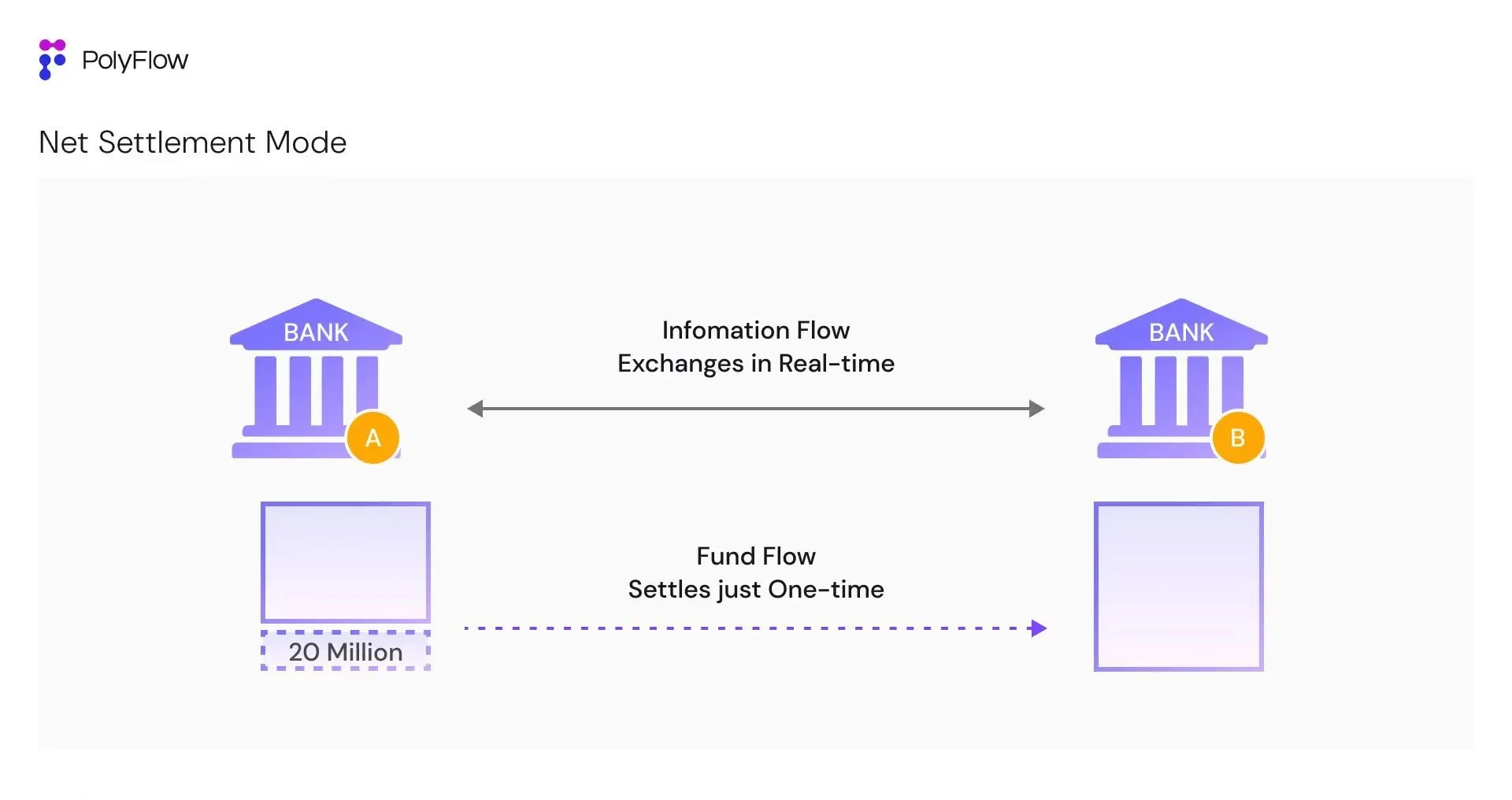

3.2 对冲模式

在传统金融中,交易的信息流和资金流虽然最终是一致的,但并不同步。基于数字网络的信息流数据能够做到实时充分交互,而对于资金流而言,底层的资金依旧被托管在固定地址中,根据约定好的结算周期来进行相对独立的结算,资金流的交互需求其实并没有那么高。

Raymond 在此给我们举了一个跨境资金流转结算的例子。

在传统世界里,中国 A 银行和美国 B 银行做资金流转结算,两个银行之间每天处理上万笔的资金交易。如前所述,如果两个银行进行笔笔交易信息流与资金流的同步结算,当前的任何金融基础设施都无法满足如此巨大体量的结算需求,也没有必要。

因此,会有轧差清算(Net Settlement)的结算方式出现,用于处理交易对手之间的多笔交易。在这种方式下,两个银行之间的信息流实时充分交互,实现各自账本的对冲。当一天结束之时(假设按天结算),在上万笔金融交易的信息流对完之后,最终确定净额进行资金流的单独结算。

例如资金净额是 A 银行欠 B 银行 2000 万,那么届时 A 银行只用一次性支付给 B 银行 2000 万就能满足当天上万笔交易资金流的结算;亦或者净额恰好是 0,那么两个银行之间的资金流就不会变动。

Raymond 解释道:“在这个案例中,上万笔交易的真正底层资金流的变动是非常小的,大家在做的都是信息流的交互。这就是为什么传统金融底层资产体量这么大的情况下,对于银行处理底层资产的能力,系统的能力,支付清算的能力要求并没有这么高。”

轧差清算(Net Settlement)这种对冲的结算方式可以大大减少交易成本,提高结算效率,降低交易对手之间的信用风险,并提高资金利用效率。

但同时,这种传统的模式必然需要一个中心化的信用体系在,且这种强信任关系是需要通过历史的信誉、严格的审计、合规的监管、抵押品支持、合同保障的多重方式来实现,并且会伴随着资金托管、信息不透明的风险。

为了在区块链上实现轧差清算这种更加高效的资金流的对冲结算方式,并消除第三方带来的中心化风险,PolyFlow 推出了 PLP 来沉淀同一区块链账本上的资金。

这样做的目的是:让没有信任基础的人们,在不必经过任何第三方信任背书的情况下进行合作,避免资金托管的不确定性,在不需要彼此信任的前提下,能够验证每一笔交易的真实性。

只有充分地验证,才能完全消除对信任的依赖。Don’t trust, verify.

这就是对区块链统一账本资金流的共识。

银行等机构记录的交易,本质上就是在区块链账本上的记账。如同上述的案例中,只要 A 银行和 B 银行的账本都构建在区块链统一账本之上,我们就能实现对于两个银行之间交易资金流的共识,消除上述需要耗费大量时间、资金构建起来的强信任关系,实现一个真正的 Trustless Network。

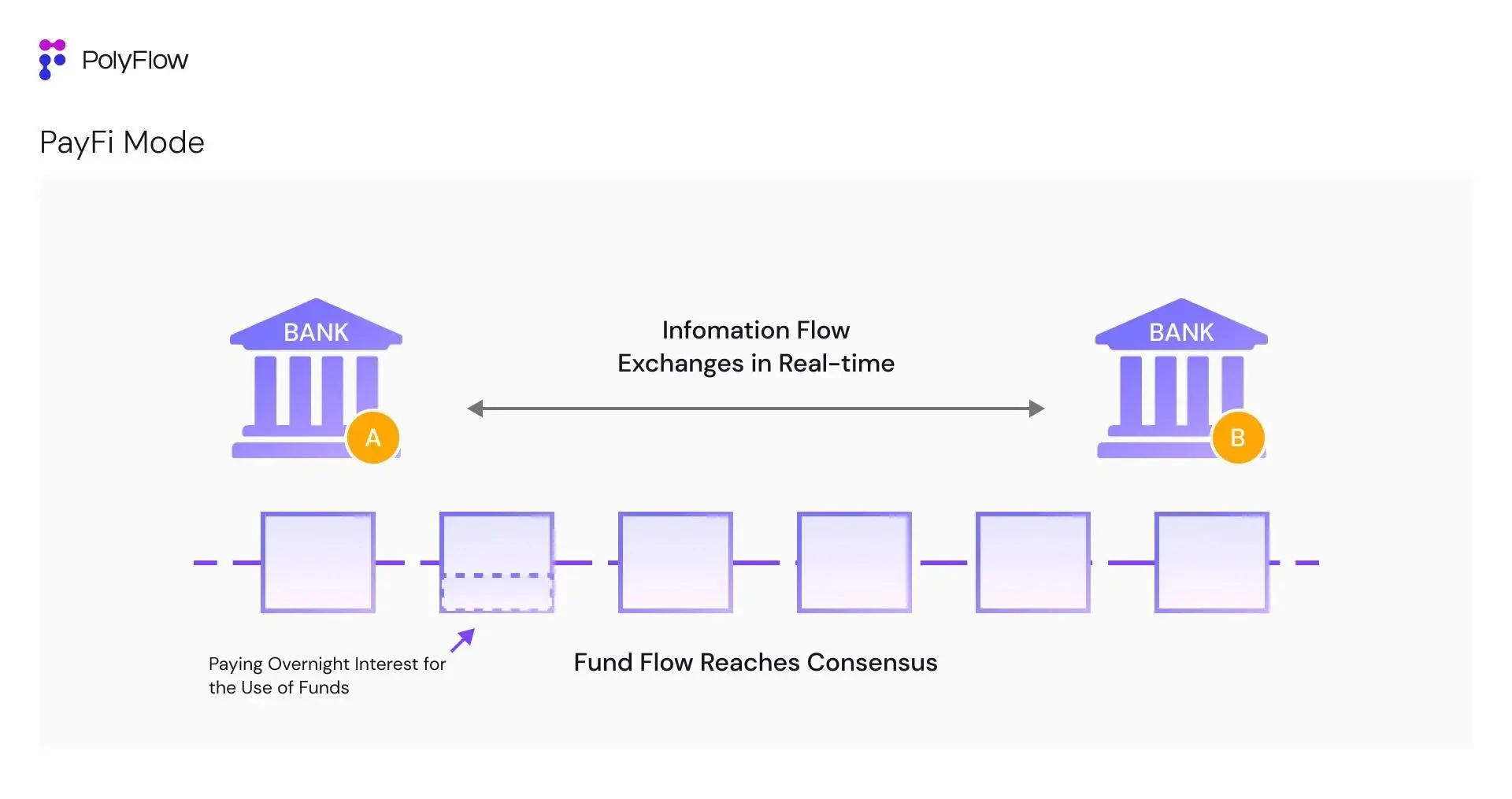

3.3 PayFi 模式

在我们形成了对区块链统一账本资金流的共识之后,才能让我们真正地进入到所谓的 PayFi 世界。

先回到银行的案例。当 A 银行与 B 银行都能够在区块链统一账本上记账,那么就解决了双方的基础信任问题,达成对资金流的共识。在此基础上,双方可以由每天对冲模式的结算方式,转变为直接向对方支付资金使用的隔夜利息(Overnight Interest)。这更进一步,能够更好地释放银行资金的流动性。

这就好比在传统银行办理房屋按揭贷款一样,银行根据你按揭的房产释放贷款,但是实际上银行的底层资产(资金贷款)是没有动的,你只需要直接支付给银行利息就行,因为按揭交易所有的资金流都沉淀在银行的账本之上。

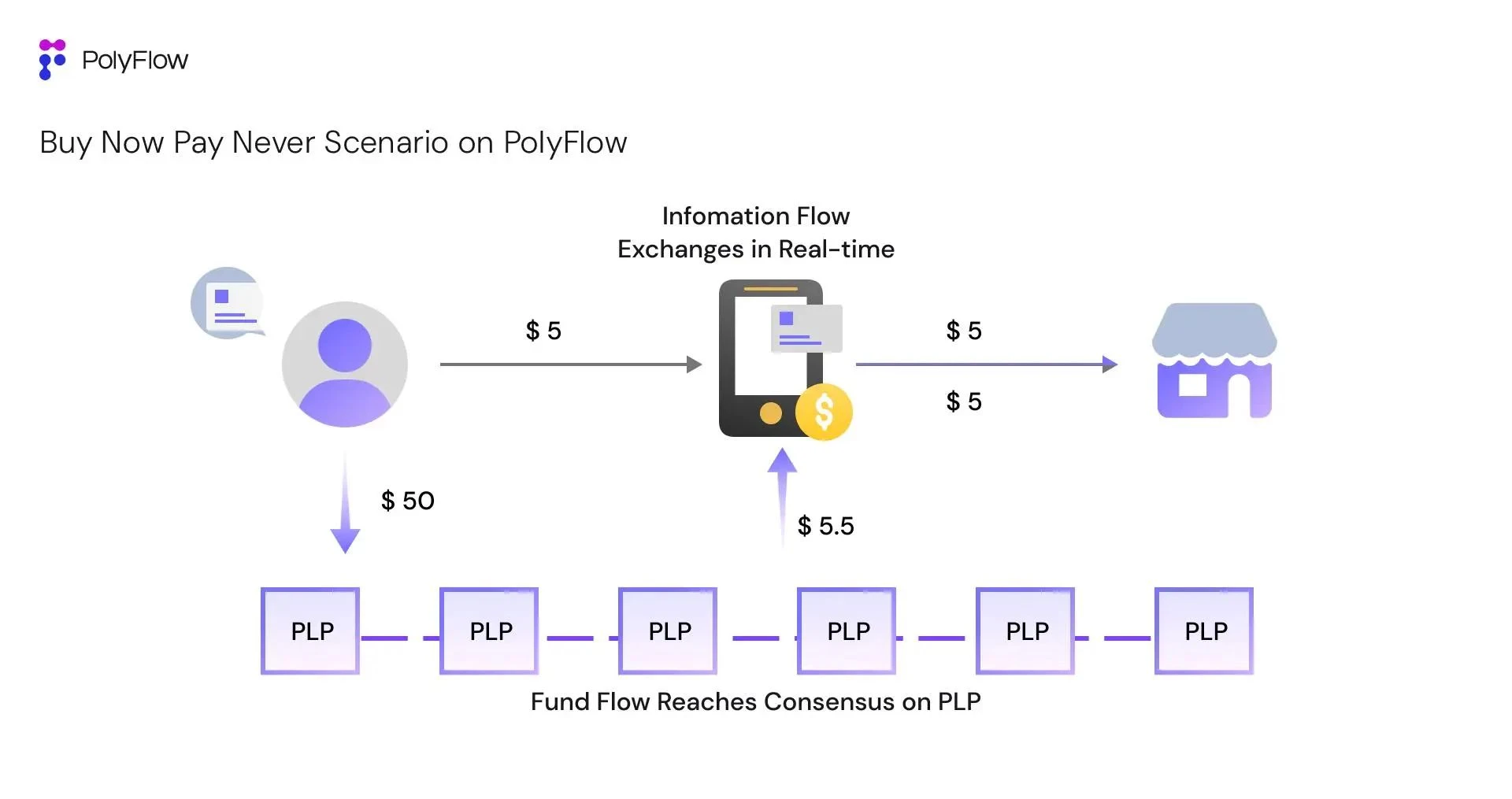

我们来构建一个基于 PolyFlow 的 Buy Now Pay Never 场景:

用户 Kevin 通过基于 PolyFlow 的去中心化支付网关向商户购买了价值 $5 美元的咖啡,该网关及商户的资金都托管在 PLP 中。假设 Kevin 同样也是 PLP 的流动性提供者,向 PLP 提供了 $50 美元的资金(每天会产生 $5.5 美金的收益),那么基于各参与方对 PLP 账本资金流的共识,就能够实现 Kevin 今天先买了咖啡(不用付钱),然后用明天 PLP 产生的收益来支付 $5 美元咖啡费用的场景,多出来的 $0.5 算是 Kevin 今天借用资金的隔夜利息。

在这个场景中,能够充分体现 PayFi 的价值:

1)降本增效:信息流充分交互,资金流其实是不动的,全部沉淀在 PLP 的账本上。

2)提高资金效率:资金流不动带来的好处是,能够充分发挥 Kevin 提供 $50 美元流动性的资金利用效率。

3)创新金融范式:Buy Now Pay Never 这种链上场景,能够实现传统金融无法实现的创新金融范式和产品体验,推动 PayFi 的 Mass Adoption。

在这种 PayFi 的模式下,资产流的利用效率就会非常高。因为各方的账本都统一到区块链这个统一账本之上了,那么就能够实现充分的信任,随时验证交易双方的信息,并对资金缺口予以确认。

Raymond 自 2011 年以来,就开始研究区块链技术:“区块链账本的统一账本,不可篡改,公开透明,这些早已耳熟能详的名词,所有人在十几年来都在讲,但是没有人能够理解它落地的意义在哪里。

对于区块链统一账本上资金流的共识,才是区块链真正的意义所在。这将提升整个 Crypto,整个 Web3 行业的效率。”

这也是 PolyFlow 旨在打造去中心化 PayFi 基础设施立足的根本所在

四、PayFi 的价值与意义

Web3 支付和 DeFi 的融合催生了 PayFi,PayFi 渴望一种全新的金融基础设施来支持其落地并解决复杂的合规问题。自从 Solana 基金会主席 Lily Liu 在香港 Web3 嘉年华上提出 PayFi 概念以来,PolyFlow 就被视为首批旨在构建 PayFi 金融基础设施的协议之一。

从字面上来看 PayFi 其实和 GameFi, SocialFi 并没有什么本质区别,但是 PayFi 的真正意义在于:促进数字货币在现实世界真实场景的应用。

正向来看,PayFi 能够顺应 Web2 群体向 Web3 迁移,例如传统金融支付公司,如何利用区块链技术,来获得更大的市场份额,避免错过时代的风口。

反向来看,Web3 的群体可以通过 Payment 来作为载体,利用区块链技术来解决传统金融体系的痛点,实现传统金融无法实现的新金融范式和产品体验。

在谈及 PayFi 时,Raymond 有更深层次的理解:“PayFi 解决的,并不是明面上 Web3 支付需要解决的问题,例如跨境资金转移的挑战、金融普惠不高等问题,而是需要解决当下最根本的问题:将交易的信息流和资金流有效地分离,让大家形成对区块链统一账本上资金流的共识,这样才能提升整个 Web3 行业的效率,推动真正的 Mass Adoption。”

当下 Web3 支付仍然处在相当早期的基础服务和原始状态,更多的是将数字货币拿去做支付的交易媒介,实现点对点模式的结算,如 OTC,Crypto Payment Card 等场景,亦或者是通过数字货币实现跨境场景的便利,实现对冲模式的结算,但是相对来说场景较为局限。

因此,随着 PolyFlow 的推出,不仅能够让更多的 PayFi 参与方更加便捷地进入区块链网络,实现我们在日常消费场景中 Buy Now Pay Never 的真实 PayFi 场景构建,更重要的是,能够让大家形成资金流的共识,实现整个区块链 Web3 生态的提效。

五、Beyond Payment

区块链分布式账本的概念可能听起来不具有革命性或吸引力,但是双重会计记账法和股份制公司也同样如此。然而,与这些伟大的创新相同的是,区块链这个看似平凡的技术或改进过程,有潜力改变人类社会的运作方式。

区块链的禀赋是金融基础设施,PolyFlow 正在整合数字货币与区块链技术给我们带来的变革力量,打造一个全新的去中心化 PayFi 加密支付网络,推动人们向创新金融的范式转变,释放 Web3 的真正价值。

最终,让比特币白皮书中的宏伟愿景成为现实。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。