Trader Chen Shu: Bitcoin and Ethereum market strategies on the evening of September 16th, *1, focusing on the 5.88 support and loss during the intraday pullback.

Summary of the article on the evening of September 15th: Yesterday evening, a light long position was given at 5.96/2380. During the Asian session today, the price continued to decline to around $58,000 due to the stimulus from the news. Currently, the price has returned to above $59,000. Whether to be bearish or bullish, please refer to my analysis below.

Looking at the daily chart of Bitcoin, after the weekend's 2-day pullback, it confirmed the pressure of the MA256 moving average with 2 bearish candles, broke below the MA30 moving average (5.9), and then recovered. The pressure level to watch is still the MA256 moving average (60,000). Looking at the 4-hour chart, after breaking through the 4-hour MA256 moving average (5.88) and recovering, let's see if the European session can continue to hold above 5.88. If it does, it will continue to rebound and test the 60,000 pressure. If it fails, it will enter a pullback process. In addition, as long as the daily MA10 moving average (5.77) is not broken, it is still advisable to take a bullish stance.

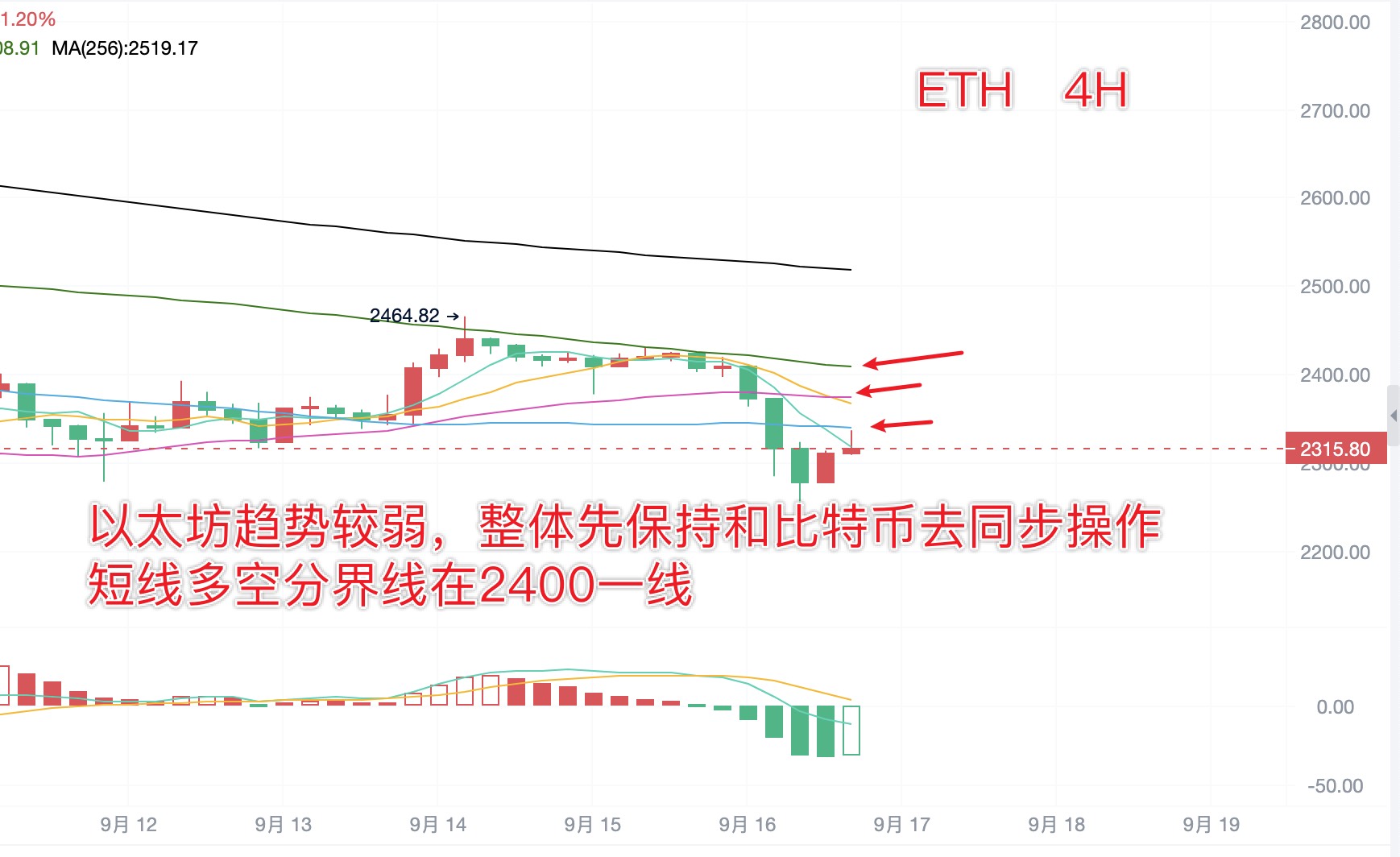

As for Ethereum, the daily price broke below the MA5/10 moving averages, showing overall weakness. It needs to return above 2370 before the short-term downtrend ends. Looking at the 4-hour chart, the price rebounded yesterday but fell after encountering resistance at the MA120 moving average (2400). Currently, the short-term pressure is focused on this price level.

Evening trading suggestions:

BTC: Light long position at 5.88. If there is a short-term decline to around 5.78 after the U.S. stock market opens, additional long positions can be added. Target is 60,000. Reduce position if broken, and hold for a target of 6.08. Consider a light short position near 60,000.

ETH: Long position near 2310, follow up with Bitcoin. Initial target is to see 2360, reduce position if broken, and hold for a target near 2400.

Note: For now, focus on long positions during the pullback. If panic sentiment appears in the U.S. stock market, it is expected to decline before rising. Therefore, for Bitcoin long positions, consider the depth of the pullback. If it fails to break through 60,000 forcefully, consider a short-term short position.

The win rate of daily analysis strategies is extremely high! Analysis is not easy, so I hope everyone can give a free follow, bookmark, like, and comment. Thank you all, and feel free to discuss in the comments below!

Real-time market strategy discussions can be found by clicking on my profile to see the introduction. Ranked first in (Coin World), a personal KOL main V, providing free guidance on live trading and answering trading questions. Welcome to communicate and exchange ideas!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。