Powell 主席以 50 个基点的降息满足了风险市场的期望,但对于这次选择较大幅度的降息,他同时也充满信心地强调经济软著陆仍然是基本情况,并多次重申美国经济表现“相当不错”。

重点摘要:

随著通胀下降,软著陆仍然是基本预期。“美国经济状况良好,我们今天的决策是为了保持这样的局面。”“美国经济基本上没问题。”“我相信通胀会降至 2%。”

保持领先。Powell 承诺在利率调整上“保持领先”,以应对就业市场的放缓,并特别关注招聘率(50 个基点的降息是我们不落后于形势的承诺)。美联储将 2024 年的失业率预期上调至 4.4%(之前为 4.0%),2025 年上调至 4.2%(之前为 4.0%),2026 年则上调至 4.3%(之前为 4.1%)。

50 个基点的变动旨在传达“强有力的举措”。Powell 承认 50 个基点的调整是较强力的举措,但他也表示未来不一定会以同样的步伐推进(“我们不应该假设这是新常态”),给美联储未来的会议留下回旋的空间。基本上,不要预期一直会是 50 个基点的调整,也不要预期 75 个基点的降息,但如果经济数据证明有必要,美联储也可能会进行多次 50 个基点的调整(“我们总是会在当下做我们认为对经济有利的事情,今天的决策也是如此。”)。

关键在于硬数据。美联储将专注于硬经济数据而非软情绪数据,将特别关注市场对较低利率的反应。

我们立场一致。Powell 指出,所有 19 名成员都同意今年应多次降息,其中 17 名成员认为会进行 3 次完整降息,2 名成员则认为将有 4 次,这与 6 月的情况有“显著不同”,唯一的异议者是 Bowman,他这次支持仅降息 25 个基点。

市场反应:

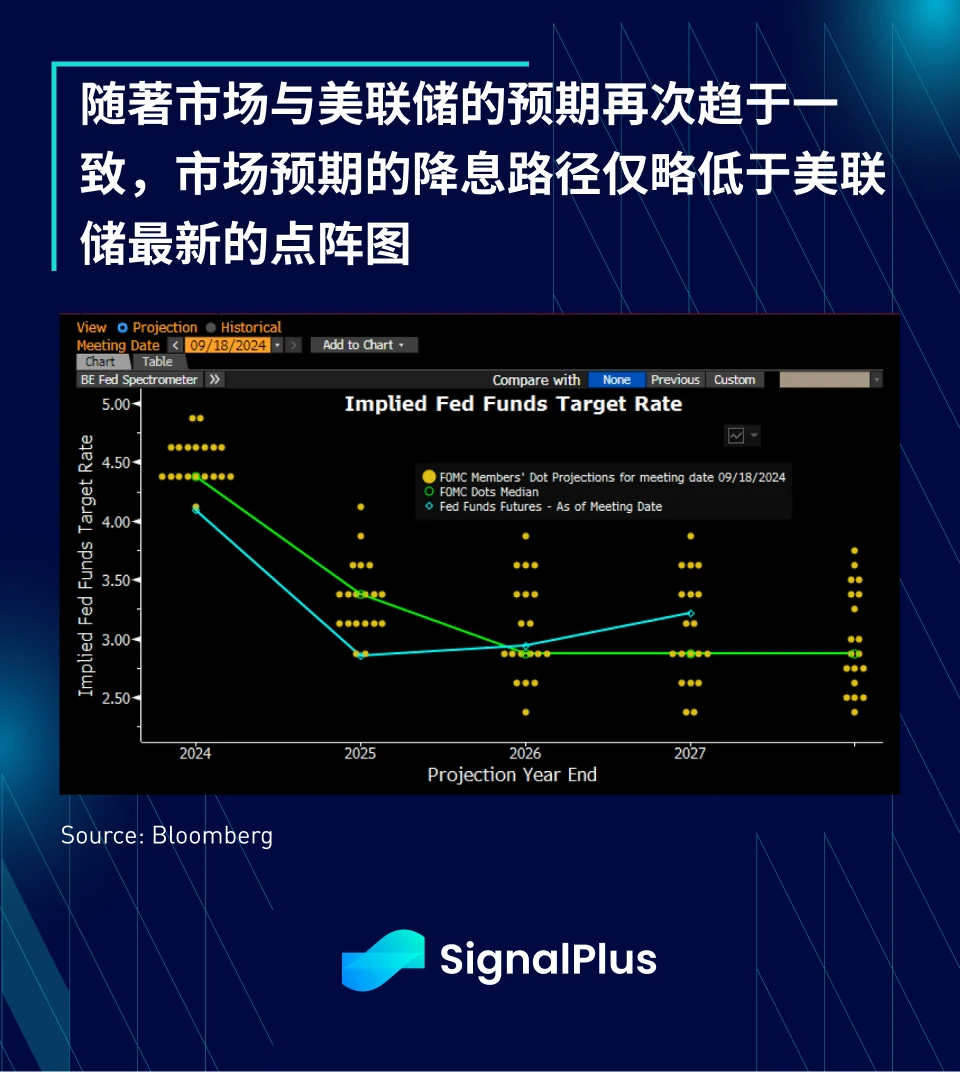

利率:市场仍然预计 2024 年会再有 2.5 次降息,略领先于美联储的点阵图中位数。债券收益率在 FOMC 会议后几乎没有变动,因为结果基本符合预期。

外汇:美联储的决策导致美元走弱,特别是考虑到日本央行在即将召开的会议上可能会保持鹰派立场,美元相对于日圆疲软。

股票:美联储实施“强有力”的宽松政策,并表示经济状况仍然良好且通胀预计会下降,促使股市上涨。

加密货币:受益于股市强势走高,BTC 回升至 60k 美元,altcoins 也表现强劲,显示整体风险情绪有所提升。

您可在 t.signalplus.com 使用 SignalPlus 交易风向标功能,获取更多实时加密资讯。如果想即时收到我们的更新,欢迎关注我们的推特账号@SignalPlusCN,或者加入我们的微信群(添加小助手微信:SignalPlus123)、Telegram 群以及 Discord 社群,和更多朋友一起交流互动。SignalPlus Official Website:https://www.signalplus.com

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。