⚡️I have been paying close attention to JD's stablecoin proposal these days and I think it might challenge BUSD to become the third largest stablecoin.

I was wondering if Binance would take any action, and then I saw @ListaDAO launching the $veLISTA community governance model, which is another major move after the listing of LISTA on Binance.

What does this have to do with Binance? Let's take a look at the background:

1. LISTA is one of the 3 stablecoin protocols deployed on the BNB Chain

In my previous analysis article: "Why is the stablecoin favored as the background analysis: As the leader of stablecoin and staking protocols on BSC, after receiving the $LISTA airdrop: should you sell, and when?"

https://link.medium.com/QmeN09LZvLb

In the article, we mentioned that BNB Chain has been developing stablecoin projects, such as:

?GrizzlyFi $GNHY, starting with stablecoin mining pools, and planning to establish a stablecoin exchange and issuance center based on this in the future;

?Pancake IFO project Wombat, preparing to do curve on BSC;

?ListaDAO, combining Maker Dao's over-collateralization and algorithmic stablecoin rebase mechanism, is preparing to launch a new stablecoin.

Now, the veLISTA model launched by ListaDAO introduces the Curve Finance model, which has been very successful.

If this stablecoin on BSC is successful, then BNB Chain will gradually establish its own central bank like Ethereum, and BSC will have the ability to compete with Solana. Naturally, traffic and transactions will also come, and there is no need to fear whether JD's stablecoin will be successfully launched.

2. How does veLISTA work? (This is additional income for holders)

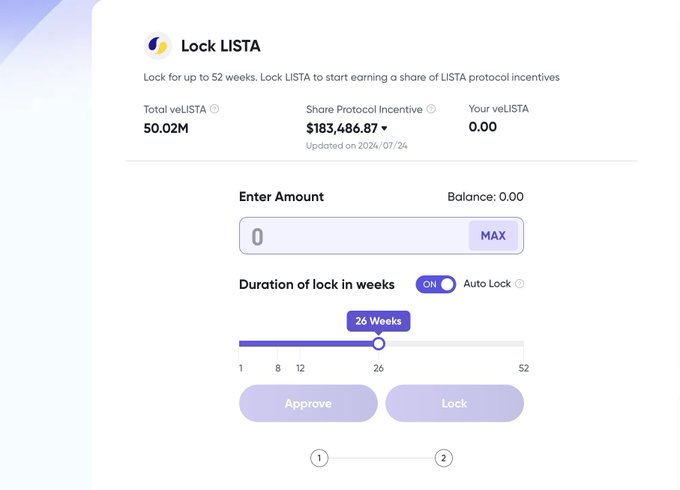

Lista DAO has introduced the veLISTA and veToken governance model, simply put, users stake Lista DAO's governance token $Lista to mint veLISTA.

?Lockup period ranges from 1 week to 52 weeks. The longer the lockup period, the more $veLISTA you receive.

?Locking up for 52 weeks = 52 veLISTA

?Locking up for 20 weeks = 20 veLISTA

?Locking up for 1 week = 1 veLISTA

? https://lista.org/lock

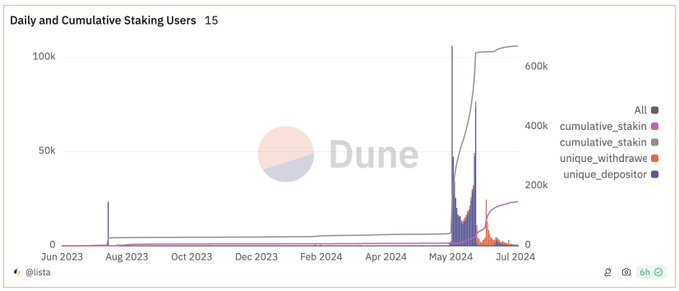

After this news was released, the price of $Lista started to rise, and the number of on-chain staking users also showed an upward trend.

3. Is there any profound impact of staking rewards?

Many people may think that this is just an activity launched by the project to attract token staking, which is normal to think so, after all, retail investors do not need such high faith.

But if we want to upgrade from "novice" to "intermediate" in Web3, from "debt" to "shore", we still need to understand the essence of things, because when a project becomes popular, there will be many copycats. Whether you will be harvested by copycats depends on your level of understanding in the community. If your understanding is shallow, the probability of being harvested will be much higher.

The introduction of the veToken governance model by Lista DAO gradually transfers the governance of the project to veLISTA holders, actively participating in protocol governance, including proposing and voting on proposals.

Here, receiving staking rewards is just an additional item, and governance voting is the main event, and also the most easily overlooked aspect.

In Lista's governance voting, you can increase the yield of designated staking pools or liquidity pools, and also allow users to contribute to the ecosystem. If you hold tokens in a certain pool, you are a stakeholder in that interest.

If you just join, you may not feel it before Lista grows, but as the TVL grows, the platform becomes a pool of traffic, and various projects will come to discuss cooperation. The community will vote on which platform to cooperate with, how to cooperate, and how to allocate rewards, and your vote will sometimes be crucial.

As the pools on the Lista platform grow, the proposals will become richer, which will encourage more users to stake $Lista and convert it to $veLISTA, which is the core advantage of veToken.

Once this advantage stands out, your $veLISTA will also have value, and can generate more income on cooperative platforms.

This is the external loop.

4. Internal income of veLISTA

If there is an external loop, there will naturally be an internal loop. If the income of the external loop is uncontrollable, the official can guarantee the income of the internal loop. There are two income streams that are distributed to users by locking $Lista:

?The project will allocate more than 50% of the income of ListaDAO to $veLISTA holders;

?250K LISTA will be distributed to $veLISTA holders weekly; the future emission will be decided by DAO voting.

?The emission of veLISTA is 250K, but the total amount given to the entire community is 312.5K.

Where does the income of ListaDAO come from?

The income of ListaDAO is not extracted from the treasury, it is mainly from "robbing Peter to pay Paul". The main sources of income for ListaDAO are:

?Advance fee for claiming $veLISTA

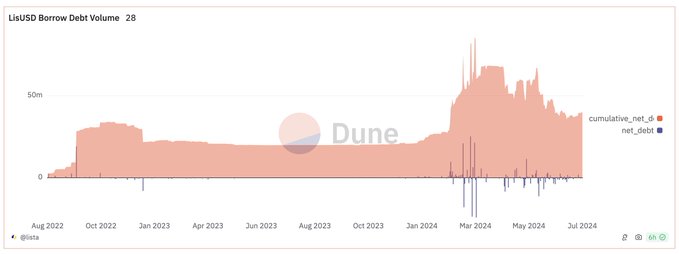

?lisUSD lending fees (lending situation as shown in the figure below)

?Advance withdrawal fee for ETH/BNB

?LST rewards and operational commissions

5. Additional rewards for veLISTA

As mentioned earlier, Lista will attract many projects to settle in, and holders of $veLISTA will receive additional rewards from the "external loop".

The first official cooperative project is @Listapiexyz_io, and holders of $veLISTA will receive additional rewards.

✅ So basically, we have understood why Lista DAO launched the veLISTA and veToken governance model, and in the future, when encountering similar projects, we will also understand the logic behind them.

Lista DAO is the third stablecoin project on the BNB Chain, and it has received high attention as soon as it was launched. Users who participated in the airdrop in the first half of the year have basically made money.

The tokens allocated to Lista DAO for the airdrop (10% of the total supply) have unlocked 8.5% at the start, and the remaining 1.5% will unlock at the end of September. Please pay attention to the recent developments of the project.

?By the way, a reminder: the team and VC unlock time is June 2025, so retail investors will not be harvested.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。