PolyFlow is the infrastructure layer of the blockchain network, aiming to integrate traditional payments, Web3 payments, and decentralized finance (DeFi).

The Bitcoin white paper in 2008 outlined a peer-to-peer electronic cash payment network that does not require a trusted third party. Payment is one of the earliest promises made by digital currency and blockchain technology, and it is also the blockchain solution proposed by Satoshi Nakamoto in response to the failure of the financial system at that time.

Although the industry has invested billions of dollars in developing underlying blockchain infrastructure over the past decade, we can now see the explosive rise of high-performance blockchains such as Solana and stablecoins. However, most of the current market infrastructure is still built around transactions and cannot truly support the real-time and scalability of payments, which also hinders the widespread adoption of Web3 payments.

So, what kind of infrastructure do we need to support real-world payment scenarios? What is the value and significance of PayFi?

In this article, we are fortunate to have had an in-depth conversation with Raymond Qu, co-founder of PayFi's infrastructure, PolyFlow. Rather than calling it a conversation, it is more about understanding and learning from this senior figure with over twenty years of international financial consulting and management experience, his comprehensive thinking and practice in digital finance from a global perspective, and his profound understanding of digital currency and blockchain technology.

Raymond has a unique perspective on innovative financial services in the international market. Under his leadership, Geoswift has become a comprehensive global financial services company covering international payments, cross-border remittances, foreign exchange, and prepaid card businesses. He is also a well-known investor in the global digital finance field, with investment targets covering financial technology, digital banking, blockchain, Web3, and artificial intelligence. Raymond is also a senior advisor to the Business Development Bank of Canada and a member of the expert group of the Financial Research Institute of the Development Research Center of the State Council of China.

1. The Original Intention of Establishing PolyFlow

PolyFlow is the infrastructure layer of the blockchain network, aiming to integrate traditional payments, Web3 payments, and decentralized finance (DeFi) by decentralizing the handling of real-world payment scenarios. PolyFlow will serve as the infrastructure for PayFi to promote the establishment of a new financial paradigm and industry standards.

Before discussing PolyFlow in detail, Raymond first explained the essence of financial transactions, helping us better understand the true value of PolyFlow.

1.1 The Core of Financial Transactions

In traditional financial markets, any financial transaction and value transfer cannot be separated from the information flow and fund flow, which together form the foundation of financial transactions.

Information Flow refers to the information in the transaction process, including the collection of transaction initiation, payment, and settlement instructions. It ensures the accuracy and timeliness of transactions and focuses on the transmission of transaction instructions and data.

Fund Flow refers to the entire process of fund transfer among parties in the transaction process and focuses on the actual flow of funds.

Information flow and fund flow are inseparable in financial transactions. Their effective combination ensures that financial transactions can be completed safely and efficiently.

1.2 Information Flow and Fund Flow in Cross-Border Contexts

Due to differences in language, currency, and regulations, the paths for information flow and fund flow in financial transactions in cross-border contexts are also different.

For example, the well-known SWIFT system focuses only on the transmission of information flow and does not involve fund flow. SWIFT has built a highly standardized and automated international financial communication network through standardized message formats, enabling banks worldwide to exchange financial transaction information quickly and accurately.

While the information flow of transactions can be fully transmitted through SWIFT, fund flow is restricted by factors such as foreign exchange controls in various jurisdictions, regulatory compliance, and anti-money laundering, and cannot be synchronized in real time like information flow. Fund flow still needs to be transferred through financial intermediaries in various countries and involves complex domestic clearing systems, cross-border payment clearing systems for settlement currencies, and international payment and settlement systems.

What further hinders the global flow of value is that even if you have a SWIFT CODE, it does not necessarily mean that you have the qualifications to participate in this network.

1.3 Promoting Value Circulation Through PolyFlow

This brings us to the original intention of establishing PolyFlow: to build a decentralized infrastructure that allows more people to participate in the construction of a global payment network, help alleviate regulatory compliance pressure, eliminate custodial risks, and minimize the intervention of third parties as much as possible.

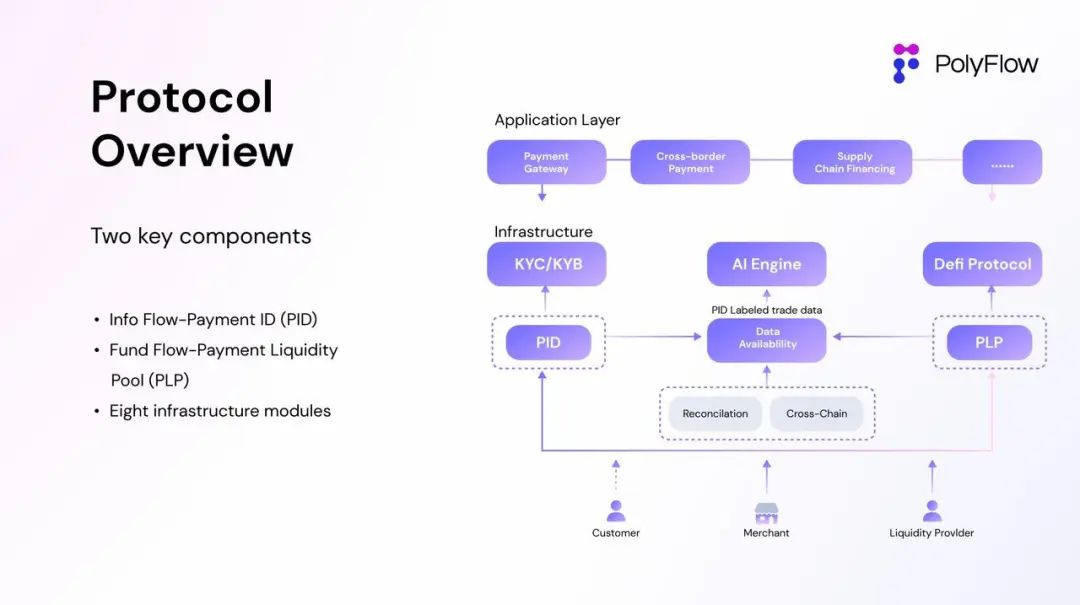

The core concept of PolyFlow is to effectively separate the transaction information flow and fund flow previously controlled by centralized institutions through modular design, using a decentralized approach to better align the various processes of transactions with regulatory compliance standards, eliminate custodial risks, and connect with the DeFi ecosystem, promoting the large-scale implementation of PayFi applications.

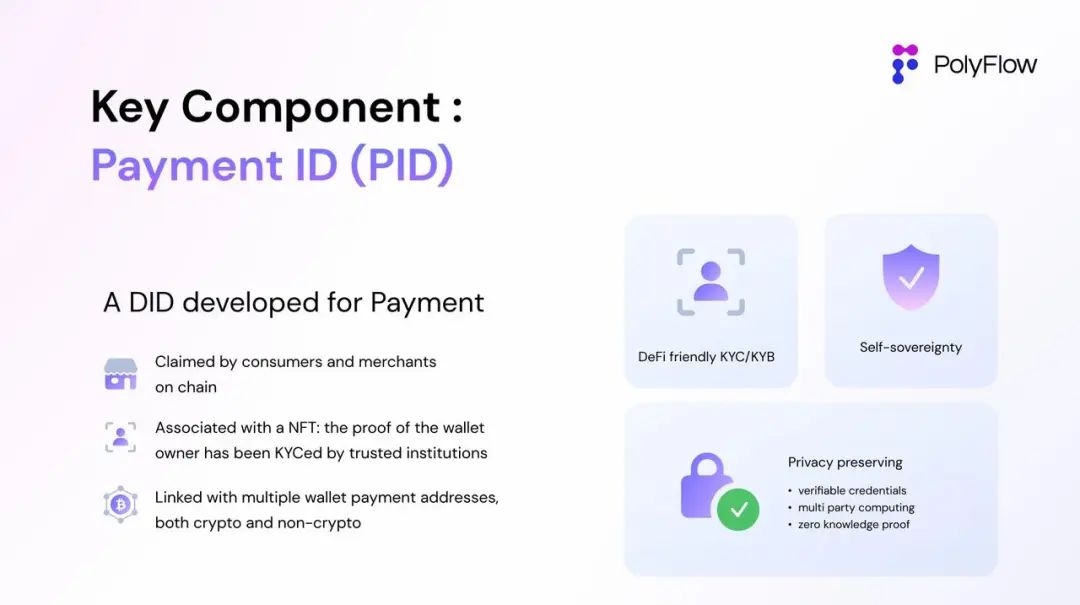

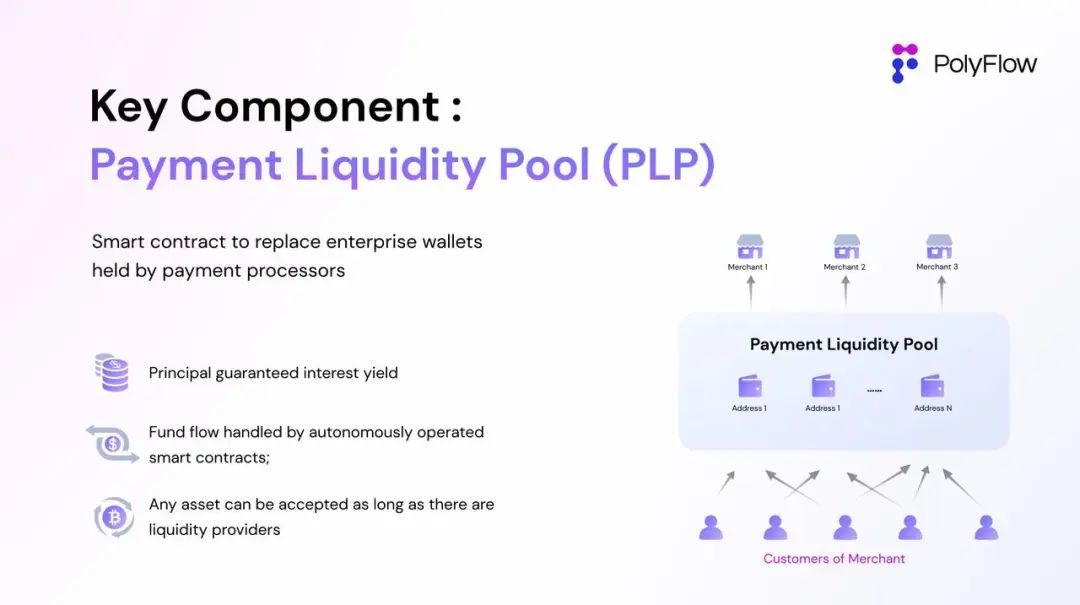

PolyFlow has introduced two key components: Payment ID (PID) and Payment Liquidity Pool (PLP):

PID is associated with information flow and serves as a powerful tool that can achieve user identity recognition and compliance access, privacy protection and data sovereignty, AI data processing, and X to earn functions.

PLP is associated with fund flow and is managed by smart contracts for the payment transaction funds, providing a secure and compliant framework for the circulation, custody, and issuance of digital assets, as well as introducing the composability and scalability of the DeFi ecosystem.

As a result, PolyFlow has built a business architecture for PayFi applications that is lightly regulated, free of custodial risks, compatible with the DeFi ecosystem, and provides a secure and compliant framework for the circulation, custody, and issuance of digital assets.

To understand that the Bitcoin and its blockchain network constructed by Satoshi Nakamoto represent a new solution to the problem of financial currency born in the digital age, it is not only aimed at solving the eternal problem of human society: how to allow value to flow across time and space, but also aimed at solving the issue of trust in third parties in transactions. These are all what PolyFlow aims to achieve.

2. PID—Linking the Physical World and Digital Currency Wallets

The Payment ID (PID) introduced by PolyFlow is a decentralized ID, a product separated from the transaction information flow, which can be bound to encrypted user privacy-protected KYC/KYB proof information and associated with verifiable credentials across multiple platforms, enabling:

Compliance access: PID can contain verification information from multiple different platforms, helping partners simplify the verification process.

Privacy protection: PID uses various technologies such as zero-knowledge proofs to help fulfill anti-money laundering/counter-terrorism financing (AML/CTF) obligations without revealing user privacy. This is a prerequisite for users to participate in the traditional financial/DeFi ecosystem.

Data sovereignty: PID can provide feedback on fund movements to regulators to meet compliance requirements, while also returning on-chain behavioral data to users.

AI-driven: In addition to KYC/KYB data information, PID can also be associated with transaction data uploaded off-chain or collected on-chain. AI can help analyze rich daily transaction data, extracting additional value for PID owners. This also plays a crucial role in establishing an on-chain credit system.

PID, this innovative introduction, provides PolyFlow, as the infrastructure for PayFi, with revolutionary advantages. It not only builds a bridge between traditional finance and the DeFi ecosystem but also provides users with a flexible and reliable way to manage digital identities, participate in cross-platform transactions, and build on-chain credit.

So, how should we understand the goal of PID to link the physical world and digital currency wallets?

Raymond said, "PID does not necessarily equate to an ID used for payments, but should be more like a physical world wallet. Think about what's in our wallets besides cash. It could be family photos (NFTs), bank cards, driver's licenses, and identity documents (support for extracting user ZK information, data privacy protection), and more. Therefore, from this perspective, a Wallet does not necessarily equate to a Money Wallet, and there is much more that PID can do. The Scan to Earn project built around PID is one example."

3. PLP—Consensus on Fund Flow

The Payment Liquidity Pool (PLP) introduced by PolyFlow is a product separated from fund flow, with smart contract addresses used to receive transaction funds, achieving on-chain custody of funds rather than relying on the traditional method of expensive enterprise wallets from centralized institutions.

This more decentralized model of PLP can achieve:

Decentralized fund custody: Provides convenient, secure, and compliant custody for PayFi applications, minimizing the need for transaction intermediaries while ensuring fund security.

Liquidity pool: By pooling transaction funds through smart contract addresses, it can provide liquidity for financing needs in payment transactions.

DeFi compatibility: Centralized applications are not compatible with the decentralized DeFi ecosystem, but PLP architecture on the blockchain can seamlessly connect with the DeFi ecosystem and bring DeFi business logic to PayFi applications.

Risk-free RWA income category: The protocol's earnings can be directly reflected in PLP, providing a risk-free stable source of income for DeFi based on real-world payment transaction scenarios.

This PLP architecture can flexibly integrate with the DeFi ecosystem, ensuring that PayFi applications can adapt to the ever-changing digital asset landscape.

So, how should we understand the goal of PLP to consolidate consensus on fund flow?

In response, Raymond explained the three settlement modes of Web3 payments:

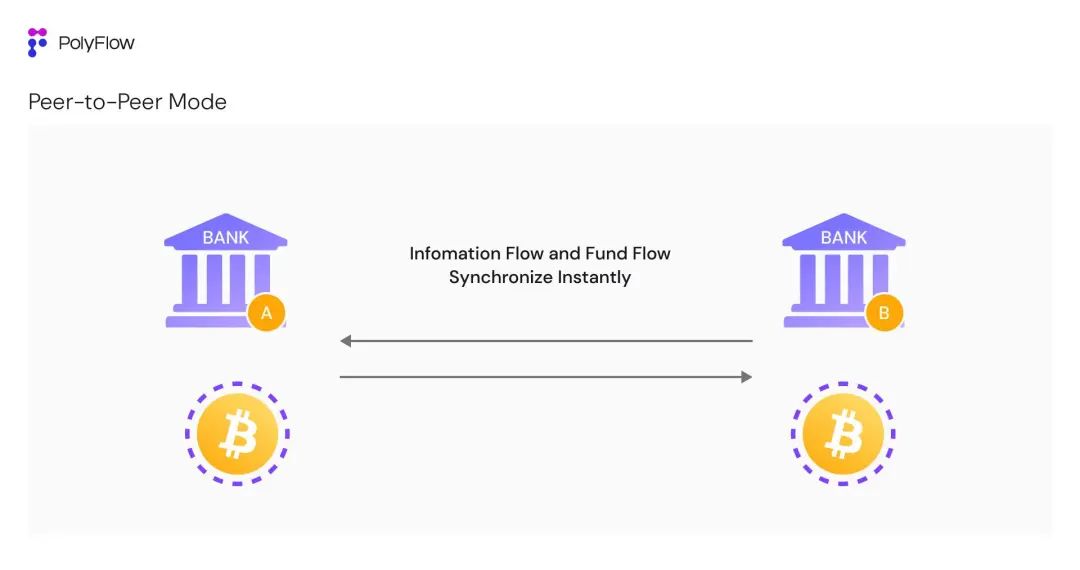

3.1 Peer-to-Peer Mode

Consider a cross-border remittance scenario—sending funds from address A to address B. Web3 payments based on blockchain characteristics can achieve synchronous confirmation of transaction information flow and fund flow, with information reflected on a publicly transparent blockchain ledger, jointly recorded and confirmed by the entire network, and transactions are tamper-proof.

In this relatively low-frequency scenario, the synchronous confirmation of information flow and fund flow can fully demonstrate the advantages of Web3 payments, such as near-instant settlement, low transaction costs, publicly transparent ledgers, and global reach.

However, the current on-chain synchronous settlement of information flow and fund flow cannot meet the high-frequency demands of thousands or even millions of transactions per second/hour/day, similar to traditional financial payments. This can easily lead to network congestion.

In 2023, VISA processed approximately 7.2 billion transactions per day, which means that the average daily transactions per second (TPS) in 2023 was about 8,300, eight times the TPS of the highest-performance blockchain Solana. Therefore, in this scenario, Web3 payments are relatively inefficient compared to traditional payments.

"The current efficiency of blockchain and distributed ledger technology cannot support the recording of every transaction. In traditional finance, it only needs to meet the recording between the two transaction parties, but the current peer-to-peer mode requires the entire network to jointly record each transaction, and it is difficult to imagine the entire network jointly recording tens of thousands of transactions per second," explained Raymond. "To accommodate the total market size of the current crypto market, which is 2 trillion, there have been multiple network congestions, not to mention integrating the traditional financial market with a size of 40-60 trillion."

So, how can we build a payment settlement model suitable for Web3?

Raymond said, "Our original answer was to believe in the power of technology. With the continuous increase in computing power, the efficiency of payment settlement is bound to be resolved. But we cannot use future technology to solve today's problems. We still need to solve it from the essence of blockchain—building consensus on fund flow."

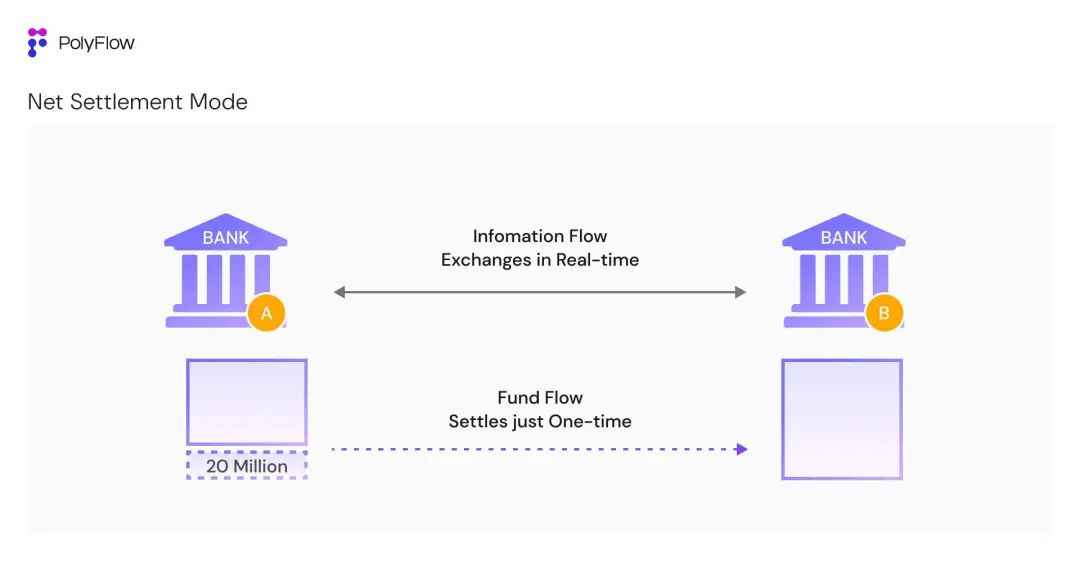

3.2 Hedging Mode

In traditional finance, although the information flow and fund flow of transactions are ultimately consistent, they are not synchronous. Information flow data based on digital networks can achieve real-time and full interaction, while for fund flow, the underlying funds are still custodied in fixed addresses and settled relatively independently according to agreed settlement periods, with less demand for fund flow interaction.

Raymond provided an example of cross-border fund transfer settlement.

In the traditional world, Chinese Bank A and American Bank B settle cross-border fund transactions, processing tens of thousands of fund transactions between the two banks every day. As mentioned earlier, if the two banks were to settle each transaction's information flow and fund flow synchronously, no current financial infrastructure could meet such a huge volume of settlement needs, nor is it necessary.

Therefore, a net settlement method appears to handle multiple transactions between transaction counterparts. In this method, the information flow between the two banks interacts in real-time, achieving hedging of their respective ledgers. At the end of the day (assuming daily settlement), after the information flow of tens of thousands of financial transactions is reconciled, the final net amount is determined for separate fund flow settlement.

For example, if the net amount is that Bank A owes Bank B 20 million, then Bank A only needs to make a one-time payment of 20 million to Bank B to settle the fund flow of tens of thousands of transactions for that day. Or if the net amount is exactly 0, then there is no change in fund flow between the two banks.

"In this case, the actual underlying fund flow changes for tens of thousands of transactions are very small, and what everyone is doing is interacting with the information flow. This is why, in the traditional financial world with such a large volume of underlying assets, the capacity of banks to handle underlying assets, system capacity, and payment settlement requirements are not so high," explained Raymond.

This net settlement method can greatly reduce transaction costs, improve settlement efficiency, reduce credit risks between transaction counterparts, and improve fund utilization efficiency.

However, this traditional model inevitably requires a centralized credit system, and this strong trust relationship needs to be achieved through multiple methods such as historical reputation, strict audits, regulatory compliance, collateral support, and contract guarantees, and it comes with the risks of fund custody and opaque information.

To achieve this more efficient hedging settlement method for fund flow on the blockchain and eliminate the centralization risks brought by third parties, PolyFlow has introduced PLP to consolidate funds on the same blockchain ledger.

The purpose of doing this is: to allow people without a trust basis to cooperate without the need for any third-party endorsement, to avoid the uncertainty of fund custody, and to be able to verify the authenticity of each transaction without needing to trust each other.

Only through thorough verification can we completely eliminate the reliance on trust. Don't trust, verify.

This is the consensus on fund flow on the blockchain unified ledger.

The transactions recorded by banks and other institutions are essentially accounting on the blockchain ledger. As in the case mentioned above, as long as the ledgers of Bank A and Bank B are both built on the unified blockchain ledger, we can achieve consensus on the transaction fund flow between the two banks, eliminating the need for the strong trust relationship that would take a lot of time and resources to build, and achieving a truly Trustless Network.

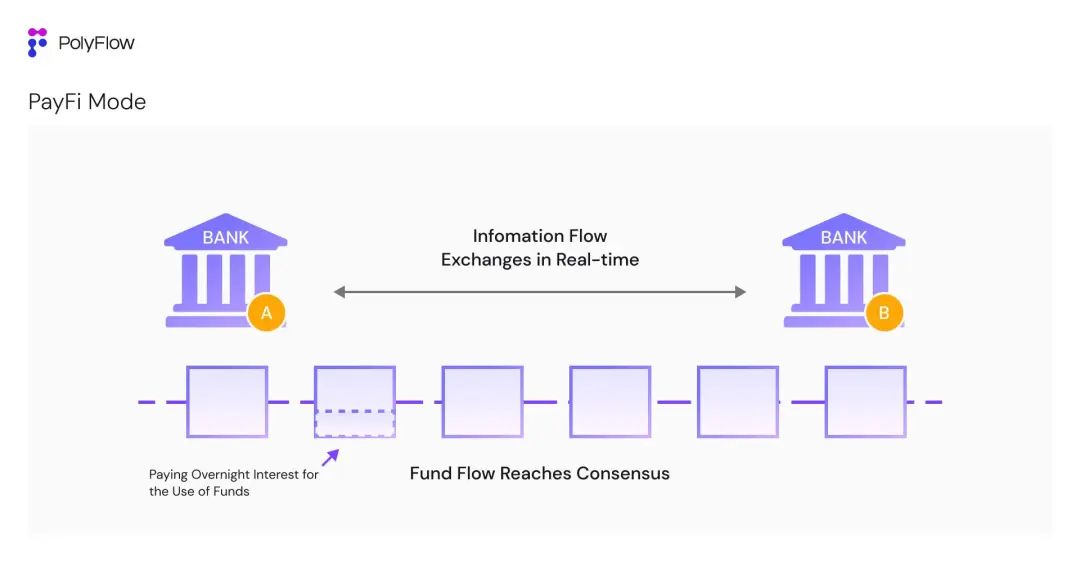

3.3 PayFi Mode

Only after we have formed a consensus on the fund flow on the blockchain unified ledger can we truly enter the so-called PayFi world.

Let's go back to the bank example. When Bank A and Bank B can both keep accounts on the unified blockchain ledger, the basic trust issue between the two parties is resolved, and consensus on the fund flow is achieved. Based on this, the settlement method between the two parties can change from the daily hedging mode to directly paying overnight interest for the use of funds to each other. This further enhances the liquidity of bank funds.

This is similar to applying for a mortgage loan at a traditional bank. The bank releases the loan based on the property you mortgage, but in reality, the bank's underlying assets (loan funds) remain unchanged. You only need to pay interest directly to the bank because all the fund flows from the mortgage transaction are deposited on the bank's ledger.

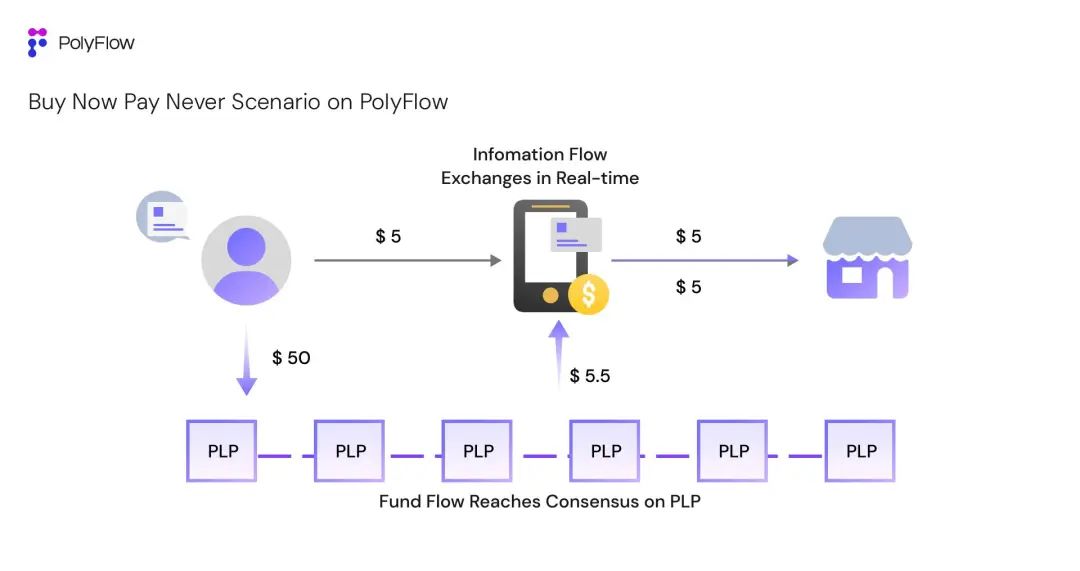

Let's build a Buy Now Pay Never scenario based on PolyFlow:

User Kevin purchases a $5 coffee from a merchant using a decentralized payment gateway based on PolyFlow, and the funds of the gateway and the merchant are both custodied in PLP. Assuming Kevin is also a liquidity provider for PLP, providing $50 in funds (generating $5.5 in daily earnings), based on the consensus of all parties on the fund flow in PLP's ledger, Kevin can buy coffee today (without paying), and then use the earnings generated by PLP tomorrow to pay the $5 coffee fee. The extra $0.5 can be considered as the overnight interest for borrowing funds by Kevin today.

In this scenario, the value of PayFi is fully demonstrated:

1) Cost reduction and efficiency improvement: Information flow is fully interactive, and fund flow remains unchanged, all deposited on PLP's ledger.

2) Increased fund efficiency: The benefit of unchanged fund flow is the ability to fully utilize the $50 provided by Kevin for liquidity.

3) Innovative financial paradigm: The Buy Now Pay Never scenario can achieve innovative financial paradigms and product experiences that traditional finance cannot, driving Mass Adoption of PayFi.

In this PayFi mode, the efficiency of fund utilization will be very high. Because everyone's ledgers are unified on the blockchain ledger, full trust can be achieved, and transaction information can be verified at any time, confirming the fund gap.

Raymond has been studying blockchain technology since 2011: "The unified ledger of the blockchain, tamper-proof, and publicly transparent, these well-known terms have been talked about by everyone for more than a decade, but no one can understand where its significance lies in landing.

Consensus on the fund flow on the unified ledger of the blockchain is the true meaning of blockchain. This will improve the efficiency of the entire crypto and Web3 industry."

This is also the fundamental basis on which PolyFlow aims to build a decentralized PayFi infrastructure.

4. The Value and Significance of PayFi

The integration of Web3 payments and DeFi has given rise to PayFi, which desires a new financial infrastructure to support its implementation and solve complex compliance issues. Since Solana Foundation Chairman Lily Liu introduced the concept of PayFi at the Hong Kong Web3 Carnival, PolyFlow has been seen as one of the first protocols aimed at building financial infrastructure for PayFi.

Literally, PayFi is not fundamentally different from GameFi or SocialFi, but the true significance of PayFi lies in: promoting the real-world application of digital currencies.

Looking forward, PayFi can cater to the migration of the Web2 community to Web3, for example, how traditional financial payment companies can use blockchain technology to gain a larger market share and avoid missing out on the trend of the times.

Looking backward, the Web3 community can use Payment as a carrier to solve pain points in the traditional financial system using blockchain technology, achieving new financial paradigms and product experiences that traditional finance cannot.

When discussing PayFi, Raymond has a deeper understanding: "What PayFi solves is not the surface-level problems that Web3 payments need to solve, such as the challenges of cross-border fund transfers and low financial inclusion, but the most fundamental problem that needs to be solved now: effectively separating the information flow and fund flow of transactions, allowing everyone to form a consensus on the fund flow on the unified ledger of the blockchain, so as to improve the efficiency of the entire Web3 industry and drive true Mass Adoption."

Currently, Web3 payments are still in a very early stage of basic services and original state, more focused on using digital currencies as a medium of exchange for payments, achieving settlement in a peer-to-peer mode, such as in OTC, Crypto Payment Card, and cross-border scenarios using digital currencies. However, the scenarios are relatively limited.

Therefore, with the launch of PolyFlow, not only can more PayFi participants easily enter the blockchain network, enabling the real-world PayFi scenario of Buy Now Pay Never in our daily consumption scenarios, but more importantly, it can allow everyone to form a consensus on fund flow, improving the efficiency of the entire blockchain Web3 ecosystem.

5. Beyond Payment

The concept of a blockchain distributed ledger may not sound revolutionary or attractive, but double-entry bookkeeping and joint-stock companies were also the same. However, like these great innovations, the seemingly ordinary technology or improvement process of blockchain has the potential to change the way human society operates.

Endowed with the financial infrastructure of blockchain, PolyFlow is integrating the transformative power of digital currencies and blockchain technology to create a brand-new decentralized PayFi encrypted payment network, driving people towards a paradigm shift in innovative finance and unlocking the true value of Web3.

Ultimately, making the grand vision in the Bitcoin whitepaper a reality.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。