Your weekly cryptocurrency market statistics, headlines, and trading ideas are all here.

Brief Overview

This week witnessed a significant rebound in the market, with Bitcoin surging to as high as $64,000 after an unexpected 50 basis point rate cut by the Federal Reserve on Wednesday, reaching a one-month high.

The altcoin market performed strongly, with several tokens recording substantial gains. Notably, TIA, SUI, and Popcats stood out as the best-performing tokens, demonstrating the breadth of the current market uptrend.

Given the current macroeconomic backdrop, traders should maintain an optimistic outlook on short-term market dynamics. However, closely monitoring the upcoming Bank of Japan meeting is crucial, as its outcome could significantly impact the yen/dollar exchange rate and, consequently, broader market sentiment.

Data Overview

Top-performing coins:

$TIA (+49.5%): TIA is squeezing the shorts aggressively as many bet against it due to the upcoming large-scale token unlock.

$SUI (+37.8%): SUI saw a significant surge for the second consecutive week, driven by positive news, including its inclusion in Grayscale's investment trust and the launch of native USDC.

$POPCAT (+38.4%): POPCAT was the best-performing meme coin on BitMEX this week.

Underperforming coins:

$DOT (+1.3%): DOT lagged behind emerging L1 tokens as attention and liquidity were focused elsewhere, with the latter dominating the best-performing list.

$ADA (+1.3%): Cardano, another "traditional" L1, underperformed in the broader market, which was not surprising.

$KLAY (+1.2%): Despite recent rebranding and potential synergies with Line and Kakao, seeing KLAY appear again on the losers' list is disappointing.

News Highlights

Macro:

ETH ETF weekly outflows: -$32.8 million (Source)

BTC ETF weekly inflows: +$305.2 million (Source)

Federal Reserve makes a significant 50 basis point rate cut, initiating the first easing cycle in four years (Source)

Trump buys burgers with Bitcoin at NYC crypto hangout PubKey (Source)

Ray Dalio says the Fed faces a tough balancing act in the face of "enormous debt" (Source)

Bank of Japan meeting on Friday to test fate of yen-sensitive Japanese stocks (Source)

Projects:

Binance CEO says the cryptocurrency exchange has seen 40% growth in institutional and corporate investors this year (Source)

LayerZero collaborates with a16z to launch the lzCatalyst program, aiming to provide up to $300 million in investment for full-stack Dapps (Source)

Stablecoin USDC now available in Brazil and Mexico, supporting direct exchange with local fiat currencies (Source)

Crypto venture capital firm Dragonfly Capital is seeking to raise $500 million for its new fund (Source)

UK fintech company Revolut reportedly planning to issue its own stablecoin (Source)

Hemi Labs completes a $15 million funding round for its modular blockchain network, with investment led by Binance Labs (Source)

Bitget and Foresight Ventures make a $30 million strategic investment in the TON blockchain (Source)

Trading Alpha

Note: The following content does not constitute financial advice. This is a compilation of market news, and we always encourage you to conduct your own research before making any trades. The following content does not imply any guarantee of returns, and BitMEX is not responsible for any underperformance in your trading.

Federal Reserve cuts rates by 50 basis points—What's next?

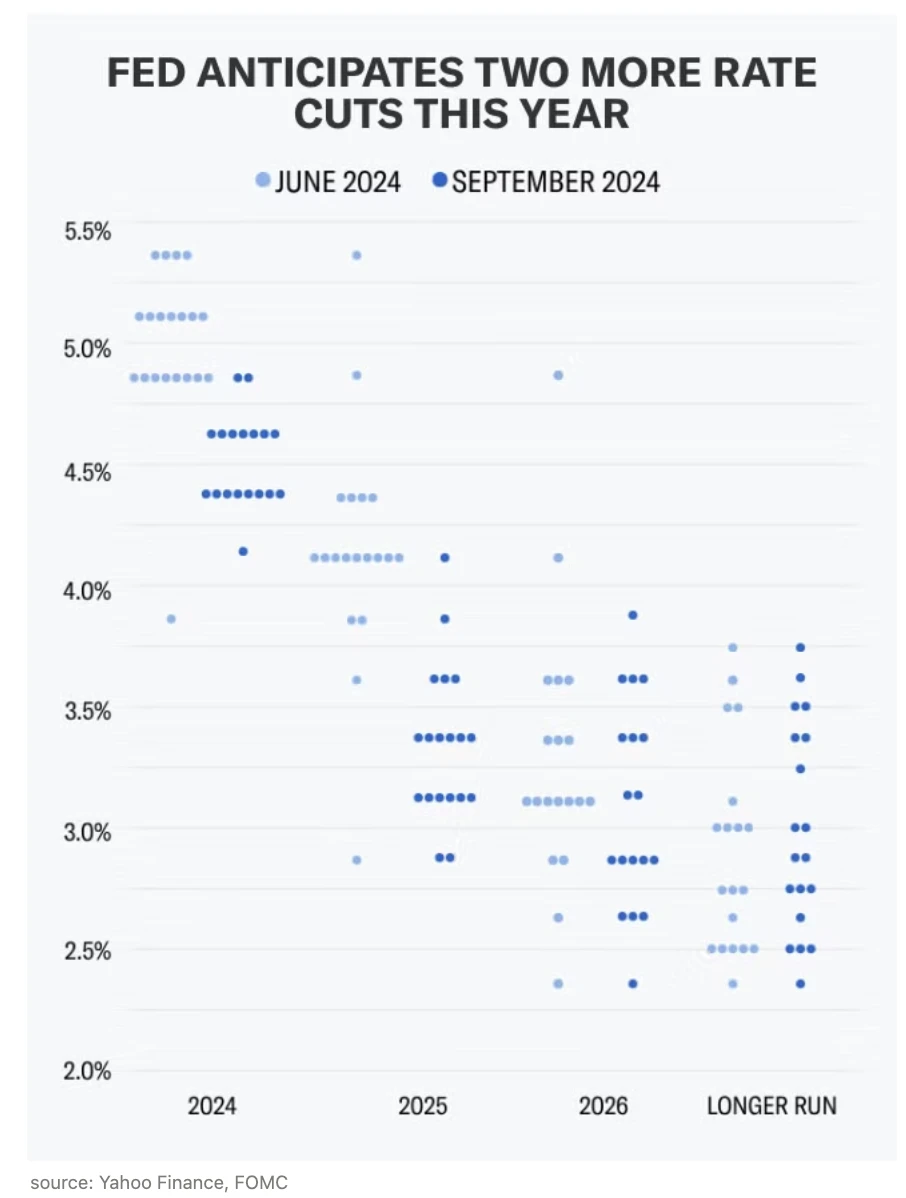

The Federal Reserve decided to make a significant 50 basis point rate cut, bringing the benchmark interest rate down to 5%—lower than the expected 5.25%. This marks the first rate cut by the Federal Reserve since March 2020, with median forecasts indicating two additional 25 basis point cuts in 2024. Despite Governor Miki Bowman casting a dissenting vote, Federal Reserve Chairman Jerome Powell expressed confidence that this aggressive move will help maintain economic strength and labor market stability while making progress towards the 2% inflation target.

Does the rate cut signal the start of a cryptocurrency bull market?

Considering the macro bullish factors, there is significant short-term upside potential: improved liquidity and economic support from rate cuts. The 50 basis point rate cut demonstrates the proactive approach of the Federal Reserve, prioritizing economic indicators such as unemployment rate over inflation. Since June, Fed officials have significantly increased their outlook for larger rate cuts. The latest dot plot shows that almost all officials unanimously believe that rates will decrease more than previously expected.

Continued strong expectations for rate cuts, coupled with the potential for high inflation and a low interest rate environment, create the perfect storm for Bitcoin's rise.

What to watch in the short term?

The USD/JPY exchange rate will be crucial. The Bank of Japan (BoJ) meeting on Friday will determine the fate of the yen exchange rate, and a strong yen could have a negative impact on risk assets, including Bitcoin and cryptocurrencies. There is still a "concern" following the unexpected rate hike in July, that the BoJ might take action. However, if these concerns are proven to be unfounded, the resulting calm should make the undervaluation of Japanese stocks even more apparent.

With the rise in Japanese inflation, the BoJ will inevitably raise the yen interest rate. With the Federal Reserve's significant 50 basis point rate cut, the yen may gradually strengthen, although this trend itself will be relatively moderate.

Which coins to buy?

As mentioned in previous issues, here are some coins that traders may be interested in and have the potential to outperform the market:

Bitcoin: BTC ETF has seen a significant inflow of positive funds, reaffirming its undisputed status as the king of cryptocurrencies.

New L1: Alternative Layer 1 blockchains continue to outperform, especially $SOL, $SUI, $APT, and $AVAX.

DeFi: DeFi tokens face multiple bullish factors, including lower rates, improved regulatory environment, and Trump's involvement in DeFi projects. Key tokens to watch are $UNI and $AAVE.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。