拓展阅读:Gate Ventures研究院:深度解析MEV,照亮黑暗森林(上)

MEV减缓探索方向

过去Ethereum生态内部,PBS的解决方案是外包给Flashbots来实现的,Flashbots专门用于研究以太坊的MEV问题,其最新一轮估值已经达到了10亿美元。但是由于Relayer毫无经济效益,并且实现Relay需要很高的技术和经济门槛,Blocknative放弃这一赛道项目的研发。为了解决去信任化以及0经济激励的问题,以太坊也在考虑使用e-PBS协议级别改进,来避免基于第三方协议mevboost的Relayer的存在。

当前MEV似乎是一个无法很好解决的问题,因为本质上这是生态系统复杂度提升以及用户时间段内信息不对称的必然产物,对于黑暗森林的以太坊来说,特别是在无需许可和抗审查的黑客思想影响下,以太坊无法在协议层面进行审查和改进来一次性切断MEV,这不可能做到也不会出现。以太坊生态下,更多的是想办法减轻MEV的负外部性,增强其正外部性。许多的项目、社区成员、开发者、VC都在探索一些值得尝试的方式,也就衍生出了许多潜在的机会。接下来,我们将大致介绍一些减缓负外部性的尝试,总的来说,所有的尝试都是三个方向:协议级别、应用级别、拍卖机制。

SUVAE

SUAVE(Single Unifying Auction for Value Expression)是Flashbots提出的,旨在改善MEV负外部性。同样,其不诉诸于解决MEV,而是引导MEV变得去中心化、透明。

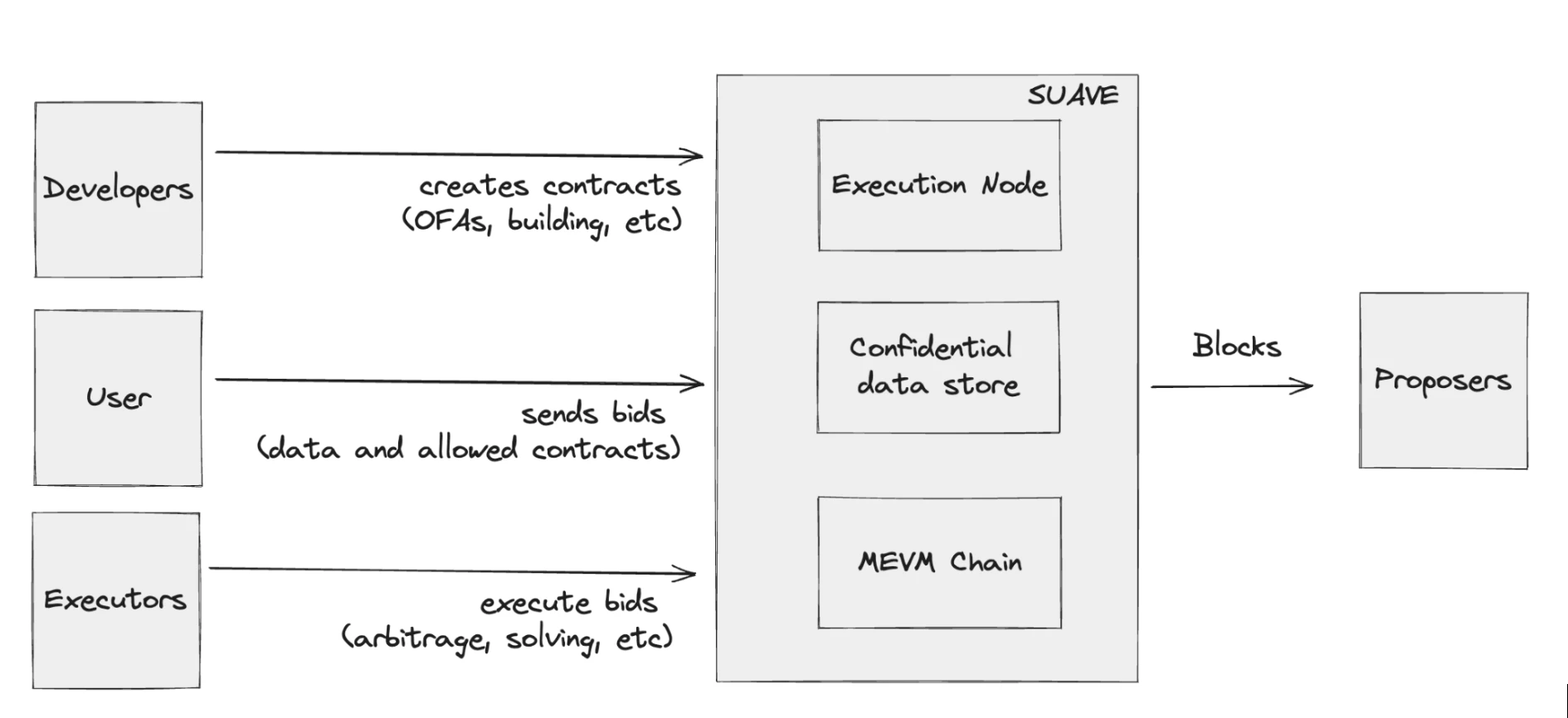

SUAVE链的架构,图源:Flashbots

其通过构建一个新的区块链SUAVE,内置了一个MEVM虚拟机,该虚拟机能够运行EVM智能合约。同时配套的开发者工具能够支持开发基于EVM虚拟机的MEV智能合约。从而允许当今任何集中式 MEV 基础设施转换为分散式区块链上的智能合约。这大幅降低创建新 MEV 应用程序的门槛,可以最大限度地提高不同机制之间的竞争,并且带来了去中心化和透明性。最后,它有助于通过使中心化基础设施(构建器、中继器、中心化 RFQ 路由等)能够被编程为去中心化区块链上的智能合约来分散MEV产业链的中心化问题。

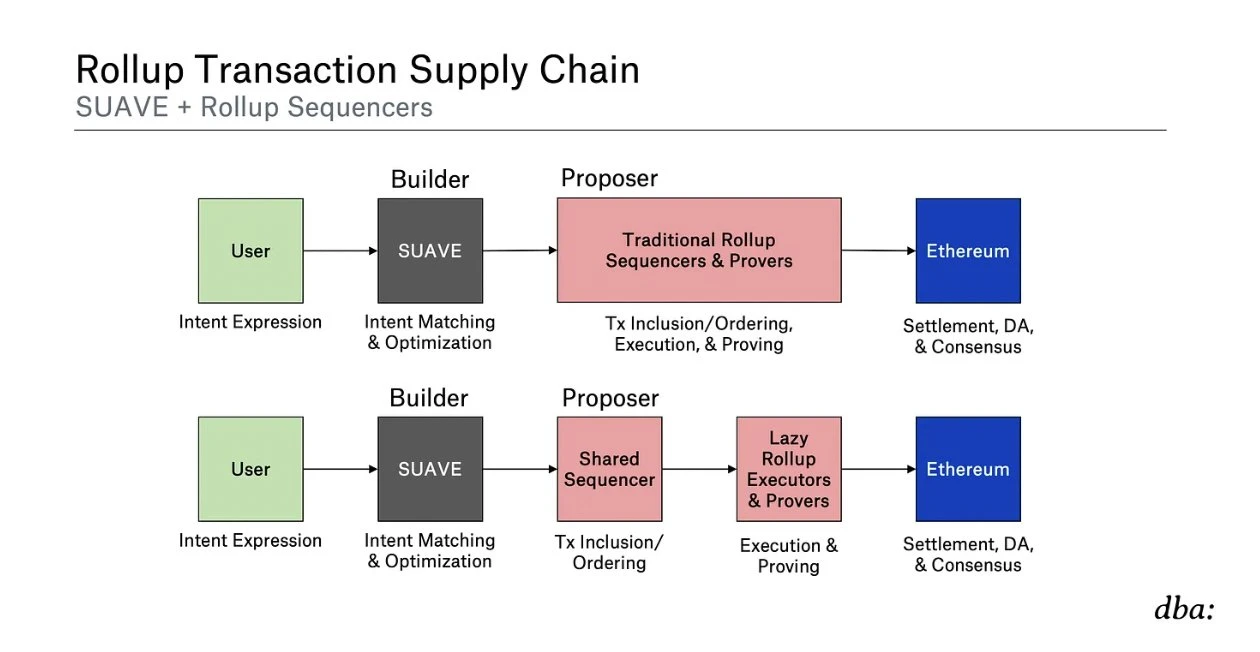

Rollup交易的供应链,图源:dba:

SUAVE能够作为去中心化的排序器以及意图识别机器提交给链上的Proposer,最后使用以太坊作为结算层。执行节点会在链下执行,采用可信执行环境或者零知识证明技术。用户能够使用意图交易,将交易交给SUAVE去解析,并且最大化的透明MEV,以进行智能合约间的MEV竞拍,这样通过透明的市场机制就能有效的减缓负外部性。同时,根据Paradigm的应用税文章,比如针对MEV bot行为,征收应用税,也是比较适合在SUAVE上实施的。而Paradigm正好也是本项目的顾问和投资人。

OFA

我们以OFA(Order Flow Auction)为例,来一览其对拍卖机制的改进。

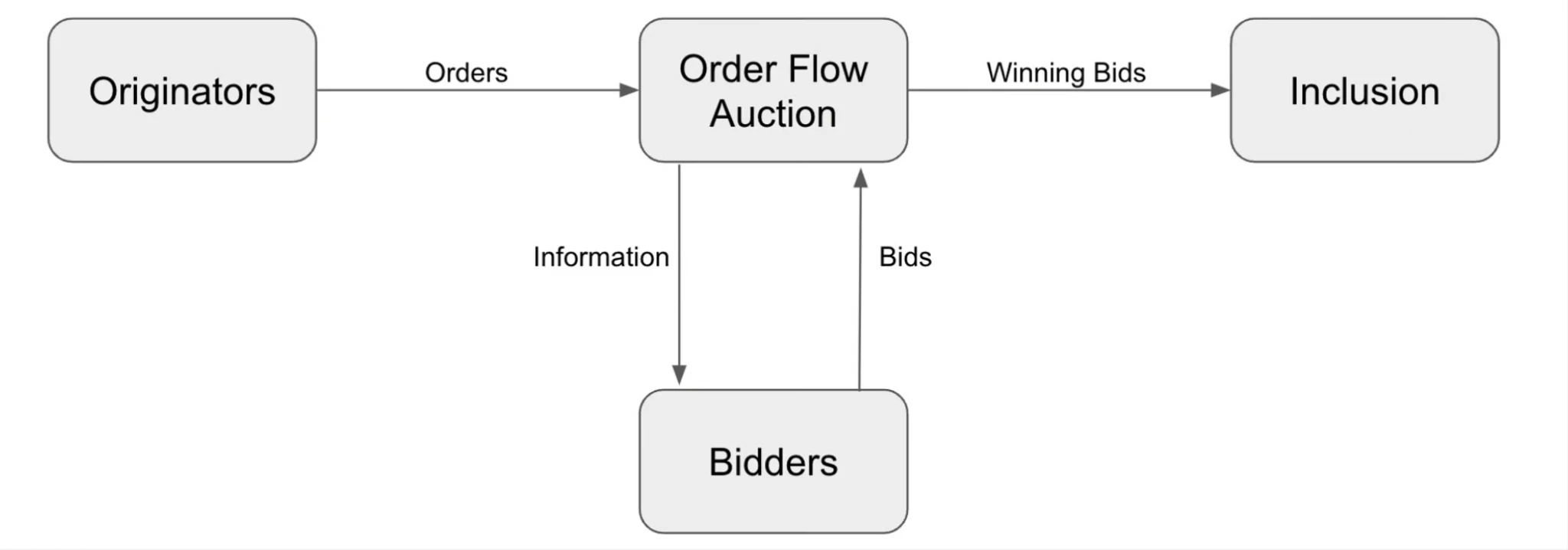

OFA拍卖机制,图源:Frontier Research

订单发起人(钱包 / 应用)将订单发送给OFA,OFA选择性的披露部分信息,包括订单价值等,这个是设计空间。

竞标者Bidders出价,获得对应的信息并且提出能够为此订单流支付的价格,之后Bidders就会对这个订单流进行MEV。

这部分私人的订单流只有Bidders能够看到,并且引入了市场化竞争以后,能够让MEV更透明,以及尽量减少用户的损失。

目前业内有不少基于OFA拍卖机制的项目正在研发,整体的运行机制和流程都非常相似,不同点在于四个核心组件之间的细节与实施方式不同。

私人交易池加密

OFA类似于构建了一个私人交易池,但是这些用户订单只能由某个拍卖机制下获胜的Bidders提取MEV,拍卖的手续费返还给订单所有者。实际上这套架构下仍然存在某种拍卖机制下的MEV提取。内存隐私池是希望解决对Searcher的保密问题,因为Searchers是MEV的主要参与方。因此只需要通过隐私交易池,让订单只有中继者和区块构建者才能看到。其中,加密意味着用户的交易可能需要支付更高的Gas,这本身应该是可选的,目前有以下几种值得探索的加密方法。

多方计算MPC:多个参与方使用MPC,这将对多个参与方隐藏交易细节,在共享排序器处也可以应用MPC来分散单一排序节点的中心化权利。

可验证延迟函数VDF:该函数需要一定的时间T来进行计算,并且一旦计算完毕,能够快速验证其正确性。通过使用VDF可以让交易顺序变成串行执行,但是却会让大量用户环境下体验变得非常糟糕,延迟时间T是一个权衡下的值。

阈值加密TSS:允许多个参与者共同参与加密和解密过程,而不需要任何单个参与者拥有完整的密钥。阈值加密可以通过加密交易内容,防止攻击者在交易被确认前看到交易细节,从而有效防止前跑攻击。相比于MPC,TSS更加简单,更适合与单一的签名与私钥生成等环节。Shutter Network使用TSS,它允许验证者在不知道交易内容的情况下对交易进行排序和打包,从而防止MEV攻击。

零知识证明ZKP,能够在不公布具体信息的情况下,验证该信息的正确性。目前发展主要受制于硬件发展的影响,成本高昂,具体商业化落地需要时间。Automata Network提出了一个名为"Conveyor"的隐私中继网络,使用多方计算(MPC)和零知识证明来保护交易隐私,同时允许验证者执行必要的计算。

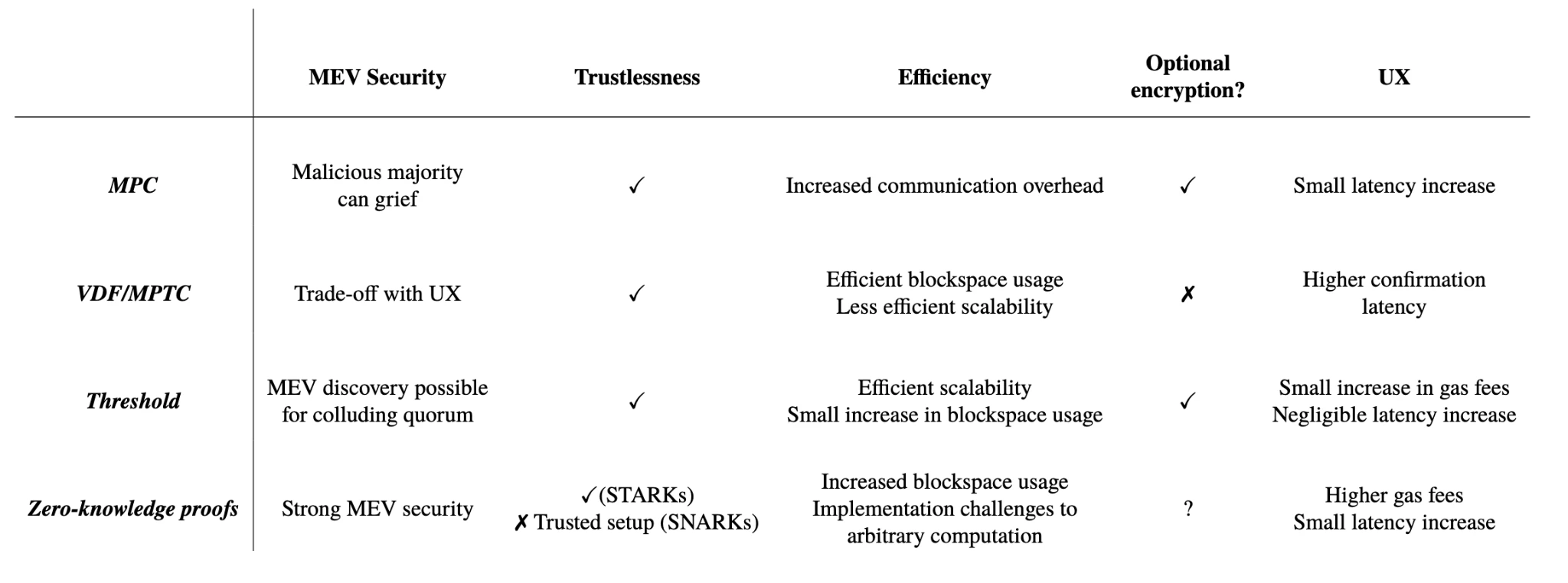

私人交易池加密方案对比,图源:Flashbots

对于私人交易池的加密有多种可选的加密算法,包括MPC、TSS、VDF、ZKP等,但是每种加密算法都有其弊端需要开发者权衡。其中具备探索性的项目有使用TSS算法的Shutter Network以及使用的MPC和ZKP来解决MEV的Automate Network值得关注。

Execution Tickets

Execution Tickets是Justin在哥伦比亚加密经济学研讨会上提出的一种解决MEV方案,这是对共识层面上的改进,其经历三个步骤:

其提出了一个 Tickets市场,获得Ticket的人能够获得在未来某个时间段提议执行区块的资格。通过动态定价机制,能够实时调控流通中的Tickets数量和现有供应调整价格。每个Ticket具体针对哪个slot也是随机选择的。

其将区块分为执行和提议两种,区块提议者是随机选择的,执行区块需要Ticket才有资格。

执行区块的Ticket持有人有权在分配到的时间段内提议执行区块,并获得相关的执行层奖励(EL Rewards = TX Fees + MEV)。执行区块提议者需要提供抵押,以确保他们在分配的slot中生成执行区块。如果他们出现双花或离线,抵押将被没收。

Slot被分为了执行轮和信标轮(共识轮),当一个Ticket被销毁,那么相当于对应的ETH被销毁,增加了ETH的通缩压力,由于执行区块和共识区块是随机选择了,因此这极大的增加了两者串通的可能性,其问题在于:

但是这个机制会衍生出多块MEV的问题,也就是购买多个连续区块的执行Ticket,这样可能会扩大MEV的利润以抵消购买Ticket的成本。因此这个机制需要很好的设计Ticket价格的变化函数。

该机制仍然没有解决用户MEV三明治攻击的问题,只是把用户的损失,补偿到了全体网络的通缩上。

e-PBS

实际上,在Merge以后,以太坊并没有实现PBS,也就是说,构建者和区块提议者都需要从验证者中选择,但是为了网络的经济效益最大化,使用MEV-Boost作为第三方的PBS协议外解决方案,目前已经有90%的Relayer市场份额。

e-PBS(enshrined PBS)是以太坊为了应对MEV-boost Relay作为第三方构建的信任化中间件的解决方案,其将PBS纳入共识级别,而不再依赖于Flashbosts这种三方提供协议外解决方案。该提案代号为EIP-7732。该协议的目标是让以太坊协议层能实现信任最小化的 PBS 解决方案,通过以太坊协议内的机制捕获绝大多数 MEV,并以以太坊协议利益最大化的方式,将捕获的 MEV 分配给参与者。该e-PBS类似于我们在PBS章节中提到的工作流程,但是其特点在于消除了Relayer角色,Builder向Proposer竞价被写成了共识层的代码。

ePBS执行流程图,图源:mikeneuder

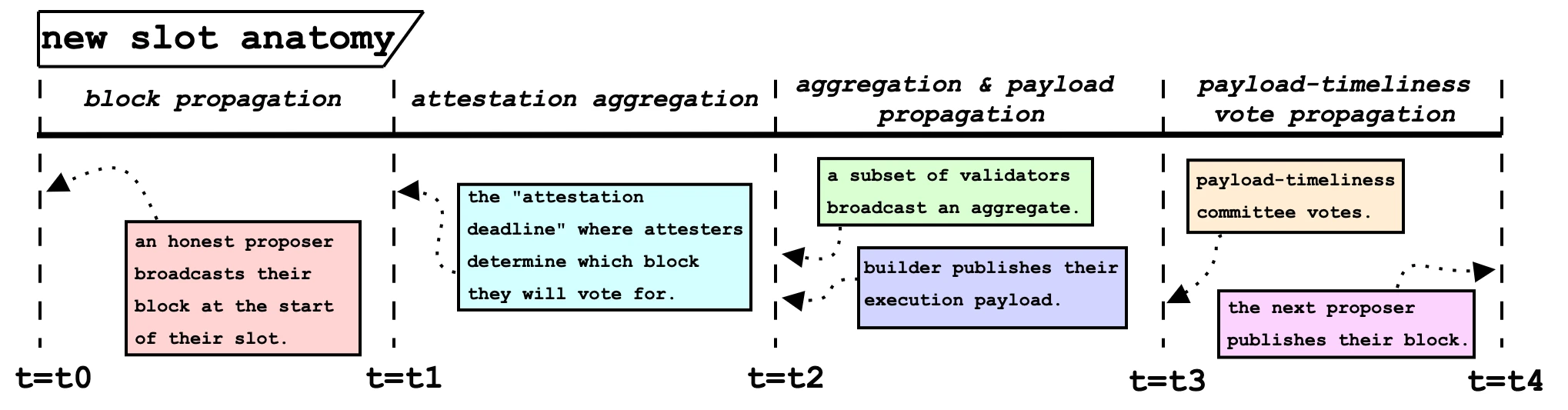

上图是,ePBS机制下的Slot N流程:

区块广播:t=0时,选定的POS验证者提议N号插槽的共识层(Consensus Layer,CL)区块,该区块包含Builder的拍卖区块出价,但是不包含执行负债。

证明截止时间:t=t1时,委员会会根据分叉规则选择正确的区块,并进行证明。

聚合证明和payload传播:t=t2时,广播Slot N的聚合证明,便于验证。同时 bulider 发布他们的 ExecutionPayload,以构建该块的完整版本。

PTC投票广播:t=t3,PTC负责监督Builder的Payload是否按照规则进行,并且判断其时机是否有效。

t=t4,下一个区块的提议者是将slotN的区块视为空块还是正确构建的满块就至关重要,这需要下一个区块的提议者根据PTC的投票和证明来判断。

需要特别注意的是,为了保证Builder在一个Slot内能及时的提交区块负载,(在Ethereum2.0上也需要保证验证者委员会在一定时间内投票以及提议区块),在协议级别的PBS中,Builder仍然倾向于较晚发布Payload内容,这样就有更多机会寻找MEV,因此在协议中引入了PTC(Payload-Timeliness Committee),顾名思义,其是针对Payload构建者的监督机制, PTC 可以从经济角度促进 bulider 及时发布 payload,保证以太坊的安全性。如果Builder的Payload被定义为不及时,那么Builder将无法获得对应执行负载的奖励。

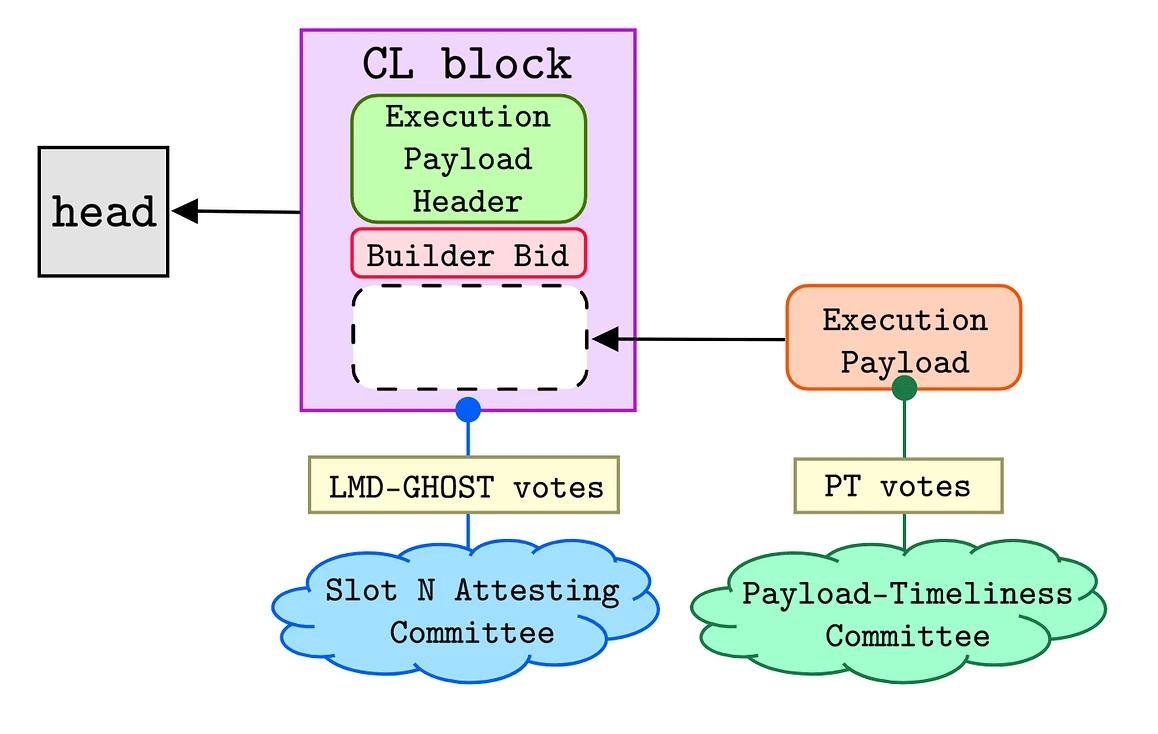

区块解析图示,图源:mikeneuder

因此在ePBS中,一整完整的区块需要两部分共同组装,一个是空的CL Block,是在slot刚开始时,由proposer构建,里面包含了Execution Payload Header和Builder Bid,但是具体的Payload 内容暂时为空。只有在证明聚合以及区块传播阶段,也就是PTC认可payload有效性后,才会主装到区块中,形成一个完整区块(Full Block)。

总的来说,EIP-7732 ePBS能够解决:

无需信任的中间第三方的透明区块拍卖方案。

分离共识层和执行层来减少验证者的计算负荷,从而提高网络效率和速度。

验证者能够立即专注于验证共识,并将执行负载的验证推迟到以后的时间,引入额外的时间窗口和投票机制,确保了系统的高效运行和公平性,同时允许更多的时间来处理执行负载。

但是也提出了一些问题有待讨论:

本质上这只是使得过去第三方Relayer的工作被取代,以此来实现区块提议流程中的去中心化和透明,但是本质仍然没有解决用户的糟糕MEV体验。

这次升级是共识层的更改,是不具备向后兼容性质的,如果ePBS的机制设计在实践中被验证失败,后续的补丁较难。

假设在一个插槽中,提议者发布了区块,但构建者由于某种原因延迟发布执行负载。这时,部分验证者可能会基于提议者的区块进行验证,而另一些验证者可能会等待构建者的执行负载,导致网络分裂。这样的分叉会增加网络的不稳定性和维护成本。

如果某个提议者故意在接近证明截止时间发布区块,可能会导致部分验证者看到区块,另一些验证者未看到区块,那么N+1个Slot的Proposer的行为将变得不可预测,极大增大链上分叉的可能性。

PEPC

同时EigenLayer也提出了一些解决方案,包括AVS组件PEPC(protocol-enforced proposer commitments)来解决MEV的问题。这个组件也希望解决第三方中间件Relayer的信任问题。主要是希望Proposer在提交CL块时,能够附带一个PEPC签名,来承诺。Builder通过验证Proposer的PEPC之后再执行负载,这在协议内引入了一个信任机制。通过内置的信任机制,也能解决Relayer作为第三方的潜在信任问题。

参考资料

《The MEVM, SUAVE Centauri, and Beyond》:https://writings.flashbots.net/mevm-suave-centauri-and-beyond

《Blockchains, MEV and the knapsack problem: a primer》:https://arxiv.org/html/2403.19077v1

《MEV ECOSYSTEM EVOLUTION FROM ETHEREUM 1.0》

《The Future of MEV》 by Blockchain Capital

《FRP-18: Cryptographic Approaches to Complete Mempool Privacy》by Flashbots

《Execution Tickets》:https://ethresear.ch/t/execution-tickets/17944

《Payload-timeliness committee (PTC) – an ePBS design》:https://ethresear.ch/t/payload-timeliness-committee-ptc-an-epbs-design/16054

免责声明:

以上内容仅供参考,不应被视为任何建议。在进行投资前,请务必寻求专业建议。

关于 Gate Ventures

Gate Ventures 是 Gate.io 旗下的风险投资部门,专注于对去中心化基础设施、生态系统和应用程序的投资,这些技术将在 Web 3.0 时代重塑世界。Gate Ventures 与全球行业领袖合作,赋能那些拥有创新思维和能力的团队和初创公司,重新定义社会和金融的交互模式。

官网:https://ventures.gate.io/Twitter:https://x.com/gate_venturesMedium:https://medium.com/gate_ventures

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。