1.美联储降息时间9月19日2:00,目前美联储观察器上显示降息25和50基点的概率都是50%,降息基本板上钉钉,就看降多少了。

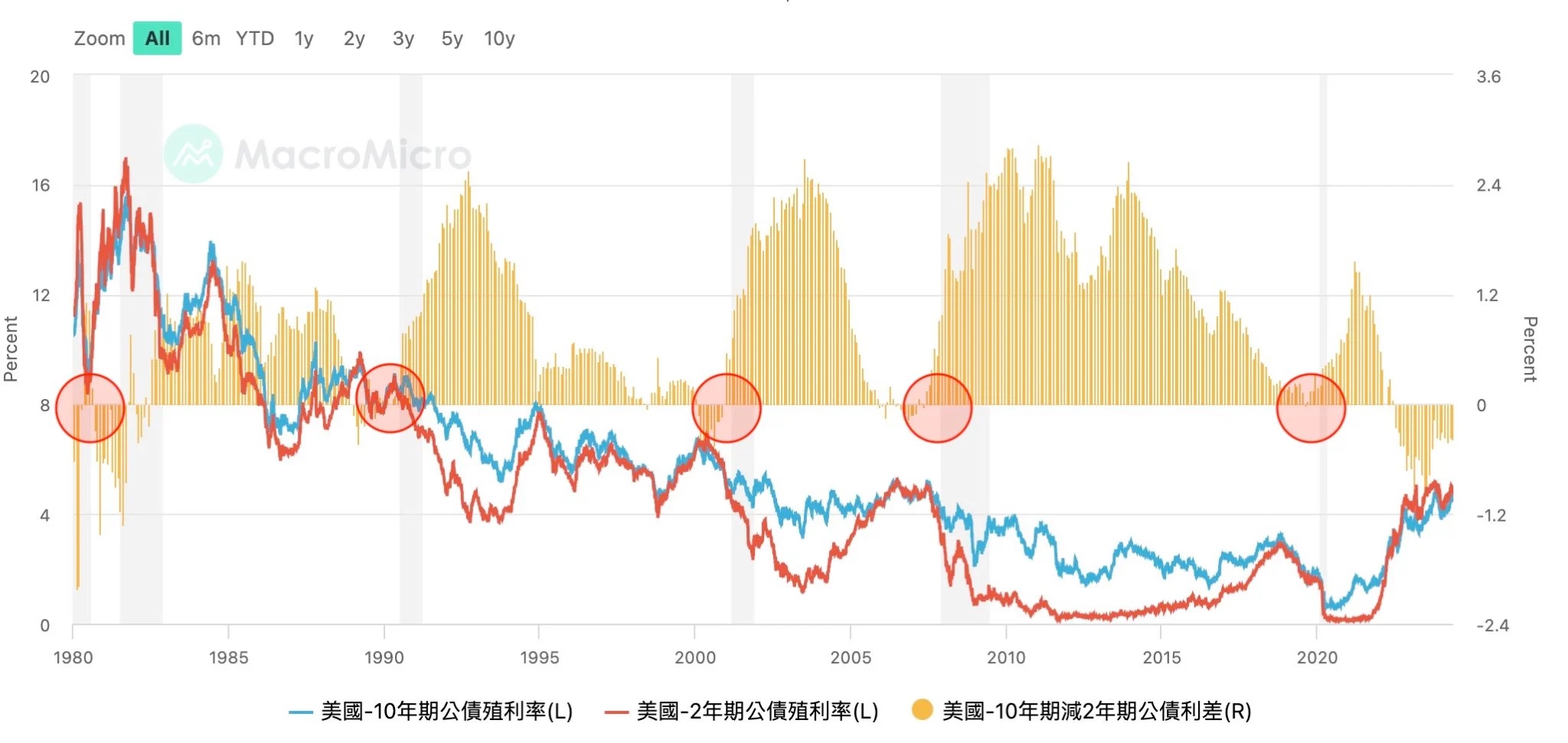

(一)、美债殖利率倒挂自2022 年7 月开始,维持超过2 年时间,创下史上最久的纪录。本周殖利率终于正式解除倒挂,美国从1980 年代至今,一共历经了五次经济衰退,且此前皆出现过殖利率倒挂情形。

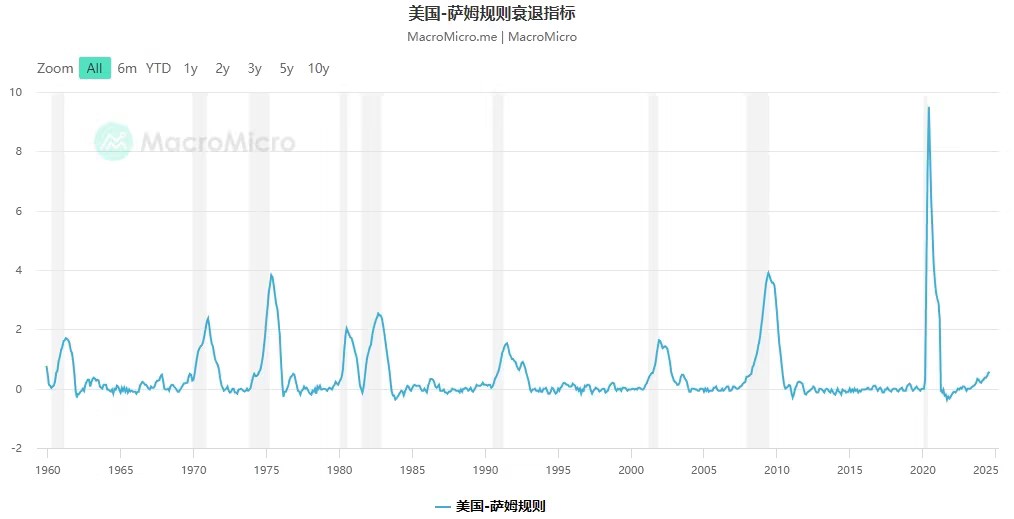

(二)、美国7月份就触发萨姆法则,这个过去准确率非常高的指标明确美国经济正式进入衰退,后面萨姆法则”提出者:美国经济“接近”但还没进入衰退。

(三)、全球大环境疫情三年、俄乌冲突、巴以冲突……全球局势动荡不安,依然还在战乱的有10个国家,而最近中美局势升级,五常已经有四个下场,漂亮国肯定也想拖熊猫下场等……

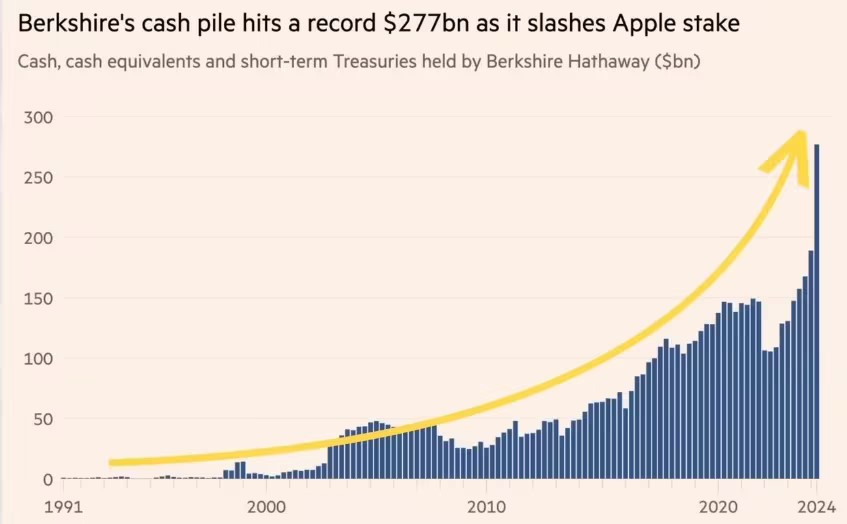

(四)、巴菲特大幅减持了头号重仓股苹果,从7.9亿股降至4亿股,减持幅度约为49%,不到两个月抛售了62亿美元的美国银行股票,现金储备再创记录新高,达2769亿美元,而根据伯克希尔2024股东大会巴菲特发表的言论联邦政府可能提高税务,目前是21%而历史上最高达到52%。而复盘巴菲特这么多年给股东的信或者公开场合抛售股票都说到太贵了,让他长期以来逃避多次金融危机且抄底。

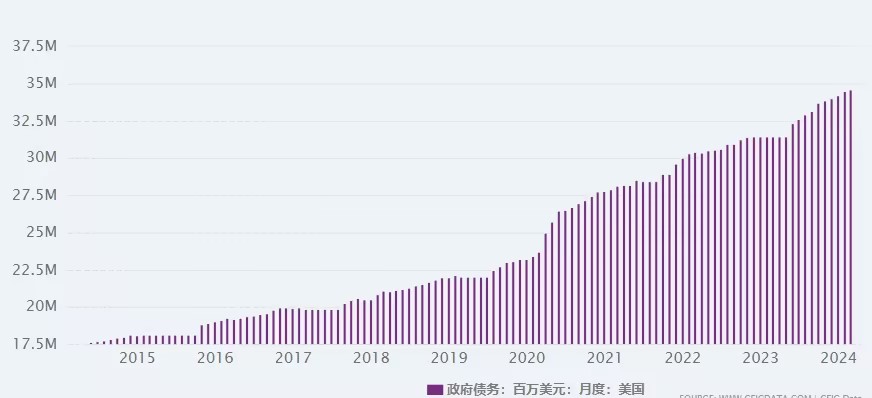

(五)、美国国债从2000年5万亿暴涨到35万亿,每天偿还国债利息上的支出超过 20 亿美元,川普提到美国政府债务问题,说要用比特币偿还,诺贝尔经济学奖得主调侃用猫的 NFT 还债,虽然看着利好比特币其实也是无奈之举目前并没有更好方法,显示与日俱增的国债问题。

(六)、再看国内房地产暴雷,断供潮激增,实体店企业纷纷倒闭,物价上涨通货膨胀,失业率不断上升,前段时间抖音热搜“再见广东”,返乡潮提前到来,八亿人负债四亿人逾期,中金公司对收入群体做了统计人均工资5000以下的是13.28亿占总人口94.87%。(还有倒查30年,ZF官员、国企、央企、上市公司高管等不展开细说懂得都懂),虽然目前梦看到的是美国经济表现出韧性,消费者支出稳健,就业增长放缓,通胀率稳定在 2.5%,但人们普遍对经济衰退担忧。

总结:2024年很难2025年将更难,经济衰退无法避免,康波周期也是进入萧条期再到复苏繁荣期需要时间。所以做任何投资需更谨慎。

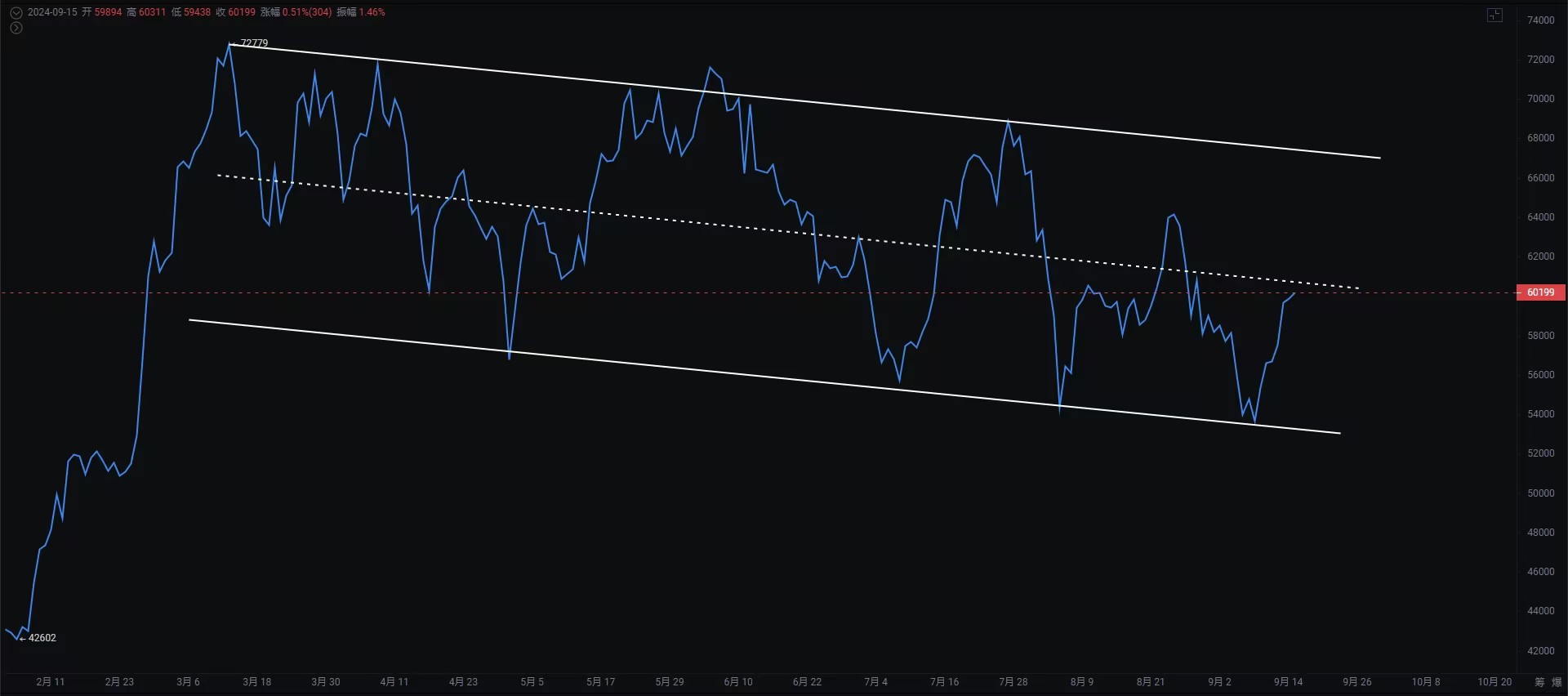

2.回到盘面高位震荡半年

16年BTC挖矿产量减半后163天,链上长期持币者开启牛市大爆发

20年BTC挖矿产量减半后163天,链上长期持币者开启牛市大爆发

当前距离24年BTC挖矿产量减半已过去147天,还有半个月左右时间能启动吗?

周线即将收线收出了看涨吞没,反弹了8000多点,周线杯柄形态我们从3/15号以来就认为会完成杯柄形态之后还有大幅上涨。3日线MACD底背离明显一些,同时两次在MA120处支撑反弹,如果后续还有回调不跌破此均线,是不排除震荡磨上去到时候回调支撑53500—55555分批布局。至于是否会到更低先看49000—52000附近支撑,跌破一样是分批介入机会50000—46000—42000,能拿到更低筹码牛市才有更大机会。

日线维持上升旗形震荡,从收盘价线来看走的还是比较标准,基本上跌至下沿反弹,上沿或者中间位就开始下跌。

日线目前是大三角格局价格线处于三角上沿承压,关注三角突破情况,4小时下跌趋势线突破有提醒后又再次回踩55555反弹。

如果你喜欢我的观点,请点赞评论分享,我们一起穿越牛熊!!!

文章具有时效性,仅供参考实时更新

专注k线技术研究,共赢全球投资机会公众号:交易公子扶苏

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。