交易员陈树:9.15晚间比特币、以太坊行情策略*1号,降息来临价格强势站上6万该如何应应对?

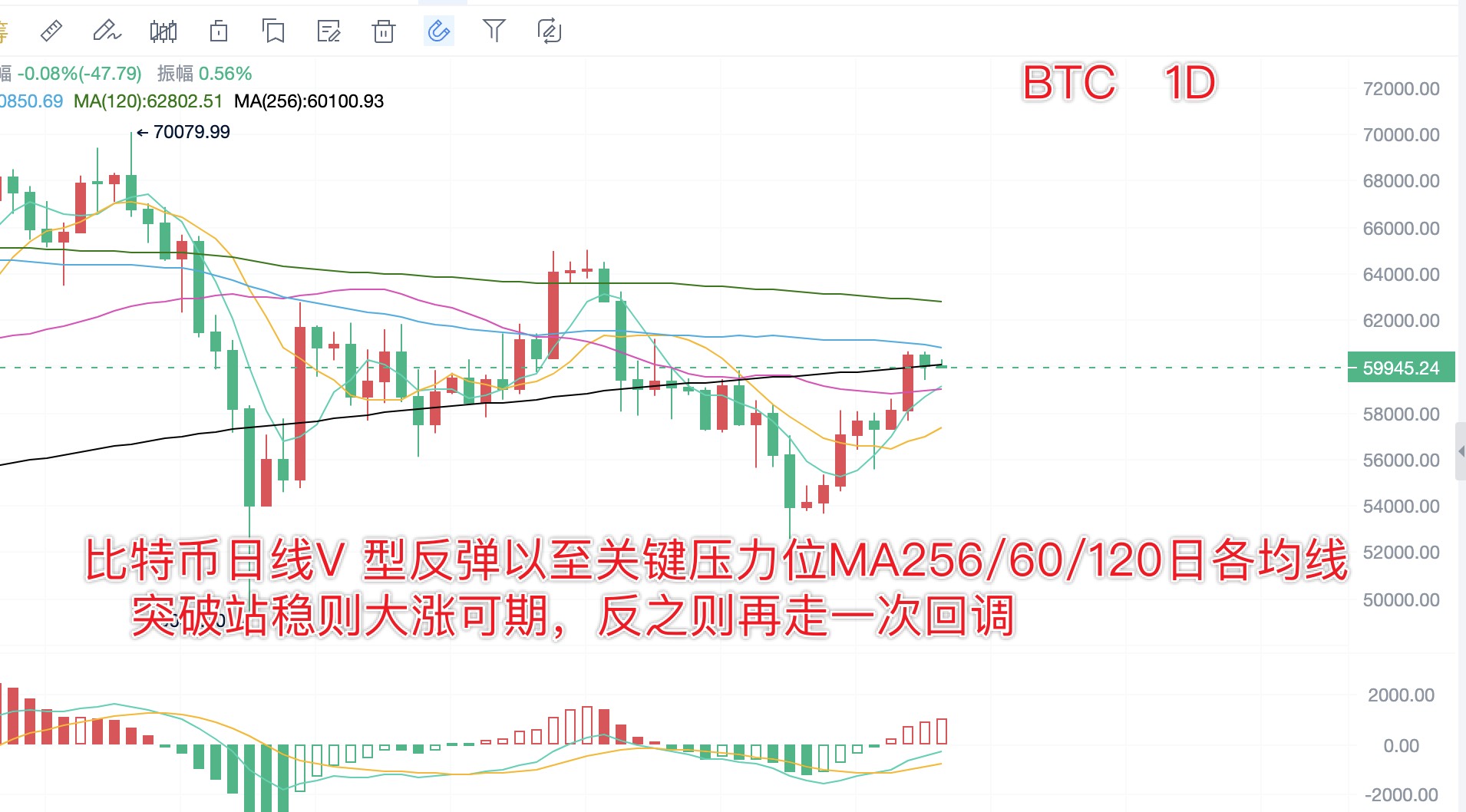

9. 14日晚间文章总结:昨日晚间给出区间操作思路基本适用,今日要关注晚盘价格是否持续站在6万美元上方,下周为美联储降息的关键周,降息来临之前以及来临之后我们该如何应对如何操作还请看我以下分析。 先分析一下目前的行情走势:比特币日线方面目前价格已经上涨至MA256日均线(6万)处,能否站上这一线还需要下周的行情来验证,如站稳那么在降息的利好刺激下还将延续这波上涨至MA60/120日均线即6.08/6.28一线,目前来看反弹测试这一线的概率较大,甚至会上涨至周线的MA30日均线即6.36附近,所以下周周初2个交易日我们暂时先以看涨对待,而到了周三以及周四的凌晨2点则需要谨慎做多,而是要转变思路去开始布局我们上周就讲到的中线空单。

对于《美国至9月18日美联储利率决定(上限》,如和市场预期的一致降息25个基点,那么对于比特币的价格上涨的刺激是有限的,预计上涨的趋势不会维持太久, 可能第二个交易日就会开始走下跌,因为降息所带来的利好已经被提前消化完,金融市场典型“买预期,卖事实”就会再次得到很好的见证,所以我不看好降息25个基点会带来大幅利好,反而会刺激比特币再走一次大幅度的回调。

而 黑天鹅即小概率事件:如降息50个点基点,或者不降息甚至升息毕竟是小概率事件,如果真的发生,那我们顺应消息面的趋势去交易就好。

再从技术面上看,为何我会在降息潮来临之前唱衰比特币,首先从月线上看比特币的低点价格是在不断的下移,周线上虽然本周收了一个大阳线,但是上方的MA30日均线(6.36)如不能突破站稳就还是回调趋势,并未真正的转为多头趋势,起码目前没有,所以如果在降息25个基点预期下,那么假突破真回落的戏码可能会再次上演。

总结来说,目前在6万美元上方我们先看涨,下周周初的交易日也都先以看涨思路去对待,技术层面先关注6万能否站稳,以及6.28/6/36压力位能否突破站稳,而中线空也需要时刻准备着,如没有黑天鹅事件,我们可以考虑在上面说的这几个压力位去分批次的做中线空单,具体如有机会我会额外发文提示。

晚间操作思路参考-BTC : 5.96轻仓做多,回调5.88加仓多,目标6.08,破位减仓持有上看6.28;空单等下周再发文安排;ETH : 2380轻仓做多,回调2360加仓多,目标看2420,破位减仓持有上看2500

每日分析策略胜率超高!分析不易,希望大家点一个免费的关注、收藏、点赞和评论,谢谢大家,欢迎大家在下方留言讨论我会一一回复!

实时行情策略交流可以点击我的头像看主页介绍, 原(币世界)排名第一 个人KOL主大V,实盘免费指导和解答交易问题,欢迎大家交流沟通!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。