「Web3 将帮助我们信任人工智能」。

撰文:Will Ogden Moore

编译:Luffy,Foresight News

人工智能 (AI) 是本世纪最有前景的新兴技术之一,它有望成倍提高人类的生产力并推动医学突破。虽然人工智能已然崭露头角,但它未来的影响力会越来越大。普华永道估计,到 2030 年,它将发展成为一个价值 15 万亿美元的庞大产业。

然而,这项前景光明的技术也面临挑战。随着人工智能技术变得越来越强大,人工智能行业变得极为中心化,权力集中在少数几家公司手中,这是对整个人类社会潜在的威胁。人工智能也引发了人们对深度伪造、偏见和数据隐私风险的严重担忧。幸运的是,加密货币及其去中心化和透明的特性为其中一些问题提供了潜在的解决方案。

下面,我们将探讨由中心化引起的问题以及去中心化人工智能如何帮助解决一些弊病,并讨论当前加密货币和人工智能的交叉领域,重点介绍该领域已显示出早期采用迹象的加密应用。

中心化人工智能的问题

如今,人工智能的发展面临着一定的挑战和风险。人工智能的网络效应和密集的资本需求非常显著,以至于大型科技公司之外的人工智能开发者,如小公司或学术研究人员,要么难以获得开发所需的资源,要么无法商业化。这限制了人工智能的整体竞争和创新。

因此,对这项关键技术的影响力主要集中在 OpenAI 和谷歌等少数几家公司手中,这引发了人们对人工智能治理的严重质疑。例如,今年 2 月,谷歌的人工智能图像生成器 Gemini 暴露了种族偏见和历史错误。此外,去年 11 月,由六人组成的董事会决定解雇 OpenAI 首席执行官 Sam Altman,暴露了少数人控制着这些公司的事实。

随着人工智能的影响力和重要性日益增强,许多人担心,一家公司可能会掌握对社会产生巨大影响的人工智能模型的决策权,它可能会设置护栏,闭门操作,或操纵模型为自己谋利。

去中心化人工智能如何提供帮助

去中心化 AI 是指利用区块链技术以提高透明度和可访问性的方式分配 AI 所有权和治理权。Grayscale Research 认为,去中心化 AI 有潜力将这些重要决策从封闭的制度中解放出来,并交接到公众手中。

区块链技术可以帮助开发者更多地接触人工智能,降低独立开发者开发和商业化的门槛。我们相信这可以帮助改善人工智能行业的创新和竞争,小公司与科技巨头之间实现某种平衡。

此外,去中心化 AI 有助于实现 AI 投资的民主化。目前,除了少数科技股之外,几乎没有其他方式可以获得与 AI 发展相关的财务收益。与此同时,大量私募资本被分配给了 AI 初创公司和私营公司(2022 年为 470 亿美元,2023 年为 420 亿美元)。因此,只有一小部分风险投资家和合格投资者可以获得这些公司的财务收益。相比之下,去中心化的 AI 加密资产对每个人都是平等的,所有人都能拥有 AI 未来的一部分。

这个交叉领域发展到了哪一步?

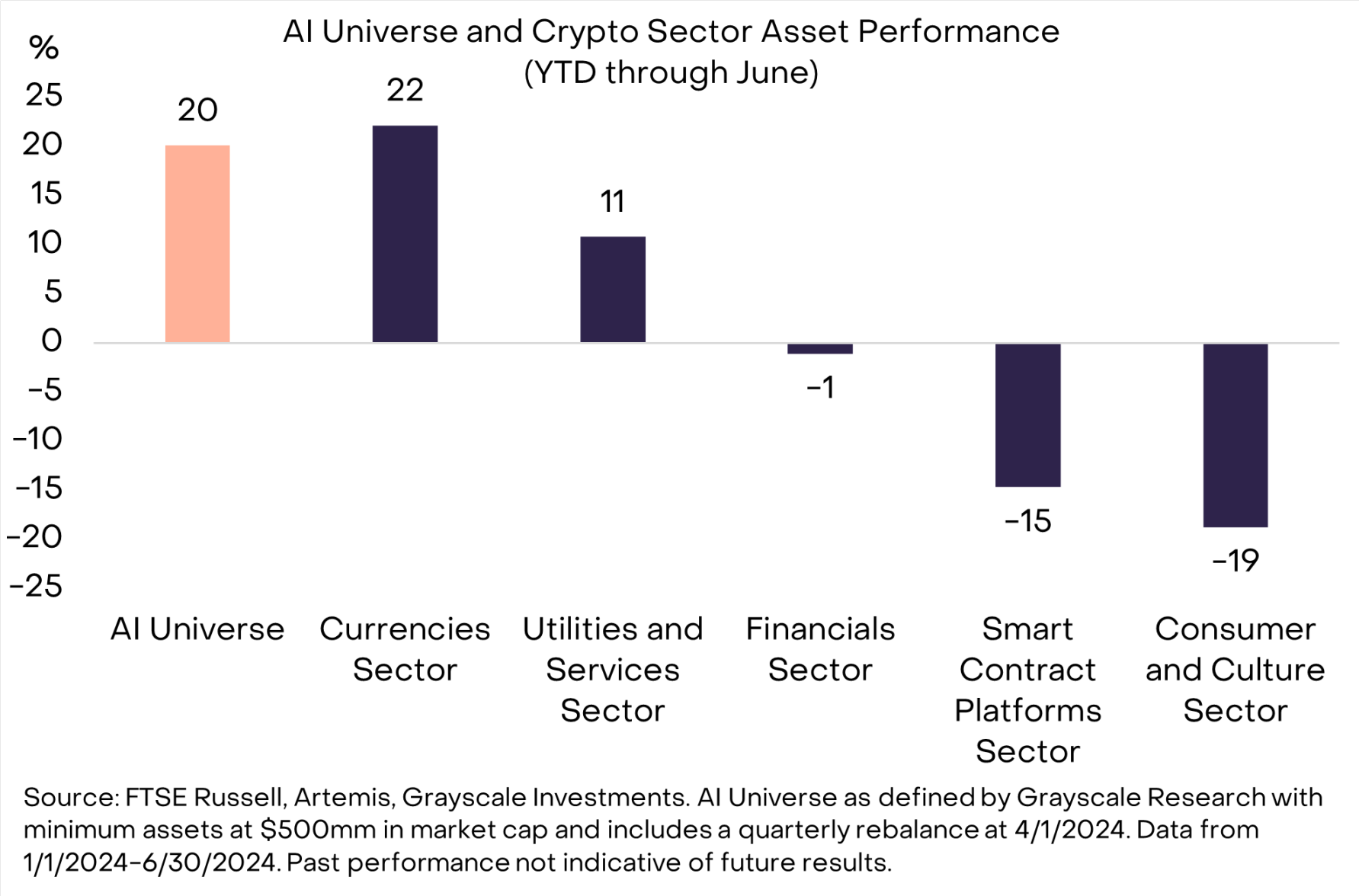

加密货币和人工智能的交叉领域仍处于早期阶段,但市场反应令人鼓舞。截至 2024 年 5 月,AI 概念加密资产(注:Grayscale Research 定义的一个加密货币投资组合,包括 NEAR、FET、RNDR、FIL、TAO、THETA、AKT、AGIX、WLD、AIOZ、TFUEL、GLM、PRIME、OCEAN、ARKM 和 LTP。)回报率为 20%,表现仅此于货币概念类别(图 1)。此外,根据数据提供商 Kaito 的数据,与 DeFi、Layer 2、Memecoin 和现实世界资产等其他主题相比,人工智能目前是社交平台上最热门的「叙事」。

最近,一些知名人士开始拥抱这一新兴交叉领域,致力于解决中心化人工智能的缺陷。今年 3 月,知名人工智能公司 Stability AI 的创始人 Emad Mostaque 离开公司,转而探索去中心化人工智能,他表示「现在是时候让人工智能开放和去中心化了」。加密货币企业家 Erik Vorhees 最近推出了 Venice.ai,这是一款专注于隐私的人工智能服务,具有端到端加密功能。

图 1:今年以来,AI 领域的表现几乎优于所有加密货币细分领域

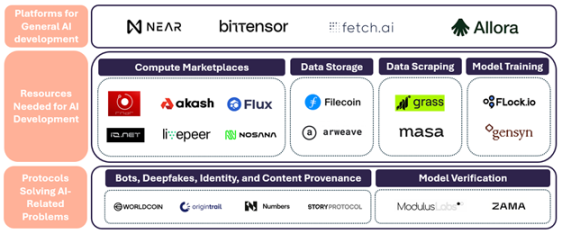

我们可以将加密货币和人工智能的融合分为三个主要子类别:

- 基础设施层:为 AI 开发提供平台的网络(例如 NEAR、TAO、FET);

- 人工智能所需的资源:提供人工智能开发所需的计算、存储、数据等关键资源(例如 RNDR、AKT、LPT、FIL、AR、MASA);

- 解决 AI 问题:试图解决 AI 相关的问题,例如机器人和深度伪造的兴起以及模型验证(例如 WLD、TRAC、NUM)。

图 2:人工智能和加密货融合的项目版图,资料来源:Grayscale Investments

AI 基础设施网络

第一类是提供无需许可的开放式架构的网络,专为 AI 开发而构建。这些网络不专注于某一种 AI 产品或服务,而是为各种 AI 应用创建底层基础设施和激励机制。

NEAR 在这一类别中脱颖而出,其创始人是「Transformer」架构的联合作者之一,该架构为 ChatGPT 等 AI 系统提供支持。然而,该公司最近利用其 AI 专业知识,通过由前 OpenAI 研究工程师顾问领导的研发部门,公布了开发「用户拥有的 AI」 的工作成果。 2024 年 6 月下旬,Near 启动了 AI 孵化器计划,用于开发 Near 原生基础模型、AI 应用程序数据平台、AI 代理框架和计算市场。

Bittensor 是另一个引人注目的例子。Bittensor 是一个使用 TAO 代币在经济上鼓励人工智能发展的平台。Bittensor 是 38 个子网络的底层平台,每个子网络都有不同的用例,例如聊天机器人、图像生成、财务预测、语言翻译、模型训练、存储和计算。Bittensor 网络用 TAO 代币奖励每个子网中表现最佳的矿工和验证者,并为开发人员提供无需许可的 API,帮助开发者构建特定的人工智能应用程序。

AI 基础设施网络还包括其他协议,例如 Fetch.ai 和 Allora。Fetch.ai 是一个供开发人员创建复杂 AI 助手(即「AI 代理」)的平台,最近与 AGIX 和 OCEAN 合并,总价值约为 75 亿美元。另一个是 Allora 网络,该平台专注于将 AI 应用于金融领域,包括去中心化交易所和预测市场的自动交易策略。Allora 尚未推出代币,并于 6 月进行了一轮战略融资,总融资额达到 3500 万美元。

提供 AI 所需的资源

第二类是以计算、存储或数据的形式提供人工智能开发所需资源的项目。

人工智能的兴起对 GPU 形式的计算资源产生了前所未有的需求。诸如 Render (RNDR)、Akash (AKT) 和 Livepeer (LPT) 之类的去中心化 GPU 市场为需要计算进行模型训练、模型推理或渲染 3D 生成式 AI 的开发人员提供了闲置 GPU 供应。据估计,Render 提供约 10,000 个 GPU,重点面向艺术家和生成式 AI,而 Akash 提供 400 个 GPU,重点面向 AI 开发人员和研究人员。与此同时,Livepeer 最近宣布了其新的 AI 子网计划,目标是在 2024 年 8 月完成文本转图像、文本转视频和图像转视频等功能。

除了需要大量计算外,AI 模型还需要大量数据。因此,对数据存储的需求大幅增加。Filecoin (FIL) 和 Arweave (AR) 等数据存储解决方案可以作为将 AI 数据存储在中心化 AWS 服务器上的替代方案。这些解决方案不仅提供经济高效且可扩展的存储,而且还通过消除单点故障和降低数据泄露风险来增强数据安全性和完整性。

最后,OpenAI 和 Gemini 等现有 AI 服务分别通过 Bing 和 Google 搜索持续访问实时数据。这使科技巨头之外的所有其他 AI 模型开发人员处于不利地位。然而,Grass 和 Masa (MASA) 等数据抓取服务可以帮助创造公平的竞争环境,因为它们允许个人通过将其应用程序数据用于 AI 模型训练来商业化,同时保持对个人数据的控制和隐私。

解决 AI 相关问题

第三类包括试图解决与人工智能相关的问题的项目,包括网络机器人和深度伪造泛滥。

人工智能加剧的一个重大问题是机器人和虚假信息的泛滥。人工智能生成的深度伪造内容已经对印度和欧洲的总统选举产生了影响,专家们「非常害怕」即将到来的总统竞选将陷入由深度伪造驱动的「虚假信息海啸」。希望通过建立可验证的内容来源来帮助解决与深度伪造相关的问题的项目包括 Origin Trail (TRAC)、Numbers Protocol (NUM) 和 Story Protocol。此外,Worldcoin (WLD) 试图通过独特的生物识别技术来证明一个人的人性,从而解决机器人问题。

人工智能的另一个风险是确保对模型本身的信任。我们如何相信收到的 AI 结果没有被篡改或操纵?目前,有几种协议正在努力通过密码学、零知识证明和全同态加密 (FHE) 来帮助解决这个问题,其中包括 Modulus Labs 和 Zama。

结论

虽然这些去中心化的人工智能资产已经取得了初步进展,但我们仍处于这一交叉领域的早期阶段。今年年初,著名风险投资家 Fred Wilson 表示,人工智能和加密货币是「同一枚硬币的两面」,「Web3 将帮助我们信任人工智能」。随着人工智能行业的不断成熟,Grayscale Research 认为,这些与人工智能相关的加密用例将变得越来越重要,这两种快速发展的技术有可能相互支持、共同发展。

很多迹象表明,人工智能时代即将到来,这将产生深远的影响,既有积极的,也有消极的。通过利用区块链技术的特性,我们相信加密货币最终可以帮助减轻人工智能带来的一些危险。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。