本文聚焦 2024 美联储降息,解读其对经济和市场的影响。从就业市场动态到资产价格波动,全面剖析了降息的动因和后果。同时为投资者提供多样化的投资策略,帮助投资者在经济不确定性中把握机遇,应对风险。

撰文:Sylvia / Mat / Darl / WolfDAO

编辑校对:Punko

降息后宏观变化

1. FOMC 会议纪要与降息展望

在 2024 年 9 月的 FOMC 会议上,美联储作出了备受瞩目的降息决定,将联邦基金利率区间下调了 2 个基点,至 4.75%~5.00%。此举表明美联储开始更加重视就业市场的疲软迹象,虽然总体经济状况尚稳,但已显现出放缓趋势。这一决策与就业市场逐步失去强劲增长动力、通胀趋缓相结合,使得未来政策变动对市场至关重要。

关键变化

- 就业市场放缓:就业增长从「温和」逐渐向「放缓」转变,失业率虽仍处历史低位,但已开始轻微攀升。这可能预示着更长远的劳动力市场调整。

- 通胀持续进展:美联储对通胀达到 2% 目标的信心增强,预计今年通胀将持续回落,表明通胀压力得到有效缓解。

- 明确的就业目标:美联储进一步强调「最大化就业」这一政策目标,释放了温和鸽派信号,表明其对支持就业稳定的坚定承诺。

利率前瞻

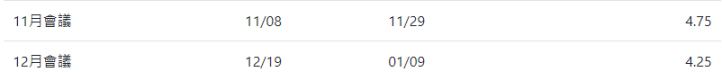

美联储降息预期分布 - Source:@10xWolfDAO 整理

根据最新的利率点阵图,2024 年的降息预期已从此前的 1 码上调至 4 码,预计年内还有两次降息空间。此外,2025 年可能再降 4 码,2026 年或进一步削减 2 码。这一预测表明美联储在未来两年内有较强的意图通过降息来维持经济增长,推动劳动力市场稳定并防止经济放缓的加剧。

2024 年内 11-12 月美联储降息预期 - Source:@10xWolfDAO 整理

尽管本次降息幅度略低于市场预期,但美联储明确表示未来的政策将依赖于最新的经济数据。这将促使市场参与者重新审视美联储的政策节奏,并对利率调整对不同资产类别的影响作出调整。

1.2 经济与通胀预测

根据最新经济预测,美联储将 2024 年的 GDP 增速预期小幅下调至 2.0%,并预计未来几年增速将保持在这一水平附近。此外,2024 至 2026 年间失业率预计上升至 4.3%~4.4%,这反映出就业市场在经济逐步放缓的背景下,仍有待重新平衡。

与此同时,PCE 通胀率和核心 PCE 通胀率预计分别下降至 2.3% 和 2.6%,这显示了美联储对未来通胀缓解的乐观预期。这也为进一步降息提供了空间,使美联储能够灵活应对经济风险,而不必过于担忧通胀压力。

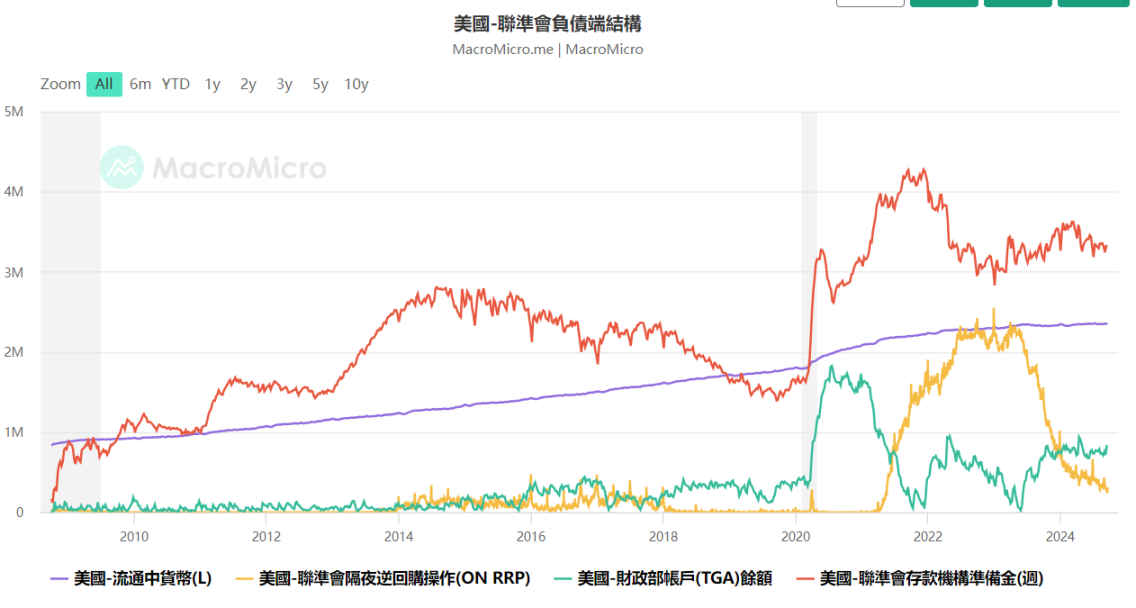

1.3 缩表进展与市场流动性

Source:Macromicro - @10xWolfDAO 整理

自 2024 年 5 月起,美联储缩表速度放缓,当前的缩表速度为每月 250 亿美元的美债减少,以及 350 亿美元的 MBS 到期规模。到 9 月,美联储的资产负债表规模已降至 7.12 万亿美元。然而,市场流动性依然充裕,逆回购工具(ON RRP)的流出维持了流动性稳定。随着美联储继续缩表,市场的反应将受到密切关注,特别是对于流动性溢出效应及其对资产价格的影响。

1.4 Powell 记者会要点

美联储主席 Jerome Powell 在记者会上重申,美联储对经济稳定的承诺。他指出,尽管失业率有所上升,但这更多是由于劳动力供应增加,而非经济衰退的信号。他还特别强调了美联储对通胀降温的信心,并表示未来的降息步伐将根据数据调整。此类言论意味着,美联储的灵活性将成为未来政策方向的核心特点,市场也将持续关注经济数据的变化以预判其政策反应。

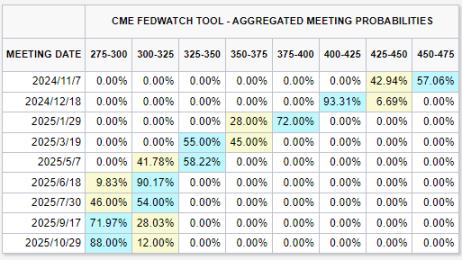

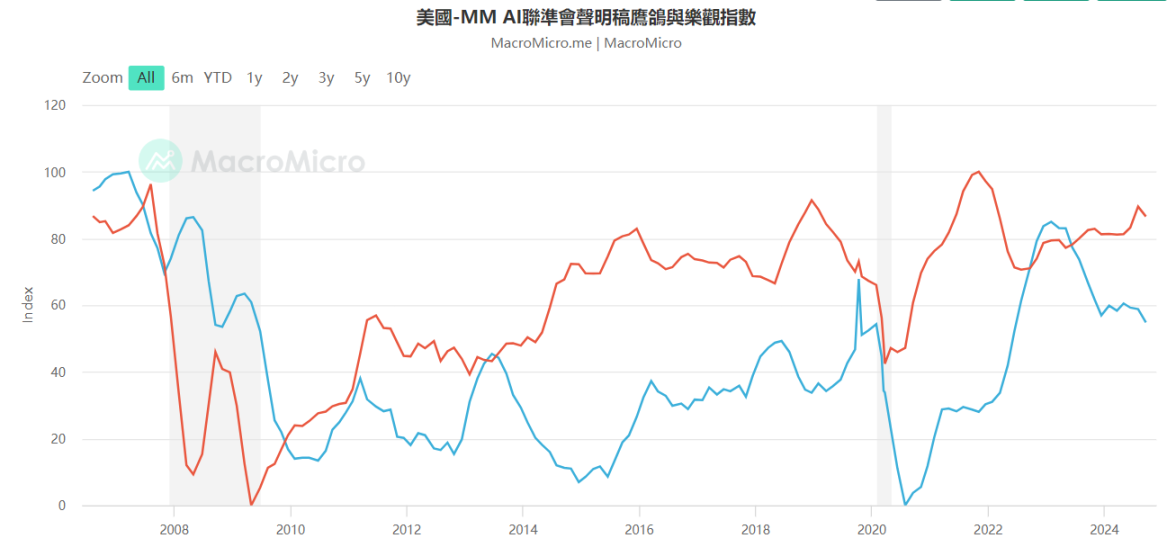

降息展望

Source:Macromicro - @10xWolfDAO 整理

此次 9 月的 FOMC 会议正式开启了预防性降息周期,目的是应对就业市场放缓的风险,并支持经济持续增长。尽管本次降息低于部分市场预期,但美联储通过持续降息的政策路径,仍显示出通过调整利率来应对经济挑战的意愿。未来,货币政策将主要受就业市场、油价及通胀变化的驱动。

市场参与者应采取灵活策略,密切关注关键数据,尤其是在全球经济风险加大的背景下,资产配置的灵活性至关重要。

降息后的应对措施与数据关注

2.1 背景与经济形势分析

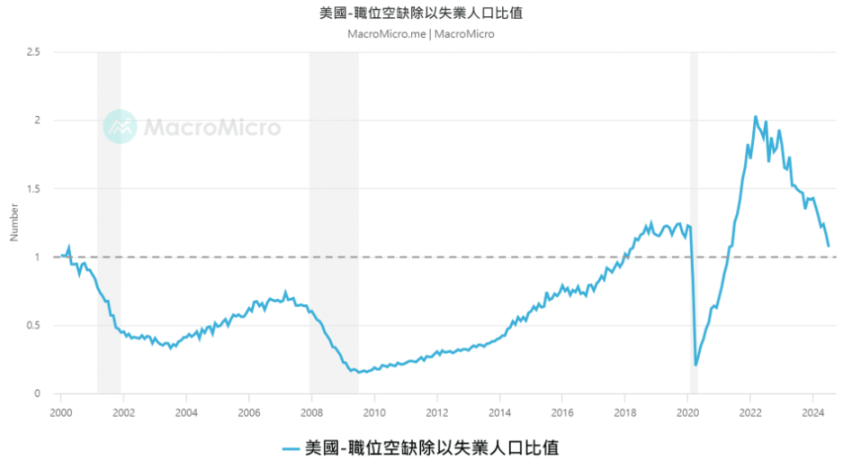

Source:Macromicro - @10xWolfDAO 整理

2024 年 8 月的非农就业报告显示,美国就业市场供需已基本达到平衡,职位空缺与失业人口的比值为 1.07。这表明每个求职者几乎都对应一个职位空缺,过去几年的劳动力市场过热现象已经减弱。与此同时,美联储为缓解就业市场的潜在疲软,采取了降息措施。

就业市场动态

- 就业保护伞的消失:随着市场供需平衡,企业招聘放缓迹象明显,失业率可能会逐步上升,特别是在非农就业数据被大幅下修后,揭示了此前高估的就业增长。

- 就业脆弱性显现:非农月度就业增速显示疲软,3 个月的平均增幅下降至 11.6 万人,多个州的失业率也在上升,预示着就业市场或将面临更大挑战。

2.2 降息动因与市场影响

降息旨在降低企业借贷成本,以防止就业市场进一步放缓并刺激经济。通过提振企业融资意愿,降息有望推动招聘活动,帮助稳定消费市场。

美联储降息后不同金融市场行情波动对比 Source:@10xWolfDAO 整理

市场展望

- 短期效应:降息后,市场预计会出现短期波动,但避险资产如黄金和债券将受益。黄金价格已有显著上涨,表明其在降息背景下受益明显。美元可能因降息承压贬值,推高其他货币和比特币等资产的价格。图表显示,比特币价格已有回升,也反映了市场对避险资产的青睐。

- 中长期影响:降息将降低企业融资成本,有望提振科技股等成长型股票。纳斯达克指数(NDXL3)虽有波动,但整体开始上涨,反映了降息对科技股的积极影响。此外,资金将会进一步回流加密货币市场,比特币价格的显著增长正验证了这一点。然而,图表显示的波动性也提醒我们,就业市场是否能稳定增长仍需进一步观察。

2.3 经济脆弱性及应对策略

随着职位空缺与失业人口比值下降,美国经济脆弱性加大,衰退风险增加。若比值持续低于 1,历史数据表明衰退可能性会增大。为此,市场参与者需要采取多样化的投资策略以分散风险。

应对策略:

- 分散投资组合:增加公债、黄金及加密货币(如 BTC)的持仓,以应对经济不确定性。

- 密切监控数据:关注就业市场的发展,尤其是职位空缺 / 失业人口比值的变化。同时,非农月增需维持在 15 万至 20 万的水平,才能确保经济不进入衰退期。

- 平衡配置:降低高风险资产的持仓比例,增加现金和低波动性资产的比重,以应对可能的经济冲击。

未来展望:市场反应与政策持续性

- 市场对降息的反应:随着降息预期逐步兑现,市场将经历短期波动。但若降息成功稳定就业和消费,市场有望逐渐走向稳定,股票市场可能迎来新的增长机会。

- 政策支持的持续性:美联储将根据未来经济数据,灵活调整政策。若就业持续疲软,未来可能进一步降息。

- 全球影响:美联储政策对全球市场影响重大,特别是在资本流动和汇率方面,全球投资者需紧密关注美国经济动向,以防范潜在市场风险。

美国经济面临较高不确定性,降息将成为美联储应对就业市场疲软的关键工具。投资者应采取多元化的策略,密切关注就业数据,平衡风险资产配置,并增加避险资产持仓,以应对未来的经济波动。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。