加密货币投资者对他们的资产的「软着陆」和积极的价格走势寄予厚望。

撰文:Jack Inabinet,Bankless

编译:善欧巴,金色财经

美联储刚刚宣布降息,这是自疫情以来的首次降息,一如预期,大幅下调了 50 个基点。这一期待已久的决定立即引发了股票和加密货币投资者的兴奋。

鲍威尔的印钞机终于重新启动了,这就是为什么市场上许多人都对此次降息可能引发另一场加密货币牛市感到乐观。

2022 年,美联储加息以应对高通胀,导致借贷成本上升,资产价格下跌,从而引发熊市。然而,随着利率下降,许多人预计货币宽松政策可能会温和地引导全球经济实现「软着陆」。

如果通胀不再飙升,且降息有助于保持失业率稳定,央行行长们就可以取得不可思议的成就——消除重大的经济不确定性,实现几十年来未曾见过的全球经济稳定水平!

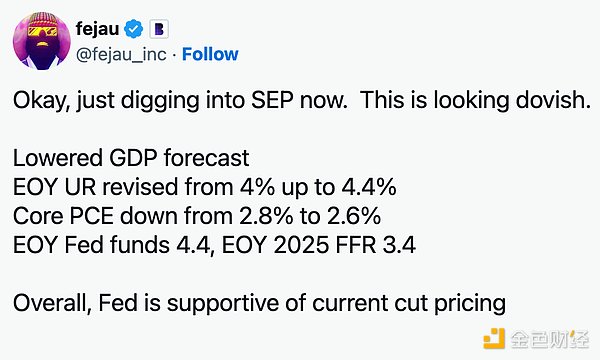

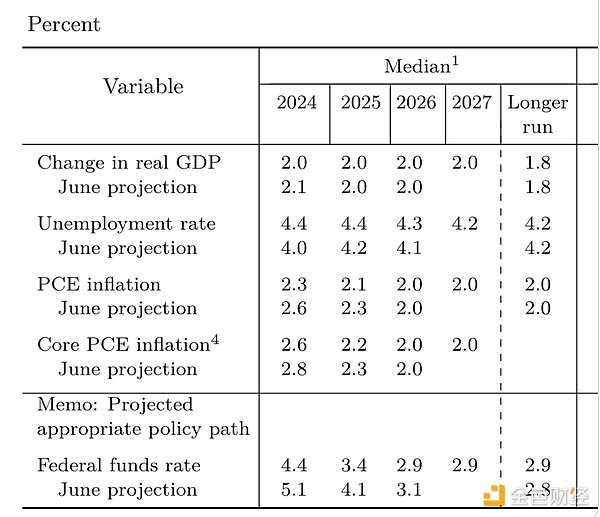

尽管美联储最新的经济预测似乎倾向于未来进一步降息,但也反映出形势的不确定性,通胀预测被下调,GDP 估计持平,失业率预期大幅上升。

最大的经济风险已从通胀上升转向就业率下降,降息决定就是明证。尽管美联储委员和其他央行行长有信心通过进一步降息来管理这些风险,但任何持续的经济下滑都可能迅速演变为严重的衰退担忧。

自周二以来一直在上升的全球债券收益率在降息消息确认后仅小幅下降,表明市场已经将这一因素考虑在内,并自 7 月以来的早期下跌中。尽管比特币在降息消息传出后一度上涨约 2%,但市场随后很快开始抛售,在收盘前抹去了涨幅。

虽然降息带来的最初兴奋显而易见,但市场的快速逆转表明不确定性仍然存在。投资者现在正在密切关注经济对这些变化的反应,希望平稳过渡,但对未来可能出现的颠簸保持警惕。随着通胀、就业和增长之间的平衡继续展开,这是否真的会引发下一轮加密货币牛市或引发更深层次的衰退担忧仍有待观察。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。