Compilation & Writing: Karen, Foresight News

A news about "Aave may activate the fee switch mechanism and repurchase tokens" caused the AAVE price to rise from $85 to above $100. At the same time, Marc Zeller, the founder of Aave-Chan Initiative, released the "Update AAVEnomics" TEMP CHECK proposal yesterday, proposing to initiate a "purchase and distribution" plan to purchase AAVE assets from protocol revenue in the secondary market and replenish the ecosystem reserve to reward the primary users of the ecosystem. Additionally, the proposal aims to activate the new security module for Atokens and cancel the GHO lending rate discount, introduce the Anti-GHO generation and destruction mechanism, thereby enhancing the alignment of interests between AAVE stakers and GHO borrowers. Furthermore, the new proposal also suggests upgrading the current AAVE security module to a new "staking module".

What are the improvements and updates to the new Aave security module?

Before understanding the potential fee switch mechanism for Aave, it is necessary to first review the original security module of Aave and understand the new version of the Aave security module "Umbrella" proposed by Aave contributor Bgd Labs.

In fact, Aave introduced the security module as early as 2020, allowing AAVE and AAVE/WETH Balancer LP holders to collateralize their tokens and receive rewards to enhance the protocol's resilience and security. In the event of a shortfall event such as smart contract vulnerabilities, liquidation risks, or oracle failures, the locked tokens may be used for auction to compensate for potential losses, building additional protective barriers for the protocol.

Currently, Aave's security module mainly operates on the Ethereum mainnet, accumulating approximately $480 million in assets at the time of writing, supporting the collateralization of AAVE, GHO, or ABPT V2 (Balancer AAVE + wstETH liquidity pool tokens), releasing approximately 820 AAVE tokens daily. According to official regulations, if there is a capital loss, the system can use up to 30% of the locked assets for compensation. If this amount is not sufficient to cover all debts, the "Recovery Issuance" mechanism will be triggered, temporarily issuing AAVE tokens for auction.

However, Bgd Labs pointed out that there is room for optimization in the existing security module, such as low efficiency in bad debt processing, inefficient capital utilization, lack of transparency and flexibility in the slashing mechanism, and complete reliance on Ethereum for collateralization and slashing. Therefore, the new security module Umbrella has been introduced, with the following improvements targeting the aforementioned issues:

1. Addition of new collateral assets stk aTokens: Canceling stkAAVE and stkABPT as the ability to directly cover debts (coverage) assets, as they lack relevance to the assets in the Aave pool that may generate bad debts, and instead using aTokens, which are more relevant to potential bad debt assets in the Aave pool, as collateral.

bgdlabs believes that aToken is the best collateral and slashable asset. When aToken is slashed, there is no need to sell it to cover the deficit, it only needs to be destroyed, i.e., the amount of bad debt is equal to the amount of aToken destroyed. This way, the balance between the supply and withdrawable amount of aToken can be maintained.

2. Network and pool-level comprehensive coverage: Setting up Umbrella for Aave on every network and every pool to ensure comprehensive security protection.

3. Automated fast slashing mechanism: Reducing reliance on manual governance proposals and achieving immediate automatic compensation when bad debts occur.

4. New incentive system: Introducing multiple rewards and more complex algorithms, such as stk aUSDT being able to simultaneously receive AAVE rewards from the ecosystem reserve and USDT rewards from protocol revenue, to enhance participant motivation.

In addition, stkGHO will still be retained in Umbrella, but the types and rules of collateral assets will be more flexible to adapt to future community needs.

How will the Umbrella security module be initiated?

The TEMP CHECK proposal suggests that as an initial step, it is proposed to separate the coverage scope of the StkGHO and StkAAVE security modules, aiming to clearly distinguish the protection responsibilities of the two, especially to enhance the efficiency of the StkGHO security module to more effectively safeguard the stability of the GHO stablecoin. Specifically, the updated StkGHO security module will focus on defending risks related to GHO debts and will only be used to clear excess debts of GHO.

The Ethereum StkGHO will be the first security module to adopt the Umbrella standard. In the event of a shortfall event, GHO can be destroyed in the security module to clear excess debts, without slippage, and without affecting the anchoring of GHO.

The proposal also plans for a gradual transition of the reward mechanism of the StkGHO security module, aiming to gradually guide resources to the potential Umbrella StkGHO security module to meet future development needs.

How will the new AAVEnomics operate?

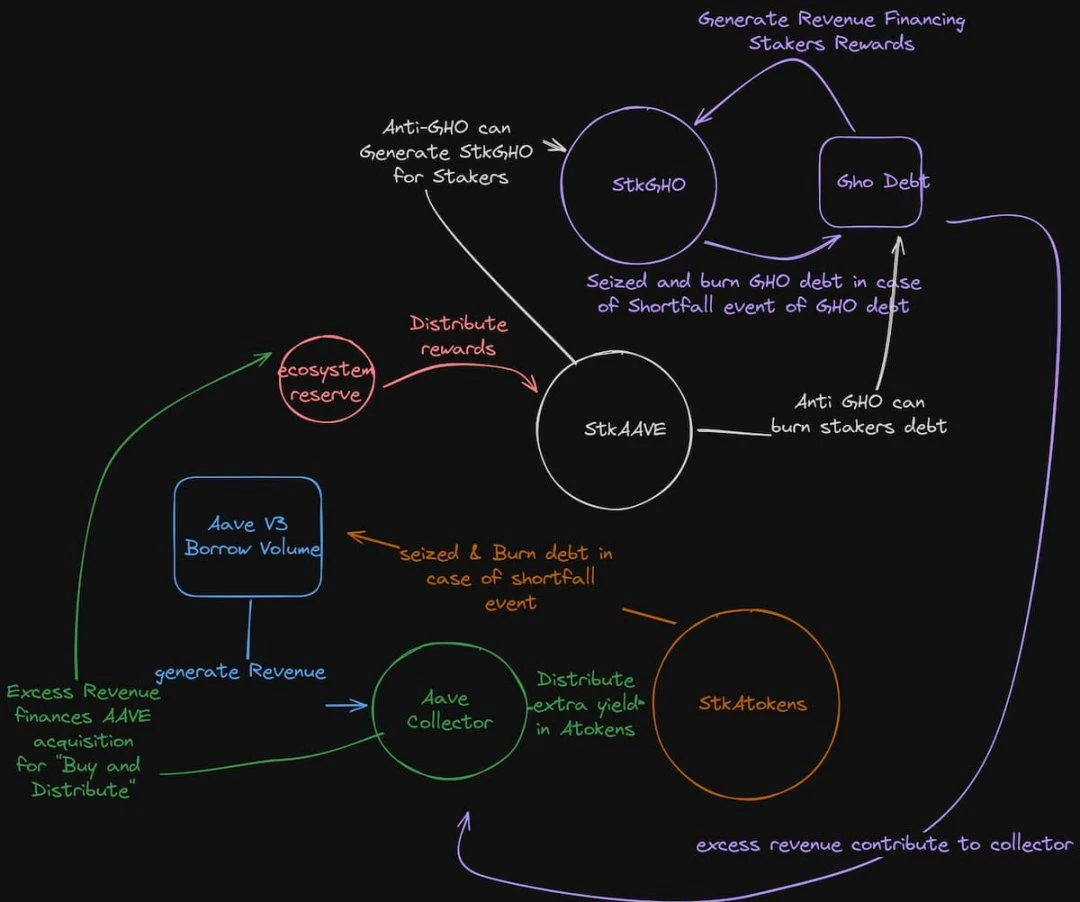

In the TEMP CHECK proposal, the biggest change in the new AAVEnomics is to upgrade the current AAVE security module to a new "staking module," rather than being part of Umbrella, and to use protocol revenue to purchase AAVE assets from the secondary market and distribute them to the ecosystem reserve. This measure not only introduces a constant demand for AAVE assets in the secondary market but also enhances the long-term sustainability of the protocol. Specific measures include:

1. It is proposed not to include the AAVE security module in the Umbrella update, and StkAAVE will evolve into a staking role, acting as a liquidity receiver and a way to collect protocol revenue and other protocol income rewards.

2. StkBPT is excluded from the Umbrella security module, and the Aave Liquidity Committee (ALC) is appointed to manage AAVE secondary liquidity, while introducing a "purchase and distribution" plan funded by protocol surplus income to improve budget efficiency and promote sustainable subsidies and refined management of liquidity.

3. Cancellation of GHO lending rate discount and introduction of Anti-GHO token: Anti-GHO is a non-transferable ERC-20 token, and users accumulate Anti-GHO linearly, with the generation of Anti-GHO being proportional to the interest accumulated by all GHO borrowers. StkAAVE holders can destroy Anti-GHO to mint GHO for repaying their own GHO debts or receiving StkGHO, thereby enhancing the alignment of interests between AAVE stakers and GHO borrowers and introducing income sharing of some Aave protocol income to certain AAVE stakers.

4. Activation of Umbrella Atokens security module. Most of Aave's protocol debts are in wETH and stablecoins. Aave is collecting feedback on launching the Umbrella Atoken security module using awETH and aUSDC, and it is suggested that the Atokens security module mainly rewards their respective aTokens, funded by their respective assets and the Reserve Factor of related assets. The details and budget of these Umbrella Atokens security modules will be discussed in the ARFC phase.

5. Launch of the "purchase and distribution" plan. With the introduction of the efficient Umbrella security module, it is expected that the surplus protocol income will increase. Aave will purchase AAVE assets from protocol income in the secondary market and replenish the ecosystem reserve to reward ecosystem users.

Summary

The token design of many projects often tends to be limited to governance functions, lacking other utilities or application value. Aave's recent move is like a stone thrown into the market, causing ripples one after another. Will this inspire other projects to re-examine their token economic models and push their tokens to transition from a single governance function to roles that carry income distribution or other practical utility values?

However, the reality is that most projects face the dilemma of lacking additional distributable income. However, when leading DeFi protocols like Aave activate the "fee switch" mechanism, the demonstration effect it generates should not be underestimated. This action is not only an exploration of the existing economic model but also sends a strong signal to the entire market - the value of tokens should not be limited to governance rights, but should be more closely linked to project income and user benefits. This will prompt market participants to re-evaluate the potential value of tokens and stimulate deep thinking on innovation in token economic models.

References:

https://governance.aave.com/t/temp-check-aavenomics-update/18379

https://governance.aave.com/t/bgd-aave-safety-module-umbrella/18366

https://docs.aave.com/aavenomics/safety-module#shortfall-events

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。