Author: JiaYi

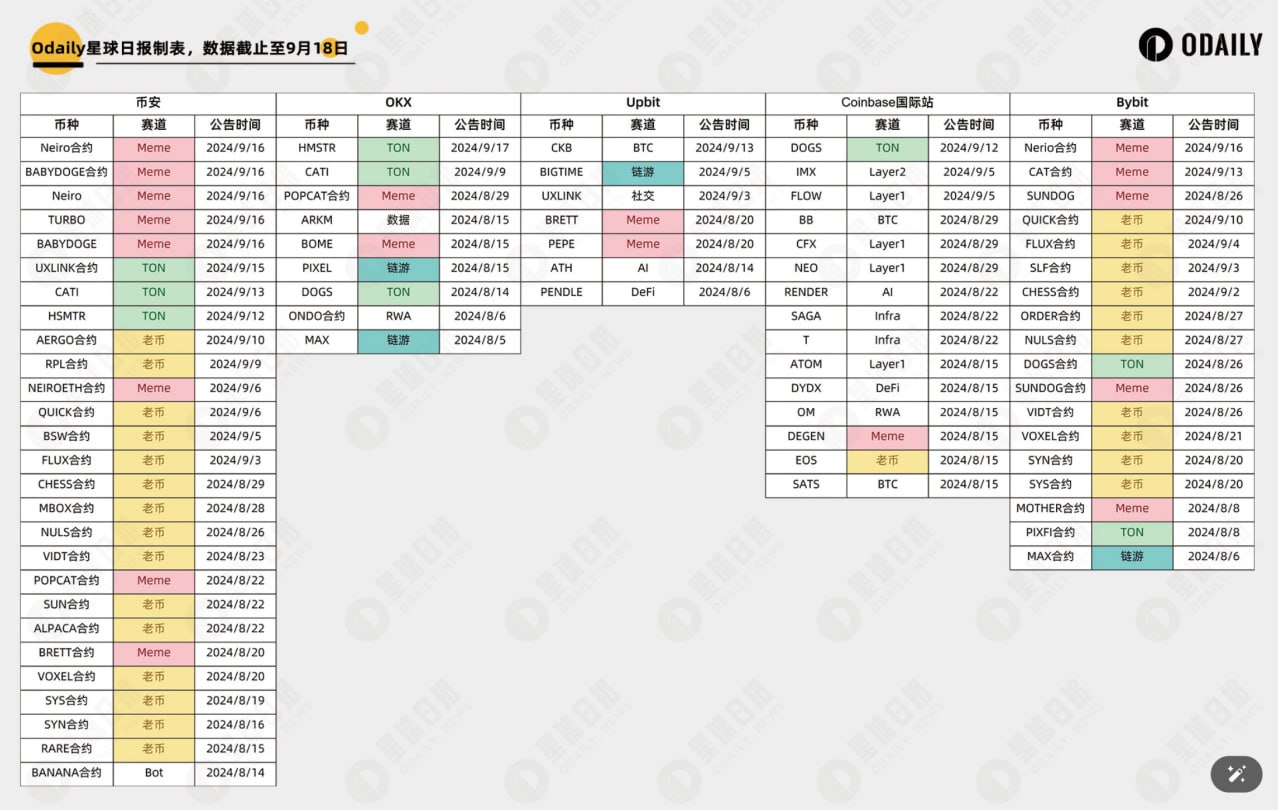

This picture is very interesting. Now, from the user's perspective, the endless stream of Meme and Ton mini-games projects have almost engulfed the market. Many people point their fingers at Binance, thinking that it has "corrupted" the atmosphere. However, upon closer inspection, it turns out that the major players are surprisingly in sync, "the big brother doesn't joke with the second brother."

In plain terms, this is not just a problem for any single CEX, but rather the entire market is going through a period of painful adjustment.

It's just that the external influence of Binance is too great, and every move directly affects everyone's nerves, making it a barometer. So, when the market systematically falls into distress, it naturally becomes the biggest and most logical target, indicating that everyone's expectations for Binance are the highest.

Crypto Industry in "Accelerated Clearance"

So, where is the problem exactly?

In my opinion, the entire crypto industry is going through an "accelerated clearance" spiral. In fact, we only need to ask ourselves: aside from mainstream coins, have you traded more Meme or VC coins this year?

The answer is undoubtedly that since 2023, everyone has been flocking to Meme coins, which are known to have no value but have continuously created "wealth myths"…

Real money votes with its feet and won't deceive anyone. The crypto industry itself is the closest to money, and users, entrepreneurs, and project parties all instinctively lean towards opportunities and hot trends that can bring real profits. So, previously, everyone criticized CEX for promoting VC projects valued at tens of billions that only tell stories but lack real value, leaving retail investors to pick up the pieces. As a result, Meme emerged as a grassroots rebellion symbol against VC and was hyped up.

However, Meme and Ton mini-games, like igniting a box of dazzling fireworks, immediately saw an increase in user flow, incremental funds, and attention, which looked good on paper, but also accelerated the depletion of market liquidity and overdrawn user trust in exchanges and crypto. Therefore, as the tide turns, the voices criticizing Meme are also growing louder.

Exchanges Are Not the Judges

At this moment, it's just like it was back then.

Ultimately, before a project is listed, the core should be to build its own community consensus. If you don't believe in your own project and token, and just want everyone to pick up the pieces while you cash out, the entire community atmosphere will completely deteriorate:

The consensus in the communities of major FDV projects now is, "I'm just here to take advantage. As long as the FDV is high after listing, I'll airdrop a lot and sell immediately."

So, the entire market is currently in a state of confusion and loss of focus, and exchanges are not judges; they look at the emotional value of the community and retail investors. When the community's attention is on Meme and Ton mini-games, and when this consensus becomes mainstream, exchanges become timid and dare not list major projects.

After all, for CEX, they can make money no matter what, so following the community trend naturally becomes the smoothest choice. It is precisely because of this situation that some truly good builders have been buried. In short, the underlying logic of the market is flawed, and CEX at most just stepped on the gas pedal hard.

So, everyone stops pretending and just embraces Meme and mini-games, like products rapidly ripened by fanatical beliefs. Even if they are not recognized by the market as imagined, at this juncture, who cares about recharging beliefs? Making money without picking up the pieces is the highest criterion.

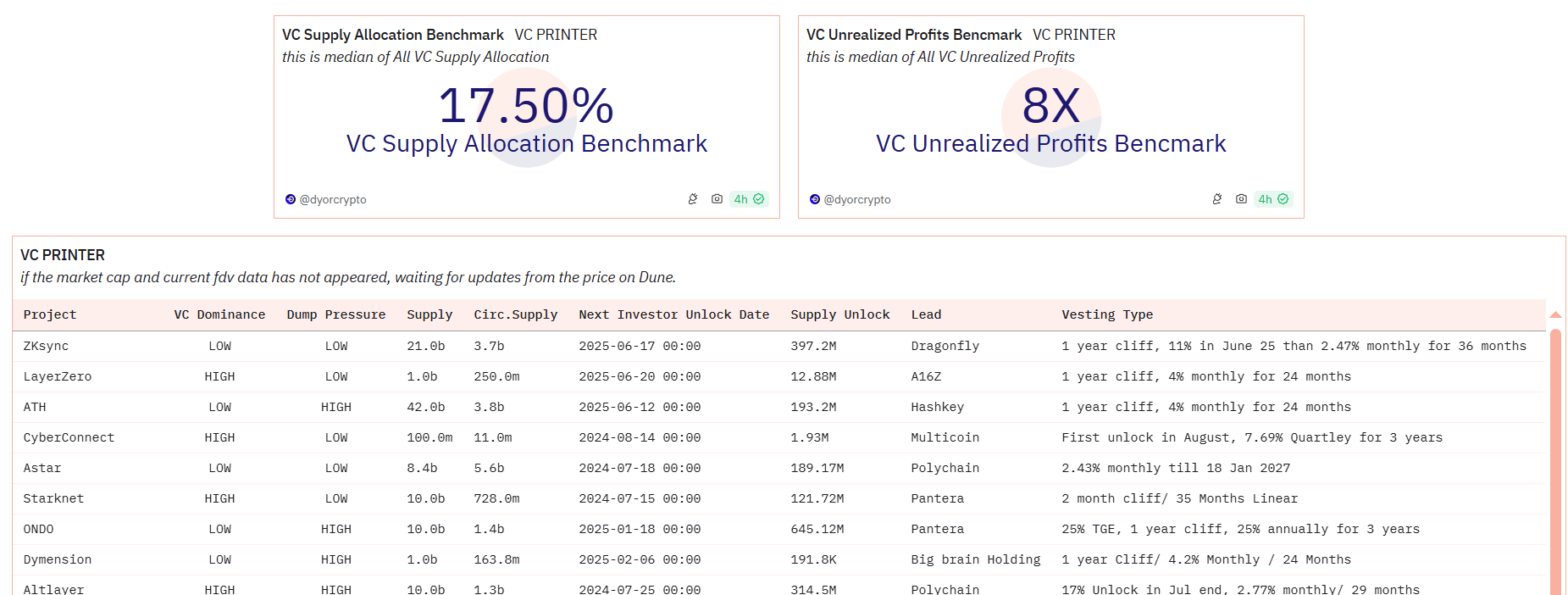

As shown in the above image, even in the face of sustained market declines, major VCs still have unrealized profits from these tokens that are several tens or even nearly a hundred times their initial investment. The overall unrealized profit of VCs is still as high as 8 times.

Breaking the Deadlock Requires Tripartite Agreement

So, how can the industry escape from this spiral?

To be honest, this first requires project teams to earnestly build truly valuable projects, rather than chasing short-term gains with flashy concepts. Then, the community will gradually stop blindly following trends and use their voices and actions to support projects with potential and sincerity. Only when project teams and communities work together can exchanges recognize the true market demand and make decisions to "drive out the bad money with good money."

I ask myself, what is a good project? A project that provides value? What is value? Simply put, making users believe in you; making users believe that holding your token can make money; making users reluctant to sell your token; making users money.

Of course, in this chaotic market, CEX needs a heavyweight role that can decisively influence the situation, stand up, withstand pressure, and become the industry's conductor, telling everyone: look, as long as the project is genuinely committed to advancing Web3 progress and innovation, creating value for users, then it deserves to make money.

We need more project teams and founding teams that deserve to make money.

Only with such a role that combines ability and willingness (to be honest, currently only Binance can step up and do something), using the effect of making money as a baton, and being willing to take a hit, can truly powerful and promising projects receive more attention and support, driving the entire industry to re-examine its development model, gradually restoring market confidence and bringing investors back to rationality.

But this requires a tripartite agreement among project teams, communities, and CEX.

Of course, the worst situation will also give rise to the most brilliant opportunities—after all, it's just a thorough clearance, "this cruel joy will eventually end cruelly," a long and dark storm will pass, everything will be clean, and it will just be a change of protagonists at most.

Conclusion

Finally, I'll secretly say, when Binance listed Nerio, I grumbled and bought it, and then shamefully made money… It's the current market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。